Florent Molinier

Article Thesis

Meta Platforms (NASDAQ:META) has been a battleground stock over the last couple of quarters. Some analysts and investors believe that there is additional downside potential, while others see considerable upside potential over the coming years. I do believe that Meta Platforms could generate compelling returns from the current level over the coming years as long as execution remains solid and as long as Metaverse spending does not rise too much. Investors should still look at some of the bear arguments, as there are risks to be considered.

Deterioration Or Massive Upside?

Meta Platforms has dropped by more than 50% over the last year, with much of that drop being attributed to the company’s high Metaverse spending that will pressure profit growth in the near term. Shares are now trading at a pretty low valuation of just 14x this year’s net profit, which is by far the lowest valuation Meta Platforms has ever traded at. And yet, not all analysts agree that it is a good value here.

Investment firm Needham has recently downgraded Meta Platforms to “Underperform”, claiming that fundamentals were deteriorating. One can argue whether a downgrade following a 50%+ price decline is especially helpful for investors, but it still makes sense to take a look at the bearish arguments. Needham states that profit will likely come in at a weaker level compared to what the company had forecasted earlier, due to rising costs. Meta is not especially vulnerable to high inflation, as there are no massive transportation, shipping, or commodity price sensitivities. Instead, rising costs are explained by the company’s growth spending in its Metaverse business unit. That is not really a new item, however, as Meta had already guided towards higher expenses in the Metaverse business months ago — which was the primary reason for the selloff we have seen over the last year.

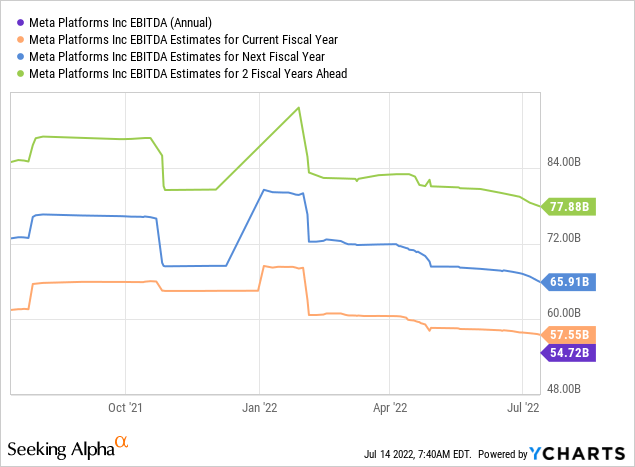

It is pretty clear that this cost growth due to Meta’s growth investments will pressure margins and profits this year, but that has been reflected in analyst estimates for quite some time. I thus don’t think that Needham did uncover a major new development here. It is also important to note that the reduction in EBITDA estimates we have seen over the last couple of months does not mean that Meta Platforms will see its profits shrink:

The company generated $55 billion in EBITDA last year and is forecasted to generate $58 billion of EBITDA this year. That number is forecasted to grow to $66 billion next year, and to $78 billion in 2024. All of these estimates are down relative to where they were at the beginning of 2022. And yet, Meta Platforms is still forecasted to grow its EBITDA every single year in the foreseeable future. Expected growth arguably is rather low this year, at about 6%, but is seen accelerating to a compelling 14% and 18% in 2023 and 2024, respectively. The average growth rate over those three years is 12%, which is far from bad. If Meta Platforms was valued at 50, 80, or 100x EBITDA like some SaaS companies and e-commerce players, then that would not be sufficient growth at all. But for a company that trades at an abysmally low enterprise value to EBITDA ratio of just 6.93x, double-digit EBITDA growth is a great feat.

Where will Meta Platforms’ growth come from? First, the company continues to grow its user count. In the most recent quarter, daily users were up 4%, which is not outstanding growth but which results in a solid baseline growth rate already. The company is, through price increases and improved monetization, able to grow its revenue per user over time. Especially in geographic markets with strong economic growth, such as parts of Asia, revenue per user is improving at a compelling pace. Since consumers in these markets will get wealthier over time, which improves their spending power, they become more and more attractive to advertisers, which is why Meta should be able to increase the revenue per user in foreign markets for many years to come. Even in the US and Europe, two more mature markets, revenue per user continues to trend up and will likely continue to do so as advertisers won’t want to miss the chance to do quick and effective campaigns, relative to what advertisers can do with television or print.

Meta’s outlook when it comes to the Metaverse is hard to forecast. It is pretty clear, though, that Mark Zuckerberg sees this as an absolute giant of a future cash and profit source. Seeking Alpha reports that he stated that the Metaverse business would become as large as the current social media business. Even if we are way more conservative and assume that the Metaverse business will only add half of the company’s current profit a decade from now, that still makes a major difference over time.

Profit growth will not only depend on rising revenues, however. Instead, Meta Platforms has also increased its focus on improving efficiency. Meta has reduced its hiring goal for the current year, and Mark Zuckerberg has told employees that they should be prepared to generate more output with fewer resources — i.e. become more efficient at their jobs. Cutting non-needed jobs and stopping the waste of resources is a good thing for investors and should result in improving margins, all else equal.

Looking at the bull view, Tigress Financial Partners believes that Meta Platforms has upside potential towards $466, which pencils out to a potential 186% gain. That price target was given with a 12-month horizon. I do believe that expecting any stock to rise by 100% over a year is aggressive and that a call for a 180%+ rise in one year is ultra-aggressive. I thus do not ascribe to the view that Meta will be trading north of $400 a year from now. Nevertheless, I do believe that there is considerable upside potential for Meta Platforms over a multi-year horizon.

Where Could Meta Be In 5 Years?

In order to be conservative, let’s assume that the recent trend of EBITDA estimate downward revisions continue and that actual EBITDA in the coming years will come in somewhat lower than what is forecasted today:

| Year | Analyst consensus | Conservative estimate |

| 2022 | $58 billion | $55 billion |

| 2023 | $66 billion | $60 billion |

| 2024 | $78 billion | $70 billion |

Source: Author

In this scenario, Meta will not generate any EBITDA growth this year, while EBITDA in 2023 and 2024 will come in a whopping 10% below current expectations. Let’s also assume that EBITDA will only grow by 5% in the following two years, which gets us to a $77 billion EBITDA estimate for 2026. Note that Meta has historically mostly beaten analyst expectations, thus this is a pretty conservative scenario, I would say.

What should be the fair value for a company that generates $77 billion in EBITDA and that might grow at a mid-single digits pace in the long run? I do believe that a 10x EBITDA multiple is warranted, which would result in a $770 billion enterprise value in 2026. Let’s round that down to $750 billion in order to be ultra-conservative.

Meta Platforms currently has a net cash position of $40 billion. If that remains constant, its market capitalization would be $790 billion five years from now. If the share count remains stable, that would result in a share price of $292, based on a share count of 2.71 billion. But Meta Platforms will generate massive cash flows over the next five years, and the company has shown that it is willing to buy back shares at a hefty pace when it sees the valuation as attractive. I estimate that the company should be able to reduce its share count by at least 20% over the next five years, potentially much more. But even a 20% share count reduction would result in a share price of $364 five years from now. That is, relative to the current share price of $163, a gain of around 125%. So my price estimate is lower than that of Tigress Global, and I do believe that it will take years for Meta to get there. But even in my scenario, Meta Platforms would easily double an investor’s money over the next five years, which seems quite attractive.

Risks To Consider

There are several risk factors to consider when investing in Meta Platforms. There is regulation, e.g. in the EU, where data transfers between the block and the US might get halted. That would not mean that Meta can’t earn money in the EU, but it might lead to additional costs and fewer synergies across the company’s businesses. The European Commission is also currently investigating the video licensing policy of the Alliance for Open Media (Meta is part of that alliance). Regulation will not bring an end to Meta or its business model, but it might lead to higher expenses for compliance which could lead to lower margins.

Competition also is a risk, as Meta Platforms has lost mindshare among the (very) young demographic while TikTok has gained share there. So far, it does not look like this trend will continue with older generations, as those do not seem to be drawn toward TikTok. Meta Platforms also is forecasted to become the leader in short-form video this year or next, thanks to the successful rollout of such options on Facebook and Instagram. I thus do not believe that the TikTok threat is overly large, but nevertheless, investors shouldn’t ignore TikTok and its potential impact on Meta.

Takeaway

Meta Platforms has been a battleground stock this year. Some are bearish on the stock, despite an already pretty low valuation. Others are ultra-bullish on Meta, forecasting that shares will almost triple over the next year.

I am bullish on Meta as well, although I don’t see shares exploding upwards in the very near term. Over a multi-year time frame, Meta Platforms could deliver highly compelling returns, however. I would not be surprised to see Meta double over the next five years, which would make for above-average total returns from the current level.

Be the first to comment