Kelly Sullivan

Meta Platforms (NASDAQ:META) clearly over spent in the last couple of years to capture the future opportunity in the Metaverse. Brad Gerstner of Altimeter Capital pushed forward a plan for the social media giant to double cash flows by making dramatic cuts to costs. My investment thesis remains ultra Bullish on the stock, but the last move the company needs to make is drastic cost cuts with growth opportunities ahead in the Metaverse and Reels.

Brad Gerstner Plan

Meta was clearly investing too much money in the Metaverse with Reality Labs losing close to a $13 billion annualized rate at the recent peak. The company just released the Oculus Pro with a multi-month lead on the similar Apple (AAPL) mixed reality device along with updates to Horizon Worlds.

CEO Mark Zuckerberg has already made hints at reducing costs and cutting employees not willing to work hard. Meta is still a profit machine with nearly $7 billion in quarterly profits in Q2.

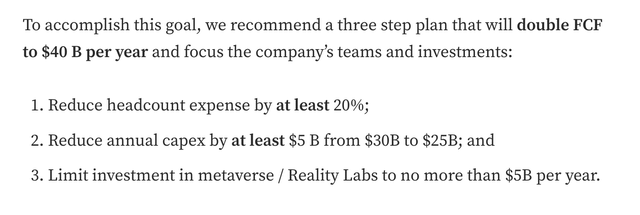

Mr. Gerstner has the following general plan to greatly reduce costs and double cash flows:

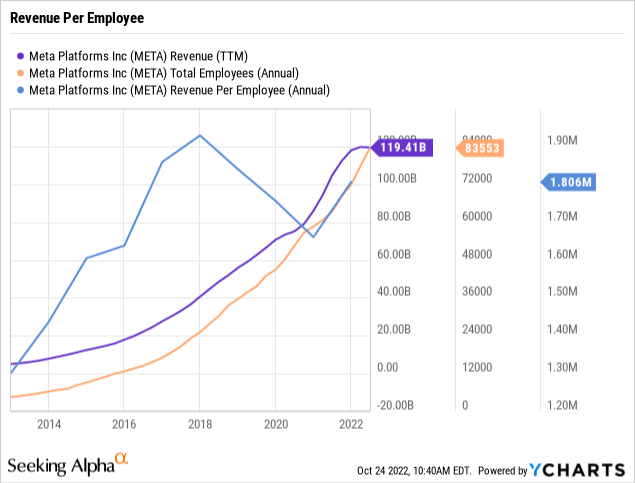

The basis of the concern is that Meta has increased the employee count from 25K to 85K in the last four years. The company has added an insanely large amount of employees during this period, but the revenue has grown dramatically in large part due to a big covid bump in online advertising to nearly $120 billion in trailing revenues.

A clear sign of problems is that the efficiency metric has the revenue per employee stalling in 2018. Meta was producing $1.9 million in annual revenues per employee and the amount has dipped to $1.8 million now.

The company has no doubt overspent on the Metaverse. Gerstner thinks the company should cut employee expenses by 20% to return to the mid-2021 levels. One can definitely argue Meta hasn’t become any better since the covid peak in revenues despite the extra spending.

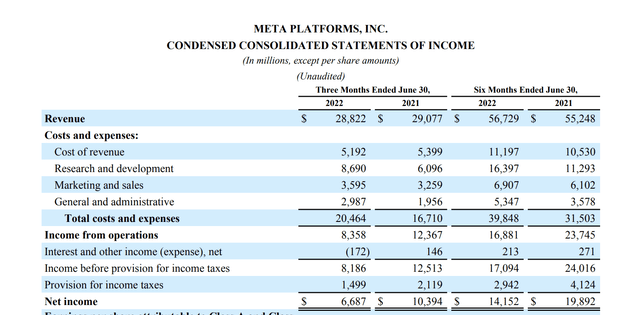

In the last quarter, management announced plans to cut total annual expenses to $85-88 billion, down from a previous plan of $87-92 billion. The key here is that Meta was cutting spending growth plans, not actually cutting expenses.

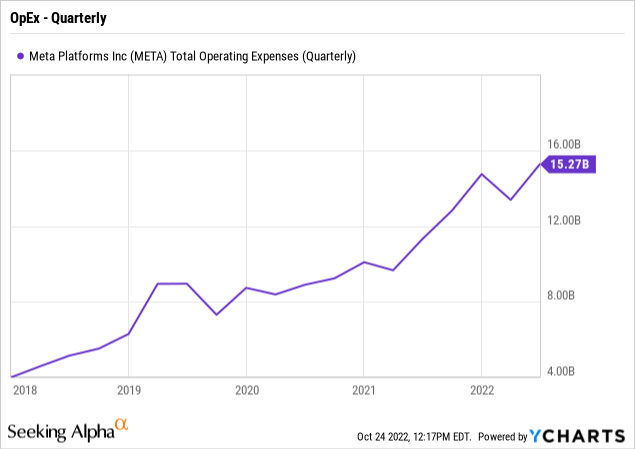

Meta only spent at a $82 billion annualize rate during Q2 with slightly above $5 billion per quarter targeted at costs of revenue. The company was spending $15 billion per quarter on operating expenses after starting 2020 in the $8+ billion range.

Naturally, the last quarterly spending hit profits hard with revenues down while expense ramped up nearly $4 billion from the prior year. Though, most of the expense growth was in R&D and primarily directed at the Reality Labs division focused on the Metaverse.

Source: Meta Platforms Q2’22 earnings release

Without a big ramp in revenues, Meta was basically guiding to OpEx spending in the quarterly range of $16 billion. The company just needs to whittle down the costs to the early 2022 levels in order to see a big boost to cash flows going forward knowing a lot of these employees added in the last year aren’t contributing to revenue growth.

Getting Fit Takes Time

What Meta needs more than anything is to control costs while growing into a slimed down corporation. The company cutting thousands of employees would disrupt the employee base and could kill innovation.

If Zuckerberg cut 20% of the staff in one move, the business would face a very destabilizing environment. The company needs to keep the expert software engineers while maybe just not replacing people leaving the company. Meta can cut costs over time without an impact to revenue growth.

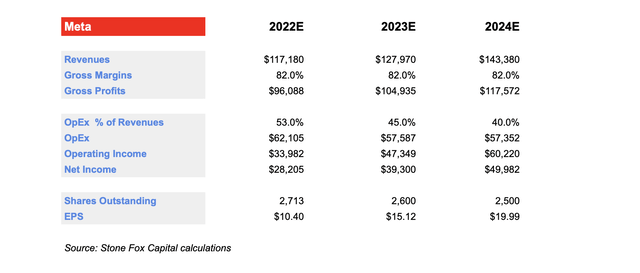

Under my plan, the social media giant would reduce the OpEx percentage of revenues from an absurdly high of ~53% now to 40% by 2024. A big key here is for Meta to focus on 10%+ revenue growth when the economy improves while cutting OpEx by 10% from the 2022 levels.

Meta can definitely double EPS during the period by using large cash flows to continue reducing share counts. The company ended the last quarter with a cash balance of $40 billion while operating cash flows were nearly $60 billion last year providing plenty of cash to reduce share counts by 100 million annually.

The company would still spend ~40% of revenues on OpEx during 2024, which would appear exceptionally high when the gross margin is an impressive 82%. Meta could produce nearly $20 in EPS during 2024 based on this plan. Analysts predicting the above revenue targets from 2022 through 2024 only target a 2024 EPS of $12.45.

The ultimate key is for Meta to not lose focus on growing revenues from Oculus and Horion Worlds. Management just can’t accept wild spending with the plan getting opex down to 40% of revenues via a focus on revenue growth and constraining cost growth. The company shouldn’t aggressively cut spending in a period where the digital ad market is exceptionally tough.

Takeaway

The key investor takeaway is that Brad Gerstner issued an intriguing plan that highlights the easy path for far higher profits and cash flows at Meta. While CEO Mark Zuckerberg does need to issue a directive for the social media giant to become fiscally fit, the company has a far better path to cost constraints without destabilizing the business.

Meta faces a competitive environment for digital ad dollars, so revenue growth isn’t guaranteed. Regardless, the company appears poised to maintain solid growth in the years ahead with constrained spending immediately leading to massive profit growth. The stock is far too cheap at $130 with an easy path to a $20 EPS.

Be the first to comment