photoman

Currently Meta Platforms (NASDAQ:META) is one of the most unloved large-cap technology stocks on the market. With its earnings multiple at an all-time low and its core ad’s business recovering I believe the company’s recent sell-off offers contrarian investors an intriguing buying opportunity. Let me explain why.

Market sentiment for Meta Platforms is at an all-time low following the release of its third-quarter earnings at the end of October. Deciphering Meta’s results and the accompanying remarks from founder/CEO Mark Zuckerberg, it’s clear Meta is no longer just a social media and online advertising company. As its core ads business matures Meta is increasingly focusing its resources on its virtual and augmented reality division, “Reality Labs”. Mark Zuckerberg is fully committed to his vision of the metaverse, and so far, Meta appears to have a commanding lead over competing VR /AR headset manufacturers. The question remains, however: will AR /VR prevail? Or is the metaverse just another overhyped Silicon Valley tech fad? While the future of the metaverse is undoubtedly fraught with uncertainty, the opportunity for virtual reality applications is enormous, with Meta Platforms the best-placed company in the space to capitalize on this secular trend in the coming years.

Q3 Earnings highlights

For Meta’s core Family of Apps (FOA) division, the company reported strong user engagement across Facebook, Instagram, and WhatsApp. Year-on-year daily active users grew 5.7% to 3.71 billion, while ad impressions increased by 17%. This, however, was offset by an 18% drop in the price per ad due to the growth in Reels which the company monetizes at a lower rate than traditional Facebook and Instagram news feed.

Investors, however, were spooked by mounting operating costs and expenses directed at Meta’s Reality Labs division. The company’s research and development expenses grew 45% year-on-year while capital expenditures ballooned to a record US$9bn for the quarter. To address the sharp increase in costs, Zuckerberg highlighted that the company would focus on reducing its total expenses in the coming quarters, including lowering the rate of hiring.

Meta’s High costs and expenses won’t be elevated forever

While Meta’s future capital needs will undoubtedly be more than they have ever been, I believe its total costs and expenses will normalize as Reality Labs achieves meaningful scale.

Meta’s spending towards the metaverse has definitely grown faster than investors, including myself, anticipated. Currently, these costs are eye wateringly high. Zuckerberg, however, clearly has a plan as to how Meta will allocate the future cash flows generated from its core advertising business. While in the short term, the company’s spending will likely be destructive to its earnings and free cash flow, in the long term, such investments have the potential to create meaningful shareholder value.

Today VR/AR technology is still incredibly nascent. Subsequently, large upfront investment is needed to iterate and develop a best-in-class product suitable for mass market adoption. With such a strong focus on its investment in the metaverse, it is hard to deny that Meta is building a strong competitive advantage over its rival AR and VR hardware developers, which will be hard to stop. The question on everyone’s mind however is whether such a large investment is justified.

If you can’t beat them join them

Meta’s recent partnership with rival technology conglomerate, Microsoft, highlights Oculus’s strong positioning in the virtual and augmented reality space. Recently, Microsoft, the popular Xbox gaming device maker, announced it would partner with Meta to integrate its office suite and enterprise collaboration software (Microsoft Teams) with Meta’s Oculus hardware devices. This collaborative approach is significant. As one of the world’s largest and most profitable technology companies, Microsoft could have easily decided to challenge Meta and develop its own Virtual Reality headset. Instead, they have chosen to work collaboratively, signaling perhaps that Oculus is well ahead of its peers in developing a highly sophisticated, leading-edge virtual reality device. While Microsoft does have its own VR headset, it has not launched a new device since 2019.

Moreover, Microsoft had the option to partner with a handful of other VR hardware device manufacturers, including the likes of Sony and Apple. Alternatively, they could have taken no action at all. In extending its software applications to virtual reality Microsoft clearly sees value in the metaverse and may indicate where the technology giant see’s the metaverse heading in the future. Traditionally, gaming and social engagement have been the two experiences most associated with the metaverse. Microsoft and Meta’s focus on enterprise collaboration and productivity tools for VR highlight the metaverse’s broad use case outside of web 3.0, gaming and social media.

Reality Labs is winning the VR race

In June of this year, Meta Platforms had sold roughly 15 million of its Oculus headsets. What’s more, Meta’s Oculus Quest 2 sales have already passed Microsoft’s Xbox ‘Series X’ total lifetime sales and are quickly catching PlayStation 5 total sales. This makes the Oculus Quest 2 the market’s most widely used virtual reality headset. While competitors such as HTC, Sony and Apple have or are in the process of developing rival devices, they have yet to come close to Oculus in terms of total units sold, attesting to the quality of the Oculus product relative to its peers. As Meta ramps up its investment in VR devices, we believe it will become increasingly challenging for competitors to compete with Oculus’s superior technological capabilities, user experience and selection of third-party applications. Going forward only time will tell as to whether Meta’s metaverse investment pays off – Looking at Zuckerberg’s track record and the lead Oculus has in the VR/AR space, we believe it will.

So where does Meta head from here?

There is no doubt significant uncertainty about the future of Meta Platforms. If there was one thing I took away from Meta’s Q3 earnings call, it was that Zuckerberg’s future capital allocation strategy will be geared toward building out the Metaverse. With Reality Labs expected to be a considerable cash burn for at least the next 2-3 years, Meta’s other businesses will need to do a lot of the heavy lifting regarding cash flow generation. Although they have struggled over the last 12 months, I believe a recovery is closer than many expect.

For Meta’s Family of Apps Division, I remain optimistic. Looking at its Q3 results, engagement across FB, Instagram and WhatsApp is stable, if not growing. Additionally, the launch of Reels appears to be gaining considerable traction. Currently, Reels are played 140 billion times daily across FB and Instagram – A 50% increase from six months ago. While still early, Reels looks like it is stealing market share back from TikTok. Meta’s integration of AI discovery engines to power its Reels recommendations has been a critical driver in the recent success of Reels across its platforms. As Meta focuses more of its time and energy on AI technology for its discovery engine, Reels should continue to gain popularity. While engagement going forward looks positive, the key metric to watch will be Reels monetization. As Reels grows, it will continue to act as a headwind to revenue given its lower monetization rate – if and when Meta fixes this, which I believe they will, revenue for its FOA division should normalize.

Turing to messaging, Meta’s click-to-messaging business for WhatsApp and Messenger is another promising development. However, both are still immaterial to the company’s top and bottom lines. Since acquiring WhatsApp in 2014, Meta has yet to monetize its enormous global user base, which has grown to over 2 billion people. Meta’s new click-to-message business is changing this and is the company’s fastest-growing product. Moreover, click to WhatsApp recently passed US$1.5 billion run rate and is growing more than 80% year-on-year. While coming off a low base, the opportunity to generate meaningful revenue from WhatsApp and Messager is huge, given the platforms have such an enormous user base. In addition, WhatsApp’s strategic partnership with Salesforce, which lets all customers use WhatsApp as the primary messaging service to answer customer questions and sell directly in chat, is an exciting development that could significantly increase WhatsApp revenue growth.

Meta’s Reality Labs is no doubt the division facing the most uncertainty. As I mentioned before, Oculus is well ahead of its peers in the VR space in terms of technology and functionality. The two questions on my mind are 1.) Is the amount of capital currently being allocated to Oculus justified? 2.) Will VR and the Metaverse become mainstream? Meta is currently throwing the kitchen sink at Reality Labs; however, this spending is very much discretionary and can be dialed back if needed. Based on Reality Lab’s recent growth rates the current spend seems unsustainable for more than 12-18 months. If Reality Labs starts to gain meaningful adoption over the next 6-12 months investors will likely be more accepting of Meta’s high CapEx and OpEx budgets. The market’s response to Meta’s new Quest Pro and 3 headsets will be a good indication of such adoption and I will be keeping a close eye on the user feedback in the coming months.

Valuation

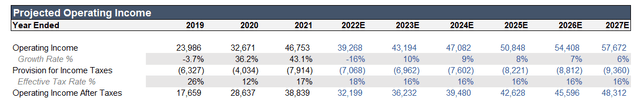

Below is a summary of my operating income growth assumptions for Meta Platforms out to the end of FY2027.

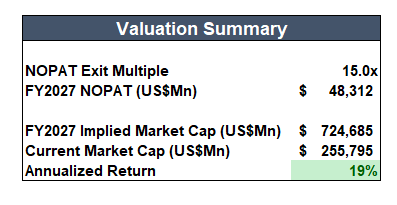

Operating Income (OJRB Investment Research) Valuation Summary (OJRB Investment Research)

Based on my conservative growth assumptions, I expect Meta Platforms to grow its net operating profit after tax (NOPAT) to approximately US$48 billion by 2027. Assuming Meta trades at 15x NOPAT (which I believe is reasonable) this gives the company an approximate market capitalization of US$725 billion IN FY2027. For investors buying the stock today, this would generate an annualized return of approximately 19%. as such I believe Meta is a buy at below US$100 per share.

Conclusion

The next 12-18 months will definitely be a challenging period for Meta Platforms, contrary to what many have been saying however I believe the company will successfully navigate this period. In my opinion, Mark Zuckerberg is a highly intelligent capital allocator who intends to maximize shareholder value over the long term. While there is a big question mark around the future of Reality Labs, Meta’s core ads business is in a good position and should continue to generate strong cash flows which will support the development of Meta’s Oculus products.

Be the first to comment