Justin Sullivan

The following segment was excerpted from this fund letter.

Meta Platforms, Inc. (NASDAQ:META)

(Meta formerly known as Facebook, when I discuss the social media apps specifically, I’ll still refer to Facebook)

The Portfolio first bought Meta in Q4’18. It was a controversial investment then and has continued to be to this day. The core mission of the company has been to make the world more open and connected. To do that, it needs to connect everyone in the world, which it largely has done with its nearly 3 billion monthly active users across its family of apps (Facebook, Instagram, and WhatsApp). That type of scale is hard to grasp and is getting pretty close to essentially every smartphone user outside of China and Russia.

From an investing perspective, there are questions surrounding Apple’s iOS App Tracking Transparency (ATT) changes that limit sharing user data across apps, investments in virtual reality (VR) and augmented reality (AR) i.e. the metaverse, and competitive threats surrounding the rise of TikTok. It seems like only yesterday (or last year) that one of the major risks of Facebook was that the company was too powerful, had too much influence on public opinion, and faced antitrust and regulatory concerns.

There has been a lot of focus on the investments in the metaverse. My high-level thoughts are that the digital evolution has progressed from text, to pictures, to video, and will progress to virtual reality into the future. This trend seems inevitable as technology advances because that is a better way for people to interact digitally, just as pictures were better than text. Like other digital ecosystems, there will be an operating system in which other programs are built upon and Meta is attempting to build it. If the company is successful in its efforts, it would likely enable massive economic value. However, our investment in Meta does not depend on its success in the metaverse.

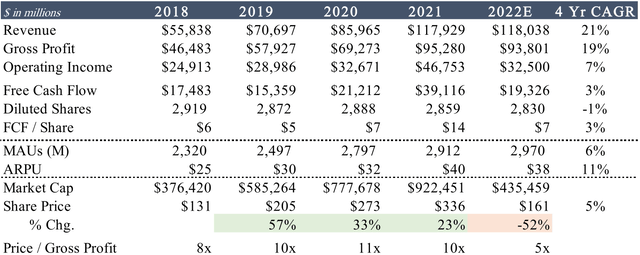

From a financial standpoint, Meta is expected to lose/invest ~$14 billion in its Reality Labs segment in 2022. While that is a big investment, it’s not a “bet the company” type of investment, making up ~12% of the $118 billion in expected revenue in 2022. Meta is expected to have $20 billion in free cash flow this year after spending $30 billion in capital expenditures. This is also a year they are facing an estimated ~$10 billion revenue headwind from Apple’s ATT changes, migrating user engagement to the currently less monetizable Reels from Stories, and seeing a pullback in advertising spend due to general economic uncertainty.

If this is what Meta looks like under financial difficulty, then I can only imagine what they will look like when there aren’t as many headwinds (we can look to 2021 for an idea, which had ~$39 billion in free cash flow after spending $10 billion in Reality Labs and $19 billion in capex).

Reality Labs aside, the overarching thesis is that Facebook is the dominant social media company. Questions surrounding its durability, competitive threats, and whether it is “cool” will likely continue. However, I think the durability of Facebook’s competitive advantage is stronger than what the market appears to believe.

The demand or “job to be done” of having a digital identity/profile will continue to exist far into the future and I do not see any other company able to do that job better than Meta. Similarly, LinkedIn may not have the best interface or content, but there is a demand for a professional online identity.

People discussing that they never use Facebook or Instagram is almost a sign of just how prevalent it is throughout society. Those that leave the platform often find themselves sucked back in because their children’s school posts updates on snow days and bus schedules on their Facebook group or they want to sell their old workout equipment and Facebook marketplace is the best place to go.

Facebook has become more of a social utility that is difficult to replace, not a viral sensation with the risk of crashing. If for some reason Facebook were to shut down, another company just like Facebook would take its place because there is a demand for its platform to provide a digital profile that connect to one’s social network. However, now that Facebook exists, trying to recreate it is nearly impossible. Let’s not forget the many attempts to displace it including Google’s (GOOG, GOOGL) direct attempts with Orkut (2004) and then with Google+ (2011).

Most recently, TikTok has had a meteoric rise to over one billion global users and presents a potential competitive threat. The disruption by TikTok has been different from prior social media companies such as Twitter (TWTR) and Snapchat (SNAP) because its content-filtering algorithm is not based on one’s social network (in which Facebook has the obvious advantage) but by an AI recommendation engine. Video does not come from your social network but from anyone on the platform where algorithms filter and surface the most appealing videos.

AI content generation is a massive computational undertaking. The companies with the most data and the greatest amount of computing resources are going to have an advantage in making the shift more quickly and effectively. Over time, the ranking algorithm turns into a machine learning-driven model that is constantly iterating based on every click and linger.

It isn’t perfectly clear to me how much of a threat TikTok really is. Facebook is clearly investing a lot of resources (roughly $30 billion in capex largely to expand its data centers in support of its AI infrastructure). I think at worst for Facebook, TikTok establishes itself as the winning short form video entertainment application potentially competing more directly with YouTube. That would obviously decrease Facebook and Instagram’s potential engagement inevitably decreasing ad inventory, and therefore, earnings power.

I think at best, Facebook uses its substantial resources to invest in its AI capabilities, incentivizes great user generated content, and is able to make Reels as successful as Stories was for them. Given their willingness to invest for the long-term by creating tools that are less monetizable today, plus the ability to combine AI capabilities with their social graph, Facebook has a good chance of building a very successful recommendation engine that can be applied across all of its applications.

Sentiment from both the general public and Wall Street has continued to be negative on Meta. From a public good perspective, I understand there are many negatives to social media and the interactions that may happen on Meta’s different platforms. However, I am in the camp that in aggregate, Meta and its platforms are a net positive to society and the economy, albeit with some much-needed regulation and controls. Meta helps connect the world, exchange information, communication, services, and goods which enhances economic output.

An analogy would be that the formation of a city increases the rate of crime, pollution, and disease. However, those negatives are more than offset by the increase in social interactions, trade, and prosperity, and with enough time and effort those problems can be tackled through further technological innovations.

From an investing perspective, it is very difficult to find a company that is the leader in their space, has jaw droppingly attractive financials, yet is so widely disliked by the investment community. I think looking back in 10 years, people will be wondering what the market was thinking by valuing Meta at its current price; not completely dissimilar to Apple circa 2013. However, it is in our best interests as long-term owners for Meta shares to continue to decline as Meta has the cash flow to buy back shares at what appears to be far below intrinsic value…just not our shares.

|

Source: Company filings, Factset, Saga Partners Note: 2022E values are Factset consensus expectations, market cap and share price are as of 6/30/22. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment