aeduard

Just over two months ago, I wrote on Metalla Royalty & Streaming (NYSE:MTA), noting that the stock was becoming mispriced after its share-price decline while we were seeing continued positive developments across the portfolio. Given these positive developments and the near-term valuation disconnect, the stock was set to enter a low-risk buy zone below US$3.70. Since heading below this level, Metalla has rallied over 40% to new multi-month highs, partially attributed to the improving sentiment in the sector after a violent 2-year bear market but also related to more positive developments across the portfolio.

With the company reporting a decline in revenue from royalty/streaming/derivative payments year-over-year and a decline in attributable gold-equivalent ounces [GEOs] in the period, the positives might not be obvious. However, if we look past the headline results, Metalla may now have another two projects owned by the world’s top-3 gold producer if the Yamana Gold (AUY) proposed acquisition goes through. In addition, early works and procurement have begun at Tocantinzinho in Brazil, which will significantly boost 2024 revenue and cash flow. Let’s take a closer look below:

Q3 Results

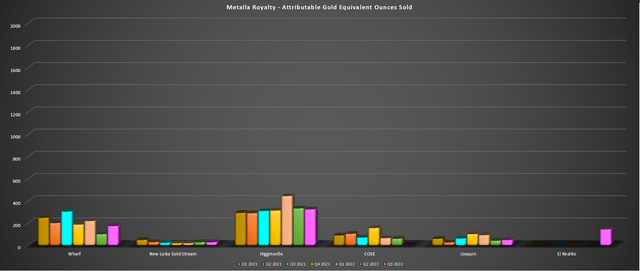

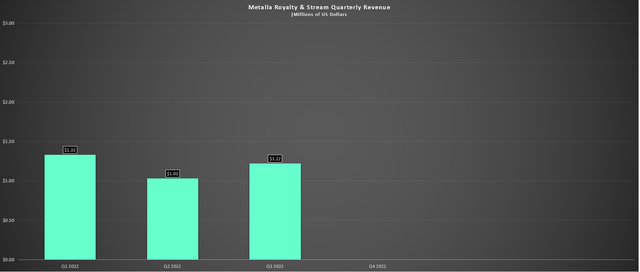

Metalla Royalty & Streaming released its Q3 2022 results earlier this month, reporting quarterly revenue/payments from derivative assets of $1.22 million, a slight decline from ~$1.33 million in the year-ago period. This was related to a 7% decline in attributable GEOs sold, with a contribution from COSE, where mining operations were completed in Q2, and lower production at Wharf (173 GEOs vs. 304 GEOs), plus slightly lower production at Joaquin. The combination of a lower gold average realized gold price ($1,714/oz vs. $1,733/oz) and fewer GEOs sold led to lower revenue and resulted in a net loss of $2.54 million vs. $2.2 million in the year-ago period.

Metalla – Attributable Gold-Equivalent Ounces Sold (Company Filings, Author’s Chart)

Unfortunately, with mining operations suspended at Beaufor (1.0% NSR), limited contribution expected from COSE in Q4, and what looks to be a slightly lower average realized gold price, I wouldn’t expect much better results in Q4. Meanwhile, although the sector is ripe for new deals after a 2-year bear market that has made it much harder and less desirable to raise capital through equity, Metalla is sitting on one of the weaker liquidity positions among its peer group (cash: $2.3 million, ~$9.5.0 million of Beedie facility available), making it more difficult for it to take advantage of this attractive environment for adding new royalties/streams, where many of the major companies have been quite busy year-to-date.

Metalla Royalty & Streaming – Quarterly Revenue (Company Filings, Author’s Chart)

Based on the lack of liquidity to pounce on new opportunities, a year-over-year decline in revenue in Q3, and a mediocre Q4 ahead, it’s understandable that some investors might be avoiding Metalla. This is especially true if they are looking at its valuation from a price-to-sales standpoint, with Metalla trading at approximately 90x estimated FY2023 revenue/derivative payments of ~$6.0 million. However, the best way to value royalty/streaming companies is on a P/NAV basis, and using 2023, 2024, or even 2025 revenue would not do justice to what is a budding royalty/streaming portfolio that continues to look better each year. Let’s dig into recent developments to see why Metalla’s future looks much brighter than its quarterly results might suggest.

Recent Developments

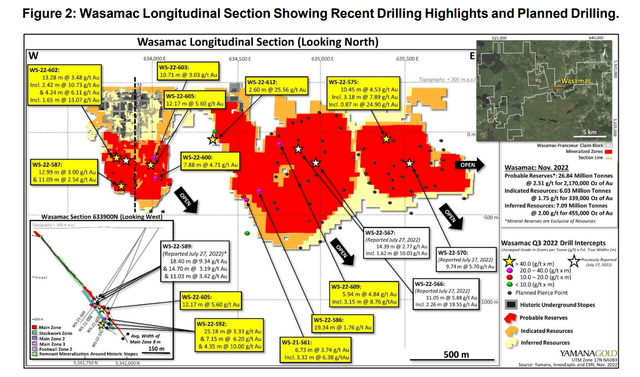

Wasamac

One of the clear stars of Metalla’s portfolio is Wasamac (15 kilometers west of Rouyn-Noranda), a planned bulk-tonnage underground mine that would have similar or higher production rates to Alamos’ (AGI) Young-Davidson Mine. Since Yamana has taken over the project, the resources and reserves have continued to expand, with reserves up to ~2.17 million ounces at 2.51 grams per tonne gold vs. ~1.77 million ounces at 2.56 grams per tonne gold previously (Wasamac 2018 FS), and 14% growth from the most recent FS. Meanwhile, the inferred resource increased over 70% from levels in the 2021 FS, which could help support a 15-year mine life at a much larger production profile than what Monarch Gold previously contemplated.

Wasamac Long Section (Yamana Gold Presentation)

In addition to significant growth in reserves and resources and continued exploration success at Wildcat and Wildcat South (two new parallel mineralized structures), Wasamac still remains open at depth and along strike. So far, the result is that Wasamac could be a ~200,000-ounce per annum producer, contributing ~$3.6 million in attributable revenue to Metalla by 2028. Plus, with the most aggressive driller in the sector potentially being the new owner after Agnico Eagle (AEM) has proposed to take over Yamana’s Canadian assets, the future has never been brighter for this project. The reason is that it’s gone from the hands of a less well-capitalized ~$200 million company to a ~$20.0 billion company and the world’s third-largest gold producer.

The $3.6 million annual revenue estimate is based on a $1,825/oz gold price, an average of 200,000 ounces per annum, and a 1.0% NSR, given that I would expect Agnico to buy down a portion of the Wasamac royalty for proceeds to Metalla of ~$7.0 million.

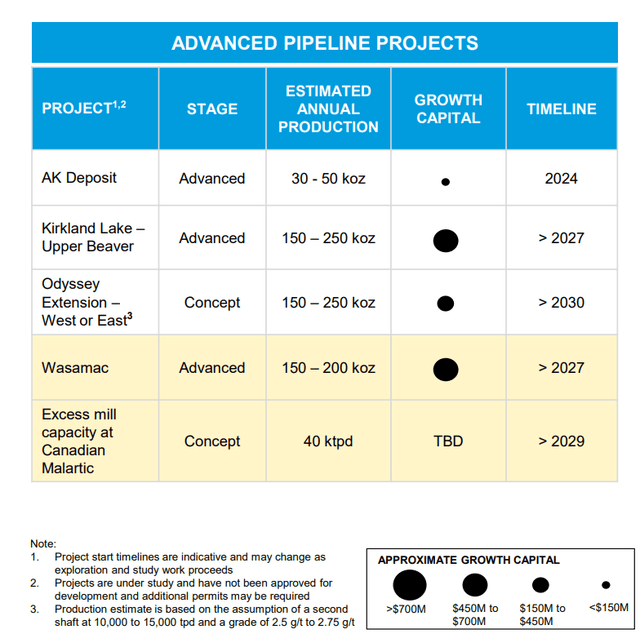

Agnico Eagle – Project Pipeline (Company Presentation)

That said, Agnico has more on its plate than Yamana did when Wasamac was its #1 priority with expansions at Detour Lake, Meliadine Phase 2, development continuing at Canadian Malartic, and work on its pipeline, which includes San Nicolas, Upper Beaver, and Hope Bay. Based on this, it’s possible that Wasamac’s first gold pour could come in H2-2028 vs. previous plans of 2027 if the company chooses to stagger capex vs. being aggressive and building multiple projects simultaneously. So, while I see the reserve growth and potential for a higher production profile (vs. the 169,000-ounce life-of-mine average in the 2021 FS) as a positive, it is worth noting that we could see a more delayed start to commercial production.

Camflo

Moving east to Camflo and the Canadian Malartic Operation, Metalla owns a 1.0% NSR royalty on the past-producing Camflo Mine (1.6 million ounces of historical production) that sits just 1 kilometer northeast of the Canadian Malartic Operation. The most recent development at this operation is that it looks like it could be solely in the hands of the world’s top-3 gold producer (Agnico Eagle) by Q2 of next year, and this asset will have over 40,000 tonnes per day of excess mill capacity post-2026. While the goal will be to fill the Canadian Malartic Mill with the most profitable material possible and Agnico has multiple high-grade ore sources, including the new East Gouldie Extension, Camflo benefits from being in very close proximity and much quicker to bring into a mine plan with the potential for near-surface open-pit material.

Canadian Malartic Operation & Camflo Property (Google Maps)

As the Canadian Malartic Partnership discussed in their prepared remarks in Q2, options for filling excess capacity at the mill include nearby sources such as Rand, Titan, the East Gouldie Extension, and the Camflo Property. With Agnico Eagle now potentially owning Camflo and having a long history of adding considerable value in acquisitions, it could look to bring Camflo into its mine plan by 2026, given the evidence of porphyry and diorite-hosted gold mineralization on the property. This would benefit Metalla, providing another small contribution to its attributable production profile as early as 2026, depending on how successful follow-up drilling is on the property.

Tocantinzinho

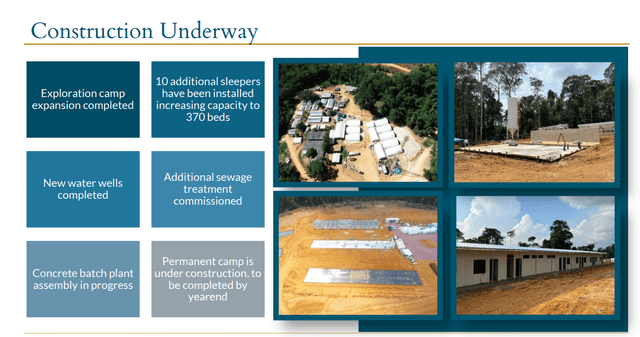

The final key development in Q3 was the announcement by G Mining Ventures (OTC:GMINF) that its Tocantinzinho Project was fully-funded and that production was anticipated by H2 2024. This is expected to be a very high-margin asset with a production profile of ~175,000 ounces of gold per annum at all-in-sustaining costs below $700/oz. Notably, G Mining Ventures may be a small company, but construction is being undertaken by a very strong technical team that previously delivered multiple major projects on budget/under budget and on schedule/ahead of schedule. These include Essakane, Merian Stage 1 & 2, Fruta del Norte, and Process Plant Automation at Meliadine. Early production at Tocantinzinho will be higher, with ~196,000 ounces per annum for the first five years.

Tocantinzinho Project Construction (G Mining Ventures Presentation)

Based on Metalla’s 0.75% Gross Value Return royalty [“GVR”], the company should see a significant contribution from TZ, with over $2.5 million in revenue per annum from the asset starting in 2025. This asset alone would represent more revenue than Metalla has generated year-to-date ($1.78 million) from its royalty/streaming interests, highlighting just how significant this asset is for the company. So, when combined with the start of expected production from Amalgamated Kirkland (2024), the start of production at Cote (2024), and potential production from Fifteen Mile Stream (late 2025), Metalla is in a position to significantly increase production even if we didn’t see much growth on a year-over-year basis in Q3 2022.

Overall, several positives continue to improve the investment thesis for Metalla, and it’s quite clear that the Metalla of 2025 and 2030 will be a much different company. So, while there were a few negatives (significant decline in reserves/resources at Joaquin, cessation of mining at COSE, temporary suspension of mining operations at Beaufor), these developments are easily outweighed by the positives. In fact, Metalla could have several royalty assets being operated by elite mining partners by 2028, including multiple assets with Agnico Eagle and G Mining Ventures. Notably, Metalla continues to have considerable exposure to Agnico’s portfolio with multiple projects/mines, including the following assets:

- El Realito

- Amalgamated Kirkland

- the possibility of future down-dip extensions at Lower Phoenix (Fosterville)

- Santa Gertrudis

- Akasaba West

- Wasamac (if the Yamana deal is successful)

- Camflo (if the Yamana deal is successful)

Valuation & Technical Picture

Based on ~48 million shares and a share price of US$5.20, Metalla trades at a market cap of ~$250 million. This compares favorably to an estimated net asset value of ~$275 million, leaving Metalla trading at 0.91x P/NAV. While this is a very reasonable valuation for a royalty/streaming company, given that they rarely trade at a discount to net asset value, this isn’t a huge divergence from the remainder of the junior royalty/streaming space, with Maverix (MMX) acquired for ~1.0x P/NAV with a much larger attributable production profile, and Gold Royalty Corp (GROY) at 0.90x P/NAV with a similar attributable production profile and also a portfolio of mostly Tier-1 jurisdiction royalty assets.

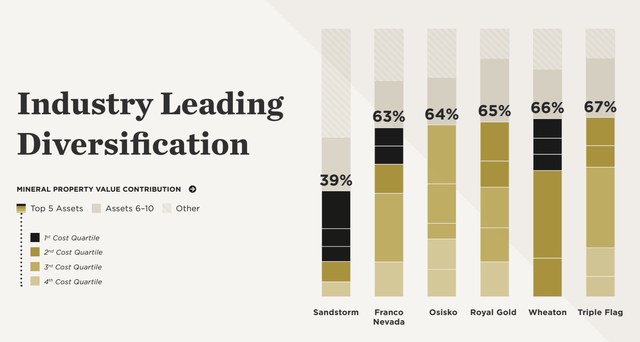

Sandstorm Gold – Asset Diversification (Company Presentation)

That said, this valuation is a major divergence from Sandstorm Gold’s (SAND) valuation of ~0.90x P/NAV with industry-leading diversification, a future ~150,000 GEO production profile (FY2025), and 50% of mines with all-in-sustaining costs in the 1st quartile industry-wide. So, if I were looking to put more capital into the precious metals royalty/streaming space, I see a far more attractive relative valuation for Sandstorm and a massive valuation disconnect currently. This is especially true given that Sandstorm’s future attributable production profile looks conservative, with minimal weight on smaller assets within the portfolio.

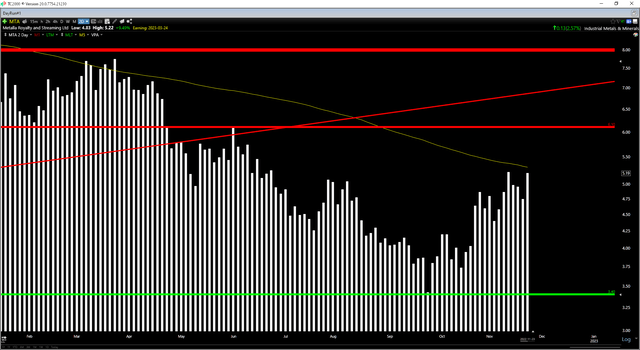

MTA Daily Chart (TC2000.com)

Finally, looking at the technical picture, we can see that MTA is now sitting in the upper portion of its trading range, with strong support at US$3.40 and strong resistance at US$6.10. Based on a current share price of US$5.20, this translates to $0.90 in potential upside to resistance and $1.80 in potential downside to support or a reward/risk ratio of 0.50 to 1.0. When it comes to micro-cap stocks, I prefer a minimum of a 6.0 to 1.0 reward/risk ratio to justify entering new positions, so I don’t see a low-risk buy opportunity. For MTA to move into a low-risk buy zone where long trades would have a higher probability of success, the stock would need to dip below US$3.80.

Summary

Metalla may not be as busy as its larger peers due to a much weaker liquidity position (less than $15.0 million), but it continues to see positive updates across its portfolio, and 2024 should mark the start of a significant transformation for the company as it passes the 5,000 GEO mark. That said, the goal is to buy great companies when they’re undervalued, and I prefer to look at cheap on an absolute basis and a relative basis. Given that Sandstorm trades at a similar valuation with 20x the production profile, I currently see it as the far more attractive bet. That said, if MTA were to dip below US$3.80, I would strongly consider starting a new position in the stock.

Be the first to comment