PonyWang

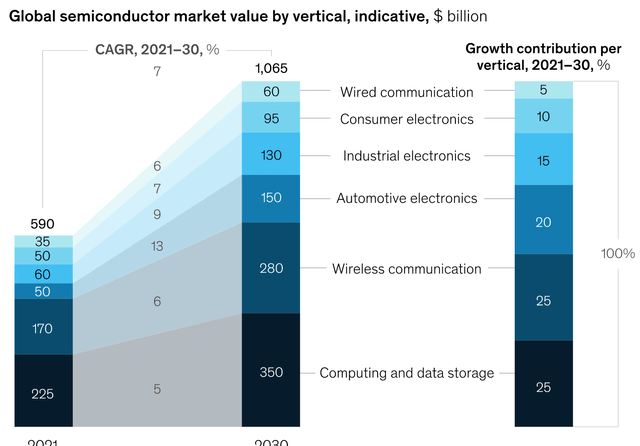

From the semiconductor shortages in 2021 to slowing demand in 2022, the semiconductor industry is cyclical. This isn’t always a bad thing in the stock market, as I like to say when there is “volatility” there can also be “opportunity”. The key to cyclical industries is to identify the underlying trends. In this case, Global Semiconductor revenue is forecasted to grow 7.4% in 2022 and then have a mild contraction of -2.5% in 2023. These rates are both significantly slower than the sharp 26.3% increase during 2021 (as the economy reopens). However, if we look at the overall long-term growth trend, a McKinsey study indicates that the Semiconductor industry will average a 6% to 8% growth rate up until 2030, meaning the industry might be worth a staggering $1 trillion by the end of the decade.

Global Semiconductor Industry (McKinsey)

This growth is no surprise due to the proliferation of semiconductor devices around us from portable devices (Apple (AAPL) watches) to 5G cell phones, Internet of Things [IoT] devices, autonomous vehicle technology, robotics and of course cloud computing.

Micron (NASDAQ:MU) is poised to ride these secular growth trends as the 4th largest semiconductor in the world. The company is also the 3rd largest DRAM (Dynamic Random Access Memory) supplier in the world with a 24.5% market share. DRAM is used in computing as a form of short-term memory, you may have seen brands such as Micron or Crucial if you have ever upgraded your laptop RAM (Random Access Memory).

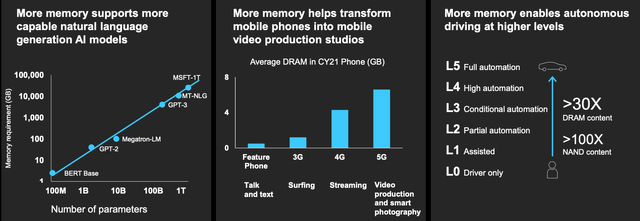

5G cell phones are an especially interesting growth tailwind as they have 50% higher DRAM and double the NAND versus 4G smartphones. This is a major deal as 5G smartphone shipments are forecasted to make up 69% of total smartphone shipments worldwide by 2023. As Micron makes approximately 71% of its Revenue from DRAM and 26% from NAND (flash memory), the company is expected to ride these growth trends long term.

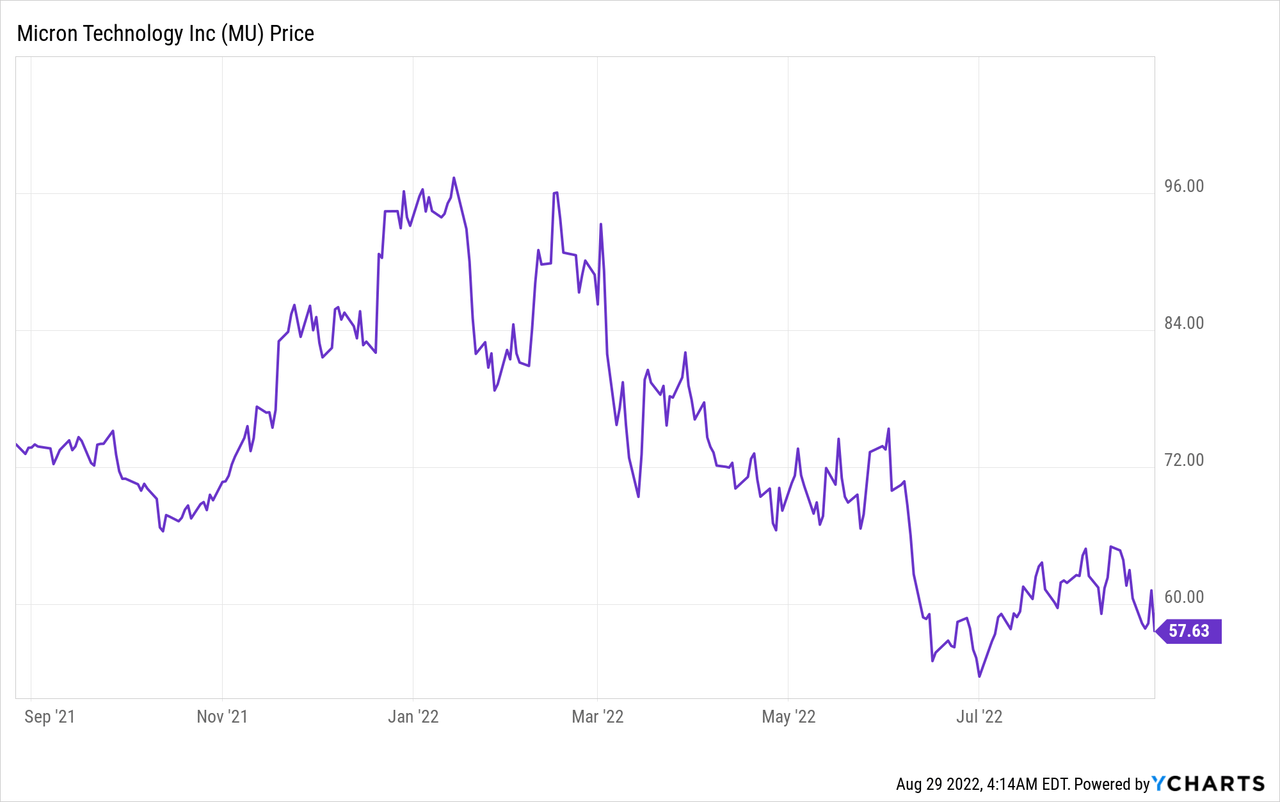

Micron’s stock price is down 40% from its all-time highs and the stock is now undervalued intrinsically. In this in-depth report I’m going to break down Micron’s business model, its financials and valuation, let’s dive in.

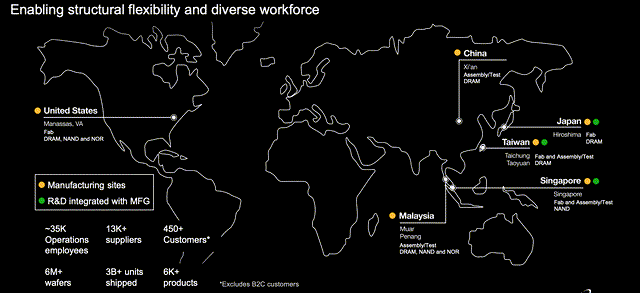

Tech Business Model

Micron is an internationally diversified company with 13 manufacturing sites, 14 labs, and an army of ~45,000 employees globally. its headquarters in Idaho and “Fab” in Virginia are especially important given the trend toward “deglobalization” and self-sufficiency of countries. For example, Biden has recently signed the $52 billion CHIPS act, which aims to boost US chips in an effort to compete with China. This legislation is expected to lower the cost of semiconductors and create more manufacturing jobs in the US. Micron also has a global footprint of facilities across the UK (Europe), Japan, Taiwan, Singapore, Malaysia, and even China. This international diversification offers more geopolitical certainty than many other semiconductor companies such as Taiwan Semiconductor Manufacturing (TSM) which is mostly in Taiwan (go figure) a region that has tensions with China and thus could be a future war zone, as we are seeing now with the Russia-Ukraine war. TSM is planning to build a new factory in Arizona but this will take some time. Micron’s vast scale also acts as a competitive advantage as the company benefits from economies of scale advantages and has an estimated $100 billion replacement cost for its manufacturing plants.

Micron Stock (Investor Presentation 2022)

Micron designs and manufactures its semiconductors and then executes strategic acquisitions to increase product diversity and scale of its manufacturing.

The company reports across three main segments;

- Data Centers

- PC & Graphics

- Mobile and Intelligent Edge

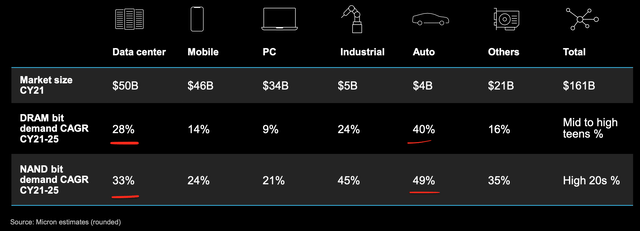

Data Center growth is an especially important tailwind given the digital transformation of an enterprise’s on-site IT to the cloud. The data center market is forecasted to grow at a rapid 21.98% compounded annual growth rate between 2021 and 2026. We can already see this growth in major companies such as Amazon (AMZN), with Amazon Web Services (its cloud segment) being the fastest growing part of the business. The same is true for Microsoft (MSFT) with Azure and Google Cloud (GOOG) (GOOGL). According to Micron’s own estimates, they expect a rapid 28% CAGR in DRAM and 33% CAGR in NAND for Data Center applications up until 2025. I also expect this Data Center revenue to smooth the cyclical cycle for the company.

Industry Tailwinds (Investor Day Presentation)

Other tailwinds include Artificial Intelligence, as more advanced models which support natural language (such as the Alexa software) require more memory. Autonomous driving also requires over 30 times more DRAM and over 100 times more NAND as it moves from Level 0 to Level 5 or full automation. Micron’s own estimates for automotive DRAM growth indicate a blistering 40% CAGR and 49% CAGR in NAND up until 2025.

Trends in Memory growth (Investor presentation 2022)

Management is highly self-aware and I find that to be necessary to stay ahead in the competitive semiconductor industry. The company states its success depends upon the following;

-

High Returns on R&D Spend

-

Efficient Manufacturing

-

Development of advanced product/processes

-

Market acceptance of products

-

Return driven capital spending.

As a large technology company, Micron must continually invest in Research and Development in order to stay ahead of the curve. The company is currently investing 10% of its revenues into R&D or ~$2 billion a year. its investments are paying off well so far, with a healthy 14.6% return on capital. As Warren Buffett has often stated in the past, a shareholder’s return over a long period of time often translates to the business’s return on capital. Multiple studies also show that companies that invest a lot into R&D also tend to produce more shareholder value long term, think Google, Facebook (META) etc.

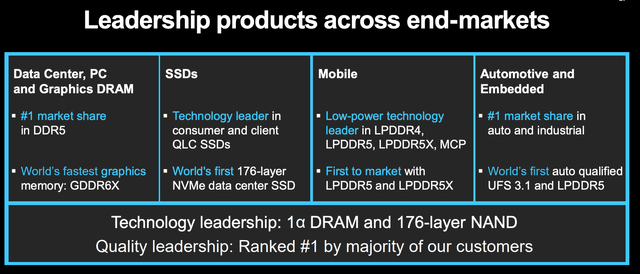

Micron has a relentless focus on reducing its manufacturing costs, and increasing efficiency and density per wafer. On the technology front, the company has over 50,000-lifetime patents and is a market leader across many areas. For example, the company has the number one market share in DDR5 which is the latest generation of RAM technology, has a higher base speed, and consumes less power than DDR4.

Technology Leader (Investor Presentation)

The company has also created the “world’s fastest discrete graphics memory solution” the GDDR6X. Which is launched as a complement to leading graphics processors such as the NVIDIA GeForce RTX 3090. Micron has also created the “World’s first” 176 layer NVMe Solid State Drive [SSD] for data center workloads. The company even pioneered the “World’s most advanced DRAM process technology” titled the 1-alpha. This enables a 40% improvement in memory density and 15% less power usage.

Micron is ahead of competitors such as SK Hynix and Samsung in certain areas. For example, its DDR5 cell size is 66.26 mm2 cell which is smaller than Samsung’s 73.58 mm2 and SK Hynix’s 75.21 mm2.

DDR5 Competitors (Tech Insights/eetasia)

Micron Technology’s Solid Financials

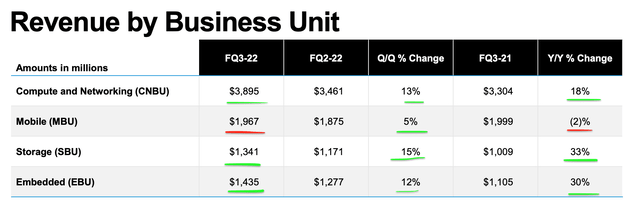

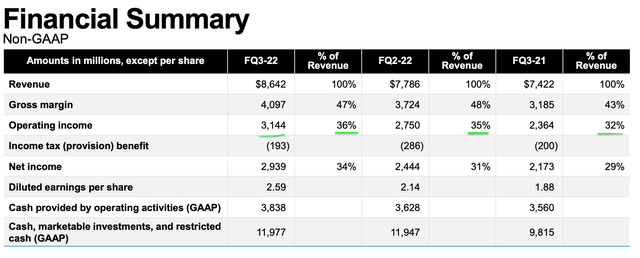

Micron generated solid financial results for FQ3, 2022. Revenue was $8.64 billion which was up 16% year over year and a record for the quarter, despite coming in slightly ($2.98 million) less than analyst estimates.

Data Center growth was a strong revenue driver and increased by double digits Q/Q and over 50% year over year. This was driven by strong growth in AI and machine learning workloads. Its Datacenter SSD’s also hit a new record in revenue for the quarter and doubled year over year. From the table below you can see that the majority of segments performed strongly. Compute and Networking revenue was $3.895 billion, up 18% year over year. Storage revenue was $1.341 billion, up a blistering 33% year over year. Embedded revenue was $1.4 billion up a rapid 30% year over year. The only negative was mobile revenue which was $1.967 billion down 2% year over year, but even this was up 5% Q/Q which was a positive.

Business Units (Micron Q3 Report)

Its Gross Margin was 47.4% in FQ3 which increased from the ~43% generated in the same period last year. The company’s operating expenses were $953 million, which was up ~9% year over year, which wasn’t a major issue given revenue has increased by ~16% over that same period.

Operating Income was $3.1 billion which was up a rapid 33% year over year. Earnings Per Share [Normalized] was $2.59, which beat analyst estimates by $0.15. EPS [GAAP], and was also in line with analyst estimates with $2.34 reported.

Micron generated strong cash flow from operations for FQ3-22 with $3.8 billion reported (44% of revenue), with Non-GAAP Free Cash Flow of $1.3 billion.

Management exuded confidence and bought back 108 million shares worth a staggering $5.7 billion. The company also issued $800 million towards settling “convert premiums” which reduced share count by 19 million shares, thus further strengthening the value of each share for shareholders.

In addition, the company announced a dividend payment of $0.115 per share, which could be an indication the company is expecting the down cycle in the semiconductor industry to be less negative than historically.

Micron has a fortress balance sheet with $11.977 billion in cash, marketable security investments, and restricted cash. That’s in addition to $5 billion in debt.

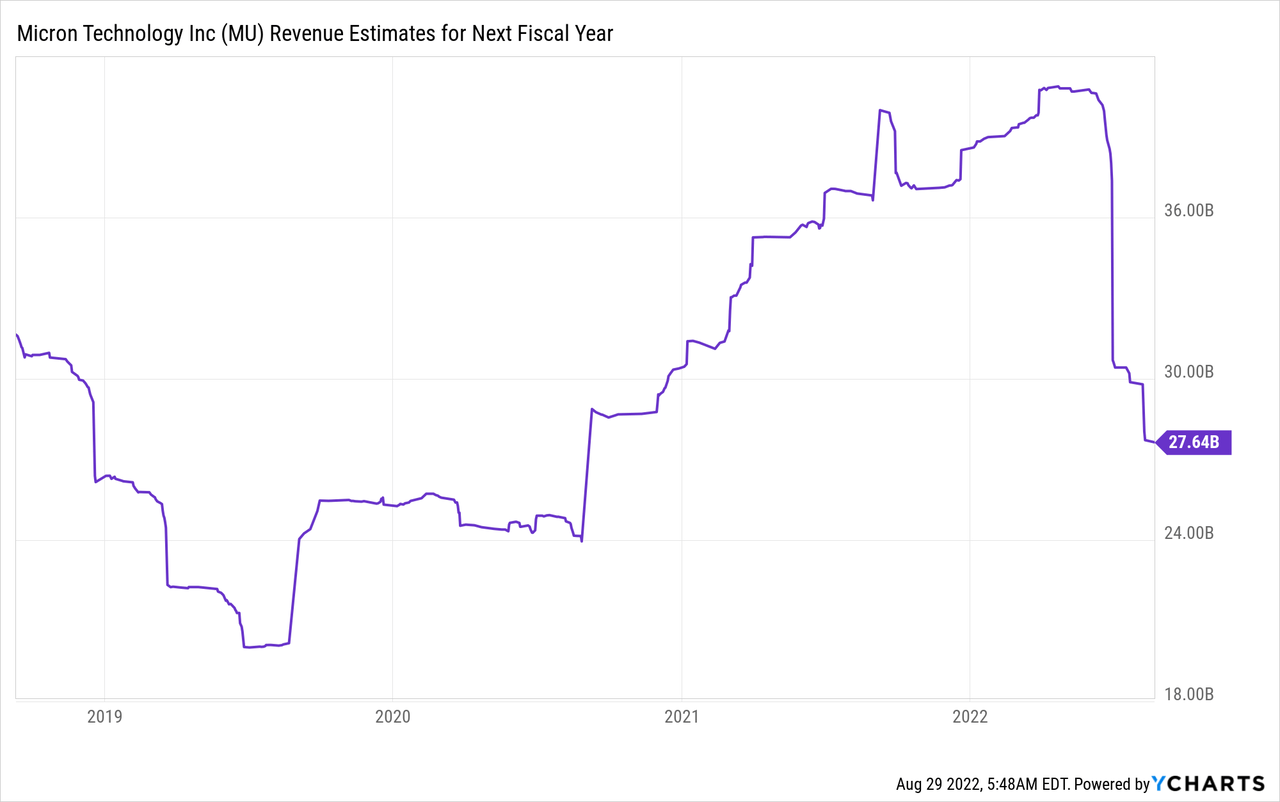

Tepid Outlook

Micron’s management believes “winter is coming” for the semiconductor industry and had moderated their demand forecast. Here is a direct quote, from their earnings report;

“Near the end of fiscal Q3, we saw a significant reduction in near-term industry bit demand, primarily attributable to end demand weakness in consumer markets, including PC and smartphone”

Due to this, the company believes its year-over-year bit demand growth for the calendar year 2022 to be below the long-term CAGR of mid to high teens for DRAM and the high 20% range for NAND. However, the good news is the company believes this is just a temporary dip and the long term outlook of demand for both DRAM and NAND “remains unchanged”.

Management has shown a bias for action and aims to reduce its supply growth trajectory. The company plans to use extra stored inventory to supply part of the market demand in FY 2023. A positive of this is less Capex for wafer fab equipment is expected to be required in FY23.

MU Stock – Advanced Valuation

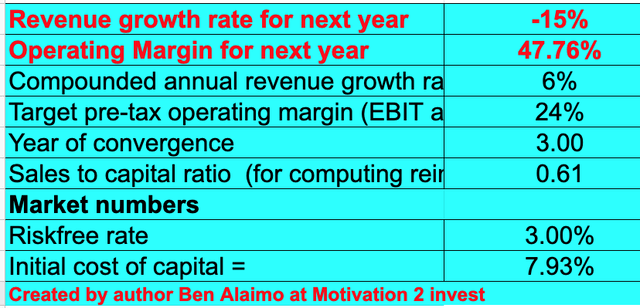

I have plugged the latest financials into my valuation model, which uses the DCF method for valuation. I have estimated conservatively that Micron’s revenue will actually decline next year by 15% due to lower semiconductor demand. But in years 2 to 5, I expect a conservative ~6% CAGR to be achieved.

Micron Stock Valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted Micron’s operating margin to decline to the semiconductor industry average of 24% over the next 3 years, driven by my conservative estimates. Note the above operating margin includes an adjustment I have made, by capitalizing the company’s R&D expenses to increase accuracy.

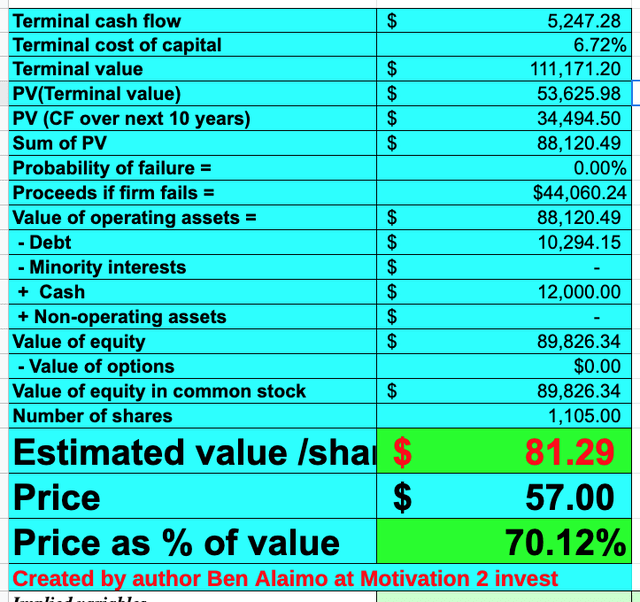

Micron stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $81.29 per share, the stock is currently trading at ~$57 per share and thus is at least 30% undervalued.

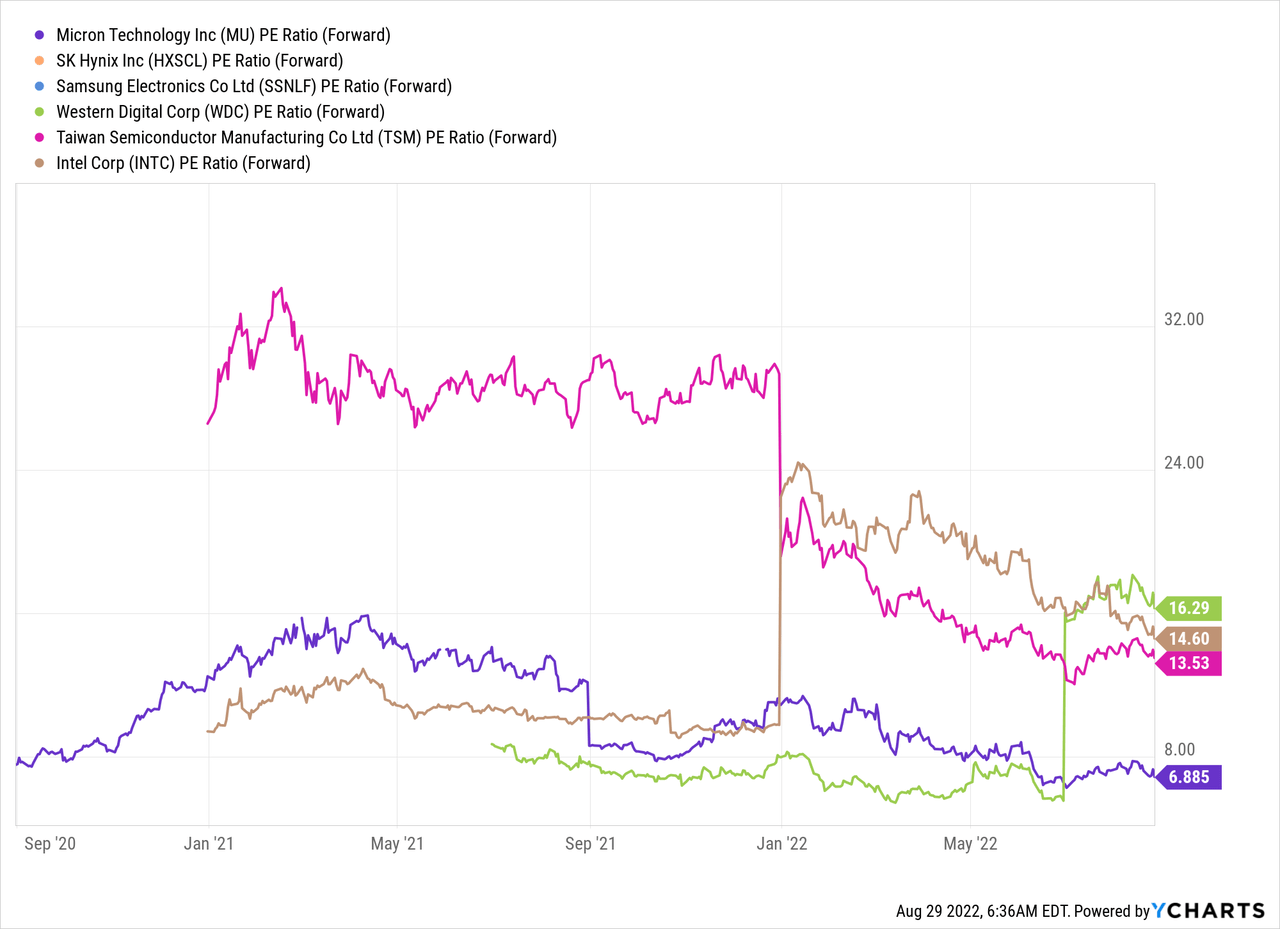

Micron is also trading at a PE Ratio (forward) = 7.39 which is over 40% cheaper than its 5-year average PE ratio = 12.41.

Micron PE Ratio (created by author Ben at Motivation 2 Invest)

The PE Ratio looking backward is 6.19, which is much lower than the US Semiconductor industry average of 15. From the competitor analysis below, Micron is trading at a cheaper PE ratio than many other semiconductor companies such as TSM which trades at a Price to Earnings Ratio = 13.53. Micron’s closest comparable is SK Hynix (OTC:HXSCL) which trades at a similar PE Ratio equal to approximately 6. SK Hynix has recently acquired Intel’s SSD business and Dalian NAND Flash Manufacturing Facility assets in China for roughly $7 billion. This gives us another data point that the NAND and SSD businesses are consolidating due to complexity.

Risks

Cyclical Semiconductor Market

As mentioned prior, the semiconductor market is cyclical and thus expects things to get worse before they get better. An investment in Micron is an investment in the long-term trends, so expect volatility and possible further declines in share prices over the next year.

Insider Selling

Insiders own ~0.27% of Micron stock, which is good but personally I would like to see this larger and some insiders buying the stock. For example, there has been a lot of insider selling with the most recent on the 15th of August 2022, coming from Michael Bokan a global sales VP who sold over $1 million worth of shares at an average price of $63/share.

Final Thoughts

Micron is one of the three big players in DRAM technology and is poised to benefit from the secular growth in the industry driven by 5G, the cloud, and autonomous vehicles. The semiconductor industry is forecasted to have lower demand in 2022 and possibly into 2023, thus lots of volatility is expected. However, as a lot of the bad news is already priced in and the stock is undervalued opening a position would not be crazy. The stock could drop lower in the short term, but long term its technology leadership gives this company a strong competitive advantage.

Be the first to comment