Lemon_tm

We are bullish on Meta Platforms (NASDAQ:META) despite missing expectations on revenue, ads coming in weak and investment losses in the metaverse in 3Q22. We believe that market volatility and inflationary pressure hit Meta hard. Yet, we believe the pullback has made Meta’s valuation extremely attractive for its position in the industry. We believe Meta stock provides an attractive entry point for long-term investors.

Meta is the parent of Facebook, Instagram, and WhatsApp through its Family of Apps (FOA). The company has also ventured into the metaverse spending billions on its AR and VR experiences through its Reality Labs (RL). While Meta is part of the FAANG family and one of the best-base social media platforms, its 3Q22 was a disaster. The 3Q22 earnings reported Meta’s revenue declined 4% year-over-year, making it the company’s second consecutive sequential decline. Net income also declined 52% over the same period. The stock fell, even more, when the company forecasted revenue and sales to drop even further in 4Q22. The company announced that it expects operating losses for its RL, which includes its metaverse. We’re optimistic about Meta because we believe the market has reacted to the negatives and priced them into the stock for the most part. We believe Meta’s valuation is very attractive trading at 8.8x C2024 compared to the average peer group of 18.7x. We don’t believe Meta’s fundamentals have changed and expect the company to grow once macroeconomic headwinds ease. We recommend investors buy into the stock at current levels.

Meta is down, but so is the peer group

Meta had a rough year, alongside most of the tech peer group. We don’t believe Meta is struggling alone; competition is also feeling the pressure of the macroeconomic environment and weaker advertisement spending. We believe a major factor in Meta’s decline has been weakening spending on advertisements. In 3Q22, Meta reported that the average price per ad decreased 18% Y/Y, compared to a 14% Y/Y decrease a quarter earlier. Weak advertisement spending has not only impacted Meta but it’s also taken a toll on its competition. Google’s YouTube (GOOG) (GOOGL) saw a decline in its advertising revenue as did Snapchat (SNAP) delivering results that disappointed investors.

Meta is facing increased churn from Apple’s (AAPL) iOS privacy update enacted as part of iOS 14.0 which makes it harder for platforms and apps to track users through other apps and websites on their devices. Earlier this year, Meta CFO Dave Wehner said he believes “the impact of iOS overall is a headwind on our business in 2022.” We believe Apple’s privacy update alongside already weakening advertisement spending harmed Meta’s Facebook and Instagram ad revenue. While advertisement spending serves as a headwind for Meta now, we expect the company is well-positioned to grow once advertisement spending picks up because of its huge customer base across its FoA. Meta’s family apps are still retaining a big chunk of popular apps used.

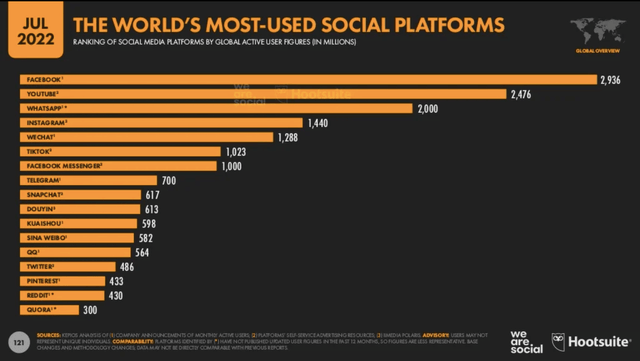

The following graph shows the most popular social networks, with Meta’s Facebook, WhatsApp, and Instagram retaining status among the top most-used social platforms.

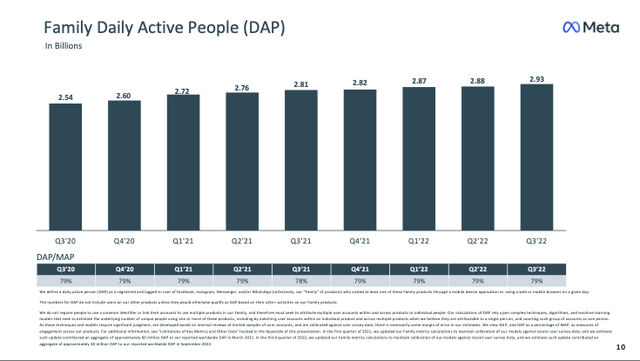

Meta still retains a huge customer base with almost 3B daily active people on all its platforms, and monthly active people almost reaching 4B – an all-time high over the past two years.

The following graph shows Meta’s Family DAP.

We believe Meta’s customer base makes it well-positioned to grow when the macroeconomic headwinds ease. We expect spending on advertisements to gradually pick up towards 1H23. We believe Meta’s advertisement segment will serve as a growth catalyst once the market recovers.

What about the Metaverse?

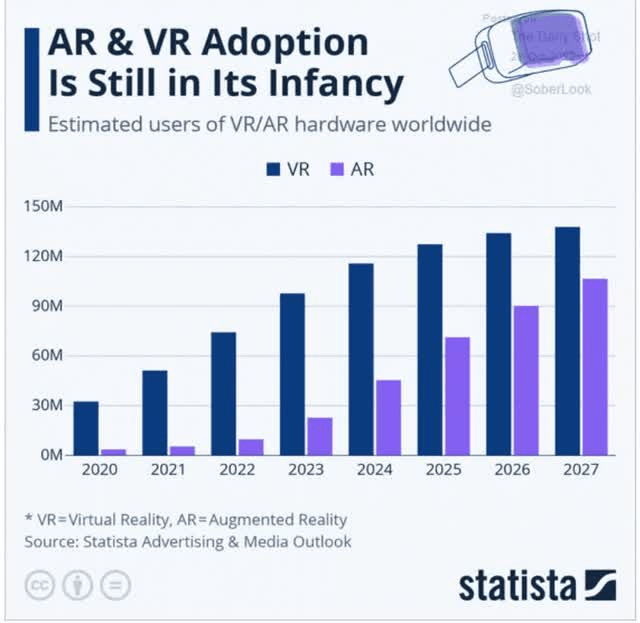

Meta is losing billions of dollars in its investments in the metaverse, suffering from $27B in operating losses in the metaverse division over the past three years. The company’s working on creating multiple VR headsets, AR glasses, and associated software. Many of the sell-rated SeekingAlpha articles emphasize that the company’s fundamentals have changed as it bets so much on the metaverse. We believe the investment into the metaverse is a major factor harming the company’s recent financial performance. Nevertheless, we don’t believe Meta’s fundamentals have changed as the company retains one of the largest social media platforms. We believe the metaverse is a long-term investment that could serve as a growth catalyst for the company going forward as AR and VR adoption are still in their infancy.

The following graph outlines estimated users of VR/AR hardware worldwide.

Statista

We’re also more constructive as Meta CEO, Mark Zuckerberg, made promises about “pacing” spending going forward. We don’t believe the metaverse should overshadow Meta’s main revenue streams- its social media platforms. We expect Meta to grow as macroeconomic headwinds ease and recommend buying the stock at current levels.

Stock pullback creates a good entry point

Meta stock dropped by almost 73% YTD. We believe this creates an attractive entry point for long-term investors who are looking to invest in the information technology industry and the social media analytics market through its apps: Instagram, Facebook, and WhatsApp. The global social media analytics market is estimated to grow at a CAGR of 23.8% between 2022-2029. Meta remains among the world’s most valuable companies, and it is currently trading at a discount. We’re not too worried about the pullback because we believe Meta’s core business is still intact.

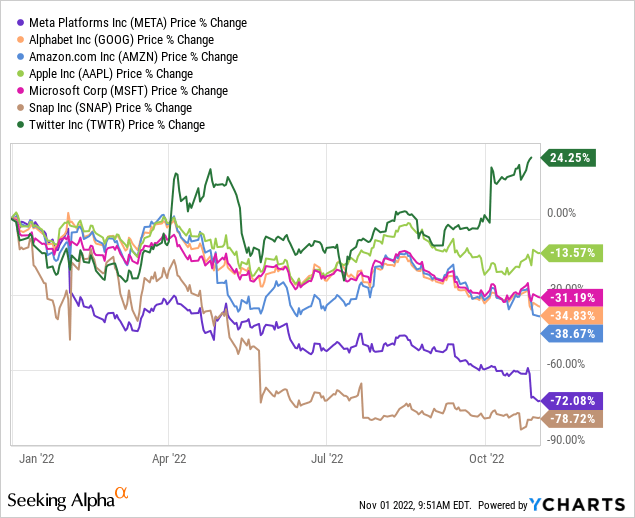

Stock Performance

Meta is down 72% YTD, underperforming its competitors: Twitter (TWTR) is up around 25%, Apple is down around 14%, Microsoft (MSFT) is down around 32%, Alphabet is down around 35%, and Amazon (AMZN) is down around 39%. Meta did outperform Snap down around 79%.

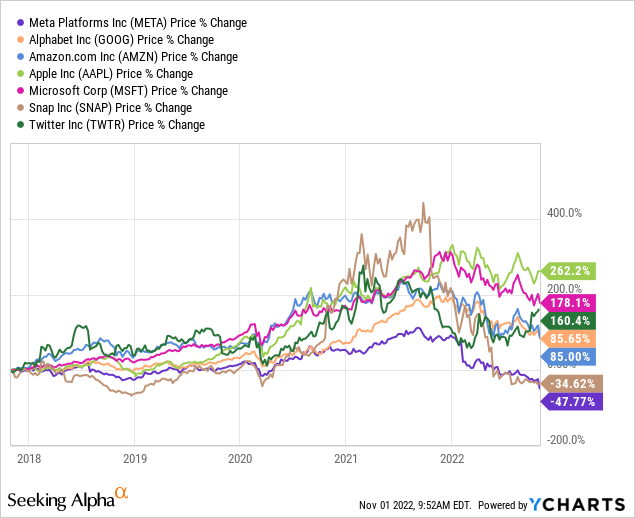

Over the past five years, Meta is down around 48% while Twitter is up around 160%, Apple is up around 262%, Microsoft is up around 178%, Alphabet is up around 86%, Amazon is up 85%, and Snap is down around 37%. We remain bullish on the stock and believe the stock offers a good entry point for investors. The following graphs show Meta’s performance among competitors over the past five years and YTD.

TechStockPros

TechStockPros

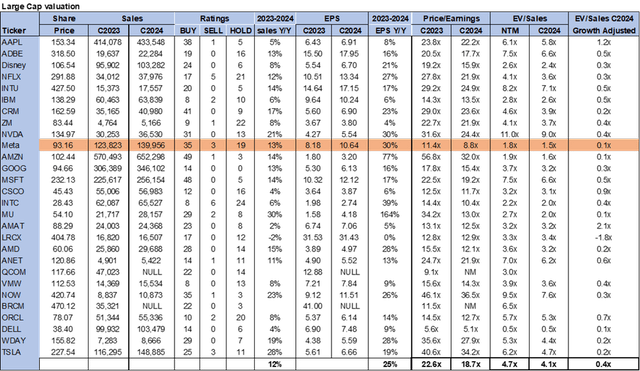

Valuation is at the core of our investment thesis

Meta is relatively cheap. On a P/E basis, Meta is currently trading at 8.8x C2024 EPS of $10.64 compared to the average peer group of 18.7x. On an EV/Sales, Meta is trading at 1.5x C2024 sales versus the peer group average of 4.1x. We believe Meta’s drop YTD has plunged into a value stock and we recommend investors buy the pullback.

The following chart illustrates Meta’s valuation relative to its peer group.

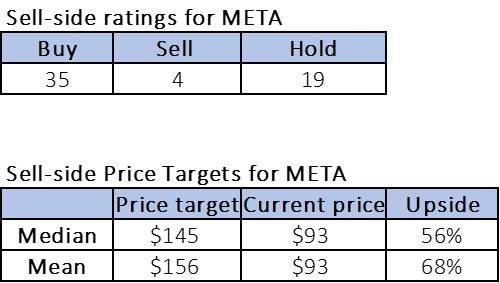

Word on Wall Street

Of the 58 analysts covering the stock, 35 are buy-rated, 19 are hold-rated, and the remaining four are sell-rated. We share Wall Street’s bullish sentiment on the stock. Meta is currently trading at around $93. The median price target is $145, and the mean price target is $156, with a potential upside of about 56-68%. The following chart indicates the sell-side ratings and price targets.

TechStockPros

What to do with the stock

We remain bullish on Meta despite its recent quarter and negative forecasts. We’re aware of the macroeconomic headwinds and overspending on the metaverse, but we believe the company’s main business is intact. We expect Meta to grow once macroeconomic headwinds ease and recommend investors buy the stock now as it is cheap and offers a favorable entry point.

Be the first to comment