Jean-Luc Ichard

Microsoft (NASDAQ:MSFT) is reporting its Q4 and FY22 earnings on July 26 after the market closes. The company is expected to experience growth in revenue and EPS on a quarterly and annual basis. Q4 revenue and earnings are expected to be $52.37 billion and $2.30 per share, respectively. As for the full fiscal year, revenue is expected to be $198.57 billion with EPS coming in at $9.36. This is due to the rising demand for Azure, despite falling PC shipments likely to cause Windows and device sales to struggle. The company also recently announced upcoming layoffs of about 1% of its workforce due to a possible recession coming soon. This may cause the stock to drop, but may be partially offset by large buybacks and a rising dividend. Despite a possible bleak future for some of the company’s products, the stock appears to be slightly overvalued. Therefore, investors may want to wait before jumping into the stock.

Microsoft is Reporting Q4 and FY22 Earnings on July 26

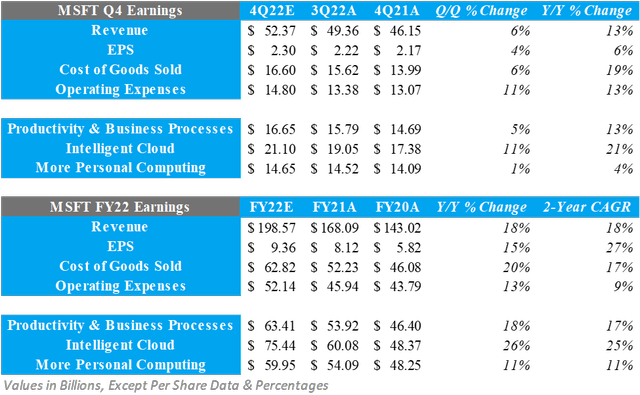

Microsoft is reporting its fourth quarter and FY22 earnings on July 26 after the market closes and is expected to see growth in both revenue and earnings. In the fourth quarter of 2022, the company is expected to achieve revenues of $52.37 billion. This would represent a Q/Q growth rate of 6% and Y/Y growth rate of 13%. On top of this, the company is expected to report an EPS of $2.30, up 4% Q/Q and 6% Y/Y. As for the full fiscal year, revenues are expected to be $198.57 billion. This would be an 18% increase compared to FY21. FY22 EPS is expected to be $9.36, up 15% from FY21.

The reason for this growth is primarily due to incredible growth in the Intelligent Cloud segment caused by Azure. The segment is expected to see fourth quarter revenue of $21.1 billion, up 11% Q/Q and 21% Y/Y. Furthermore, its FY22 revenue is expected to be $75.44 billion, up 26% since last year.

MSFT Key Earnings Data (Created by Author)

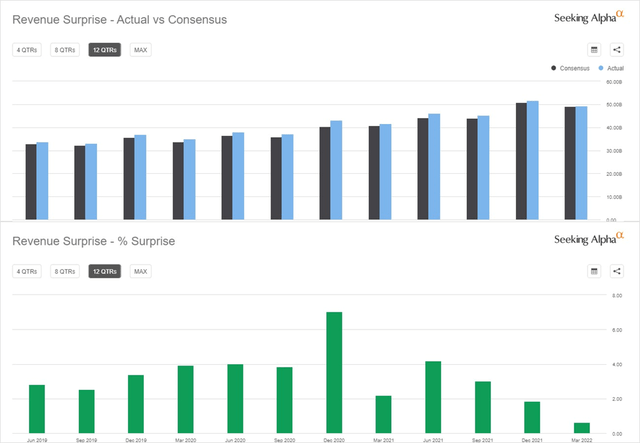

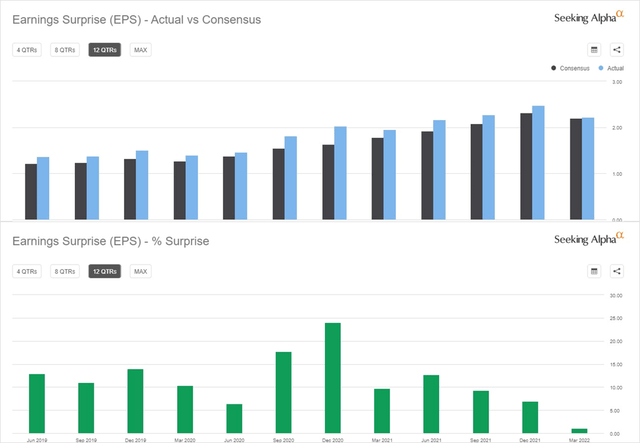

As for how Microsoft could perform compared to analysts’ expectations, we can look at its past surprises. Over the past 12 quarters, the company has beat expectations for revenue and EPS every time. However, its surprise for both metrics have been on the decline for the past four quarters. In its 3Q22 report, it only beat revenue estimates by 0.64% and beat EPS estimates by 1.06%. This is its lowest surprise in any of its past 12 quarters. If this decline continues, it is possible Microsoft will miss estimates. This could be devastating to the stock and overall market.

MSFT Revenue Surprise Data (Seeking Alpha)

MSFT EPS Surprise Data (Seeking Alpha)

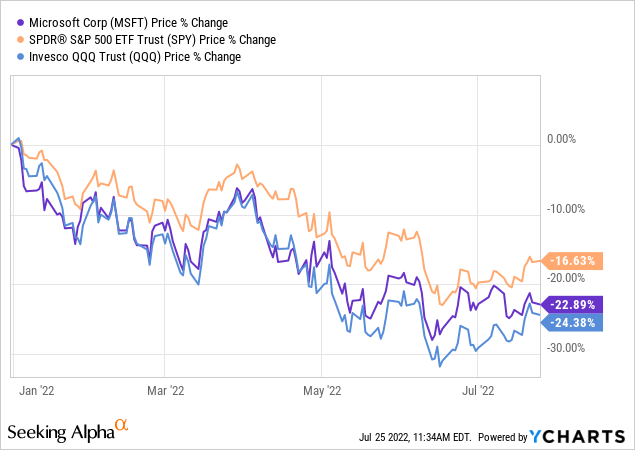

During this calendar year, Microsoft stock is down nearly 23%. This is slightly above the Nasdaq yet below the S&P 500. Its selloff is mainly due to the general tech selloff, as well as lower demand for consumer electronics.

PC Shipments Are Down Heavily, Look for Azure to Grow

A key factor affecting Microsoft’s upcoming earnings report is the lower shipments of PCs, which fell by 15.3% in the second quarter of 2022. This was due to issues with both supply and demand. During the second quarter, lockdowns in China and other macroeconomic headwinds caused the production and shipping of PCs worldwide to be disrupted. Even though China is ending its lockdowns, demand is becoming a huge issue. With a recession likely already here, consumer demand for PCs and other electronics is on the decline. This lower demand will directly hurt Microsoft’s More Personal Computing segment. Lower PC demand and shipments means less sales of Surface, Xbox, etc., as well as less licensing of Windows.

With PC shipments likely continuing to decline, investors are looking to the Intelligent Cloud segment and Azure to protect Microsoft’s top and bottom lines. As shown previously, this segment is expected to experience double-digit growth on a quarterly and annual basis. This is because of rising demand for cloud services, as well as its rising market share against AWS (AMZN).

To see how Azure could perform, we can look at how other cloud services have performed in this quarter. A good competitor that has recently reported earnings is IBM (IBM). In the past 12 months, IBM’s hybrid cloud revenue has increased by 19% excluding currency changes. In its second quarter, hybrid cloud revenue was up 18% excluding currency changes. This could mean that Azure will also see great growth, protecting the company’s top and bottom lines from lower PC sales.

Large Buyback Programs and Consistent Dividend Hikes Provide Value

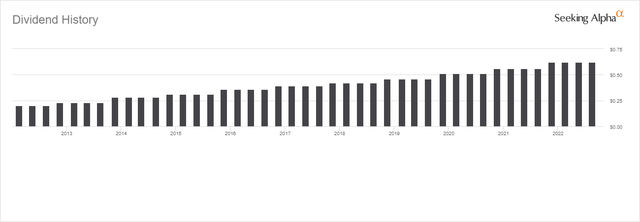

In Microsoft’s previous quarter, the company returned $12.4 billion to shareholders. This was up 25% Y/Y and was comprised of $7.8 billion in share repurchases and $4.6 billion in dividends. This is part of its $60 billion share buyback program announced in late 2021. So far in FY22, the company has bought back over $23 billion in stock. Investors should expect a similar quarterly buyback in its upcoming earnings report. In the long-run, Microsoft is expected to continue announcing share buyback programs. Since 2013, the company has announced a new program every three years.

At the same time of announcing its increased buyback program, Microsoft also raised its quarterly dividend by 11% to $0.62 per share, which has consecutively risen for over 18 years. This likely means that the trend will continue, meaning Microsoft may raise its dividend in the near future.

MSFT Dividend Data (Seeking Alpha)

Like Other Tech Companies, Microsoft is Cutting Its Staff

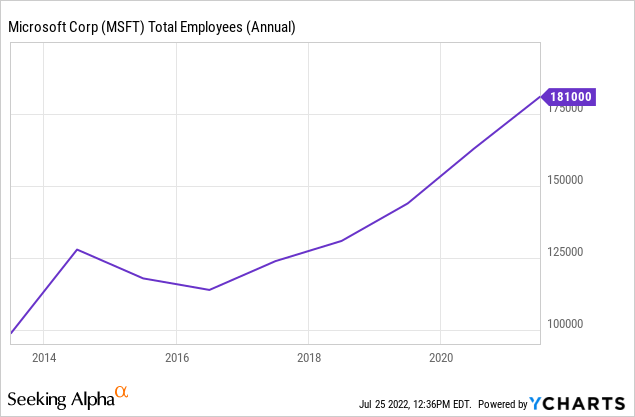

Similar to competitors like Google (GOOG)(GOOGL), Apple (AAPL), and more, Microsoft is cutting its staff in anticipation of a recession. The company announced it would lay off about 18,000 employees over the next year, representing about 1% of its total workforce. About 12,500 of these employees are in sales, marketing, and engineering roles for realignment and streamlining purposes. On top of this, Microsoft has cut multiple open job listings for Azure and security software positions. Once again, this is in anticipation for an economic slowdown. Over the past 10 years, Microsoft has increased its headcount by nearly double. This is due to increasing demand for the company’s services but has caused expenses to rise much higher than before. Therefore, the likelihood of lower demand in the upcoming future is causing it to cut jobs that are no longer required.

MSFT Stock Valuation

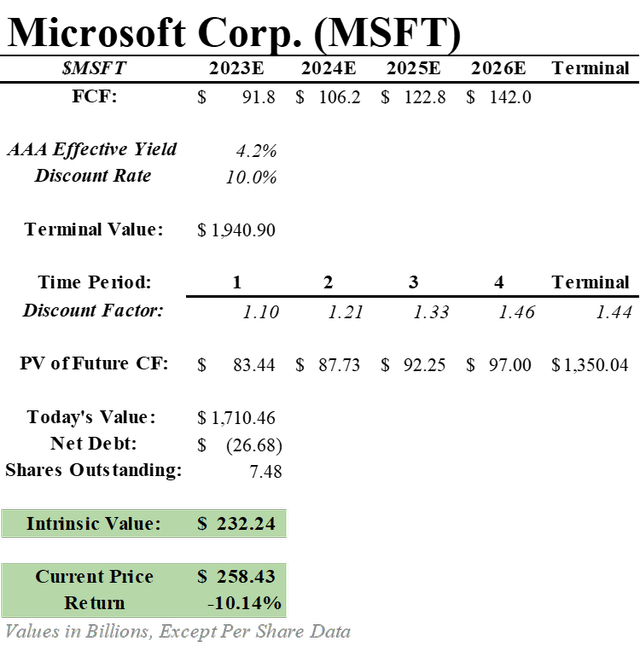

When valuing Microsoft stock, I created a DCF based off consensus analyst estimates for free cash flow, as well as a relative valuation. For a discount rate, I used 10% to give a premium over current AAA corporate bonds, as well as a terminal growth rate of 2.5%. After applying this discount rate to the company’s future free cash flows and adjusting for net debt, a fair value of $232.24 can be calculated. This means the stock could have an implied downside of about 10.14%.

MSFT DCF with 10% Discount Rate (Created by Author)

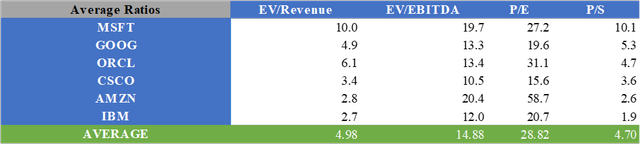

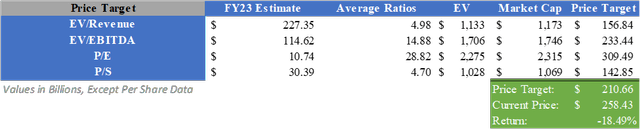

For the relative valuation, I used the average valuation multiples of Microsoft and its competitors and consensus analyst estimates for FY23. By multiplying the consensus analyst estimates for FY23 by the average valuation multiples for EV/Revenue, EV/EBITDA, P/E, and P/S of Microsoft and its competitors, a price target of $210.66 can be calculated after adjusting for net debt. This gives the stock an implied downside of 18.49%.

Average Valuation Multiples (Created by Author)

Relative Valuation of MSFT (Created by Author)

What Does This Mean for Investors?

Microsoft is announcing its Q4 and FY22 earnings on July 26 after the market closes. The company is expected to report fourth quarter revenues of $52.37 billion, growing by 6% Q/Q and 13% Y/Y. EPS is expected to come in at $2.30, up 4% Q/Q and 6% Y/Y. As for FY22, total revenue is expected to be $198.57 billion, up 18% since FY21. EPS is expected to be $9.36, up 15% since last year. The growth is mainly being caused by double-digit revenue increases in the Intelligent Cloud segment due to rising demand for Azure. Azure is expected to perform well, as seen by IBM’s growth in its cloud services revenue. However, falling PC Shipments will likely cause the More Personal Computing segment to see little growth, if any. On top of this, the company is laying off about 1% of its workforce in anticipation of an economic downturn. However, a large buyback and dividend will help offset these issues. Due to all of these points, as well as its current share price, I will apply a Hold rating to Microsoft stock.

Be the first to comment