andresr/E+ via Getty Images

Investment Thesis

MercadoLibre (NASDAQ:MELI) Q2 results were very strong. But what was particularly impressive about its operations is that its fintech segment now makes up more than half of the business.

I argue that MercadoLibre’s business model has changed significantly this quarter and that this will lead to a change in the narrative around the company.

It will be seen as less exposed to its commerce business which is plagued by heavy competition both online and offline, and the focus will increasingly be on the narrative around its very strong fintech operation.

I believe that paying 86x next year’s earnings is a far multiple. I rate this stock a buy.

Revenue Growth Rates Are Still Strong

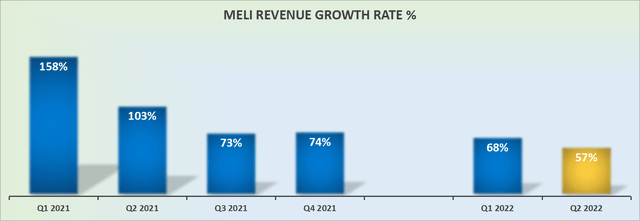

MercadoLibre revenue growth rates, FX neutral

MercadoLibre succeeded in posting a strong increase in FX-neutral revenue growth rates of 57% y/y.

Given that we are more than 2 years since the start of the pandemic, together with a plethora of emerging competition, both online and offline, as well as MercadoLibre coming up against such a tough comparable quarter last year, and even then, for its revenue growth rates to be up 57% y/y, clearly shows that the business is doing something right.

MercadoLibre’s Near-Term Prospects

MercadoLibre has 4 different business lines. The commerce business (Mercado Libre), the logistics business (Mercado Envios), Fintech (Mercado Pago), and credit business (Mercado Credito).

That being said, those 4 businesses come under only two distinct segments:

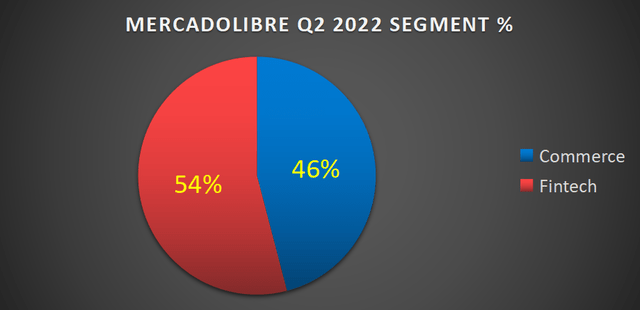

Author’s work

As you can see above, today, MercadoLibre’s fintech business is bigger than its commerce business. And given that the fintech segment grew by 113% y/y, compared with only 23% for its Commerce segment, I believe that a change is underway for MercadoLibre.

I believe that over the next two years, even not significantly sooner, MercadoLibre will see its narrative change away from the perception of it being a commerce player with exciting growth opportunities, to a fintech business with a commerce business attached.

Where the Crown Jewel Lies: Profitability Profile

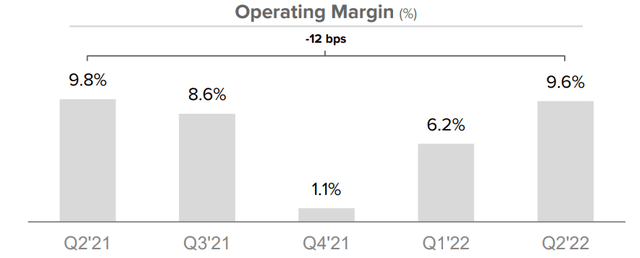

MELI Q2 2022 results

MercadoLibre’s Q2 2022 operating margins were essentially flat with the same period a year ago. Although if one were to ever-so-slightly picky, one could make the case that provision for doubtful accounts on its credit portfolio led the way to its operating margins compressing marginally.

That being said, MercadoLibre, at this stage of its operations, should not be intent on maximizing profitability. However, the fact that not only it can report strong revenue growth rates while being incredibly mindful of its bottom line profitability is what sets MercadoLibre apart from countless other US-based e-commerce and fintech business models.

MELI Stock Valuation – Priced at 86x Next Year’s EPS

For Q1 2022, diluted EPS was $1.30, while for Q2 2022, it was $2.43. Looking ahead, if analysts are vaguely correct, this would imply that the second half of 2022 would see diluted EPS of $1.93 for Q3 and $1.75 for Q4.

Now, given that Q3 already saw MercadoLibre’s EPS numbers substantially above $2.00, I believe that analysts are likely in the coming days to upwards revise their financial models, and get MercadoLibre’s EPS estimate closer to $2.00 per quarter.

Consequently, I don’t believe my estimate would be overly aggressive to assume that MercadoLibre’s diluted 2022 EPS could reach $7.73.

Furthermore, given that we are coming close to wrapping up 2022, it becomes more useful to estimate what 2023 will look like.

Presently, MercadoLibre’s bottom line EPS comparisons with the previous year are nothing short of impressive, with an increase of 77.4% versus the same period a year ago.

However, if we assume that next year’s EPS figures moderate to approximately a 50% increase y/y, this would put next year’s EPS figure at $11.60.

This would put MercadoLibre trading at 86x forward earnings. Needless to say that this is not a bargain basement valuation, even now with the stock down approximately 50% from previous highs.

That being said, this valuation is far from shocking. In particular when compared with what investors are being forced to pay for US-based pure-play e-commerce opportunities that are reporting minimal growth.

To illustrate, Amazon (AMZN) is not a pure-play e-commerce business, since a disproportionate amount of its profitability is derived from AWS, advertising, and Prime, but it is one data point to aid our analysis.

Amazon is being priced at 58x next year’s EPS, which is admittedly a substantial discount to the 86x EPS that investors are paying for MercadoLibre. However, I believe that MercadoLibre’s high growth trajectory still has a much longer runway than what Amazon has in front.

The Bottom Line

So far through this earnings season, there has been a very mixed bag of positive and negative results. For the most part, earnings have delighted investors, with countless stocks jumping strong.

In fact, the case could be made that particularly ”junkie”, highly shorted stocks, have seen short squeezes on the back of earnings results.

The one area that has not performed well this earnings season has been ad-related companies.

However, I believe that MercadoLibre’s after-hours reaction is indeed entirely justified given that the business is not only unquestionably still reporting strong growth, but it’s doing so while being mindful of its bottom line profitability.

Therefore, I rate this stock a buy.

Be the first to comment