remotevfx/iStock via Getty Images

Is Meta Platforms (NASDAQ:META) a black hole sucking cash from Facebook dry, or an entrance into a new universe that will make billions? Who knows? Some smart bottom-fisher like Warren has to step up to the plate and say yes, that META is a bargain, and not a black hole. However, you know Warren’s golden rule. Never invest in something you don’t understand. I understand Facebook but haven’t a clue on Meta Platforms.

The CEO owns the company and can do whatever he wants. Likewise, the shareholders can do whatever they want and they are dumping META. Portfolio managers are only interested in performance. You can see on the monthly chart below where it started underperforming the Index back in 2021. You can also see our red, vertical line, Sell Signal. We won’t put META in the Model Portfolio until we get a vertical line Buy Signal.

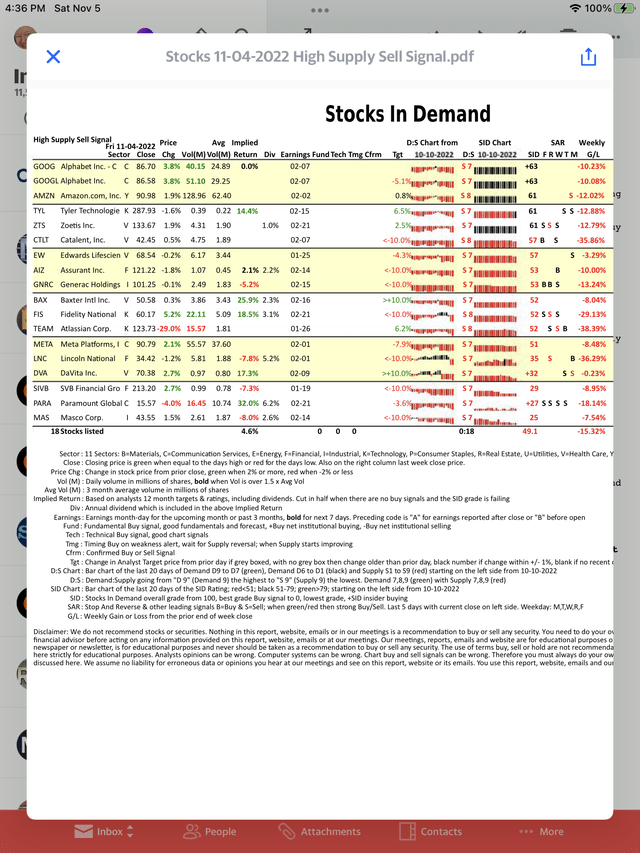

That will happen when the famous bottom-fishers start buying. We will see it on the chart. It will happen when the sellers are exhausted. Unfortunately, they are still dumping it and META appears on the list below where we identify stocks with our “High Supply Sell Signal” in the D:S column.

The shareholders are interested in the future of META, where it is going, what the earnings and growth will be and, if all of that is clear, they buy. Obviously that is not clear with META and they are selling META until it does become clear. Maybe Zuckerberg needs to take META on a roadshow and sell it to investors, otherwise it looks like he is going to be the lonely investor in META until the bottom-fishers start buying.

On the list below you can see that our signal shows insider buying in Google (GOOGL) but not in META. The bottom-fishers will probably be more interested in GOOGL and the insider “+” buy signal that we attach to the SID score in the SID column. This SID score is our most important, Buy/Hold/Sell signal. It uses both fundamentals and technicals.

Where is the bottom for META? The buy signal on the chart will tell us when the bottom occurs, but the fundamentals should also help identify the bottom. Seeking Alpha rates it as a quant “Hold” but the underlying scores tell you why META continues to drop. Growth gets an “F” rating, so growth portfolio managers are rotating out of it, selling it. Momentum is “D” telling us it has not bottomed yet and is too early to buy. Revisions are rated “C” and the latest drop in targets by analysts indicate that will not improve and probably will get a lower grade. Profitability gets an “A+” and Valuation has a “B-“. I add that all up and to me it spells “value trap” as folks zero in on just profitability and valuation. I would wait for that Hold rating to improve to a Buy rating or for Growth, Momentum and Revisions to start improving.

In the last 90-days, earnings estimates for the current quarter have dropped from $2.87 to $2.25. For next year they have dropped from $11.99 to $7.74. Let’s be generous and say the earnings estimates are finished dropping. Applying META’s current PE of 10.5 to $7.74 gives a target of $81.27. Since we want to make some money on any buy, let’s target $70 as our buy point. Looks like price may keep falling.

Let’s check with Wall St. Morgan Stanley just dropped the target to $105. Let’s be generous and say they are finished dropping their target because it is well below the average analyst target of $156. In this case, I would start looking for the bottom-fishers to start buying at $90. Let’s split the difference between our $70 and $90 and target an $80 entry for the time being. At $80, we will come back and take another look. We want to see a bottoming formation. We want to see exhaustion selling. We want to see a retest of the bottom that holds. Then we will think about bottom-fishing META.

Buying value is great, but timing is everything. Warren had perfect timing buying Apple (AAPL) at the bottom. I would prefer to bottom-fish AAPL and Google instead of META.

Here is our monthly chart showing the red, vertical line, Sell Signal in 2021. Price has not formed a bottom yet. The signals have not turned up.

META Sell Signal In 2021 (StockCharts)

Here is our daily report sent to subscribers identifying stocks that investors are dumping. All the stocks on this list show extreme Supply readings in the D:S column. Our most important Buy/Hold/Sell signal is shown in the SID column. You can see GOOGL and META on this list. GOOGL is at the top of the list with a +63 out of 100 Hold grade. It has a better SID grade in the SID column, then META, which has a 51 Sell Signal.

META Sell Signals In D:S and SID Columns (StocksInDemand.com)

Be the first to comment