Marcus Millo

Thesis Summary

Meta Platforms, Inc. (NASDAQ:META) presented Q3 results on Wednesday after closing and fell a whopping 24% on Thursday. Investors are concerned about the inexistent growth and the high expenditures in the metaverse. However, I see untapped potential in WhatsApp as a company that is becoming a leader in a new but fast-growing market.

Q3 Overview

META disappointed investors with underwhelming Q3 earnings. While most were expecting a miss and poor performance metrics, I think few would have predicted the +12% drop we saw during Thursday’s pre-market. The reason behind this drop can be summarized in a couple of charts.

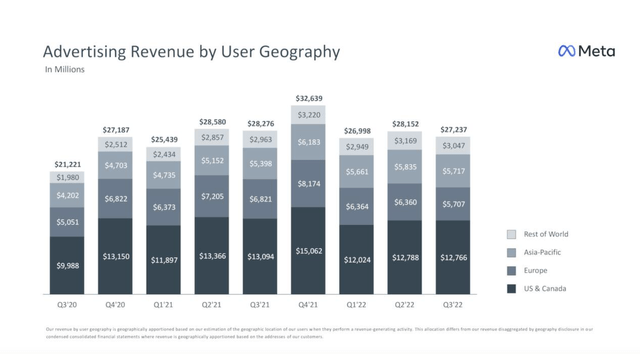

Revenue By Geography (Investor Presentation)

First off, this is one of a few quarters where revenue was down across the board in terms of user geography. There is no growth to be seen, even in the lesser developed areas, where META could still stand to make an impact. While revenues in the U.S. and Canada have held steady, European revenues fell by nearly 10%, though some of this could be attributed to the strong dollar.

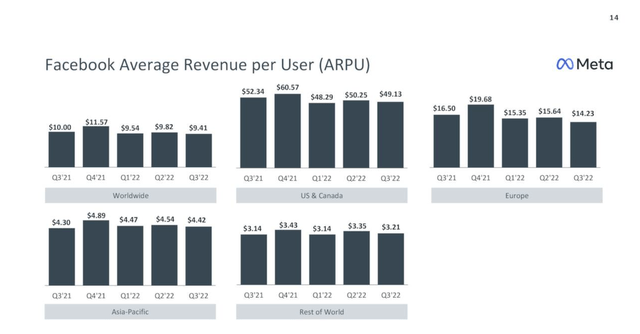

Even though Facebook continues to grow its users, albeit, at a slower pace, profitability has been in a clear downtrend for the last year. If users are stagnating and profitability has topped, what can META do?

One answer would be to reduce costs, but this has not happened yet:

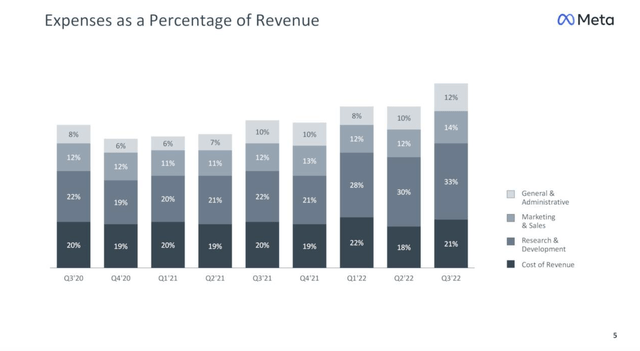

Expenses (Investor Presentation)

We can see that costs as a percentage of revenue are also up across the board. In fact, one of the biggest issues with the company right now is the fact that it is pouring money into the metaverse/AR/VR. This was one of the most discussed issues in the earnings call.

Q3 Earnings Call

A lot of points were discussed in the earnings call. META did not give very exact guidance going forward in terms of revenue, but it does seem that the company will be reigning in costs. The way CEO Mark Zuckerberg put it is that the company will be focusing on the most important high-growth areas, while less important segments could see reduced headcounts and investment.

In my opinion, though, the two most important takes on the earnings call related to WhatsApp and the metaverse.

We started with click-to-messaging ads, which lets businesses run ads on Facebook and Instagram that start a thread on Messenger, WhatsApp or Instagram Direct, so they can communicate with customers directly. And this is one of our fastest growing ads products with a $9 billion annual run-rate. And this revenue is mostly on click to Messenger today since we started there first, but click to WhatsApp just passed a $1.5 billion run rate and is growing more than 80% year-over-year.

Source: Mark Zuckerberg, Earnings Call.

I believe click-to-message will be the driving force of profitability moving forward, and the untapped potential of WhatsApp’s 2 billion users could surprise many investors. If you want growth, that 80% growth in run rate should definitely pique your interest.

Now, moving on to the Metaverse.

I know that sometimes when we ship a product, there is a meme where people say, “Hey, you are spending all this money, and you have produced this thing,” and it’s – I think that, that’s not really the right way to think about it. I think there is a number of different products and platforms that we are building where we think we are doing leading work that will become – launching consumer products and then eventually mature products at different cadences in different periods of time over the next 5 years to 10 years.

Source: Mark Zuckerberg, Earnings Call.

As an investor, it’s normal to be concerned about the company’s Metaverse efforts. In Q3, Reality Labs lost $3.6 billion, and this number is expected to grow in 2023. I think the right way to think about this, though, is that META is investing in the foundations of what could be a multi-billion dollar segment. This doesn’t speak to the unprofitability of the market or the lack of demand for these products.

My 2 Cents

It’s clear that META is not going through its best moment, but to be fair, that could be said of most large-cap tech companies. However, there is light at the end of the tunnel, and with META trading at 9.3x earnings, this seems like a no-brainer, especially after considering the two points above.

Firstly, investors are grossly underestimating the potential of WhatsApp and click-to-messaging. The latter is only the latest in a long line of improvements that are bringing the shopping experience closer to the customer. By doing this, META has more control and can extract even more value.

And WhatsApp alone is worth billions of dollars. It has just surpassed $1.5 billion in revenue with an 80% growth. This could easily be adding $15 billion to the topline in the next 2-3 years.

On the other hand, unlike many investors, I am very excited about the metaverse investment. It takes money to make money, and that’s a fact. What’s also a fact is that 80% of VR headsets sold last year were Oculus Quest 2. META is dominating this market, which will grow at a CAGR of 37.8% through 2030.

There’s a market, albeit young, and a dominant player, META. Not only that, but META has the privilege of being able to invest money into this new segment, using some of the best talent available, and all the while retaining a healthy profit.

It continues to baffle me that investors are upset with the company’s new direction. It is clear that social media, as it exists now, isn’t going to cut it. Revenue and growth are slowing. If the company did nothing, it would be seen negatively, but if the company invests aggressively in growth, it’s also bad.

I have yet to hear how META’s energy could be better spent, and until I do, my faith is in the visionary who built a billion-dollar company from his dorm.

Be the first to comment