Jack Andersen/DigitalVision via Getty Images

Molson Coors Beverage Company (NYSE:TAP) is a leading maker and distributor of beer and other beverages. This company was formed in 2005, when Molson of Canada merged with Coors in the USA. In addition to the namesake brands, this company owns and/or distributes many other well-known brands including: Arizona Hard, Arnold Palmer Spiked, Barmen Pilsner, Birra Roma, Black Ice, Blue Moon, Bodega Bay, Carling, Foster’s, George Killian’s Irish Red, Grolsh, Hamm’s Beer, Miller High Life, Pilsner Urquell, Redd’s Hard Apple, Sol Cerveza, and more.

This company was a beneficiary of the controversy with Bud Lite Beer, but in the latest earnings report, there were signs that this is no longer a big tailwind and the stock dropped significantly after Q1 2024, earnings were released. After a big drop, this stock appears to be offering a solid buying opportunity, so let’s take a closer look:

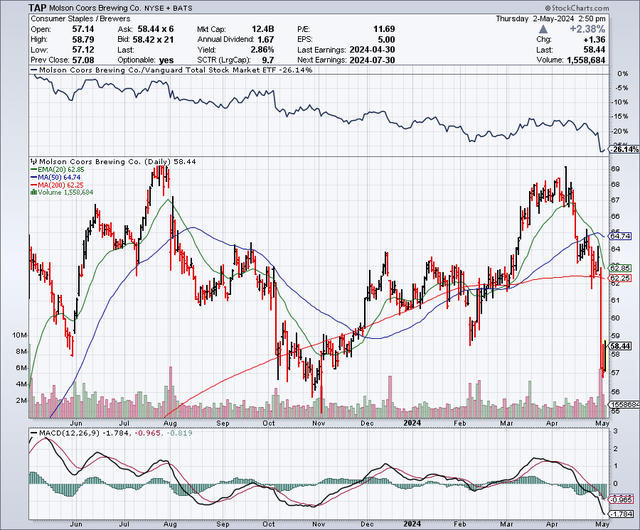

The Chart

As the chart below shows, this stock was trading around $68 in April, but has since plunged after Q1 2024 earnings were released on April 30. The stock dropped to around $57 per share, and it is now trading well below the 50-day moving average of $64.81 and the 200-day moving average of $62.29.

Q1 2024 Earnings Results Were Solid

When Molson Coors released Q1 2024 results, the initial reaction was positive, and the stock was up in pre-market trading, but it later declined even though it beat estimates and reaffirmed guidance. The selloff seems excessive when considering it reported non-GAAP earnings per share of $0.95, which beat the estimates for $0.75 per share. It reported $2.6 billion in revenues, which beat estimates by $100 million. This represented a 10.6% increase, year over year. As shown below, this company also repurchased 1.76 million shares in the first quarter.

Earnings Estimates And The Balance Sheet

Analysts expect Molson Coors to earn $5.67 per share in 2024, on revenues of $11.82 billion. For 2025, estimates rise to $5.91 per share, with revenues coming in at $11.92 billion. The slow and steady growth is expected to continue in 2026, with estimates at $6.13 per share on revenues of $12.01 billion. At current levels of just around $57 per share, this stock is trading at just about 10 times earnings. That is way below the current market multiple, and it is also below many other companies in the beer and beverage industry.

As for the balance sheet, this company has $6.43 billion in debt and nearly $869 million in cash.

The Dividend And Share Buybacks

Molson Coors raised the quarterly dividend from $0.41 per share to $0.44 earlier this year. The dividend totals $1.76 per share on an annual basis, and it currently yields over 3%. This is an attractive yield that will be even more attractive to investors when interest rates decline, which is what is expected over the next couple of years. The payout ratio is just around 29%, so there is safety in that, and it also leaves plenty of room for additional dividend increases.

In addition to the dividend, this company is also returning capital to shareholders by implementing share buybacks. In late 2023, the Board of Directors announced a new $2 billion share buyback plan that is expected to be completed over the next 5 years. With a market capitalization of around $12 billion, a $2 billion buyback would put a significant dent in the number of shares outstanding, and therefore boost earnings per share.

Valuation

When you look at some comparable companies, Molson Coors shares look like a bargain. For example, Anheuser-Busch InBev (BUD) is trading around $59, which is just above where Molson Coors trades at currently. However, analysts expect Anheuser-Busch InBev to earn only $3.35 per share in 2024, (which implies a PE multiple of about 18 times earnings) and $3.89 per share in 2025. In addition, the dividend offered by Anheuser-Busch InBev only yields about 1.4%. Molson Coors pays a dividend that yields more than twice as much, and the PE ratio is getting close to being half that of Anheuser-Busch InBev. If I am given an option on which beer stock to buy, it is an easy decision based on these valuation metrics.

Potential Downside Risks

The beer and beverage business is very competitive and consumers can be fickle. This company faces potential downside risks from foreign exchange rates and possible supply chain interruptions. Rising input costs from aluminum price increases could erode profit margins and create downside risks for investors.

The market seems to prefer growth stocks over value stocks like Molson Coors, so this could be a potential value trap and create downside risks for shareholders in terms of opportunity costs.

A recession could impact results and create a downside risk for investors as well; however, this business is relatively better off in a recession when compared to other industries.

In Summary

Molson Coors shares appear undervalued and oversold after the earnings pullback. I see rebound potential from this unwarranted drop in the share price, and with a yield of around 3%, this stock could offer solid total returns. Dividend increases and continued stock buybacks are additional positives to consider. When looking at a comparable company like Anheuser-Busch InBev, the buying opportunity in Molson Coors seems even more clear, as this stock is trading at an unwarranted discount to its peers.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Be the first to comment