phototechno/E+ via Getty Images

This article was originally published on June 1st, 2022 to members of the CEF/ETF Income Laboratory. The market has been extremely volatile, check all the latest data before making any investing decisions.

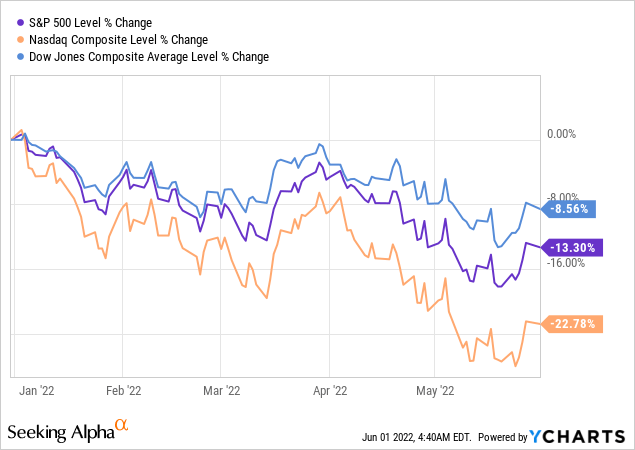

During May, I was a busy investor, putting a lot of my cash to work as we hit new lows for the year. The S&P 500 briefly joined the Nasdaq in bear territory. The Nasdaq has been in bear territory for much longer and has gone well over the 20% technical bear market level.

We received some relief over the last week of trading for the month as the indexes shot higher. The last trading day of the month was certainly a volatile one on its own – going between gains and losses throughout the day. The Dow Jones Industrial Average, full of its old stodgy, mostly boring names, has been holding on much better.

Ycharts

Bear markets aren’t pleasant to go through, but they are a normal market experience. Every bear market is different too, but given history, we know that eventually, the market reaches new highs. For a longer-term investor, these generally open up opportunities for us to put capital to work.

I never know when or where the bottom will be, so I utilize a fairly arbitrary gauge of how I put my capital to work. When we are hitting new highs, I tend to hold onto the cash or invest in cash-like ETFs. I usually allow my cash position to go anywhere from 10 to 12%. Over that, and whether there is a great deal or not, I’m putting the cash to work.

When we go lower, I usually start being more aggressive with purchases at the 5% decline level. In other words, when the market has a “dip.” After that comes the “correction,” marked by a 10% decline from the prior highs. When this happens, I become even more aggressive with buying and will whittle my cash position down.

Once we hit the bear market of a 20% decline, that’s when I start putting all my cash to work. I still have some cash for writing cash-secured puts, but otherwise, any new capital coming in from dividends or outside sources is being put to work immediately.

Since we were getting close to that 20% correction on the “market,” which I would put as the S&P 500 Index, I was very busy and aggressive with purchasing. There were multiple positions that I bought multiple times throughout the month.

This month, there was no common theme besides “things are cheap, I want to start buying everything that’s on sale.”

Cohen & Steers Quality Income Realty Fund (RQI)

I initiated the kick-off to my buying spree picking up this name first. I then followed this initial purchase up only just over a week later. I had also picked up more shares here back in February too. This is the largest exposure that I have to any position, CEF, ETF or individual stock. As this position remains attractively valued, it remains a candidate for considering to add further too. This is another fund that I regularly cover, which is the case with many of these names that I bought over the last month.

Eaton Vance Tax-Advantaged Global Dividend Fund (ETG)

This was one of those double buys too. I purchased rather early in the month and then followed it up with further purchases later in the month. I had highlighted this second purchase briefly in the month because it came from closing out my Kayne Anderson NextGen Energy & Infrastructure Inc (KMF) position.

I regularly cover this fund, and there isn’t much to say here. Equities are down, and this fund holds mostly equities. The discount has widened on this name, making it an even better opportunity. I’ve held this name for years. Besides adding to this position in February of this year, I hadn’t picked up some shares in a while. It was time to up my position, and I feel this is the best market to be buying – when it is down and discounted.

Invesco Senior Income Trust (VVR)

This is one of my plays at the higher rates. As I’ve mentioned previously, I don’t drastically change my portfolio to anticipate what could happen next. However, I will take small bets here and there to participate in such events. VVR being a senior loan fund, is packed full of floating-rate securities. As interest rates head higher, so too should this fund’s income.

The caveat here is that it is a highly leveraged fund through both borrowings and variable-rate preferred shares. Both of these liabilities will see their interest expenses rise. That will slow down some of the benefits of higher rates. On top of this, there will still be the floor that rates need to go through before we see higher income. That being said, in anticipation of these higher rates to come and start working into the system, the VVR managers have boosted their distribution already.

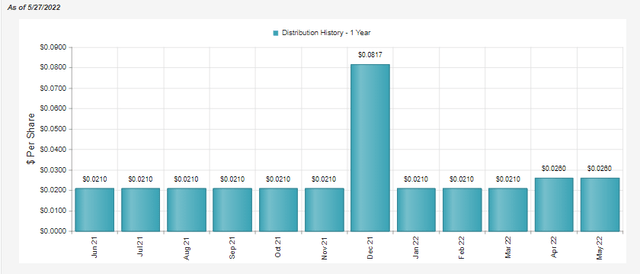

VVR Distribution (CEFConnect)

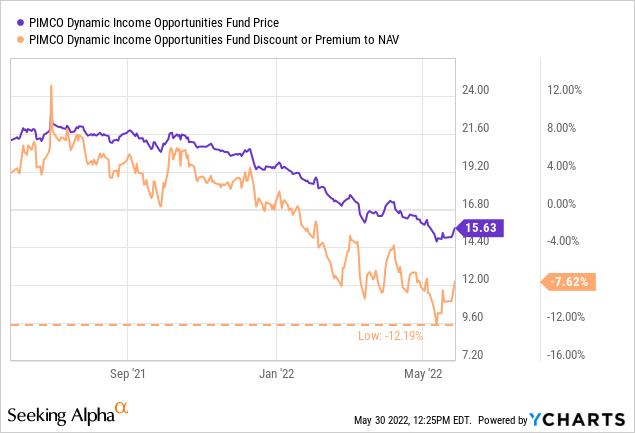

PIMCO Dynamic Income Opportunities Fund (PDO)

This was another doubler, adding to my position twice within the last month. PIMCO is one of the highest regarded fixed-income managers. This is one of their cheapest funds. It all seemed like a great idea to me.

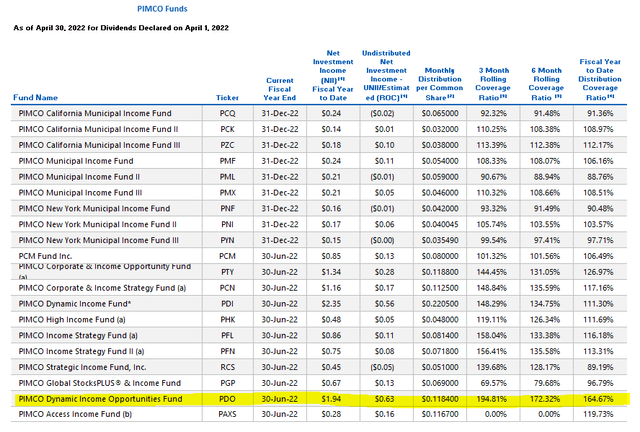

Ycharts

One of the cautions is that it is still a relatively new fund, which seems to make investors nervous. The coverage of their distribution remains incredibly high, which gives me the confidence to continue to add. I’m not too concerned with the price except in regards to where it lands relative to its NAV per share.

PIMCO April UNII Report (PIMCO)

Calamos Strategic Total Return Fund (CSQ)

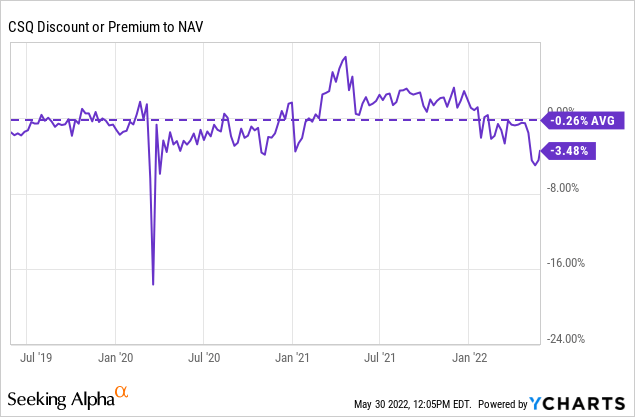

This was a similar situation to ETG. They hold mostly equities but also a significant allocation to convertible securities. The convertible securities will participate with the potential upside of equity markets but also have the floor due to the par value, the same as a bond.

This fund doesn’t go to a discount often in the last several years, so as it did, I was a buyer. Before the last few years, it was at a regular discount. That means there is always a risk for more downside here. It isn’t an overly large position in my portfolio, so I continue to have room to average down should we see new lows.

Ycharts

BlackRock Science & Technology (BSTZ)

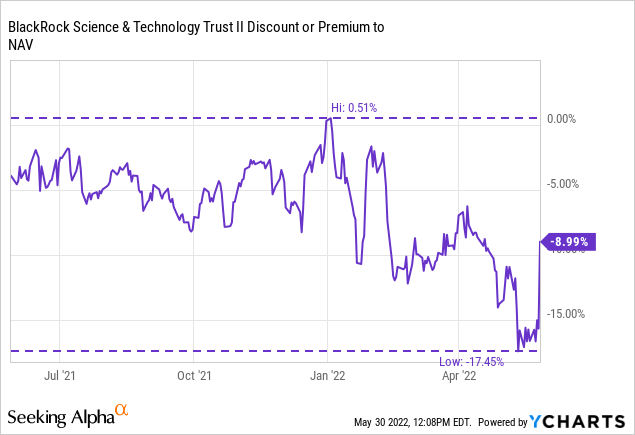

How the mighty have fallen. This position was the largest position in my portfolio for a considerable amount of time. The fund kept on going higher and higher throughout 2020 and through the first half of 2021. However, the tech plunge has brought this fund down significantly. So much so that we now have to consider that there is a real possibility of a distribution cut.

That being said, the fund has been significantly punished. I picked up this name as it broke around the 17% discount level.

Ycharts

Could it drop further with tech? It absolutely could, but it has declined so far that I was comfortable topping the position back up. It still isn’t back to number one in my portfolio but continues to sit up there at number three. This is certainly a long-term position that is rather risky. Definitely not a position for everyone.

Eagle Point Credit Company (ECC)

Here’s a fund I don’t add to very often but had taken the opportunity to in the past month. This is one of the equity CLO funds. It is quite a volatile name but should also do well in a rising rate environment. One of the differences here relative to other CEFs is that the leverage is through baby bonds and preferred at fixed rates.

Several of these are traded on exchanges that might interest some readers. Examples would be the Eagle Point Credit Company 6.75% Preferred (ECC.PD) and Eagle Point Capital 6.6875% Notes (ECCX). Going forward, they have less of a headwind with interest expenses rising. It can set them up better to participate in higher rates with less to worry about.

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (ETW)

I have recently provided an update for this fund. The focus here is that it has an equity tilt. At this time, there seem to be greater geopolitical risks for the fund as Europe deals with Russia’s war on Ukraine. That being said, international positions are relatively cheaper than U.S. investments. Adding to that the fund’s discount, you have a fairly attractive investment that continues to pay investors month after month.

BlackRock Floating Rate Income Trust (FRA)

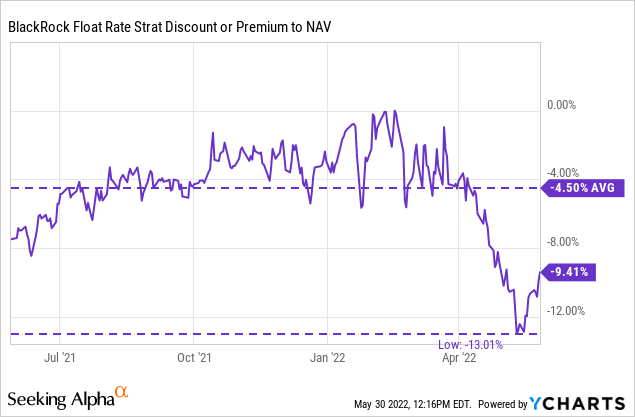

Here is another play on the higher interest rate environment, similar to VVR. This portfolio is almost entirely exposed to floating-rate securities. I’ve regularly covered this fund in the past, and it was time to take a nibble. Like so many other funds, the discount widened substantially, creating an incredible opportunity.

Ycharts

One of the main risks about these floating-rate exposed funds is that they are often junk-rated companies. That leaves them more exposed to credit risk rather than interest rate risk. If the Fed raises rates too aggressively, that could easily put us into a recession. Which some economists are expecting to happen over the next year or two.

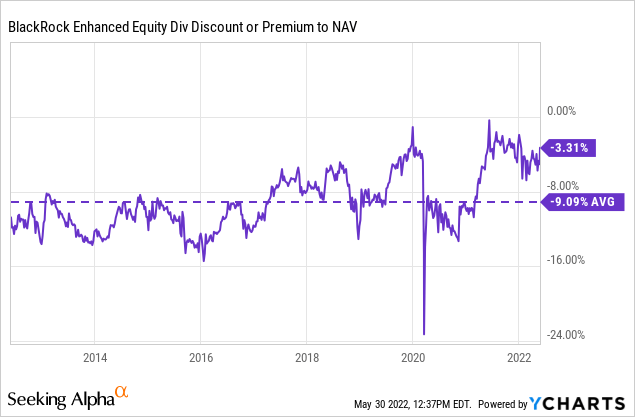

BlackRock Enhanced Equity Dividend Trust (BDJ)

Here was another position that I had picked up due to the closing of my KMF position. BDJ has been a long-time position in my portfolio. The fund doesn’t get much coverage, and there is definitely pushback from other investors who scorn it for its weaker relative performance to the “market.”

However, that’s what I enjoy about it. It isn’t the “market.” In fact, its largest allocation is to financials, followed by healthcare. It then employs a covered call option writing strategy over its portfolio. It’s been a steady performer and has held up fairly well this year. We even received a distribution boost starting in March of this year.

This fund has long traded at a discount. Although some of that discount has disappeared through 2021 and even 2022, it hasn’t been as deep. Perhaps a shift towards its heavier allocation to value-oriented sectors is getting investors interested. For me, it’s the second-largest position in my CEF portfolio.

Ycharts

John Hancock Tax-Advantaged Dividend Income Fund (HTD)

This was the third position that I picked up due to closing out KMF. This fund sits as the largest weighting in my CEF portfolio. However, it is still a smaller exposure than I have to RQI. I hold RQI in two different accounts, which brings it to the single greatest weighting of my invested capital.

HTD would be a fairly steady fund with a utility and preferred stock approach. However, the higher leverage on the fund is something to consider before investing. It makes it a much more volatile position than it otherwise would be.

Cohen & Steers Infrastructure Income Fund (UTF)

I rounded out the month by adding to my UTF position. (Which was on the same day I added to PDO through the second batch of shares.) This was a long-term position for me that I had sold off in 2021. The valuation was just too elevated, and it was time to take the profits. Now that 2022 has been so volatile, it presented the opportunity to add it back to my holdings earlier this year.

This latest purchase was to up the position to a heavier weighting in my portfolio. It had previously been a top ten, and I’m comfortable with it being in such a position. It now comes in at number nine. It just so happened that I was also able to lower my cost basis just a touch while it continues to flirt with a discount.

Be the first to comment