Olemedia

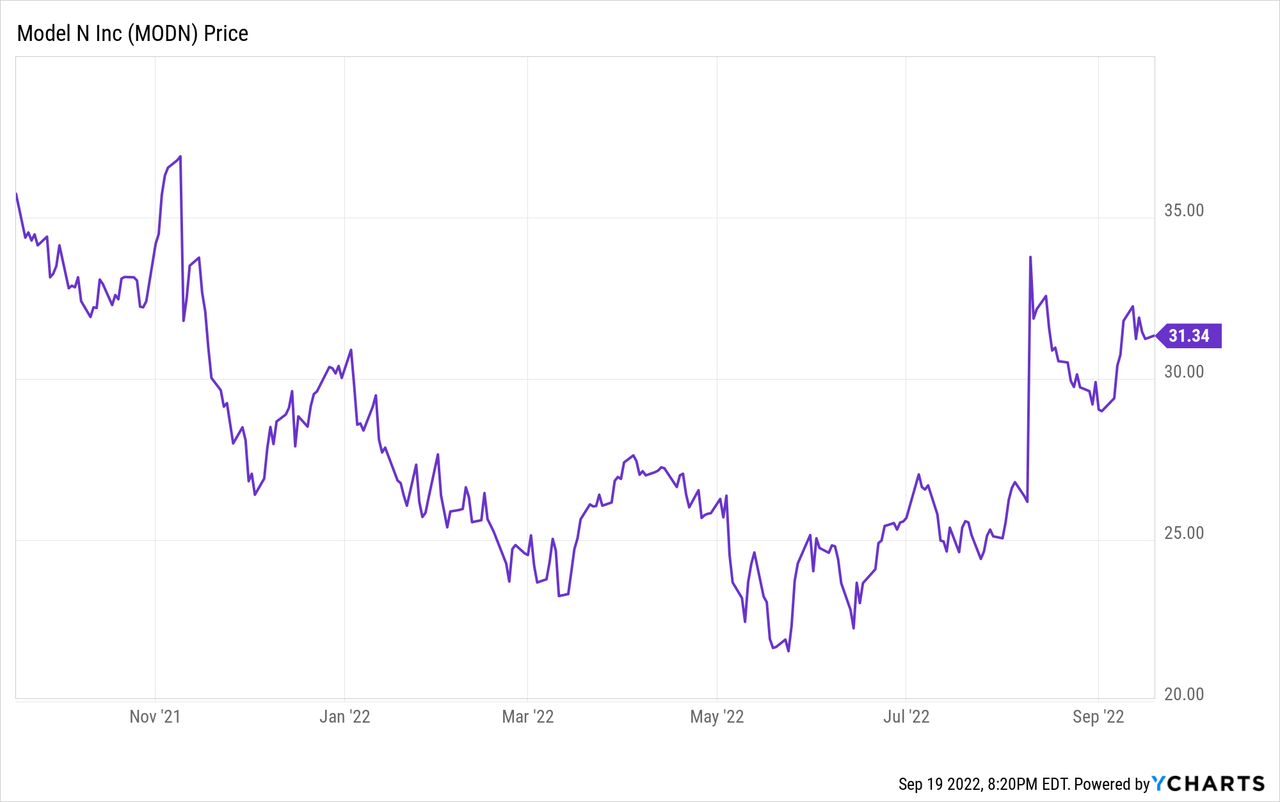

I’ve always held onto the premise that picking small-cap, relatively unknown stocks during times of market volatility is the best way to outperform indices. Model N (NYSE:MODN) is living proof of that. This relatively obscure software vendor, which sells revenue-management solutions specifically to life sciences and technology companies, has been one of the few tech stocks to actually see a year to date gain versus crushing losses for the rest of the sector.

So far, Model N is up ~1% on the year – which doesn’t sound like much unless you’re acutely aware that most SaaS stocks are down in the neighborhood of 40% or more. Yet at this juncture, I also think Model N’s luck has run out, as I don’t view this company as having significant fundamental drivers to continue fueling its rally.

I remain neutral on Model N. The company saw a burst of enthusiasm from investors after it reported fiscal Q3 results (which we’ll dig into more detail in the next section) in mid-August, particularly on its gross margin gains and adjusted EBITDA growth. At the same time, however, I do have some “yellow flags” that prevent me from being as enthusiastic on Model N at >$30 as I was when the stock was trading in the $20s:

- Very niche solution that doesn’t have a huge growth runway ahead of it. Recall that Model N serves only two industries, life sciences and high technology (and on the latter, it’s more limited to semiconductor companies). While Model N’s traction within these industries is certainly impressive, having nabbed some of the largest names including Pfizer (PFE) and Intel (INTC), it begs the question: how much further does Model N really have to go? Model N’s ~10% y/y revenue growth rates is a pretty stark indication that the company’s runway is quite limited.

- M&A-driven growth. A lot of the company’s >20% y/y revenue growth last year (which has since dwindled) is due to an acquisition of Deloitte Business Services. Going forward, Model N may continue to double down on its inorganic growth playbook, despite the fact that it has quite limited liquidity.

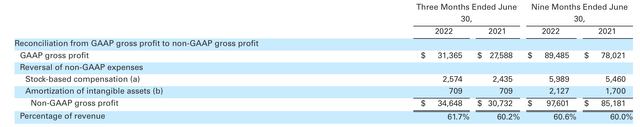

- Gross margin deficit to other SaaS peers. Though Model N saw slight expansion in gross margins in its most recent quarter, its low-60% pro forma gross margins are a full 10-15 points lower than most other SaaS companies, reducing its ability for operating leverage at scale.

Valuation wise, I also don’t see Model N as much of a bargain anymore. At current share prices near $31, Model N trades at a market cap of $1.16 billion. After we net off the $184.5 million of cash and $132.5 million of debt on the company’s most recent balance sheet (a pretty thin $52 million net cash position), the company’s resulting enterprise value is $1.11 billion.

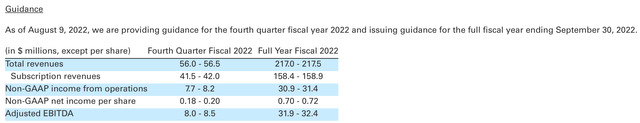

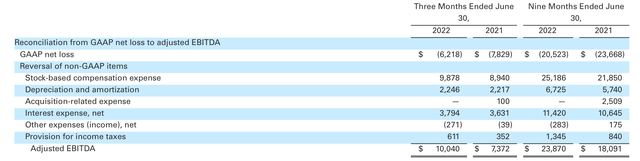

Meanwhile, for the current fiscal year (for which only one quarter remains), Model N has slightly boosted its full-year guidance to $217.0-$217.5 million in revenue and $31.9-$32.4 million in adjusted EBITDA, versus a prior outlook of $215.5-$216.5 million in revenue and $27.5-$28.5 million in adjusted EBITDA. This guidance now implies a 15% adjusted EBITDA margin, two points richer than 13% in the prior outlook.

Model N guidance (Model N Q3 earnings release)

This puts Model N’s current-year valuation multiples at:

- 5.1x EV/FY22 revenue

- 35.6x EV/FY22 adjusted EBITDA

Even if we carry forward to next year’s FY23 estimates (consensus stands at $242.2 million in revenue, representing 12% y/y growth; data from Yahoo Finance), Model N’s revenue multiple only slides down slightly to 4.6x EV/FY23 revenue.

For context – there are software companies that are growing at a much faster current pace (25%+) that are trading at lower multiples of next year’s revenue, including Smartsheet (SMAR), Okta (OKTA), Splunk (SPLK), and C3.ai (AI). Bear in mind as well that Model N’s gross margin gap to most SaaS peers warrants a discount.

The bottom line here: I see very little incentive to stay invested in Model N at current levels. It’s a good time to lock in gains and reinvest the profits in more battered SaaS stocks.

Q3 download

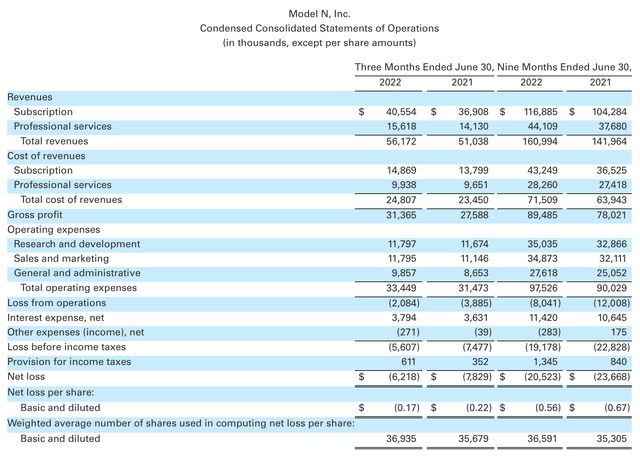

Let’s now go through Model N’s latest fiscal Q3 (covering the June quarter; Model N has a September year-end) in greater detail. The Q3 earnings summary is shown below:

Model N Q3 results (Model N Q3 earnings release)

Q3 revenue grew 10% y/y to $56.2 million, beating Wall Street’s expectations of $54.9 million (+8% y/y). Revenue growth did decelerate, however, relative to 11% y/y growth in Q2. The positive spin on this: the company noted that its transition to subscriptions/SaaS is proceeding ahead of plan, which is always a near-term hit to revenue growth.

Per CEO Jason Blessing’s prepared remarks on the Q3 earnings call:

We remain ahead of our internal plan for SaaS transitions, which is one of the growth levers driving upside this year. And perhaps even more importantly, we are seeing a meaningful amount of new sales coming from non-SaaS transition deals, which bodes well for the future.

Given the success we are experiencing with SaaS transition, we also continue to see our maintenance decline at an accelerating rate compared to recent levels. Declining maintenance is a seminal event in any on-premise to SaaS transition, and we view this as a very positive trend in the business.”

Pro forma gross margins in the quarter expanded 150bps to 61.7%. This was driven both by a higher mix of software revenue (versus lower-margin professional services), as well as an uptick in professional services margin.

Model N Q3 gross margins (Model N Q3 earnings release)

We note however, as previously mentioned, that Model N’s gross margin still trails most peer software companies by 10-15 points.

The big bright side this quarter was a 36% y/y jump in adjusted EBITDA to $10.0 million, representing a 17.9% margin – 350bps richer than 14.4% in the year-ago quarter.

Model N adjusted EBITDA (Model N Q3 earnings release)

Key takeaways

Trading at a similar multiple to software companies that are growing faster and boast richer margins, I don’t see any appeal to investing in Model N at current levels. Stay on the sidelines here, and invest elsewhere.

Be the first to comment