We Are/DigitalVision via Getty Images

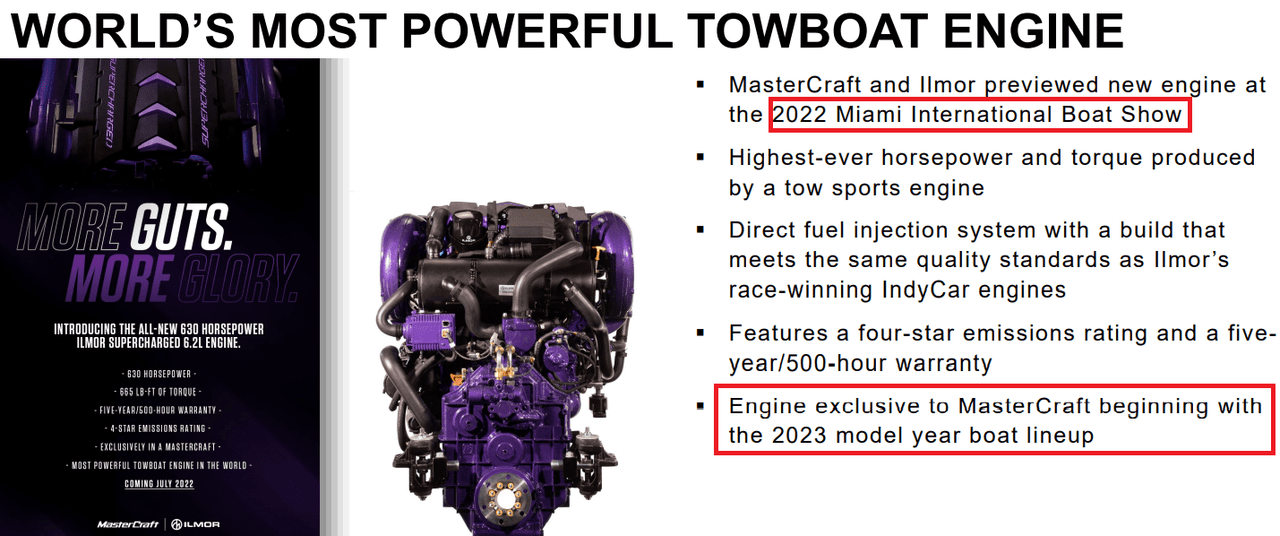

MasterCraft (NASDAQ:MCFT) announced a new 630 horsepower engine to be included in its boats from 2023. The company also increased its employees focusing on product development and increased its capacity. Even considering risks from recession and inflation, in my view, the company appears undervalued. New innovative features and better relationships with dealers will likely enhance revenue generation, which may push the stock price up.

MasterCraft

Incorporated in Delaware and founded in 1968, MasterCraft is a designer, manufacturer, and marketer of recreational power boats sold under four brands.

Q3 2022 Presentation

Among the recent developments coming in 2022 and 2023, I would highlight the introduction of a new 630 horsepower Ilmor Supercharged 6.2 litres engine, exclusive to MasterCraft. In my opinion, when MasterCraft starts to include the new engine in the 2023 boat lineup, demand for the boats may increase.

Q3 2022 Presentation

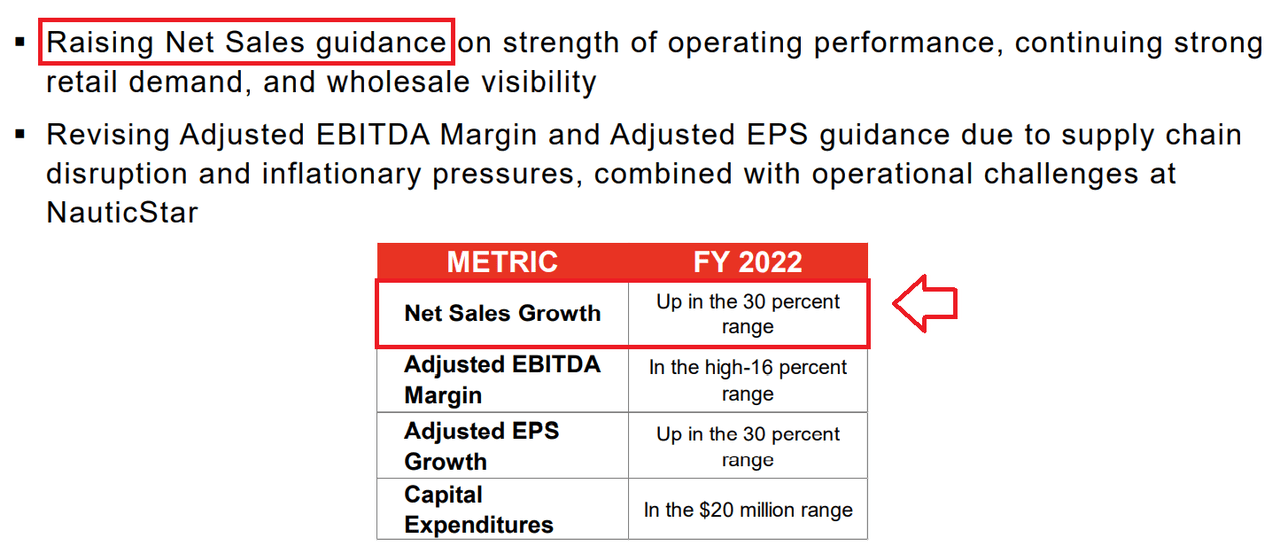

Even for those investors that are not boat lovers, MasterCraft is an interesting business model. Considering the fact that net sales guidance increased in the most recent quarterly report, I decided to run several DCF models. Let’s note that MasterCraft increased its adjusted EBITDA margin and adjusted EPS growth guidance.

Q3 2022 Presentation

With Good Relationships With Dealers And More Capacity, MasterCraft Could Be Worth $36.5 Per Share

MasterCraft offers technology, sales training, and a dealer incentive program to MasterCraft’s network of dealers. In my view, the relationship with dealers is the most delicate part of MasterCraft’s business model. If management increases the number of dealers, the target market may increase, which would lead to revenue growth.

We provide our dealers with comprehensive sales training and a complete set of technology-based tools designed to help dealers maximize performance. Our dealer incentive program has been refined through years of experience with some of the key elements including wholesale rebates, retail rebates and promotions, other allowances, and floor plan reimbursement or cash discounts to encourage balanced production throughout the year. Source: 10-k

If MasterCraft continues to design products for larger consumer groups, like MasterCraft NXT, the target market will likely increase. As a result, I believe that clients may be interested in the products, and revenue would trend north. I am optimistic about this strategy, which was discussed in the most recent annual report:

We have strategically designed and priced the MasterCraft NXT models to target the fast-growing entry-level consumer group that is distinct from our traditional consumer base, while maintaining our core MasterCraft brand attributes at profit margins comparable to our other offerings. Source: 10-k

Finally, after the acquisition of a boat manufacturing facility in Merritt Island, I expect more products and more production. In my view, if MasterCraft continues to increase its capacity, more dealers may be interested in the products. As a result, revenue expectations may increase, which would lead to a larger market capitalization:

In October 2020, we purchased a 140,000-square-foot boat manufacturing facility in Merritt Island, Florida. Aviara boats were manufactured in our Vonore, Tennessee facility until the third quarter of fiscal 2021 and are now manufactured solely at our Merritt Island, Florida facility. Source: 10-k

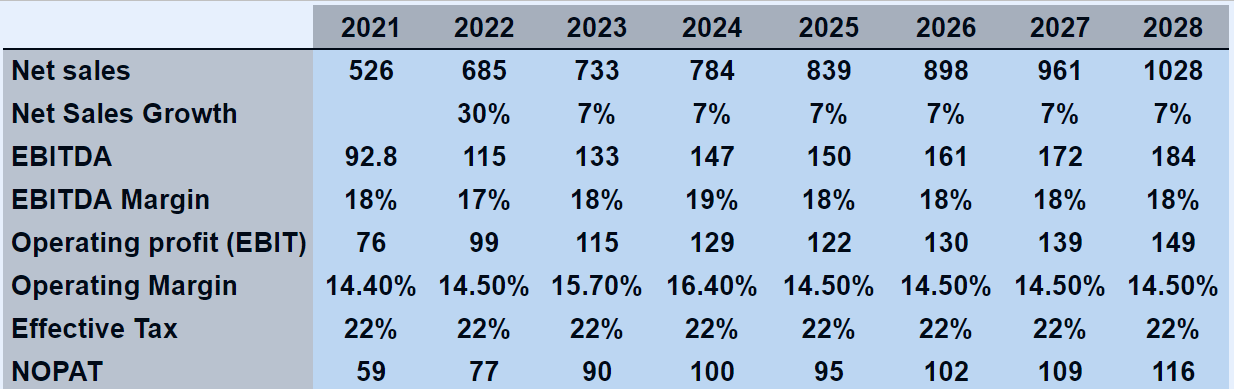

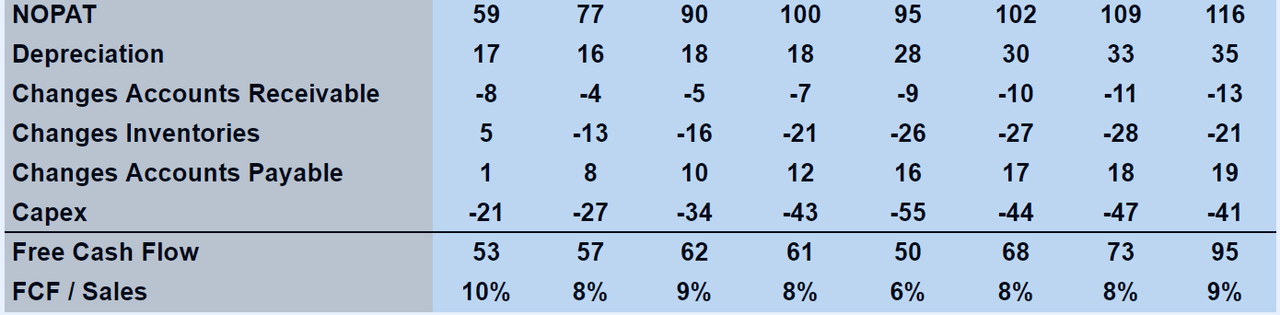

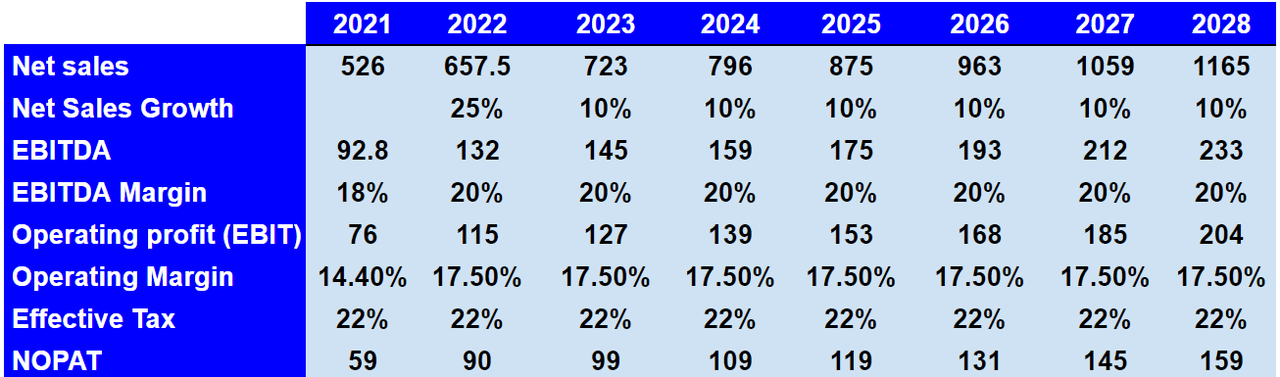

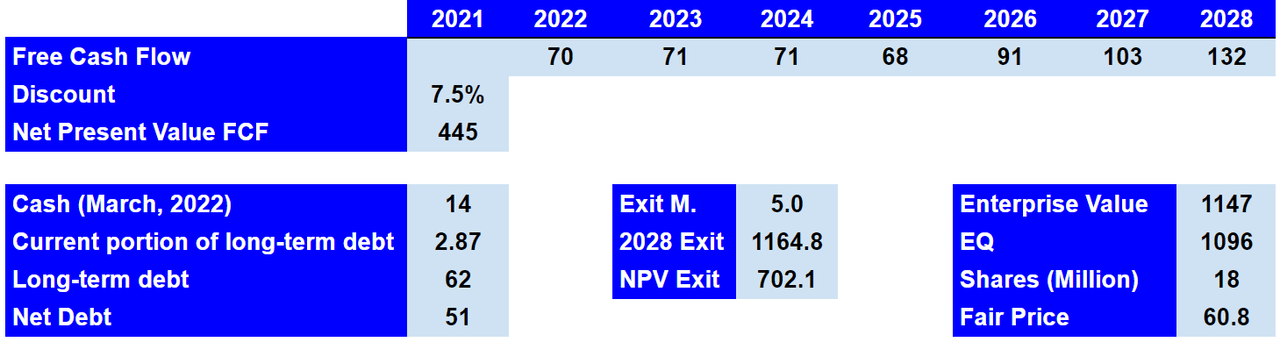

Under this scenario I used 30% sales growth in 2022 and 7% from 2023 to 2028, EBITDA margin of 19%-17%, and operating margin around 14.40%. The results include a 2028 NOPAT of $116 million.

Arie Investment Management

With D&A around $17-$35 million, changes in inventories around -$5 million to $21 million, and capital expenditures of $21-$41, 2028 FCF would stand at $94-$95 million.

Arie Investment Management

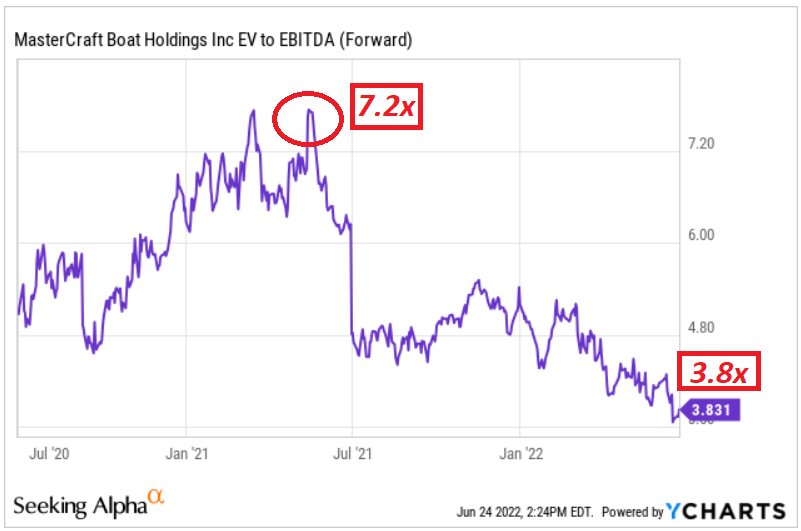

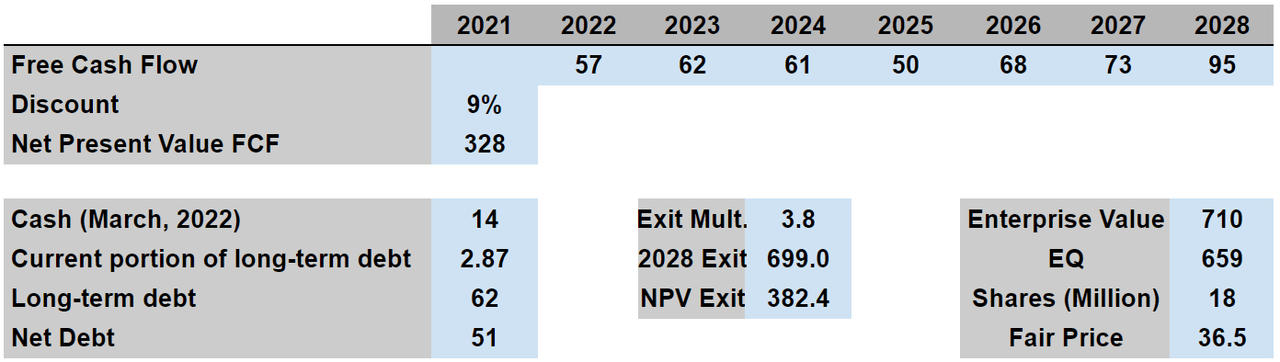

With a discount of 9% and free cash flow ranging from $53 million to $95 million, the net present value would stand at $328 million. Besides, I remained very conservative by using the exit multiple of 3.8x. Let’s keep in mind that MasterCraft traded at 7.2x in 2021.

YCharts

My results include an enterprise value of $710 million, equity of $659 million, and a fair price of $36.5 per share. Considering MasterCraft’s current valuation, under this case scenario, the company appears undervalued.

Arie Investment Management

Recession, Wage Inflation, Aluminium Inflation, And Problems With Suppliers Could Push The Stock Price Down To $10

MasterCraft noted very clearly that a recession could lead to a significant decrease in revenue growth. Keep in mind that customers may decide to expend less money on boats, which are non-essential items:

In times of economic uncertainty or recession, consumers tend to have less discretionary income and to defer significant spending on non-essential items, which may adversely affect our financial performance. We continue to develop our portfolio of brands, but our business remains cyclical and sensitive to consumer spending on new boats. Source: 10-k

Increases in the price of fibreglass, aluminium, lumber, and steel could also bring the company’s free cash flow down. Besides, increase in wages in other industries could also pressure MasterCraft to increase their salaries. In the worst-case scenario, management may not be able to increase the price of their boats, which would lead to a decrease in the EBITDA margin. As a result, MasterCraft’s stock valuation would decrease.

The market prices of certain materials and components used in manufacturing our products, especially resins that are made with hydrocarbon feedstocks, fiberglass, aluminum, lumber, and steel, can be volatile. While, historically, inflation has not had a material effect on our results of operations, significant increases in inflation, particularly those related to wages and increases in the cost of raw materials, recently have, and may continue to have, an adverse impact on our business, financial condition, and results of operations. Source: 10-k

If there is a wage increase in the industry, MasterCraft may suffer from skilled labor shortages. This case scenario could be among the worst things that may happen to MasterCraft. As a result, the company may produce less, which would lead to a decrease in revenues and loss of reputation.

We may not be able to recruit or maintain sufficient skilled labor or our suppliers may not be able to deliver sufficient quantities of parts and components for us to match production with rapid changes in forecasted demand. Source: 10-k

Finally, MasterCraft would suffer substantially if the network of independent dealers does not report revenue. Let’s keep in mind that the company has sales thanks to the marketing and efforts of independent dealers. I don’t really see why management does not run many more its own shops:

For fiscal 2021, the Company’s top ten dealers accounted for approximately 30% of our net sales and none of our dealers individually accounted for more than 6% of our total net sales.

Substantially all of our sales are derived from our network of independent dealers. Maintaining a reliable network of dealers is essential to our success. Our agreements with dealers in our networks typically provide for one-year terms, although some agreements have longer terms. The loss of one or more of these dealers could have a material adverse effect on our financial condition and results of operations. The number of dealers supporting our products and the quality of their marketing and servicing efforts are essential to our ability to generate sales. We face competition from other manufacturers in attracting and retaining independent boat dealers. Source: 10-k

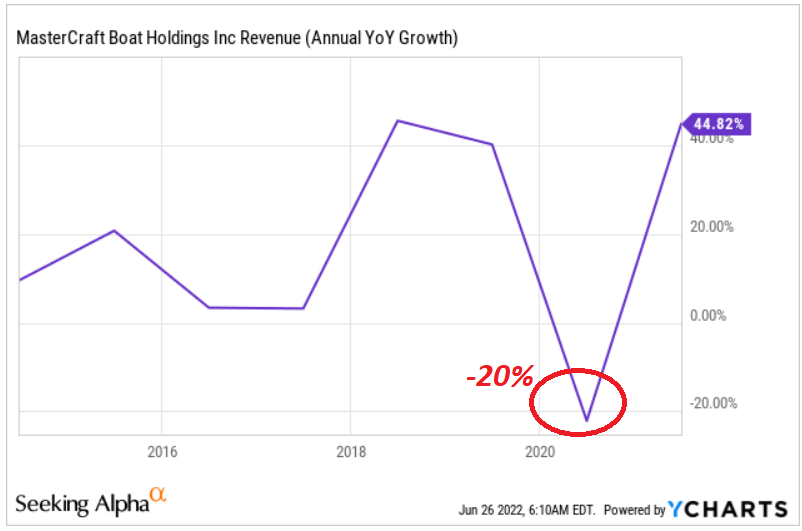

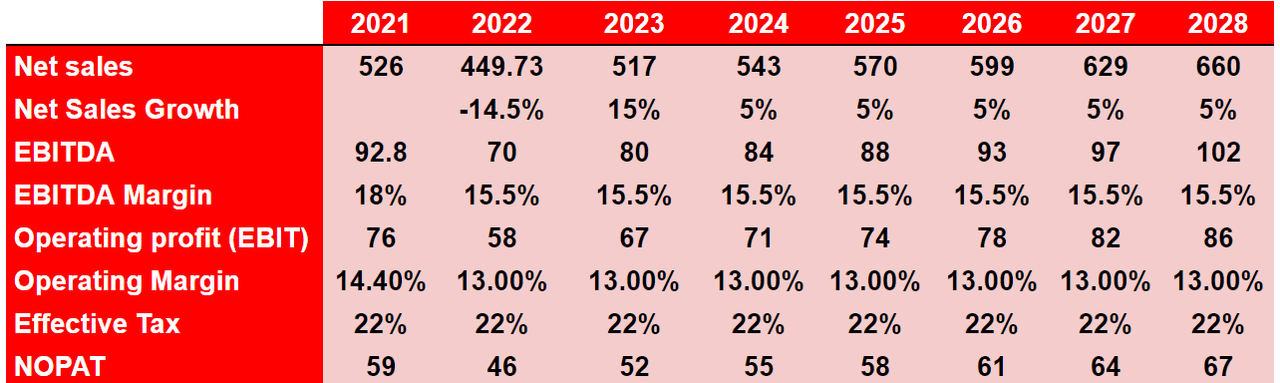

I included sales growth of -14.5%, which is close to the worst sales growth reported in the last five to six years by MasterCraft. From 2024 to 2028, I believe that sales growth around 5% is also conservative.

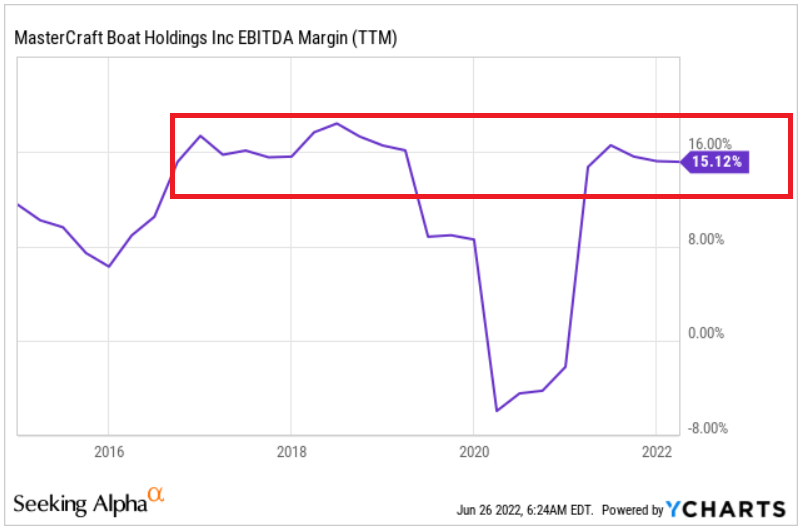

YCharts

I assumed an EBITDA margin around 15.5% and an effective tax of 22%, which imply 2027 NOPAT of $64 million and 2028 EBITDA close to $100 million. My EBITDA margin is close to the figures reported by MasterCraft, so I believe that my numbers are reasonable.

YCharts

Arie Investment Management

Considering free cash flow around $11 million and $27 million along with a discount of 11.5%, the net present value of FCF stands at $68 million. Besides, with an exit multiple of 3.5x, the equity valuation would stand at $184 million with a fair price of $10 per share.

Arie Investment Management

Best Case Scenario: The Recent Increase In Product Development And Engineering Personnel Could Push The Stock Price To $60

Under the best-case scenario, I included beneficial results from the increase in the number of engineering personnel. Let’s keep in mind that since June 2020, the company approximately doubled its head count focused on product development. In my view, more employees mean more products, better R&D, and more innovation. Under this case, I believe that innovation will successfully drive revenue growth thanks to innovative features, new designs for manufacturing, and new boat models.

Since June 30, 2020, the Company has approximately doubled the number of product development and engineering personnel, further solidifying our commitment to being the most consumer-centric and innovative company in our industry. Source: 10-k

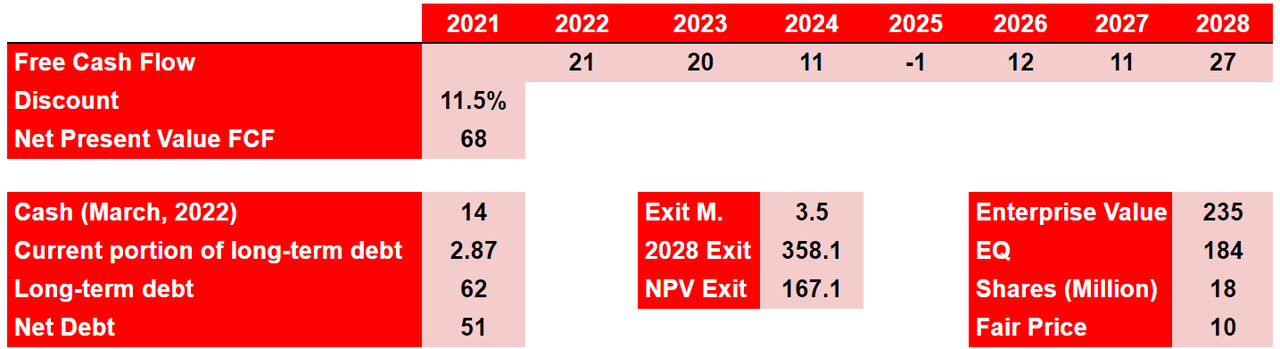

Under my best-case scenario, I used sales growth of 10% from 2023 to 2028, an EBITDA margin of 20%, and an operating margin around 17.5%. My results include an EBITDA close to $235 million and a NOPAT around $155 million and $160 million.

Arie Investment Management

I used a weighted average cost of capital of 7.5%, which implied a discounted free cash flow of $445 million. Besides, with an exit multiple of 5x, the implied market capitalization would stay close to $1 billion, and the fair price would stand at around $60 per share.

Arie Investment Management

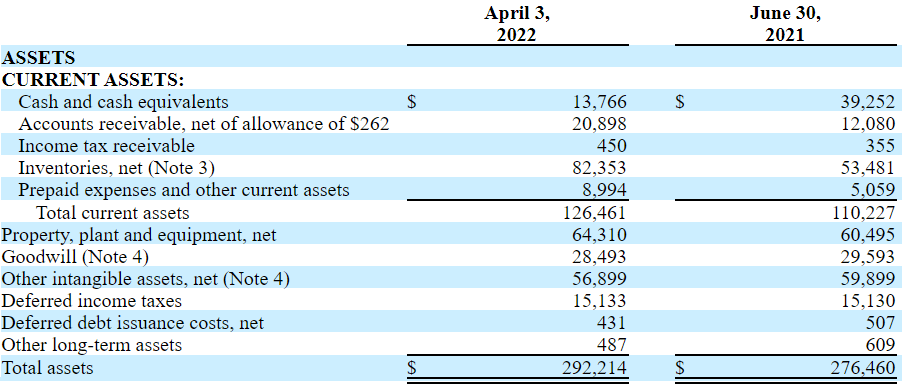

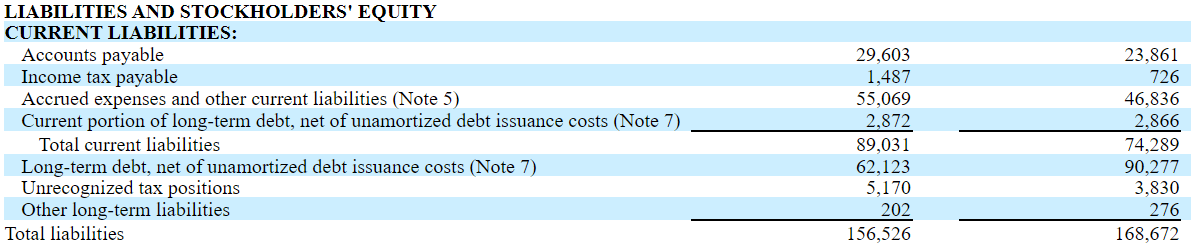

Balance Sheet

MasterCraft’s asset/liability ratio is close to 2x, and management also reports $13.7 million in cash. In my view, MasterCraft’s financial situation appears stable.

10-Q

As of April 3, 2022, MasterCraft had long-term debt of $62 million and current portion debt of $2.8 million, which resulted in a net debt of $51 million. Considering free cash flow per year of around $51-$101 million, I don’t believe that the net debt is worrying.

10-Q

Conclusion

MasterCraft recently announced a new 630 horsepower Ilmor Supercharged 6.2 liters engine and increased its guidance for the year 2022. In my view, if management successfully develops more relationships with dealers, revenue growth may trend north. Besides, I expect a lot more of innovation considering that MasterCraft increased its headcount significantly. Recession, wage inflation, and problems with suppliers are serious risks. However, the company appears undervalued at its current price mark.

Be the first to comment