Kelly Sullivan/Getty Images Entertainment

Thesis

I believe Meta’s (NASDAQ:FB) advertising business is still strong and a necessary part of many businesses’ advertising expenditure, even following Apple’s (AAPL) IDFA update. In my opinion, Meta will continue to effectively monetize the Family of Apps platforms in the wake of IDFA changes and slowing user growth to increase revenue per user domestically and internationally. Through potential continuous ad algorithm improvements, e-commerce, and international focuses, Meta may continue to generate earnings power and free cash flow to potentially support strong returns.

Even with new capital expenditures in the metaverse and other competitive pressures, I believe Meta is still attractive at these levels. Success with the metaverse and reality labs may help increase potential returns in the long run but even excluding those segments, Meta presents attractive potential ROIs in my opinion.

Background

I’ve covered Meta in the past so I will link my previous article for a more extensive background.

To summarize Meta in short, it operates the largest social media platform in the world, Facebook, with ~3 billion monthly active users. Meta’s business is broken up into two segments:

- Family of Apps [FoA]: Includes Facebook, Instagram, Messenger, WhatsApp, and other services.

- Facebook Reality Labs [FRL]: Includes augmented & virtual reality and potential Metaverse-related sales.

Meta makes the majority of its revenue (97.5% in 2021) by selling ads to businesses to market on their social media platforms.

Thesis Support

Effective Monetization

I believe the recent stall in Meta’s userbase isn’t temporary:

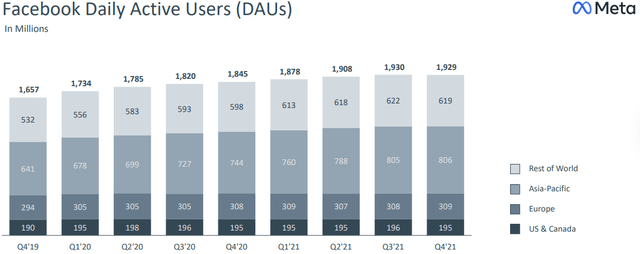

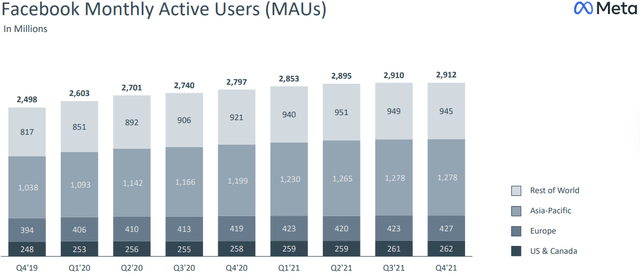

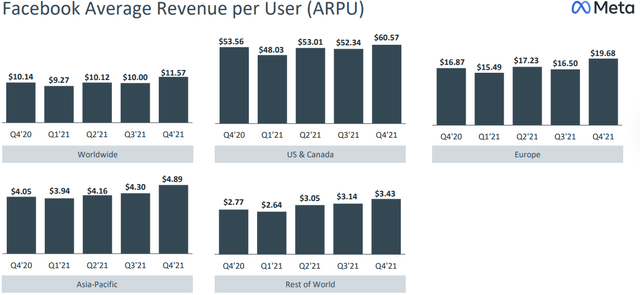

Facebook users have grown from 845 million at the end of 2011 to 2.9 billion at the end of 2021, a 13.2% CAGR over that decade-long period. After that explosive growth, I believe user migration growth may stall moving forward making effective monetization in advertising even more important. I believe even with iOS 14 advertising headwinds, Meta has shown promise in this realm as revenue per user metrics have grown healthily over the past year:

This data is reassuring knowing Facebook was able to still grow ARPU by 14% YoY while adjusting to the new IDFA changes Apple introduced with iOS 14. I believe WhatsApp is in the early stages of general monetization while Facebook and Instagram are still aiming to make a larger footprint in e-commerce. With these prospects on the table, I still think Meta can grow ARPU over the long term.

Advertising Business to Support Long Shots

While excluding Metaverse, I believe Meta’s advertising business is still discounted at the current market value. With that being said, as long as management continues to focus on the core advertising algorithm and boosting revenue per user metrics, the potential windfalls from wide Metaverse adoption could support long-term earnings growth.

Risks

Metaverse

I don’t believe a flop in the Metaverse will financially impact Meta long term enough to completely deter investors from the stock at current levels. I do think the Metaverse has the chance to change the Family of Apps advertising business shareholder base in the future which may cause volatility in the short term. In a longer view, I believe if the Metaverse is a flop, both Metaverse and advertising-driven shareholders will lose confidence in management potentially forcing the share price down even further.

Social Media Competition

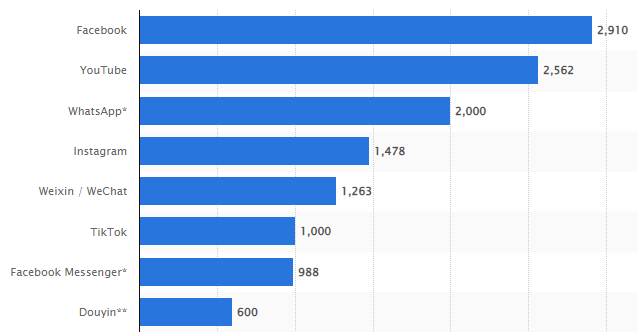

Social media companies (advertising companies) are all looking for the most watch time in order to generate more ad revenue by businesses marketing on their platform. I believe the industry landscape is inherently competitive but is also heightening for Meta’s Family of Apps. Currently, Meta’s Family of Apps holds 4 out of the top 10 spots of most popular social networks globally ranked by the number of monthly active users:

Statista

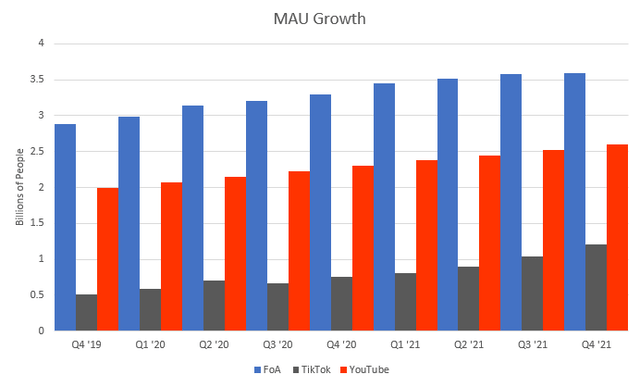

With TikTok and YouTube increasing monthly active users [MAUs] by 60.32% & 13.04% respectively in the last twelve months versus Meta’s Family of Apps increasing by only 8.79%, I believe Meta will have to continue innovating to fight for user screen time:

Financials

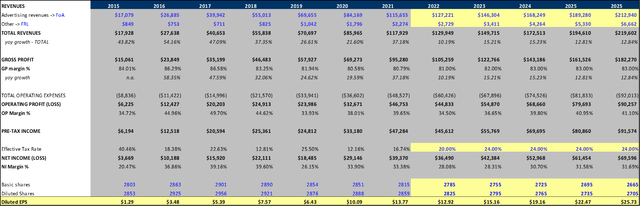

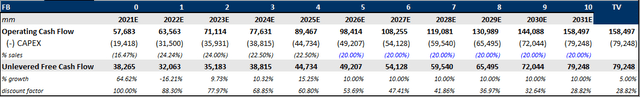

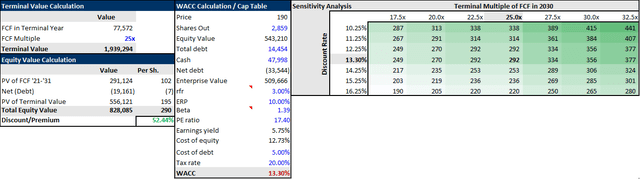

Below are my income statement forecasts for Meta over the next five years. Some key notes in my forecasts include:

- I only have FRL making up 3% of total revenues by the end of the fiscal year [FY] 5, showing minimal relative growth in the Metaverse.

- CAPEX as a % of sales increases in 2022 and 2023 before tapering off to 20% long-term due to initial upfront costs potentially associated with Metaverse.

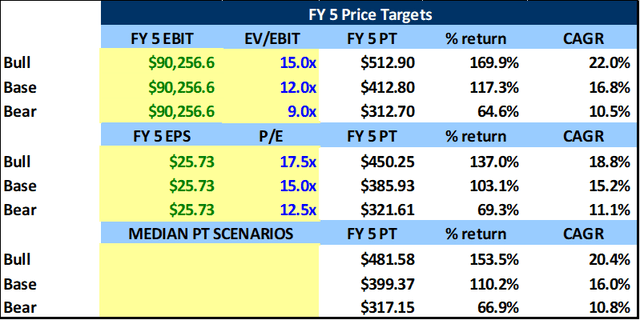

- Price targets are taking into account my buyback expectations by using the 2,705 diluted share count number in the calculations.

- Price target growth rates are based on a current $FB stock price of $190.

Created By Author Created By Author Created By Author Created By Author

Summary

I believe the current risks for Meta are significant and mainly revolve around a Metaverse flop and social media competition. While my earnings forecasts are minimally impacted by potential Metaverse growth, I believe the real risk lies in a changing shareholder base and lost confidence in management. In my opinion, these risks posed are severe but I believe they are relatively short-term and Meta’s advertising business still has the potential to deliver significant results over the next five years. Even though my earnings forecasts have growth decelerating and margins compressing relative to recent history, I still believe growth prospects including a more efficient algorithm, e-commerce, and international expansion could drive earnings power excess of my forecasts.

Last note, I believe the recent downside earnings revisions management has made are already reflected in the stock but I would still proceed with caution into the earnings release next week.

Be the first to comment