Joe Raedle

Thesis

Moderna, Inc.’s (NASDAQ:MRNA) Q3 earnings release led to an initial selloff that buyers have rejected, as MRNA remains in a relatively tight consolidation range that we highlighted in our previous article.

Hence, MRNA’s October lows continued to hold robustly, attracting buyers to “play” the range setup. However, long-term investors should know that MRNA has already lost its medium-term uptrend, even though its bias is likely neutral for now.

The company highlighted 48 development programs in the pipeline. Hence, investors willing to speculate on Moderna’s future pipeline have likely used its October lows to add more positions, even though its COVID vaccine remains its only commercial opportunity.

We gleaned that the Street estimates have been revised significantly downward following its Q3 release, as management provided tepid forward guidance. As such, it demonstrates just how challenging it is to model assumptions for a company with just a single product in a vaccine market that has moved into an endemic phase.

As such, we believe the potential for re-rating in MRNA remains highly challenging at the current levels and urge investors to be cautious in joining the recent momentum spike. We think it’s critical for investors to assign a more considerable margin of safety and follow the current support/resistance zones to plan their opportunities.

Revising from Speculative Buy to Hold for now.

Much Lower COVID Vaccine Sales Moving Forward

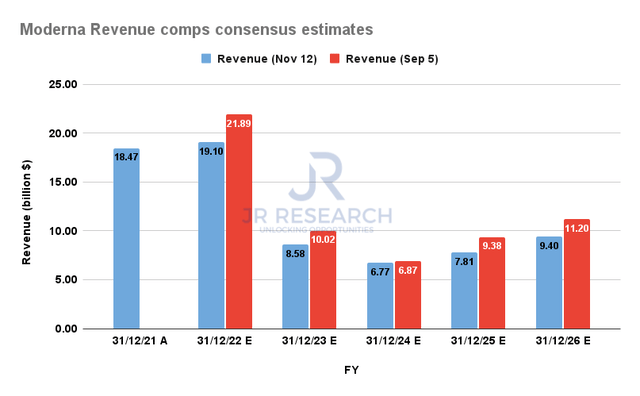

Moderna Revenue comps consensus estimates (S&P Cap IQ)

Despite the opportunity for bivalent boosters as the world moves into an endemic phase, Moderna’s revised guidance suggests much lower sales than the previous consensus estimates just two months ago.

As seen above, the revised estimates indicate that Moderna’s revenue is projected to be $8.58B in FY23, down more than 14% from September’s estimates. Notwithstanding, the visibility for its FY23 revenue metrics should be pretty straightforward from here.

Management highlighted that it deferred $2.5B (midpoint) of revenue from FY22’s pipeline due to unforeseen manufacturing challenges, which should be resolved expeditiously. Also, Moderna highlighted that it has $5B (midpoint) of confirmed contracts and deferrals for FY23 with optionality embedded. Hence, we postulate that the visibility of $7.5B (midpoint) in Moderna’s guidance should be robust. As such, we think the Street’s revised FY23 estimates should see much lower revisions than previous adjustments.

However, the critical question is how Moderna’s projections could be impacted moving ahead, as its private commercial opportunity remains uncertain. The company has telegraphed that it estimates the volume in the booster market could be close to the annual flu vaccines, suggesting an annual opportunity of about 550M doses (midpoint). However, it didn’t provide clarity on its potential penetration, given the current market dynamics. Hence, it’s still too early to project where Moderna’s medium-term revenue could end up, as it only has one commercial product.

Is MRNA Stock A Buy, Sell, Or Hold?

With the significant revisions in its revenue projections, it’s only reasonable for investors to expect marked changes in its profitability metric. With a potentially smaller manufacturing footprint; it has also impacted Moderna’s gross margins for FY22, with the cost of sales revised upward to 27% (midpoint).

Therefore, it implies gross margins of 73% for FY22, which is much lower than its FY21 metrics of nearly 86%. Moderna also highlighted the risks in its 10-Q:

We anticipate that our product mix will shift from a two-dose 100 µg primary series to 50 µg booster doses as COVID-19 evolves to an endemic phase. We will likely require lower levels of raw materials and production capacity as the market shifts to seasonal booster doses. [It] will require us to purchase fewer raw materials and scale back our manufacturing operations with contract manufacturers, [which could] result in increased costs associated with exiting commitments with suppliers, as well as charges to write off unused inventory. (Moderna 10-Q)

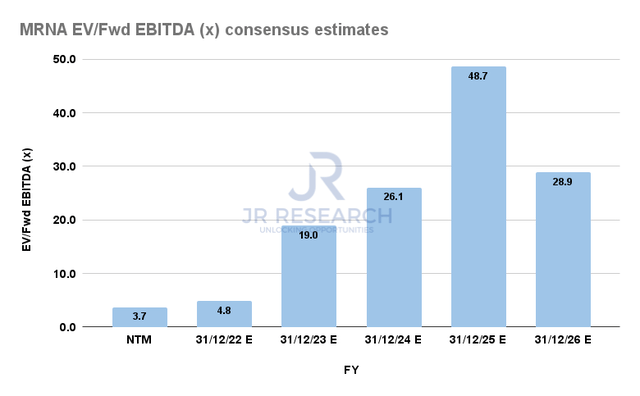

MRNA Forward EBITDA multiples consensus estimates (S&P Cap IQ)

As such, MRNA last traded at an FY24 EBITDA multiple of 26.1x. It also suggests an FY24 normalized P/E of 55.6x, well above its biotech peers’ 10Y median P/E of 19x.

Hence, we believe there’s a significant level of uncertainty in its underlying performance that could impact its valuation considerably. So, for now, its valuation doesn’t seem attractive to us.

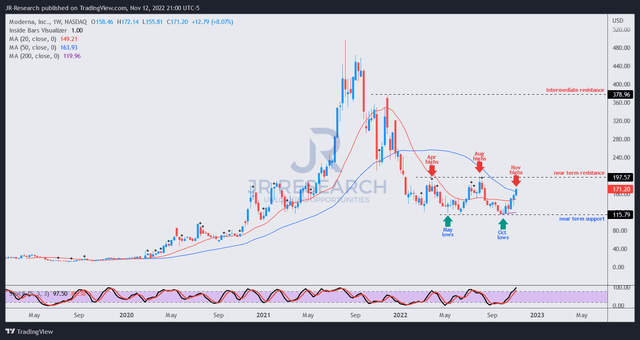

MRNA price chart (weekly) (TradingView)

MRNA is closing in against its near-term resistance that has held its consolidation zone since March 2022. Therefore, we expect sellers to patiently wait for late buyers to push MRNA toward that zone before digesting its recent momentum spike.

Furthermore, the 50-week moving average (blue line) could be another significant dynamic resistance zone for MRNA’s buying upside but has yet to be validated.

Hence, we believe it’s appropriate to be cautious at the current levels and urge investors to be patient with speculative stocks like MRNA.

Revising from Speculative Buy to Hold.

Be the first to comment