vzphotos

Micron Technology, Inc. (NASDAQ:MU) submitted its fourth-quarter earnings sheet yesterday that beat on the bottom line but fell short of expectations on the topline. Unfortunately, the chipmaker even under-performed its own guidance for FQ4’22 revenues, and the outlook for FQ1’23 is extremely weak as well. The drop-off in revenues is partly driven by softening average DRAM and NAND selling prices… which, in the past, were a key driver for Micron’s topline expansion. Since revenue risks are growing and the company has announced a 30% reduction in its capex to account for the new reality of slower growth, Micron’s risk profile has fundamentally changed!

Weak revenue performance

Micron guided for $7.2B +/- $400M in revenues in the fourth fiscal quarter, which the company failed to achieve. Micron had FQ4’22 revenues of $6.6B, showing a massive 23% quarter-over-quarter drop. Compared to the same quarter in the year-earlier period, Micron’s revenues dropped off 20%. Still, Micron managed to beat earnings estimates slightly but fell short of revenue expectations.

Broad-based weakness has developed in Micron’s business

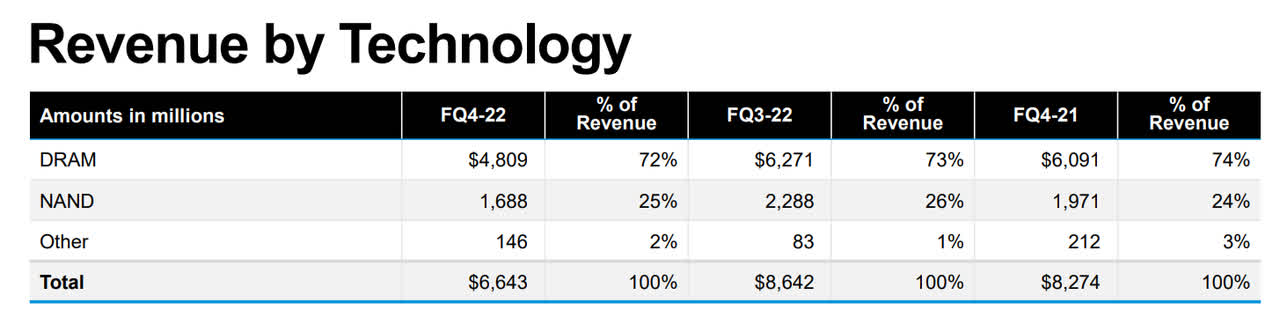

Micron’s DRAM revenues declined 23% quarter over quarter to $4.8B while NAND revenues skidded at an even higher percentage: 26% quarter over quarter. The decline in Micron’s revenue base is broad-based and is driven by lower shipments of consumer electronics goods post-pandemic.

Micron FQ4’22 Revenue Breakdown

Probably most concerning in Micron’s earnings sheet was that the firm’s average selling prices in the DRAM as well as the NAND business kept falling in the fourth quarter, which explains the steep drop-off in revenues in FQ4’22. In the third quarter, average selling prices for DRAM and NAND products declined slightly, but in the fourth quarter the downtrend accelerated: Micron’s average DRAM selling prices fell in the low-teens percentage range, while NAND prices dropped in the mid-to-high single-digit percentage range, according to Micron’s earnings presentation. The reason for the drop in pricing is weaker product demand and persistently high inflation. Bit shipments also fell in both of Micron’s product groups, with DRAM shipments contracting 10% and NAND shipments declining in the low-20s percentage range.

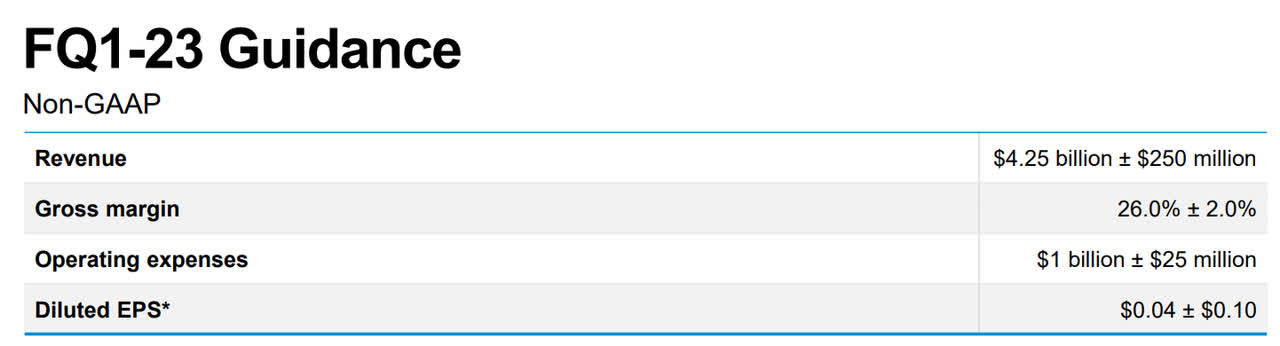

With weaker pricing and demand weighing on Micron, the company saw a compression of its gross margin in the fourth quarter as well. Micron generated a non-GAAP gross margin of 40.3% compared to a margin of 47.4% in the previous quarter. Considering that the outlook for FQ1’23 calls for a gross margin of only 26% +/- 2%, I believe it is safe to say that the current semiconductor expansion cycle has officially ended for Micron. To compensate for the decline in revenues and gross margins, Micron announced that it would cut its investments by 30% to $8B in FY 2023.

Disaster outlook for FQ1’23

The outlook for the next fiscal quarter is a nightmare as the chipmaker expects a continual draw-down in its revenue base: Micron expects to generate revenues of $4.25B +/- $250M, which translates to a quarter-over-quarter drop of 36% in its topline while its gross margin is set for an up to 40% contraction quarter over quarter.

Micron FQ1’23 Outlook

My own outlook

I believe Micron will have to put with an aggressive pricing environment for DRAM and NAND products for quite some time because PC and device shipments are down big in 2022 and projected to continue to drop. Also, consumers have upgraded their devices during the pandemic, and with inflation weighing on consumer spending, a rebound in the consumer electronics industry is unlikely in the near term. The result of these circumstances is that the pricing environment will likely remain weak, and bit shipments are also likely going to continue to decline.

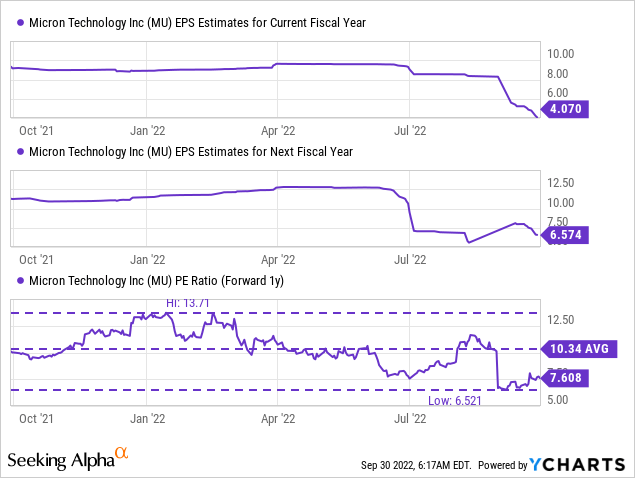

Earnings estimates are likely going to see steep revisions

Micron trades at a higher P/E valuation now than earlier this year due to shares revaluing lower. Because of the disaster outlook for the next quarter, however, I believe that earnings estimates are going to drop off steeply and broadly, exposing Micron to the risk of a further downward revaluation.

The average estimate for Micron’s FY 2023 earnings is currently anchored at $4.07, while analysts estimate $6.57 in FY 2024 earnings. Micron’s P/E ratio, based off of FY 2024 estimates, is 7.6 X and the stock is trading below its 1-year average P-E ratio. Because the outlook for FQ1’23 is as bad as it is, investors must expect EPS estimates to trend down broadly.

Risks with Micron

Weaker average selling prices in both the DRAM and NAND business are highly concerning, and Micron’s outlook for the next quarter is a disaster. The weak outlook, especially regarding topline growth and gross margin contraction, strongly indicates that average selling prices for both DRAM and NAND products will continue to fall as a more aggressive pricing environment has emerged.

Final thoughts

Micron presented a bad earnings sheet for FQ4’22 (which was largely expected) and a disaster outlook for FQ1’23 due to projections of crashing topline growth and a significant contraction in expected gross margins. The reason behind the weakening fundamentals is slowing demand in the consumer electronics industry as well as high inflation, both of which are driving significantly lower average selling prices for Micron’s two main product categories. Based on the information provided by Micron, I believe the semiconductor expansion cycle has ended and Micron faces weaker growth prospects for a while!

Be the first to comment