JHVEPhoto/iStock Editorial via Getty Images

Medtronic (NYSE:MDT) is one of the largest medical technology and device companies. Medtronic serves the healthcare industry, physicians, clinicians, and patients in more than 150 countries, and they are committed to a mission “to alleviate pain, restore health, and extend life.” Medtronic has been doing an excellent job at expanding their market share by developing a strong pipeline and accelerating biomedical innovation. They have leadership positions in many biomedical devices in the fields of cardiovascular, neuroscience, medical surgical, and diabetes. Medtronic has been an outstanding investment for several decades, and their solid business model generates strong and steady cash flow, which has helped them become a Dividend Aristocrat. Given their business strength, I expect that to be the case for years to come. I believe Medtronic is a great investment option, especially in these volatile times, because:

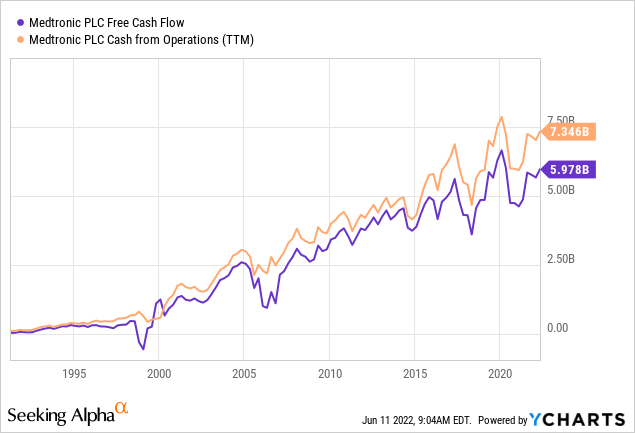

- Medtronic has been the epitome of a stable and shareholder friendly company. They generated more than $4 B operating cash flow in each of the past 10 years, and have raised their dividend for 45 consecutive years.

- They are the largest medical device company in the world, and they hold leadership positions in many fields with a strong economic moat.

- The current supply challenge presents a short-term risk, which will alleviate with time. Revenue growth will follow naturally.

Stable Operation All Around

Medtronic is an example of a stable company that makes money during both good and bad economic cycles. Medtronic sells devices that are essential to medical professionals’ and patients’ lives (e.g., cardiovascular device, insulin pump, glucose monitoring, etc.), so revenue and profits are minimally impacted by economic cycles. In the past decade, Medtronic generated at least $4.5 B of operating cash flow each year, and operating cash flow has never dipped below zero for several decades at this point.

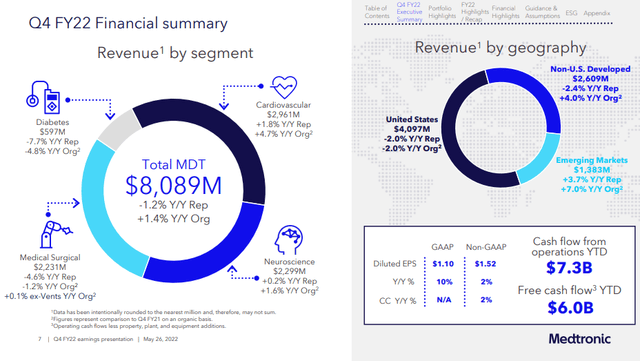

Looking at Q4 Fiscal Year (FY) 2022, they are well on the way to continuing this path of stable growth. All four main segments (Cardiovascular, Diabetes, Medical Surgical, and Neuroscience) performed well. Diabetes segment did experience a 7.7% YoY decline in revenue, as they are waiting to obtain approvals for the MiniMed 780G and the Guardian 4 sensor in the US. Medtronic is in active dialogue with the FDA, so I’m fully expecting them to ultimately obtain approval. They shared MiniMed 780G and Guardian 4 sensor data at Advanced Technologies & Treatment for Diabetes [ATTD], and the results were very well received. Overall, I expect the company to meet management’s FY 23 guidance of 4%-5% revenue growth.

Financial Performance 4Q 2022 (Medtronic Investor Relations)

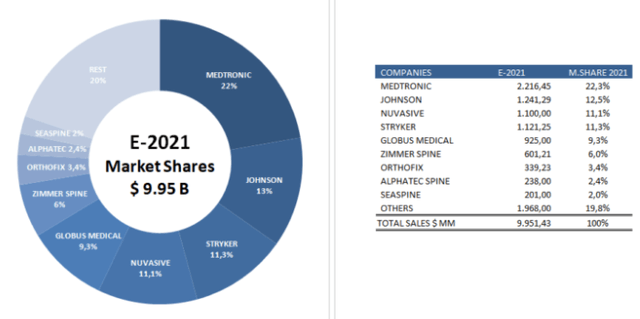

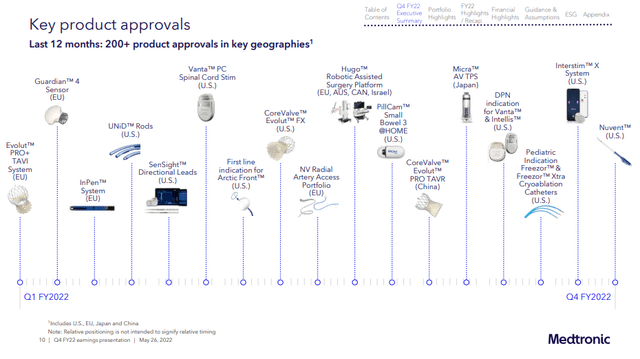

Strong Economic Moat And Outstanding Pipeline

Medtronic holds a very strong economic moat with technological superiority, patent protection, and high switching costs. Medtronic is known for technologically advanced and high quality products, and their products hold leadership positions in many different fields. Those fields include cardiac rhythm management, interventional cardiology, spine, and neurology. Given their consistent focus on R&D ($2.7 B R&D expense in the past year) and strong pipeline (200+ product approvals in the last 12 month), I expect them to maintain leadership in these areas.

Medical Device for Spine in 2021 (Spine Market Group)

Medtronic Products Approvals (Medtronic Investor Relations)

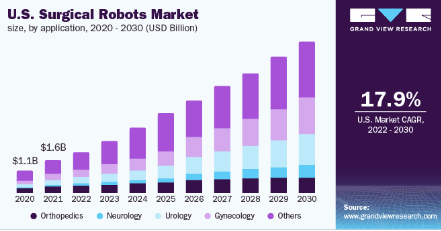

There are several areas that are particularly exciting in my opinion. Medtronic is building momentum in the surgical robotics space. They introduced the Hugo RAS system, which has now been installed in multiple sites across Europe. Also, they are preparing additional clinical trials and system installation in the U.S. The market for surgical robotics is expected to grow rapidly in the future (17.9% CAGR), so the successful launch of products in this field should bring nice growth to Medtronic.

U.S. Surgical Robots Market (Grand View Research)

Supply Chain And Elective Procedures

There have been two main headwinds for Medtronic during this pandemic era. One is the supply chain issue. The lockdowns in China are causing tight supplies of raw materials and parts, and this put downward pressure on their revenue and profit. To mitigate the issue, they have restructured their organization to consolidate operations and improve efficiency, which I expect will have a positive impact. Also, the easing of Chinese lockdowns will help as well.

The other major headwind was related to elective procedures being postponed. During the pandemic, as hospitals were dealing with labor and capacity shortage, they cut non-critical surgeries. This reduction in elective procedures negatively impacted Medtronic’s revenue. However, as we leave the pandemic behind us, the number of non-critical surgeries should pick up and give Medtronic a revenue boost.

Intrinsic Value Estimation

I used a DCF model to estimate the intrinsic value of Medtronic. For the estimation, I utilized EBITDA ($9.6 B) and current WACC of 7.0% as the discount rate. For the base case, I assumed EBITDA growth of 3% (a touch lower than the past 5-year average) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish cases, I assumed EBITDA growth of 4% and 5%, respectively, for the next 5 years and zero growth afterwards.

The estimation revealed that the current stock price represents 10-15% upside. Given their strong economic moat and impressive pipeline, I expect them to achieve this upside.

|

Price Target |

Upside |

|

|

Base Case |

$99.42 |

7% |

|

Bullish Case |

$103.53 |

12% |

|

Very Bullish Case |

$107.78 |

16% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 7.0%

- EBITDA Growth Rate: 3% (Base Case), 4% (Bullish Case), 5% (Very Bullish Case)

- Current EBITDA : $9.6 B

- Current Stock Price: $92.74 (06/10/2022)

- Tax rate: 20%

Cappuccino Stock Rating

| Weighting | MDT | |

| Economic Moat Strength | 30% | 5 |

| Financial Strength | 30% | 4 |

| Growth Rate vs. Sector | 15% | 2 |

| Margin of Safety | 15% | 4 |

| Sector Outlook | 10% | 4 |

| Overall | 4.0 |

Economic Moat Strength (5/5)

Medtronic has a very strong economic moat. Their technological superiority, patent protections, and brand recognition provide a substantial competitive advantage over competitors. Medtronic’s strong leadership positions in neuroscience and cardiovascular won’t go away anytime soon.

Financial Strength (4/5)

Medtronic has a good balance sheet with adequate liquidity. They have total cash and short-term investments of $10.6 B with a current ratio of 1.86x and quick ratio of 1.30x. With their strong business model, they have been generating tons of operating cash flow ($7.4 B in the past twelve month), and I expect that will be the case in the future.

Growth Rate (2/5)

Medtronic has been growing steadily, but not at a great pace. Given their size (the largest medical device company), organic growth probably has reached its limit, and additional rapid growth can probably only be achieved through an acquisition or new product line. One of the main reasons that I’m excited about Medtronic entering robotic surgery is the fact that it has potential to be a lucrative growth engine.

Margin of Safety (4/5)

Based on the intrinsic value calculation, Medtronic is currently being traded 10-15% below its intrinsic value. Also, the dividend yield of 2.9% is a great bonus. During the current volatile market, Medtronic stock with a long track record of success is a safe option.

Sector Outlook (4/5)

Healthcare and biomedical device sector will continue to grow in the future. As Medtronic is spread across multiple sub-segments (cardiovascular, neuroscience, diabetes, etc.), it’s hard to have coordinated 10-20% sector wide growth. Some sectors will growth quickly, while others lag. But this structure does bring stability, which is a great thing in a volatile market.

Risk

Even though Medtronic management is doing a great job at working through the supply chain issues, and China’s reopening should help, there is no clear timeline. For as long as the problem continues, it will put downward pressure on revenue growth and contract company margins. Note that Medtronic also spent a (non-trivial) $200+ M in 2021 to restructure the business. Management claims that this will alleviate supply chain problems, but investors should monitor the outcome of these efforts.

Medtronic operates in a tightly regulated industry, and the government approval process for their products can be unpredictable and costly. The robotic surgery device (Hugo) and a couple of diabetes products (MiniMed 780G and the Guardian 4 sensor) are waiting for approval from the FDA. A delay in the approval process would have a negative impact on revenue growth.

Conclusion

Medtronic has been a great investment option for dividend growth investors for several decades. In both good and bad economies, Medtronic generates solid profit and operating cash flow. Given their leadership position and solid pipeline, I expect this to be the case for a long time. Supply chain issues and the government approval process present ongoing challenges, but I expect them to overcome these hurdles. Overall, I see 10-15% upside with 3% dividend.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment