Scott Olson/Getty Images News

Thesis

For millions of consumers, Molson Coors (NYSE:TAP) is a company that needs no introduction. Serving consumers for many years, the popularity and quality of the brand are unquestionable. In a brewing industry that remains highly competitive, while growing slowly, I examine whether Molson Coors can offer a solid investment option. In this analysis, financial performance, balance sheet health, and valuation are reviewed.

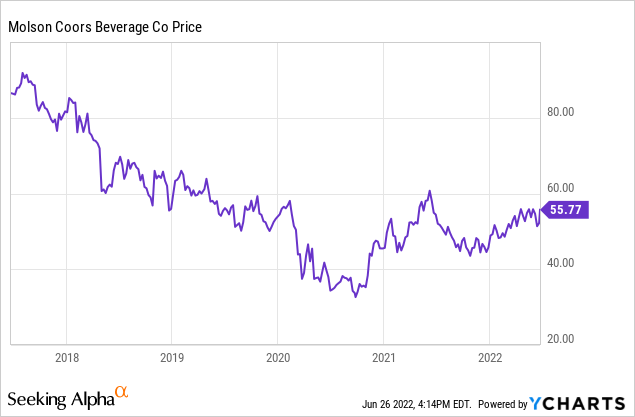

Stock Performance

While 2022 has yielded relatively positive results in terms of stock performance, Molson Coors has struggled a lot in the past few years. Structural and financial factors (explained in the next segments) have held the stock back, recording a negative 5-year total return. Currently, TAP trades at $55.77 per share ($11.67B) market cap, while paying a respectable 2.58% dividend yield.

The Business

Throughout its long 200-year history, Molson Coors has been providing consumers with beverages via a strong brand portfolio that includes the Coors, Miller, and Sol beer families, among other popular names. By providing both inexpensive and premium beverages the company stands in a good position to absorb a decent amount of inflationary pressures. Molson Coors maintains three operating segments, distinguished geographically, Americas, EMEA, and APAC, with the majority of sales volumes originating from the United States. International expansion is one of the key challenges Molson Coors is facing, as the lack thereof has contributed to mediocre growth performance. The company’s market share at home has also contracted from 25% in 2017 to 21% in 2021.

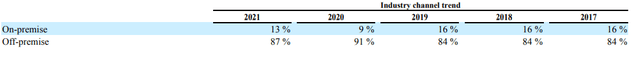

Distribution channels include on-premise (bars, restaurants etc.) and off-premise (convenience, grocery, and liquor stores). Sales distribution between on and off-premise wholesalers is provided in the table below.

10K Report

The adverse effects of the Covid-19 pandemic led to a halt in operation for many restaurants and bars and can explain the large drop in on-premise sales in 2020. As the economy reopens, it is clear that the on-premise distribution channel trends towards restoring its standing.

In late 2019, the company announced its strategic revitalization plan for the next years. It boils down to building on the company’s core beer brands, expanding premium offerings, and extending sales beyond just beer beverages. Recently introduced products from Molson Coors include non-alcoholic beverages, hard seltzers, and ready-to-drink beverages. Even if sales volumes decline, an improved revenue mix where premium products account for a larger percentage of sales will help improve profit margins.

The Brewing Industry

The global brewing industry is highly competitive and somewhat fragmented. Brewers compete for market share with key international industry players and local brewers as well, as more and more consumers seek out the small-brewery experience. Beer continues to hold a prominent position among consumers’ beverage preferences as new flavors and taste offerings appeal to Gen Z consumers. Currently, according to fortunebusinessinsights.com the global beer market size was $768.17B in 2021, and is expected to grow to $989.48B in 2028, at a CAGR of 3.68%. These moderate growth estimates call for global leaders like Molson Coors to acquire more market share while increasing operational efficiency in order to provide above-average returns to shareholders.

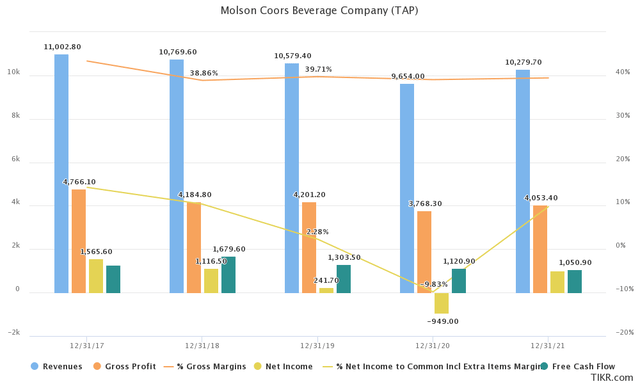

Financials

Top line growth has remained flat over the last few years, even decreasing a bit, from $11.0B in 2017 to $10.3B in 2021. The Covid-19 pandemic took a heavy toll on Molson Coors’ net income numbers in 2020, with the company recovering, however, in 2021. On a more positive note, gross margins have remained consistently high, around 40% since 2017. Free cash flow generation has also been sufficient, even surpassing earnings productivity over the last four fiscal years. Net and FCF margins stand around 10% and while improvement is desirable they don’t raise any serious profitability concerns.

Tikr.com

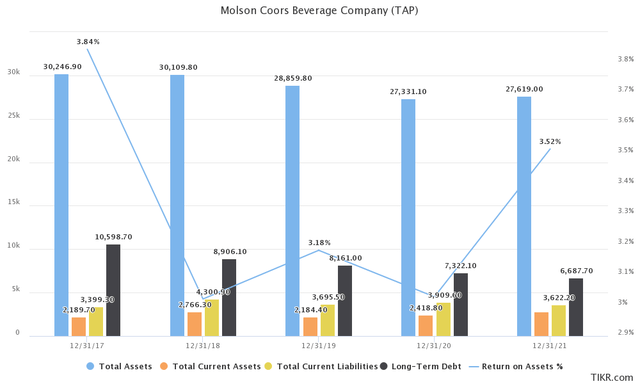

A brief analysis of the company’s balance sheet will also uncover some concerns. While decreasing over the last few years, the company’s long-term debt balance is still sizable ($6.69B compared to the $11.67B market cap). Liquidity also raises alarms as current assets have been consistently lower than current liabilities, requiring more debt instruments to be deployed. Asset utilization also stands on the low side, with returns on assets below 4.0%. While in a capital-intensive business like a brewing company, great returns on assets are rarely seen, still with Molson Coors’ current numbers, the room for improvement is evident.

Tikr.com

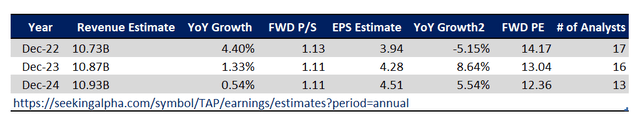

Future Expectations

Over the next few years, analysts see revenue growth remaining relatively flat, growing at a CAGR of around 2% to reach $10.93B in 2024. EPS in 2021 is expected to recede with mid-single-digit growth following in 2023 and 2024. The average target price for the stock is at $56.12, according to Yahoo! Finance, also points to moderate upside potential in the near term.

SeekingAlpha

Valuation

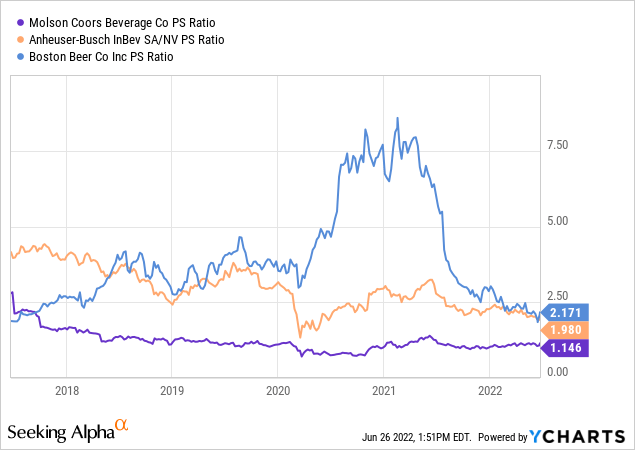

A silver lining for a business that seems otherwise rather unattractive as an investment, lies in its valuation. Low growth expectations appear to be fully priced in, at a 12.6x P/E, 8.3x EV/EBITDA, and 1.14x P/S multiple. That said, Molson Coors also trades in 5 and 3-year averages in terms of P/S and EV/EBITDA multiples, indicating that not much of a discount is currently available. A quick look across two major competitors, however, Anheuser-Busch and Boston Beer will reveal that Molson Coors is relatively inexpensive. Note, however, that both companies mentioned offer better growth potential, at least in the near term.

Final Thoughts

After all things are considered, some key improvements should be required for investors to consider Molson Coors as a long-term investment opportunity. Restoring revenue growth is the persisting challenge for Molson Coors and given the current state of the economy and intensifying competition, the next few years will likely prove to be critical. Improvements in asset utilization and operational efficiency will also prove beneficial. Currently, I would rate the stock as a hold.

Be the first to comment