Nattakorn Maneerat

Thesis

Medical Properties Trust, Inc. (NYSE:MPW) management took great pains in its recent FQ3 earnings call to address the uncertainty surrounding Pipeline, Prospect, and Steward.

Management’s emphasis and assurance was undoubtedly welcome after MPW fell to a low last seen in early 2016, as discussed in our previous update.

We highlighted why we urged investors not to get caught up in the panic-selling maneuver that the market forced on holders. Notwithstanding, the dynamics surrounding MPW’s tenant base remain fluid, given the challenging macroeconomic environment driving up wages coupled with significant labor shortages.

However, we believe the battering in the market has likely reflected substantial challenges in its performance. Accordingly, MPW has recovered nearly 15% since we last updated, outperforming the broad market.

However, MPW remains significantly discounted against its broad REIT peers, as it last traded at an NTM AFFO per share multiple of 8.9x, well below its peers’ median of 12.7x (according to S&P Cap IQ data).

While we don’t expect a material re-rating to MPW’s 10Y mean of 12.8x in the near term, we believe its shares remain attractively valued, and the reward/risk is skewed to the upside at these levels.

Notwithstanding, given its recovery, we discuss why we think a pullback seems likely. Therefore, investors looking to add exposure can consider layering in to capitalize on potential downside volatility if the market decides to digest its recent sharp recovery.

Maintain Buy.

Management Raised Its FQ4 NFFO Guidance

CEO Ed Aldag & team probably knew the most impactful method of assurance that management remains in control of is the dynamic to raise guidance, in my view.

MPW narrowed the guidance range of its FY22 normalized FFO (NFFO) from its previous outlook. Therefore, it implies a NFFO per share outlook of $1.81 (midpoint) for FY22, up slightly from its prior guidance of $1.80 (midpoint).

We believe that demonstrated management’s confidence in the improving economics of its tenants. Accordingly, MPW also highlighted that it expected its rental coverage to improve further moving forward, as it laps challenging TTM comps due to COVID grants previously. CEO Ed Aldag accentuated:

We continue to see the impact of the COVID grant monies rolling off the trailing 12-month period. However, we are seeing positive increases in quarter-over-quarter coverages. This is being bolstered by increased volumes and decreases in contract labor and overall salary, wages, and benefits. We are almost at the point where no COVID grants will be included in the trailing 12 months. (MPW FQ3’22 earnings call)

Accordingly, MPW’s EBITDARM rent coverage has fallen to 2.2x on a TTM basis in FQ2’22, down from 2.5x in FQ1’22. Management was confident investors could expect higher coverage moving forward, bolstered by its embedded rent escalators. Accordingly, MPW telegraphed that “forecasted escalations in [MPW’s] CPI-linked leases point to overall cash rent growth in the four to five percent range for [2023].”

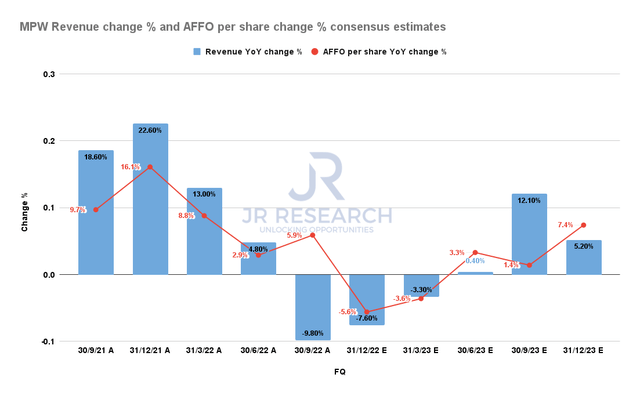

MPW Revenue change % and AFFO per share change % consensus estimates (S&P Cap IQ)

Therefore, we are confident that the revised consensus estimates have reflected significant pessimism in its operating metrics through FY23.

As seen above, MPW is not expected to see material growth in its revenue and AFFO per share until Q3’23. However, it’s critical for investors to note that the market is a forward-discounting mechanism.

And it’s also vital to consider whether investors think the worst in MPW’s operating performance may already have occurred in Q2/Q3FY22.

Based on management’s commentary and raised guidance, we are optimistic.

Coupled with the significant battering in MPW’s valuations, we believe the potential for a subsequent re-rating is attractive at these levels.

Is MPW Stock A Buy, Sell, Or Hold?

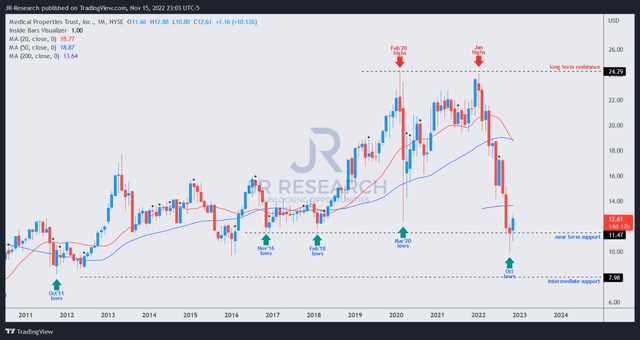

MPW price chart (weekly) (TradingView)

As seen in MPW’s long-term chart, the market forced an astute bear trap against panic sellers in October before reversing into a validated bullish reversal. As we highlighted in our previous article, the selloff was pivotal as the market forced a re-test of its critical support level that undergirded important swing-lows dating all the way back to November 2016.

Hence, a validated bullish reversal against its critical support zone demonstrated the robustness of the bear trap, as it forced weak holders to flee at the worst possible moments.

The buying momentum in November has also been constructive as MPW attempts to emerge strongly from its calamity.

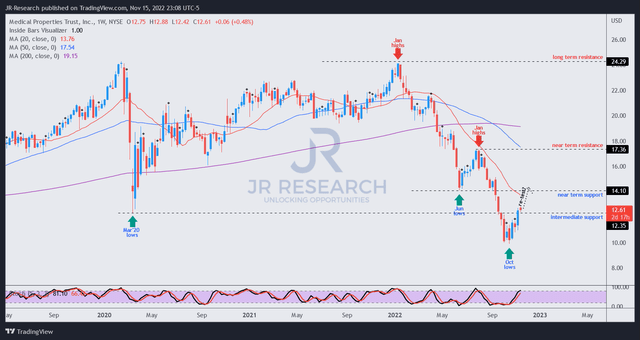

MPW price chart (weekly) (TradingView)

Notwithstanding, we believe it’s important for MPW holders not to get overly excited with the reversal over the past month.

MPW has already lost its medium-term uptrend, particularly its 200-week moving average (purple line), a vital defense line to sustain its upward bias.

Hence, we expect the mean-reversion rally to face a re-test against sellers’ conviction at its previous “near-term support” annotated above. That level could cause downside volatility, as buyers who picked October lows could also be looking to unload some exposure at those levels. Furthermore, MPW’s momentum indicator is also overbought at the current levels on its medium-term chart. However, a pullback is healthy as long as it does not break below its October lows decisively.

We encourage investors to use potential downside volatility to add more to positions moving ahead. We believe a material re-rating could be in store if MPW could demonstrate its strong execution track record.

Maintain Buy.

Be the first to comment