Khanchit Khirisutchalual

Thesis

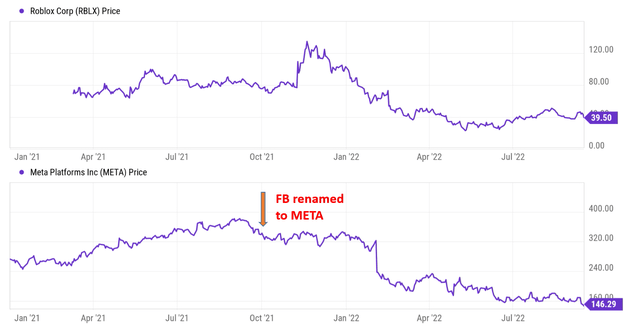

The recent metaverse hype reminded investors of this costly lesson again: the hotter the investment concept, the cooler our minds need to be. In March 2021, Roblox (RBLX) went IPO as the first metaverse stock. The two-year-old company, with no operating income, landed on the New York Stock Exchange with a market cap of ~$40B at a share price of ~$80. The stock price went up quickly to nearly $135 and the market cap nearly doubled to $80B by Nov 2021. Likely many past hypes, this one does not end too well either (at least so far). As you can see from the following chart, its stock prices collapsed from the $135 peak to the current level of about $40. Only 30% of its peak price (which would take a 237% rally to get back there – if it ever does) and about half of its IPO price (which would take a 100% rally to break even).

Source: Author based on Seeking Alpha data

I am mentioning the Roblox episode to remind ourselves that the same lesson applies to other Metaverse stocks too, and Meta Platforms (NASDAQ:META) is no exception. About 6 months after the Roblox IPO, Zuckerberg announced that Facebook would be renamed META together with the “all in Metaverse” strategy. With the development of the global mobile Internet, an innovation as fundamental as metaverse carries high hopes, captures investors’ imagination of the future, and also provides vast shareholder return potential.

And it is therefore the goal of this article to examine the metaverse future calmly. I am a long-term bull on the metaverse future and also on META. Next, you will see that even though the future is bright, you do have to consider if the timeline fits your goal and risk profile.

After all, in order to finish first, first you must finish.

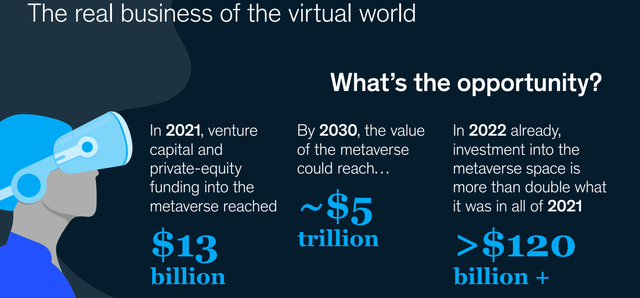

Metaverse: bright future but long timeline

According to the following McKinsey report, by 2030, the impact of the metaverse is projected to generate up to $5 trillion in value. The metaverse future is simply too big for companies and investors to ignore. To be more specific, the impact on the game market will be $108 billion to $125 billion, the impact on the advertising market will be $144 billion to $206 billion, and the impact on the virtual learning market is expected to be $180 billion to $270 billion. The bulk of the impact will come from the e-commerce sector may reach a scale between 2 trillion to 2.6 trillion US dollars.

However, in my view, the metaverse (like every other earth-shaking technology innovation before it) will be a long journey that may last for years or more. The construction of the Metaverse ecosystem cannot be completed by any company alone but requires the industry to jointly build the infrastructure step by step. Each step, such as computing technology, algorithm development, VR content production, will take years and progress in a zig-zag path.

A large part of my career involved high-tech R&D and consulting. And a fascinating topic always involves the so-called 10/10 rule as detailed in my earlier article on Tesla:

We may feel that technology innovation is accelerating and there are some truths to the feelings – in terms of the NUMBER of new technologies emerging every year (or even every quarter). But if you look a bit deeper, you will find that the PACE most innovations have followed and are still following the 10/10 rule: 10 years to build and another 10 years to find a mass audience. And here we are talking about innovations that are “obviously” earthshaking (that is, from hindsight) such as cell phones, personal computers, the internet, GPS, et al.

I see no reason why the metaverse innovation would defy the 10/10 rule. So potential investors should carefully evaluate their investment timelines and goals. Instead of hoping for a sudden breakthrough, I recommend investors focus more on the business fundamentals and see if it has the resources to play the long game. And the good news is that META has a cash cow business to bridge the transition, as detailed next.

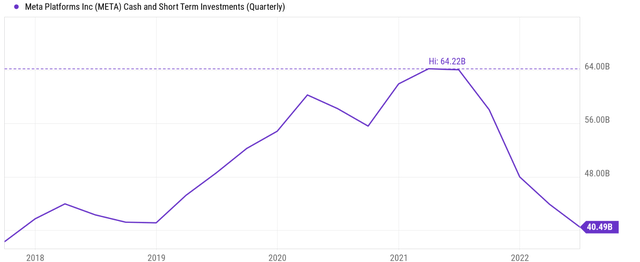

Cash burn rates and CAPEX

Given the timeframe for virtual reality to meaningfully contribute and the need for continued heavy capital investment, the cash burn rates need to be carefully monitored. META used to be a cash cow as you can see from the following chart. Its cash and equivalent position ballooned from below $40B to a peak of more than $64.2B during 2018 and 2020. Its current cash and equivalent position stand at $40.5B due to recent operation headwinds and heavy capital investment. Thus, it has deployed almost $24B of cash in less than 2 years. And after such a hefty investment, the Reality Labs only contributes less than 2% of its income currently.

Source: Seeking Alpha data

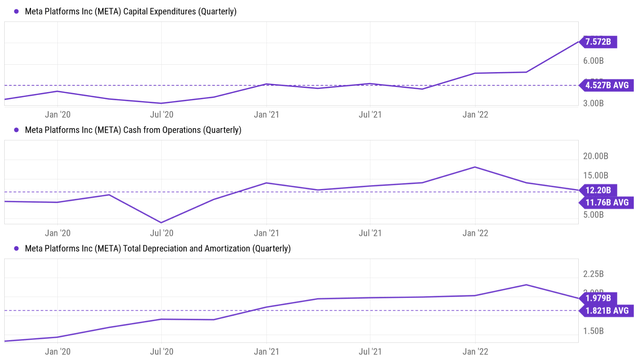

Going forward, to fuel its growth, META needs to continue spending aggressively both on growth CAPEX and OPEX (operating expenses) as summarized in the chart below. The top panel of the chart shows META CAPEX spending in the past 3 years on a quarterly basis. Its CAPEX expenditures have been consistently around or below $4B till 2021 and then surged to $7.57B in the past quarter. Compared to its operating cash flow of $12.2B in the past quarter (shown in the mid-panel), it still generates a healthy amount of free cash flow (about $4.63B). Also, the trend is concerning as you can see. CAPEX expenditures are trending up while operating income is down.

The silver lining might be that META does not need to spend too much on maintenance CAPEX, as you can see from the bottom panel of the chart. If we approximate its maintenance CAPEX with depreciation, then its maintenance CAPEX cost is only on average about $1.8B per quarter over the past 3 years, which was only 40% of its average CAPEX spending in the past 3 years. Last quarter’s number came in at about $2B, which was only about ¼ of its CAPEX expenditures during the same period. As a result, a large part of its CAPEX spending is growth spending.

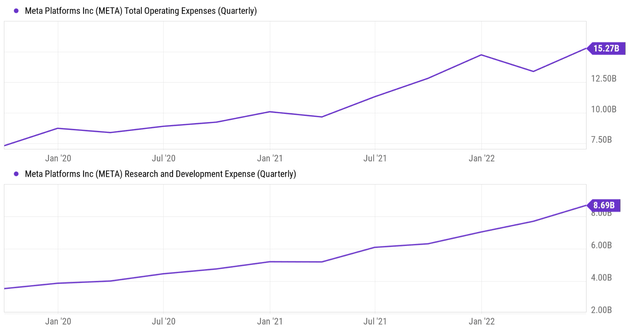

Although the bad news is that, as a SaaS software company, it has to spend heavily on OPEX as you can see from the following chart. The company has been consistently spending billions of dollars on new software research development. To wit, its total operating expenses have been around $15B in recent quarters since 2022, almost 50% higher than only 1 year ago. And its research and development expenses have been climbing rapidly too. It has more than doubled from the $4B level in 2020 to the current level of $8.7B.

Balance sheet status and valuation

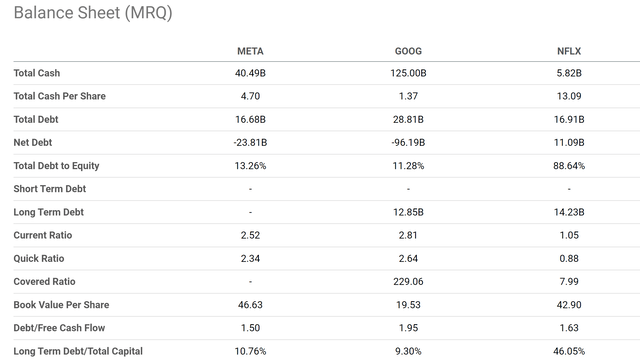

Currently, META has about $40.5 billion of cash on its ledger, translating into $4.7 per share. It also has some debt (totaling $16.6B) but the debt is lower than the cash position. As a result, it carries a net cash position of $23.8B, a quite sizable one. In other words, at its current market cap ($401 billion), about 5.9% of META’s market is just its cash.

When we subtract the cash out of the stock price, its PE multiple would both become even lower. For META, its FY1 PE is around 15.3x based on SA data as of this writing. And it would become only 14.4x after adjusting for its cash position.

And furthermore, as you can see from the chart below, compared to other similar peers such as Google and Netflix, META’s balance sheet is quite strong. Its debt-to-equity ratio is at a very conservative 13.2%, on the same level as Google’s (11.3%). So is the debt-to-total capital ratio (only 10.7%). Finally, note that the debt/free cash flow ratio is also very conservative. All three of them have conservative debt/free cash flow ratios, and META has the lowest one. META’s ratio stands at 1.5x, meaning that it would only 1.5 years of its current free cash flow to pay off all debt.

Other risks and final thoughts

Besides the long and uncertain timeline, there are some risks in the near term too as detailed in my earlier articles. These risks include foreign currency headwinds, margin pressure, and tougher monetizing rates due to privacy changes. In particular, the U.S. dollar has strengthened to a peak level in about 20 years recently. And given the last CPI data, the strengthening might continue as Fed hikes rates further. For global businesses like META, such strengthening might create stronger headwinds than expected. Finally, META has very likely over-expanded in the past few years and has some overcapacity. During its recent Q2 earnings report, management mentioned reduced hiring and the possibility of Layoffs.

To conclude, in order to finish first, first you must finish. I see no reason why the metaverse innovation would defy the 10/10 rule that has governed so many other earth-shaking innovations in the past. Instead of hoping for a sudden breakthrough, META investors should focus more on the business fundamentals and see if it has the resources to play the long game.

And I am optimistic that its existing digital ad segment can bring enough cash to support the metaverse initiative in this long game. It is true that the business has deployed almost $24B of cash in the past 1~2 years, a large sum by any standard. However, I see no reason to be overly concerned as the business is still generating a healthy amount of free cash flow. It generated about $4.63B of free cash flow in the past quarter (operating cash flow of $12.2B minus $7.57B of CAPEX expenses). To make the good news even better, it does not need to spend too much on maintenance CAPEX, adding further to its capital deployment flexibility. Finally, in the worse scenario, META has other means to raise additional capital either via the equity or debt market. For example, it recently decided to issue a $10B jumbo bond deal for the first time in its history as detailed in this Bloomberg report. Thanks to its robust cash generating ability and strong financial positions, the bond offerings were welcomed by the debt market and orders for the bonds hit more than $30B.

Be the first to comment