courtneyk

Moderate loan growth will likely be the chief driver of Meridian Corporation’s (NASDAQ:MRBK) earnings this year. On the other hand, a decline in noninterest income and above-average provisioning for expected loan losses will limit earnings growth. Overall, I’m expecting Meridian Corporation to report earnings of $4.04 per share for 2023, up 8% from my estimated earnings of $3.74 per share for 2022. The December 2023 target price suggests a large upside from the current market price. Therefore, I’m adopting a buy rating on Meridian Corporation.

Mortgage Banking Income Likely to Have Already Bottomed Out

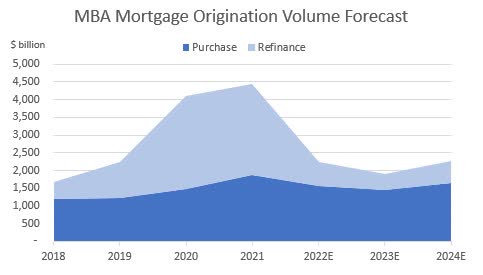

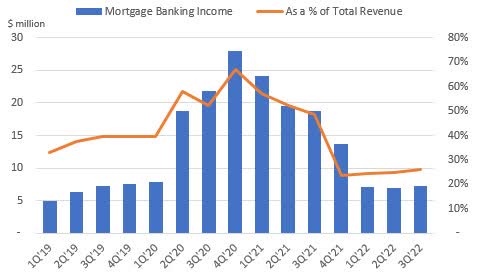

Meridian Corporation’s mortgage banking income remained stable in the third quarter, almost unchanged from the second quarter of 2022 but down 61% from the same period last year. Mortgage banking income makes up a large part of Meridian Corporation’s total revenues; therefore, the health of the housing market is an important factor for the company’s earnings. The Mortgage Bankers Association is expecting a further decline in mortgage refinancing and purchasing activity in 2023.

Mortgage Bankers Association

However, I think Meridian’s mortgage banking business has already bottomed out based on the historical trend. Income from mortgage banking is already contributing less to total revenues than it did before the start of the latest rate-cut cycle in early 2020.

SEC Filings

Therefore, I believe mortgage banking income won’t fall any further. However, total non-interest income will still be lower in 2023 compared to 2022 because the large gain on hedging activity and SBA loan income reported for the first quarter of 2022 will likely not be repeated. Overall, I’m expecting Meridian Bancorp to report a noninterest income of around $41 million for 2023, down 7% from my estimated noninterest income of $44 million for 2022.

Above-Average Provisioning Likely

Meridian Corporation’s provisioning remained below normal for the first nine months of 2022. I don’t think this trend can be maintained for long because of the allowance coverage. Non-accrual loans made up 1.4% of total loans, while allowances made up just 1.18% of total loans at the end of September 2022. In my opinion, this coverage is insufficient, especially in light of the threats of a recession and persistently high inflation. Therefore, I believe Meridian Corporation will need to make above-average provisioning to properly cover the credit risk. Overall, I’m expecting the net provision expense to make up around 0.25% of total loans in 2023, which is above the 2018 to 2019 average of 0.14%.

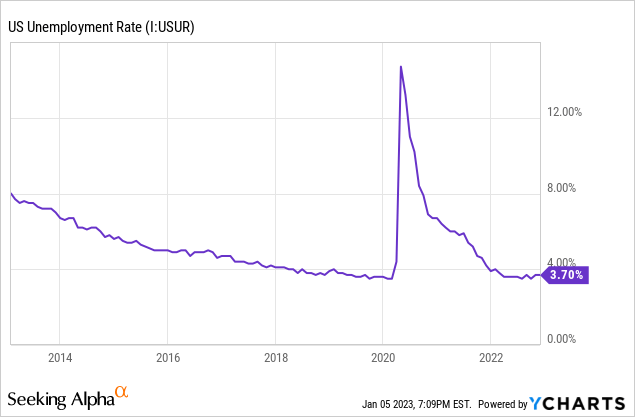

Loan Growth to Drive the Earnings

Meridian Corporation’s loan portfolio continued to grow sharply in the third quarter, rising by 6.1% and taking the first nine months’ growth to 16%, or 22% annualized. I’m expecting loan growth to have started decelerating in the fourth quarter because of high-interest rates. Fortunately, other economic metrics are more conducive to loan growth. Meridian Corporation provides banking services to businesses and customers in Pennsylvania, New Jersey, Delaware, Maryland, and Florida. As the economies of these states vary greatly from each other, the national average is a suitable proxy for Meridian’s local markets. As shown below, the national unemployment rate has remained persistently low throughout 2022.

Considering these factors, I’m expecting the loan portfolio to have grown by 2% in the last quarter of 2022, taking full-year loan growth to 19%. For 2023, I’m expecting the portfolio to grow by 8%. Further, I’m expecting deposits to grow in line with loans. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 830 | 955 | 1,266 | 1,368 | 1,623 | 1,757 |

| Growth of Net Loans | 20.7% | 15.1% | 32.6% | 8.0% | 18.7% | 8.2% |

| Other Earning Assets | 102 | 123 | 360 | 249 | 224 | 228 |

| Deposits | 752 | 851 | 1,241 | 1,446 | 1,707 | 1,848 |

| Borrowings and Sub-Debt | 130 | 168 | 313 | 82 | 64 | 64 |

| Common equity | 110 | 121 | 142 | 165 | 155 | 169 |

| Book Value Per Share ($) | 17.0 | 18.7 | 22.9 | 26.6 | 25.6 | 27.9 |

| Tangible BVPS ($) | 16.3 | 18.0 | 22.2 | 26.0 | 25.0 | 27.2 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Meanwhile, I’m expecting the topline to receive little support from the rising rate environment and its effects on the margin. Due to the combination of the loan and deposit mixes, the net interest margin is barely rate sensitive. The management’s interest-rate simulation model shows that a 200-basis points rate hike could increase the net interest income by only 0.29%, as mentioned in the earnings presentation.

Overall, I’m expecting the margin to remain unchanged from the third quarter’s level through the end of 2023. Based on my loan and margin estimates, I’m expecting the net interest income to increase by around 11% year-over-year in 2023.

Expecting Earnings to Grow by 8%

The anticipated loan growth will most probably be the chief earnings catalyst for this year. On the other hand, above-average provisioning and lower noninterest income will likely drag earnings. Overall, I’m expecting Meridian Corporation to report earnings of $3.74 per share for 2022, down 35% year-over-year. For 2023, I’m expecting earnings to grow by 11% to $4.04 per share. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 33 | 36 | 49 | 63 | 70 | 78 |

| Provision for loan losses | 2 | 1 | 8 | 1 | 3 | 4 |

| Non-interest income | 32 | 33 | 87 | 88 | 44 | 41 |

| Non-interest expense | 53 | 55 | 93 | 104 | 82 | 82 |

| Net income – Common Sh. | 8 | 10 | 26 | 36 | 23 | 24 |

| EPS – Diluted ($) | 1.27 | 1.63 | 4.27 | 5.73 | 3.74 | 4.04 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

My estimates are based on certain macroeconomic assumptions that may not come to fruition. Therefore, actual earnings can differ materially from my estimates.

Adopting a Buy Rating

Meridian Corporation is offering a high dividend yield of 5.9%, including a special dividend of $1.00 per share and a quarterly dividend of $0.20 per share. Excluding the special dividend, the dividend yield is only 2.6% for the year. My earnings and total dividend estimates suggest a payout ratio of 44.6% for 2023, which is easily sustainable. Therefore, I don’t think there is any threat to the special dividend.

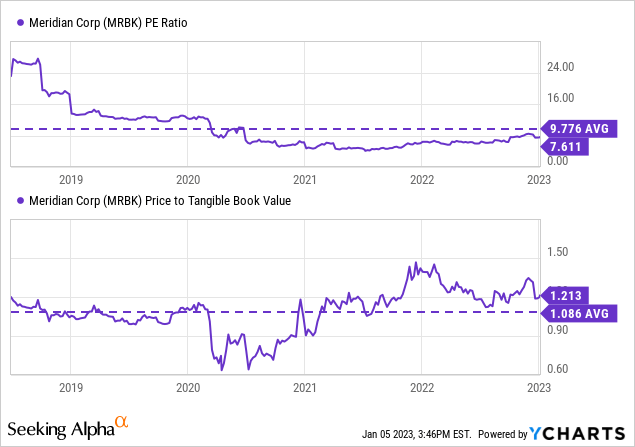

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value CBSH. The stock has traded at an average P/E ratio of 9.78 and a P/TB ratio of 1.09 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $27.2 gives a target price of $29.5 for the end of 2023. This price target implies a 2.6% downside from the January 5 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.89x | 0.99x | 1.09x | 1.19x | 1.29x |

| TBVPS – Dec 2023 ($) | 27.2 | 27.2 | 27.2 | 27.2 | 27.2 |

| Target Price ($) | 24.1 | 26.8 | 29.5 | 32.3 | 35.0 |

| Market Price ($) | 30.3 | 30.3 | 30.3 | 30.3 | 30.3 |

| Upside/(Downside) | (20.5)% | (11.6)% | (2.6)% | 6.4% | 15.3% |

| Source: Author’s Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $4.04 gives a target price of $39.5 for the end of 2023. This price target implies a 30.3% upside from the January 5 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.8x | 8.8x | 9.78x | 10.8x | 11.8x |

| EPS – 2023 ($) | 4.04 | 4.04 | 4.04 | 4.04 | 4.04 |

| Target Price ($) | 31.4 | 35.5 | 39.5 | 43.5 | 47.6 |

| Market Price ($) | 30.3 | 30.3 | 30.3 | 30.3 | 30.3 |

| Upside/(Downside) | 3.6% | 16.9% | 30.3% | 43.6% | 56.9% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $34.5, which implies a 13.8% upside from the current market price. Adding the forward dividend yield gives a total expected return of 19.8%. Hence, I’m adopting a buy rating on Meridian Corporation.

Be the first to comment