sankai/iStock via Getty Images

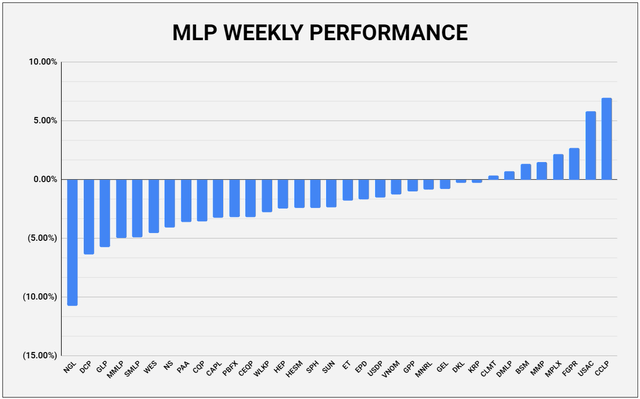

Midstream Sector Performance

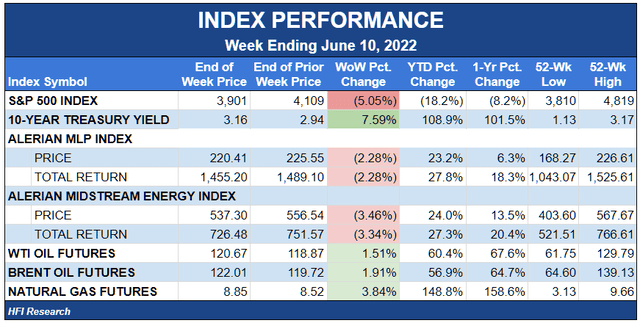

Midstream traded lower during the week, falling 2.3%. Still, the sector significantly outperformed the S&P 500, which traded 5.1% lower.

The week’s biggest financial headline was that inflation surged to a 40-year high on a year-over-year basis. The specter of sustained higher inflation spooked the markets when the inflation news leaked late Thursday. The selling continued on Friday, sending every stock market sector down for the week.

Higher inflation increases the risk of economic weakness and higher interest rates, both of which will serve as a headwind for the stock market sectors that powered the S&P 500’s growth over the last decade. By contrast, midstream equities have outperformed during times when interest rates begin to rise. We believe rates are still so low that a gradual increase, even if sustained, won’t stand in the way of continued equity price gains for the sector.

Energy commodities remained well supported during the week. Oil prices notched their seventh straight weekly gain and were strong all week until cooling off on Friday in response to a general “risk-off” trade, and not due to any discernable fundamental weakness.

Natural gas prices rocketed out of the gate, rising more than 9% on Monday only to fall by more than 10% after an explosion disrupted operations at a Freeport LNG facility. The reduced natural gas demand caused by the explosion is likely to keep natural prices tame in the near term but does nothing to alter long-term natural gas fundamentals.

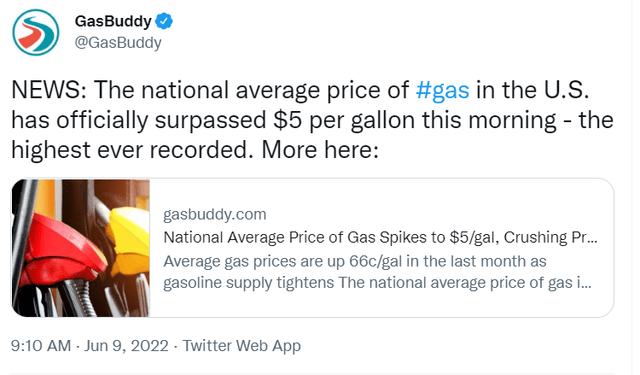

The other big news was that the average U.S. retail gasoline price hit $5.00 during the week.

No doubt this is a negative for the U.S. consumer, and by extension, economic growth. We’ll be keeping a close watch for demand destruction at high retail gasoline prices.

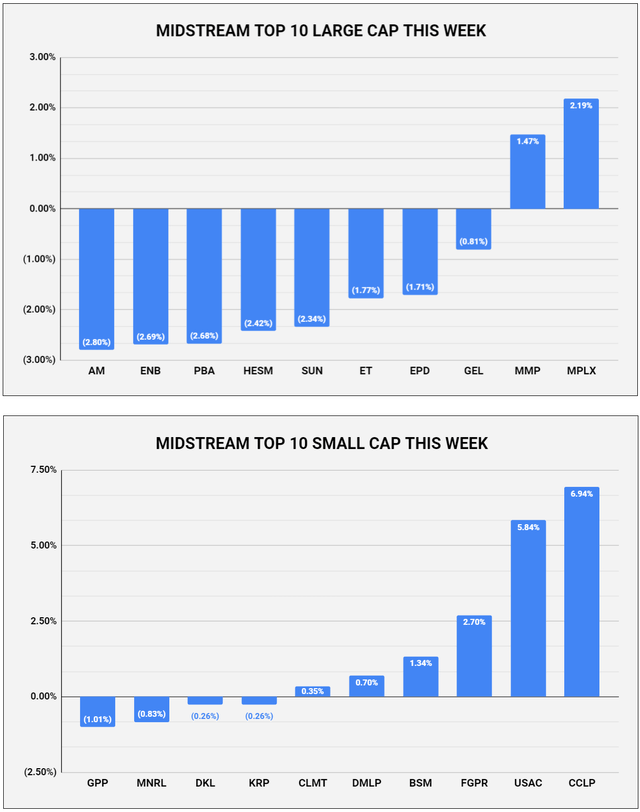

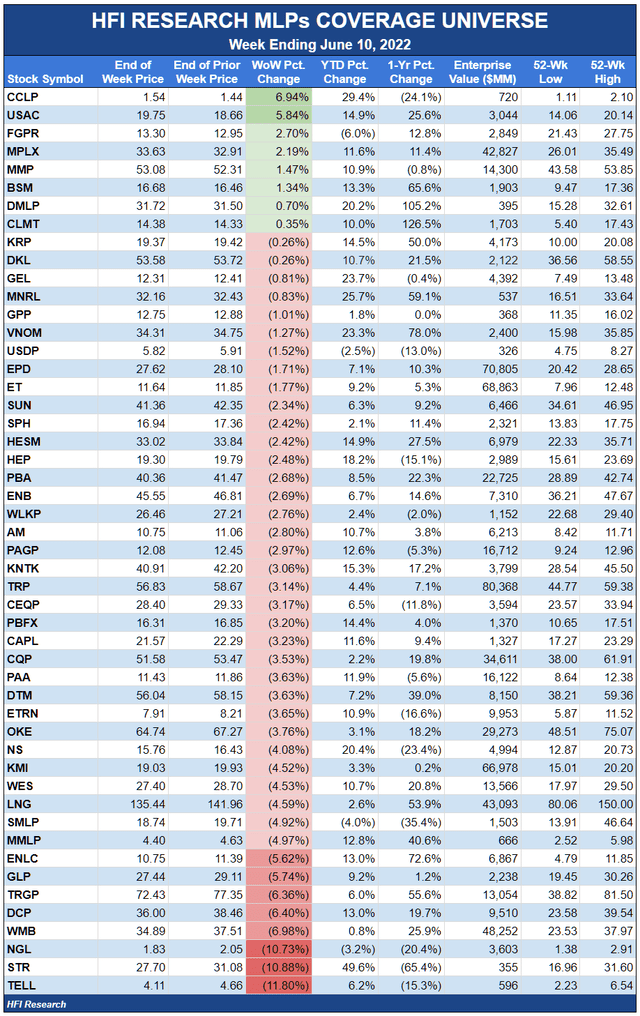

Midstream was weak all around. In a reversal from the typical trend, small caps outperformed large caps. There was no pattern to the outperformance. CSI Compressco (CCLP) and USA Compression Partners (USAC) led the small-cap gainers on no news. Ferrellgas Partners (OTCPK:FGPR) units traded higher as the company reported a 15% increase in revenues from the year-ago quarter.

Among large caps, Magellan Midstream (MMP) and MPLX LP (MPLX) were higher on no fundamental news. We believe these equities are catching up to their peers’ valuations and recommend both as Buys at current prices.

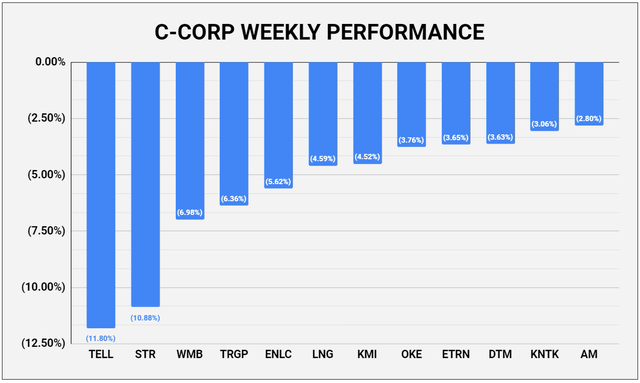

Another unusual development during the week was MLPs’ outperforming C-corps. Perhaps investors were selling large and liquid C-corp midstream stocks in response to the wider downturn.

We continue to prefer MLPs over C-corps because their units trade at a relatively discounted multiple.

There wasn’t news among the decliners. Falcon Minerals completed its merger with private Desert Peak Minerals to form Sitio Royalties (STR). The units, which underwent a 4-for-1 reverse split, traded lower immediately after the announcement.

NGL Energy units were hammered after the company missed quarterly earnings estimates and lowered its fiscal year 2023 free cash flow guidance. We continue to rate NGL units as a “Sell” and recommend that investors avoid them.

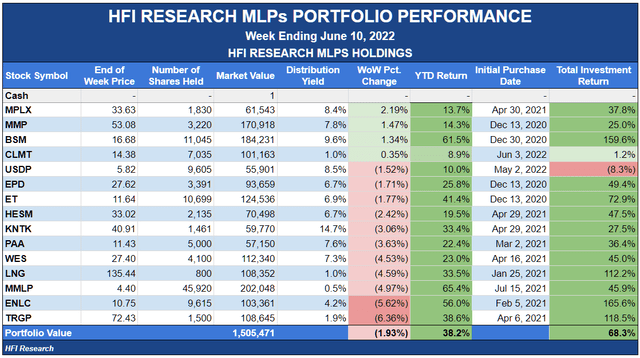

Weekly HFI Research MLPs Portfolio Recap

Our portfolio outperformed its benchmark, the Alerian (recently renamed “VettaFi”) MLP Index (AMLP), by 0.4%.

MPLX was the biggest gainer on no news. The name had lagged its peers’ performance and we believe more outperformance is warranted from current levels. We recommend the units as the best “Buy” in the sector for conservative income accounts.

MMP received a boost from an upgrade to “Buy” at Goldman Sachs, which cited the inflation resistance of the company’s refined products segment. Goldman has a $59 price target on the units, which is in line with our own estimate of MMP’s value. We expect that MMP units will rise toward our value estimate as more investors become aware of the company’s economic attributes and as the valuation gap between it and its peers closes.

Martin Midstream Partners (MMLP) filed an S-3 securities offering prospectus with the SEC for the sale of $250 million of debt securities and 6.1 million units, essentially the number of units owned by its sponsor. The filing replaced a prior S-3 “shelf” registration filed in 2019, which expired in June of this year, as shown in the excerpt from that offering below:

These filings have been made on a routine basis by MMLP for many years and we don’t regard the latest filling as a material development for unitholders.

MMLP equity will remain speculative until management can deleverage and/or refinance its 2024 and 2025 maturities. However, by the time it does so, we believe its units are likely to trade significantly higher than current levels. We recommend that investors allocate their speculative funds to the name for long-term appreciation potential and increasing distributions.

Our G&P holdings took in on the chin, particularly on Friday, even though their fundamental outlooks remain unchanged. We believe the selloff is a good entry point for investors looking for long-term exposure to U.S. production growth.

News of the Week

June 6. After beginning as a natural gas producer, then pivoting to oil, ending up in bankruptcy after oil prices collapsed, emerging with a focus on natural gas, and proceeding to purchase various private E&Ps, Chesapeake Energy (CHK) appears to be shifting its strategic focus once again—this time to LNG. Reuters reported that CHK is looking to hire an advisor to guide its executives on LNG marketing activities. If we were CHK shareholders, we’d view these developments negatively, as the company’s propensity to chase the latest, hottest thing has hurt shareholders repeatedly in the past. However, we believe CHK’s interest in LNG attests to the long-term attractiveness of LNG economics for the incumbent producers, such as our holding Cheniere Energy (LNG). New entrants are a certainty, but with the dash to renewables increasing natural gas demand throughout the world, we don’t see an LNG glut on the horizon for at least the next few years.

June 5. The next LNG news came from Energy Transfer (ET), which entered into an LNG sale and purchase agreement with a subsidiary of China Gas related to ET’s Lake Charles LNG project. The agreement is for 25 years, and deliveries are expected to begin in 2026. ET reported that it brings the total amount of LNG contracted from Lake Charles to 6.0 million tons per annum. It brings ET closer to announcing a final investment decision on the project.

June 9. In yet more LNG news, Cheniere Energy (LNG) became the next U.S. LNG producer to announce a sale and purchase agreement, this time with Equinor (EQNR). In the deal, Cheniere will sell 1.75 million metric tons per year of LNG for 15 years beginning in 2026. Cheniere management said that half of the volumes are subject to the company’s final investment decision for its Corpus Christi State III expansion project. We hold Cheniere shares and believe they still have significant upside and have a catalyst for building value in the form of Corpus Christi Stage III, which we expect to receive a final investment decision over the coming months.

June 9. EnLink Midstream (ENLC) announced that it had reached a Phase I Final Investment Decision to develop a carbon capture and sequestration project in the Barnett Shale region of North Texas with private E&P BKV Corporation. ENLC also announced a deal with Honeywell (HON) to pursue carbon capture solutions to industrial-scale carbon dioxide emitters within the U.S. Gulf Coast area. So far, ENLC management—along with virtually every other midstream management—has been mum on the economics of these deals. We hope they’ll create value for equity owners, but we’ll remain skeptical until we see concrete evidence. Still, ENLC management has done a good job deleveraging the company and returning excess capital to shareholders over the past few years. We believe this week’s selloff provides a good entry point to buy ENLC shares.

June 9. Summit Midstream (SMLP) announced the sale of its Lane gathering and processing system in the Delaware Basin to Matador Resources for $75 million. With the sale, the company plans to focus its efforts in the Delaware on its Double E pipeline system. We recommend avoiding speculative SMLP units.

Capital Markets Activity

None.

Be the first to comment