Thomas Barwick

Marriott Vacations Worldwide Corporation’s (NYSE:VAC) continues to perform well as consumers continue to prioritize travel and lodging in their spending plans, as they seek out experiences and events after a prolonged period of being shut in response to the pandemic.

While the company caters primarily to a higher income clientele, I think there could be limits to spending over the next year because many people have already participated in travel, and if the recession goes on deeper for longer, there is no doubt in my mind they’ll rethink the level of spending they’ll engage in for leisure travel.

Company Presentation

Yet, based upon the visibility we have at this time, it looks like VAC may have another good year in 2023, if the global economy doesn’t deteriorate in a drastic way.

In this article we’ll look at how the company did in the last quarter, the share price level the stock needs to break through to move sustainably higher, what some of its strengths are at this time, and how business looks like for 2023.

Some of the numbers

Total revenue in the third quarter of 2022 was $1.25 billion, up $200 million from the third quarter of 2021, beating estimates by $69.48 million. For the first nine months of 2022, revenue was $3.5 billion, an increase of approximately $700 million from the first nine months of 2021.

Net income was $109 million, or $2.53 per share. Adjusted net income was $131 million, or non-GAAP EPS of $2.28, missing by $0.25.

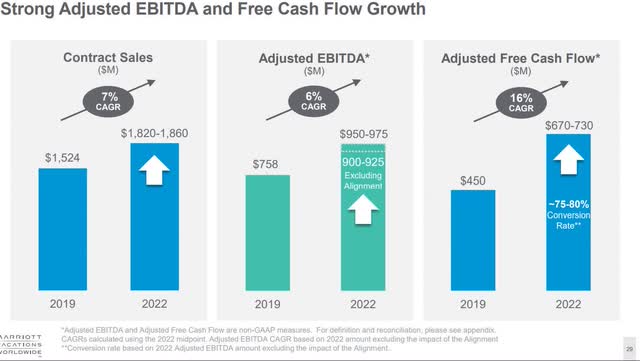

Adjusted EBITDA in the quarter was $240 million, up 17 percent year-over-year, and an increase of 27 percent from the third quarter of 2019. Adjusted EBITDA margin in the third quarter was 28 percent, up 90 basis points from last year in the same quarter.

Customer Presentation

Contributions to adjusted EBITDA from recurring sources were 36 percent from Management and Exchange, 30 percent from Development, 19 percent from Financing, and 15 percent from Rentals.

Cash and cash equivalents at the end of the quarter $294 million, with $249 million in restricted cash. The company also held $142 million in notes that could be securitized, and $4,519 million available from its revolver. Net debt was $2.7 billion, up $118 million from the end of calendar 2021.

Company Presentation

Share price movement

I’m looking at a five-year chart of VAC in order to get a feel for how it was trading pre-pandemic, how it recovered after collapsing, and how it has been trading once it reached its five-year high of about $190.00 per share in mid-March 2021.

At the end of 2019 the stock was trading at a little above $130.00 per share, and in the midst of the pandemic dropped to under $31.00 per share before starting a long, upward trajectory.

TradingView

Bringing it forward, at the beginning of 2021, VAC was trading at $145.00 per share before jumping to the high I mentioned earlier. The significance there is, as I’m writing today the share price has closed on Friday, November 25, 2022, at $147.50 per share, and in after hours trading pulled back to $143.86 per share.

The reason I see this as important is because there have been a lot of positive performance results from VAC recently, yet it has struggled to retain momentum with its share price, even though its performance has shown some ongoing momentum.

In other words, the market may have already priced it in, and is waiting to see how it continues to perform in an economy that is going to be more challenging in 2023 than in 2022.

As mentioned above, there is simply no way of knowing how consumers will spend in 2023 with expectations inflation is going to remain high and the recession may get deeper and may last longer than many think it will at this time.

There is also the factor of what level consumers have assuaged their pent-up demand for travel and experiences, and if they’ll continue to open up their wallets if the economic situation worsens.

As for the share price of VAC, I see it having to first break through the $155.00 per share mark on its way to $160.00 per share if it is to break out of its current trading ceiling. If it’s not able to, I think we’re going to see it correct further before rebounding, assuming the company performs well in the next couple of quarters.

One thing it has managed to do is continue to have higher lows since mid-June 2022. What it hasn’t been able to do so far is break out. Again, my thesis is it’s because of concerns over sustainable spending on leisure travel in what most believe will be a challenging year ahead of us, and the current performance of the company, as well as expectations for the near future, are already priced in, and I think investors are thinking it’s not going to be quite as optimistic as management thinks going forward.

Momentum is the key

I think momentum is the key element in how to view VAC. By momentum I’m referring to consumer sentiment concerning the economy going forward, and whether or not they’ll continue to prioritize experiences and events that require, for the most part, travel and lodging.

The fact is we simply have no way of knowing how all of this will play out, and a lot of it remains in the hands of the Federal Reserve and other key central banks and how they continue to respond to inflation.

As we come closer to the end of 2022, commentators and analysts are starting to be all over the map concerning what the next steps of the Federal Reserve specifically will be. There are those that believe it isn’t close to raising interest rates high enough to tame inflation, and those that believe it needs to pivot now in order not to wreck the economy.

We are also starting to see a lot of businesses starting to lower employee counts, even in the midst of the seasonal temporary hiring that comes during the holiday season.

VAC does have some resilience because it takes longer for economic weakness to filter up to the primary customer base it serves, but if companies accelerate the firing process, especially among higher-income individuals, it’s going to make people think twice about spending on travel and leisure activities, which would definitely cut into the performance of VAC.

Conclusion

Along with expectations of investors concerning the performance of VAC probably already being priced in, I also think it’s struggled to break out of its current share price ceiling because of the lack of clarity on what’s going to happen in the economy next year, and what the Fed is going to do over the next couple of quarters.

If the Fed were to pivot, it would be a big boost to VAC, as consumers would feel comfortable, in my opinion, with continuing to spend on travel. That would be the one catalyst that probably would drive its share price higher. I don’t think that’s going to play out that way, but it could.

With the information available at this time, it seems investors are taking a wait-and-see outlook concerning VAC, holding back until they see where inflation is at and how the Federal Reserve will react to it with its next interest rate hike.

For that reason, I think VAC is going to continue to be rangebound until a catalyst emerges that provides some direction as to how it’ll perform in the market it competes in; and that catalyst could be a positive one or a negative one.

Concerning the longer term, VAC is well-positioned for long-term growth, and patient shareholders should continue to do well by holding on. For those considering taking a new position, I think it would be better to wait to see what happens in the next couple of quarters, as it’s trading at a pretty hefty level at this time with not a lot of upside left under current market conditions.

The stock has been trading volatile as of late, and has made some big swings over the last six months. I don’t see that changing in the near future, so waiting for a pullback, for those wanting to take a position, would probably be the best way to play VAC at this time.

Be the first to comment