adrian825/iStock via Getty Images

Milestone Scientific (NYSE:MLSS) has a technology (DPS Dynamic Pressure Sensing technology) that enables devices to administer injections in precise locations, this matters a great deal in situations where the margins for error are small.

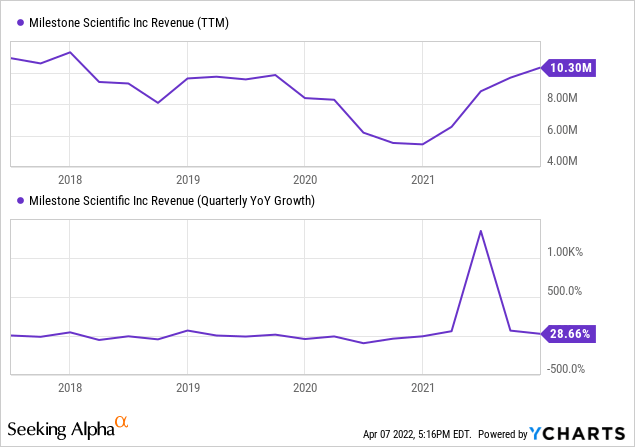

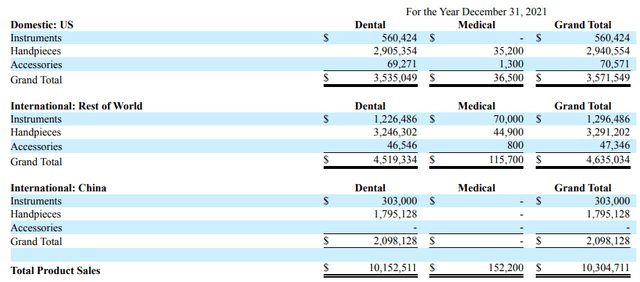

Growth has clearly returned, but the company has two business segments so let’s start with an overview of the revenue split, from the 10-K:

MLSS 10-K

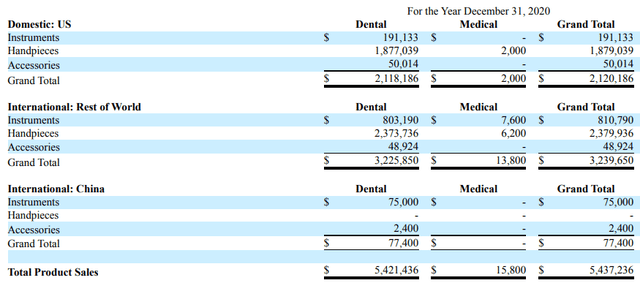

And compared with 2020:

MLSS 10-K

Dental market

Their legacy market is the dental market, where they sell a series of devices that enable secure local anesthesia. After using the business basically as a cash cow in order to develop the CompuFlow.

However, in 2020 the board decided to revamp the dental business through, amongst other things, hiring people with a background in the industry and concluding a series of non-exclusive domestic and foreign distribution deals. There are two things one might appreciate in the table above:

- Dental is good for nearly all company revenue.

- Dental generates a large stream of recurring revenues (handpieces and accessories).

That consumables revenue stream is in fact several times the size of the revenue from selling instruments, it’s a pretty attractive business model.

Revenue almost doubled, testifying to the great comeback of the business and this promises quite a bit for the future:

- There is clearly sales momentum in instruments.

- A larger installed base of instruments produces a long tail of consumables sales.

The sales are exceeding pre-pandemic levels, so we can conclude that the revival of their dental business is a success that seems mostly down to distribution (Q4CC):

The growth in the Dental division reflects the success of our three-year multi-distribution strategy to expand the worldwide global dental market. As a result, we are successfully adding domestic and global distribution partners.

CompuFlow

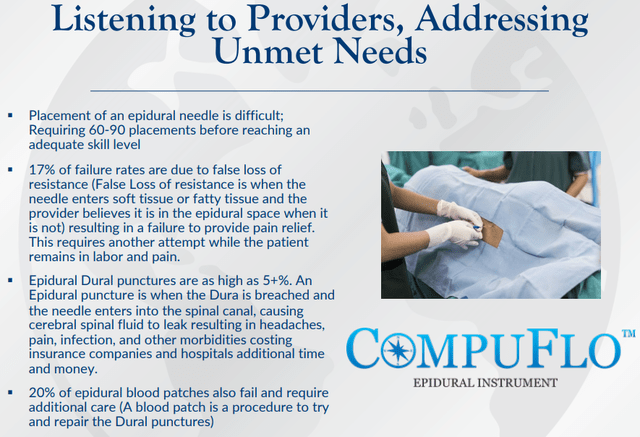

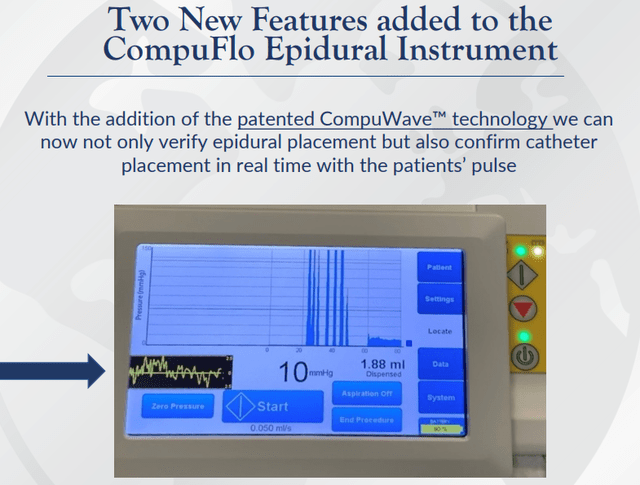

The cash flow from the dental business was put to good use for years to finance the development of the CompuFlow, a similar instrument primarily used for epidurals to mitigate the pain of childbirth. The CompuFlow takes the guessing and errors out of epidurals:

MLSS IR presentation

On average, the savings with the CompuFlow amount to a little over $500 per epidural and that can quickly add up to $3M for a hospital performing 6000 epidurals a year.

CompuFlow sales suffered from the pandemic and just when it looked like things would improve and efforts investing in salesforce were paying off with three deals in December 2020 alone, but then the Omicron wave came.

As many pregnant women are not vaccinated, this again produced serious headwinds for sales efforts, but we should now be passed that. And the company did have sales, even if they couldn’t name the hospitals in every case. For instance, they sold to:

- a major Northeast teaching hospital

- across Memorial Healthcare Systems network of hospitals

- University of Texas Medical brands in Galveston

- Health Clear Lake Campus Hospital

- the University Hospital of Wurzburg

Just as with their dental business, new distributors are also playing a role here adding new international distributors in markets such as Austria, Switzerland, Canada, Slovenia, and the United Arab Emirates, and they’re not stopping there either.

Growth

Apart from winning new hospitals and distribution deals, the company has additional growth vectors:

- Salesforce

- New indications

- Reimbursement

- New instruments

The company now has a specialized sales force of 11 territorial managers and clinical specialists that (Q4CC):

are going to stay at the hospital on a daily basis, helping with the nursing staff and the anesthesia staff to push and to increase the penetration and the adoption and the utility at these hospitals.

For new indications, there is the pain management segment with over 11M epidural procedures it’s much larger than the labor and delivery segment, and it’s served by a variety of health institutions like hospitals, specialty centers, outpatient centers, and sports medicine centers.

The company has already had a few recent wins here like Cypress Surgery Center and Galileo Surgery Center and demand for disposables is already emerging.

They have also filed for a CTP code in February, expecting to receive a temporary code early next year which would greatly help their commercialization.

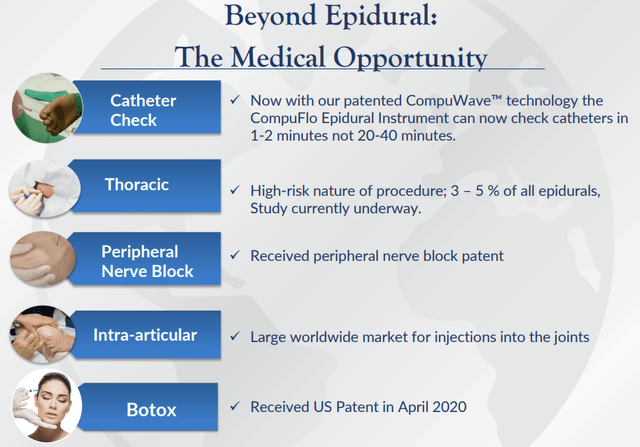

In terms of new instruments, first there was the CathCheck:

MLSS IR presentation

And in terms of future segments that can be serviced with the same core capabilities:

MLSS IR presentation

The thoracic indication is already approved in the EU, and it accounts for 30%+ of all epidurals in the US so this is another significant market opportunity for the company.

The company is planning to submit a 510(K) submission to the FDA for approval and management is optimistic this will be approved in H2.

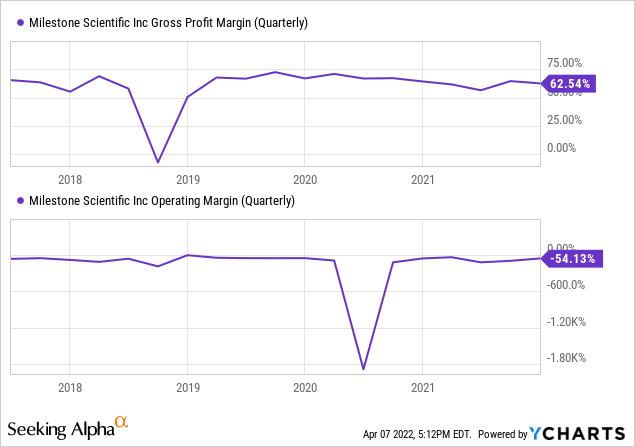

Margins

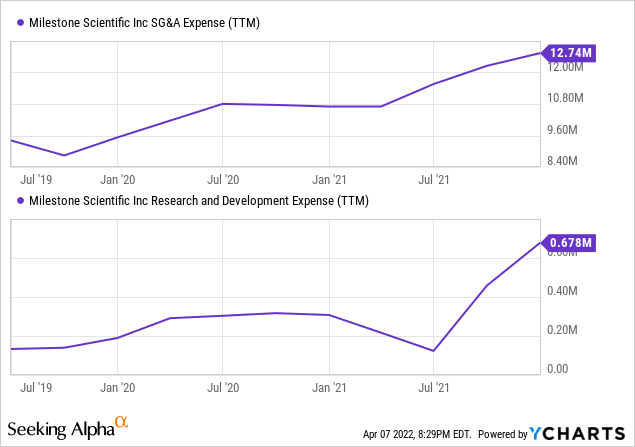

The company still has a significant operating loss ($7.4M in FY2021) with a net loss of $6.8M. There has been some uptick in OpEx as a result of the build-out of the sales force:

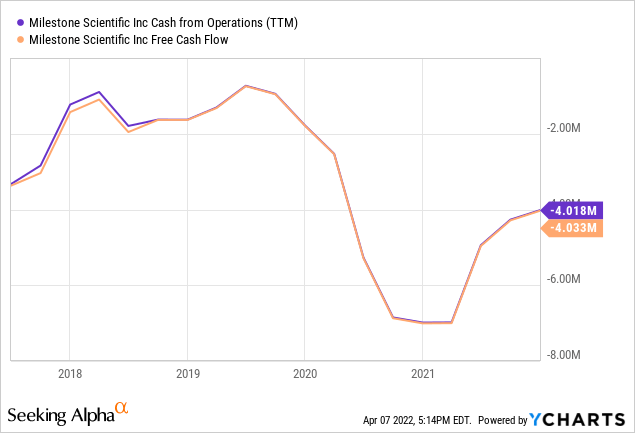

Despite that the company is recovering from the depth of the pandemic and the strong sales in their dental business, it isn’t losing much cash even in a year with considerable headwinds:

With $14.8M in cash, the company seems amply financed and we expect if the cash bleed to diminish or even halt in the current year.

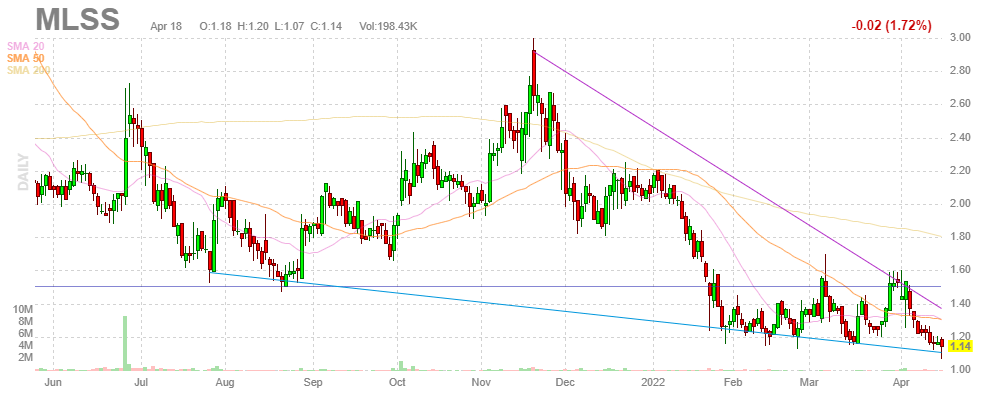

FinViz

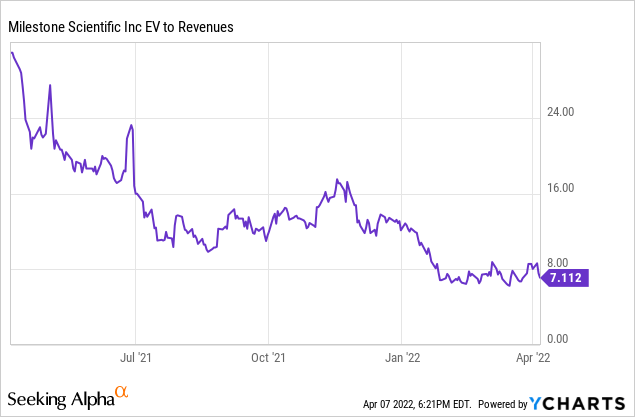

Valuation

Valuation is at a low but still pretty steep:

There were 68.1M shares outstanding on March 31, 2022 and 4.2M warrants (at year-end 2021) with an average exercise price of $1.97. There are 2.8M options from performance pay outstanding, 522K of which were exercisable at year-end 2021.

Analysts expect an EPS of -$0.12 this year rising only to -$0.10 next year, which seems low to us. For starters, EPS in 2021 came in at -$0.10 and it looks like the sales of dental seem to have pretty good momentum and the increasing base is producing an ever-greater stream of high-margin disposables.

Gross margin was 61% but that’s likely to expand as the business scales. At a revenue of $20M and gross margin of 65% the company’s gross profit ($13M) would put it very close to break-even and probably in the black on an adjusted earnings basis.

$20M in revenue is a considerable stretch for this year, but in 2023 that should be within the realms of possibilities.

Conclusion

We see quite a few reasons to be bullish on the shares:

- The dental business is recovering strongly through a new focus and new domestic and overseas distribution deals.

- The increasing installed base in dental is generating a large stream of demand for (high-margin) consumables.

- Sales in CompuFlow are catching on through new marketing efforts, the company’s new sales force, and distribution deals.

- CompuFlow too generates a stream of consumables that will grow with the installed base.

- The pain management market offers a large new sentiment and the company is starting to make inroads here.

- The company is planning to launch new instruments and pursue new indications.

- While growth was inflated this year as a result of the pandemic impact in 2020, all signs are that the company will be able to grow at a considerable rate in both its divisions and the company has enough cash to make it until it becomes cash flow positive.

- We think the shares are attractive at current levels.

Be the first to comment