Maksym Isachenko/iStock via Getty Images

Mesabi Trust (NYSE:MSB) is a pass-through royalty vehicle that takes a cut on the production of an iron ore mine and distributes it to shareholders. Otherwise, it doesn’t do much. Currently, it doesn’t do much as Cleveland-Cliffs (CLF), which operates the Northshore operation, decided to idle it until at least April 2023. But the operator included a thinly veiled threat within its decision to keep it shut for longer. The outspoken CEO of the operator also referenced the ridiculous royalty structure in place:

…with the use of additional scrap in our BOF’s [basic oxygen furnaces], our iron ore needs are not as high as before, and we no longer need to run our mines full out. When determining where to adjust production, our first look is at our cost structure. Because we are now able to produce DR-grade pellets at Minorca, and mainly due to the ridiculous royalty structure we have in place with the Mesabi Trust, we will be idling all production at our Northshore mine, starting in the Spring, carrying through at least to the Fall period, and maybe beyond. At Northshore, no production, no shipments, no royalty payments. We also acknowledge that our strategy to stretch hot metal, by adding increased amounts of scrap to the BOF’s is working extremely well. With more scrap in the BOF’s, we need fewer tons of hot metal to produce the same tonnage of liquid steel. As a consequence, the Northshore idle could go longer than currently planned.”

According to Mesabi, there’s been no outreach over that agreement:

Cliffs has not recently requested any changes to the royalty structure, which is governed by a 1989 royalty agreement, and Cliffs has historically failed to engage in meaningful negotiations requested by Mesabi Trust to address the interpretations of the royalty structure. Finally, since Cliffs’ announcements that began in October 2021, Mesabi Trust has not received requests from Cliffs or any other party to discuss renegotiation of the 1989 royalty agreement.

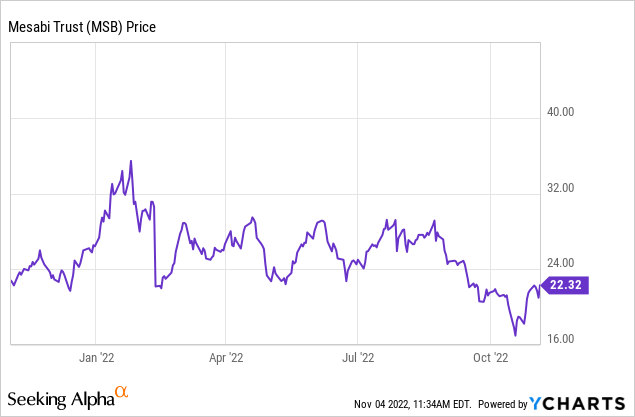

This is a yield vehicle. Something income-seeking investors tend to buy. Not surprisingly, it has come off quite a bit since CLF decided to idle the mine, although I would have expected it to fall even more.

Currently, it is trading at around $22, and there’s no distribution. I don’t expect it to be reinstated until there is more clarity on the situation of the mine in the future.

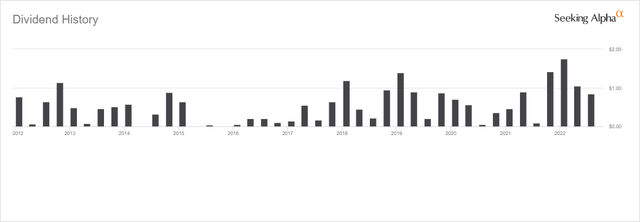

Here’s an overview of historical dividends:

MSB dividend history (Seeking Alpha)

You have to go back to 2017 to see distribution dip below $2 per unit.

This kind of vehicle trades at high yields and low multiples because they are liquidating vehicles with no or little residual value. As the mine runs out, the value of the royalty goes to zero as well. The Northshore mine has ample reserves. See this table from its 10-K:

Mining and Pelletizing Mineral Reserves

As of December 31, 2021

(In Millions of Long Tons)

|

Proven |

Probable |

Proven & Probable |

|||||||||||||||

|

Cliffs’ |

% |

% |

% |

Process |

|||||||||||||

|

Property |

Share |

Tonnage |

Grade |

Tonnage |

Grade |

Tonnage |

Grade(1) |

Recovery(2) |

|||||||||

|

Northshore |

100% |

303.2 |

25.3 |

519.2 |

24.1 |

822.4 |

24.6 |

29.4% |

|||||||||

| (1) | Cutoff grade was 19%. |

| (2) | Process recovery includes all factors for converting crude ore tonnage, shown above, to a dry saleable product. |

Annual production is something like 6 million tonnes. Given the reserves picture, the mine life is still very, very long. It’s also possible over time, tonnes are added to reserves as discoveries or improved technology that allow more economic extraction.

I’m not afraid of the trust winding up because the ore runs out, but it also winds up ~20 years after the last of 25 individuals has passed away. James Duade analyzed that situation here. Suffice to say, it would be quite unlucky for said individuals, and second unitholders if this were a problem within the next fifty years. I think his analysis is a bit on the conservative side, but it doesn’t matter that much whether it winds up in 50 or 70 years (because investors will heavily discount the back year earnings).

I listened to the Cleveland-Cliffs recent earnings call to see if there were any hints. It is unlikely CLF will outright say they’re going to restart because it hurts their negotiating leverage. It’s in their best interest to act as if they don’t care about this mine, and they’re fine if it remains shut forever. Here are some interesting remarks (emphasis mine):

Celso Goncalves

Yeah, sure, Emily. As we stated on our prepared remarks, there was a lot of repair and maintenance that we had to do here in 2022. And as we look to next year, a lot of those repairs and maintenance costs are going to come down significantly. You can expect them to be down in the area of $400 million for next year. We’ll have a lot lower idle costs next year relative to this year. We don’t have any major outages like we did this year. So there’s a lot of tailwinds that are going to start dropping our costs here rapidly.

And as we increase our volumes, this year, we’ve been kind of at that 3.6 million ton level every quarter, and we’re really pushing to get up to 3.8 million, 4 million tons again, and that’s going to further dilute our fixed costs going forward as well.

And then you have other things like energy cost, natural gas has come down a lot and things like that, that are also going to be a tailwind next year.

Even if you idle a mine but keep it in good enough shape to restart, there are quite a few costs. This isn’t a direct reference to Northshore but the mine does add to idle costs and Goncalves suggests these will come down.

Thanks for the question. Look, we will continue to export, maximize the utilization of the assets that we have. And we are not going to take equipment down just to implement discipline in the market if others are completely undisciplined.

If the others feel like the business model is predicated on destroying the marketplace, just because they feel that they can put the scrap price whatever they want. They might be right, but we just don’t agree with that type of approach. But we run our assets to minimize our costs. As long as we can make money, we will run. And I think that it’s a good balance because we can generate cash that way.

So don’t count on me to take my capacity out to make the life of others better. That happened in Q2 and the portion of Q3 because we had to make a big repair at Cleveland Works. When Cleveland Works was done, we came back. But also, remember, Cleveland Works, I don’t know if you know that, but it’s the biggest producer of advanced high-strength use for automotive, no exposed users. So the one reason that we fixed that thing is because we have a lot of confidence that automotive will pick up and the orders that come to Cleveland Works will start to pile up.

And actually, we are seeing that as we speak. Others cannot do that. That’s why our capacity can come back, can come back because it’s serving markets that I believe in 2023 might be the only ones that will be exciting, automotive being the biggest one.

It also looks like Goncalves isn’t going to keep CLF’s production down so others can profit at their expense. He’ll put production online if it is in the best interest of the company, even if it will hurt the market in the short term as well as gross margins.

I’m not exactly sure what Goncalves is trying to achieve. Maybe he wants the agreement restructured a bit? The last few years have shown everyone how important it is to have some onshore or U.S. production of key metals. This is favorable to mines like this. I expect Goncalves will want to bring it back. But the game of chicken could continue for a while. The longer CLF waits, the more it will rack up costs idling the mine and finding people. I would never want to own this if I wasn’t prepared for the mine to get idled for an extended period. Ultimately, CLF will become a rational actor and get this asset producing (it has done so for over 60 years already). In the near term, I think the stock will fall as fears will rise as the period of non-production gets extended.

For the long-term investor, the next few months could be a great opportunity to acquire units at highly favorable prices in the grand scheme of things. My approach is to hold a small position and add to it as favorable prices materialize (absent fresh bad news).

Be the first to comment