Torsten Asmus

MarketAxess (NASDAQ:MKTX), a leading electronic credit trading platform, continues to benefit from the normalizing rate backdrop. Its latest quarter saw not only strong credit volume growth and stabilized revenue capture but also broad-based market share gains across most of its products. With portfolio trading volume also up significantly to $25bn (up from ~$9bn in Q3 2021), the fundamental prospects look good for MKTX heading into more quantitative tightening in 2023.

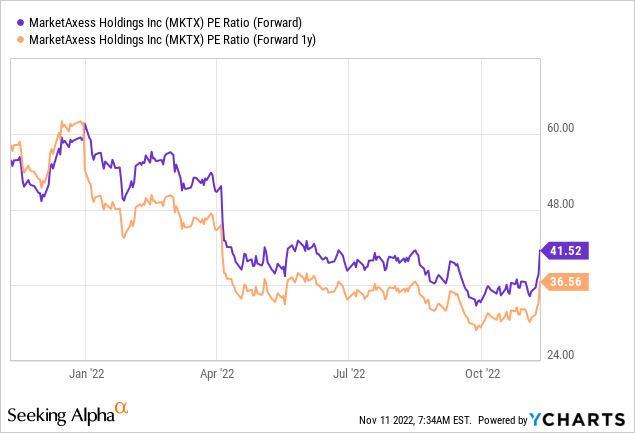

The only caveat here is the performance on the high-grade side of the business, as near-term duration and yield-related headwinds will weigh on revenue capture (i.e., fees per $ million traded), even with some offset from improved near-term volume dynamics. Beyond the near term, there are incremental growth opportunities from here, including further market share gains and product expansion across geographies. For the stock to work, though, the valuation needs to be a lot lower than the current >30x fwd P/E, in my view, so I would sit this one out for now.

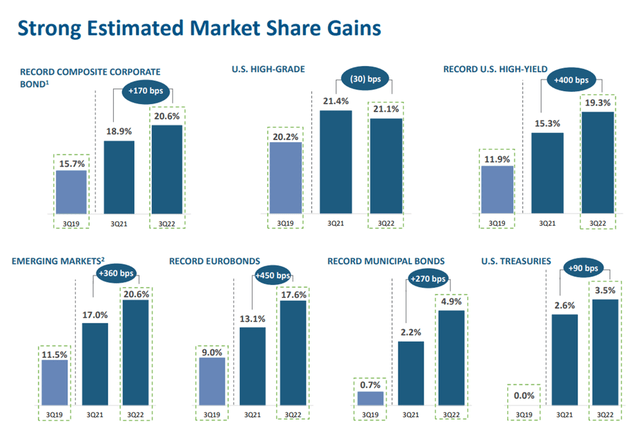

High-Yield Outperformance and All-to-All Trading Drives Market Share Gains

MKTX has sustained some impressive market share gains throughout the year. Q3 2022 saw more of the same, with record share reached across high yield, US municipal bonds, and Eurobonds, as well as in emerging markets. One key driver has been the challenging liquidity environment, particularly on the high-yield side, with MKTX benefiting from clients moving toward its all-to-all trading mechanism (i.e., market participants trading and providing liquidity to one another). As a result, the composite corporate bond market share now stands at 20.6% in Q3 (up from 20.2% in the prior quarter). Unsurprisingly, US high-yield market share has been the standout performer at 19.3% share (well above the 17.3% in Q2); this more than offset modest market share losses in high-grade at 21.1% (down from 22.3% in Q2).

With liquidity conditions likely to be tight heading into 2023, MKTX’s protocol breadth sets it apart in the fixed-income space, where trading relies on a variety of strategies for liquidity identification and aggregation. In line with this trend, MKTX’s all-to-all trading capabilities have gained traction, allowing for alternative liquidity providers (e.g., ETF market makers) to fill in gaps in the market when liquidity is tight. As a result, all-to-all trading now contributes ~53% of high-yield trading, with ample room for expansion ahead. Elsewhere, continued efforts at protocol expansions and enhancements (e.g., workflow efficiencies and analytics) should also help to accelerate MKTX’s market share gains in the credit space alongside a more favorable macro backdrop.

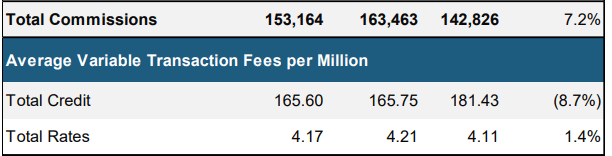

Stabilizing Fee Capture Resets Expectations Heading into 2023

With the average maturity of bonds traded on the platform settling in the eight to nine-year range, MKTX’s fee capture stabilized in Q3 2022. Still, credit fees did come in lower YoY at $165.6/$ million (down from $181.4 in Q3 2021) amid an unfavorable product mix shift toward lower duration US high-grade bonds. For context, high-grade fee capture tends to have more duration sensitivity as investors trade on yield (vs. price); hence, the current rate cycle has weighed on fees. Of note, high-grade fees will also no longer be broken out separately, with management opting to instead report total credit fees going forward. While I view the decline in high-grade fee rates as a cyclical issue that should reverse over time, more reporting opacity represents a step backward, in my view, and will likely be met with skepticism by investors.

MarketAxess

From here, the capture rate looks likely to stabilize at the Q3 implied run rate, as trading activity continues to be focused at the short end of the curve at this stage of the rate cycle. Management has also observed a similar run rate in October, which makes sense given that Q3 results were also in-line with the Q2 exit rate. So assuming the worst of the recent fee pressure fades in the coming quarters, MKTX’s narrowed expense guidance range to $390m-$398m for the full-year (+9% YoY growth) bodes well for margins (recall the prior margin guidance range was $385m-$415m). Effectively, the implied Q4 expense guide stands at a very achievable $103m at the mid-point.

Rate Hike Beneficiary at a Premium Price

Coming off a very solid quarter, the MKTX platform looks well-positioned to capitalize on widening credit spreads and volatility amid the Fed-driven quantitative tightening into the upcoming year. Even with MKTX already outperforming across its key fixed income products, there could still be more upside to be unlocked as credit demand picks up and FX headwinds fade in a normalized backdrop. Over the mid to long term, there remain ample growth opportunities available to tap into as well, spanning market share gains to product expansion across geographies. For now, the catch is the valuation – at the current >30x fwd P/E, the stock has priced in a lot of positives, limiting the upside potential from here.

Be the first to comment