Parradee Kietsirikul

Investment Thesis

Marathon Petroleum (NYSE:MPC) has a 2.4% dividend yield. And within the oil and gas space, I would say that’s at the low end of the range compared with peers.

Indeed, MPLX’s cash distribution to Marathon of approximately $2 billion annualized is more than my rough estimates of the $1.3 billion annualized run-rate in dividend payout Marathon will make in the coming twelve months, once Marathon’s future share repurchases are factored in.

What’s more, Marathon is eager to repurchase $5 billion worth of its stock, or approximately 8.3% capital return via buybacks.

In fact, these repurchases will most likely be completed in less than 12 months. This means that the buybacks could possibly annualize at more than 10%.

Thus, altogether, Marathon’s capital return program will probably reach more than 13% going forward.

What’s more, the macro environment appears to be strong at present. Indeed, instead of providing you with my articulation of the dynamics, I believe that Marathon’s CEO Michael Hennigan’s comments illustrate the overall backdrop well.

We normally see seasonal demand decline at this time of the year but to date, we’re not seeing those signs. Strong forward crack spreads and wide salary differentials for 2023 indicate the expectation of a strong refining environment going forward.

So with the capital return policy and the positive environment in mind, let’s get to it.

Marathon Petroleum Financial Position

Before going further into the balance sheet, it’s important to know that Marathon Petroleum holds 64% of MPLX LP (”MPLX”). MPLX is a Marathon’s Midstream business unit. This is responsible for the transport and other logistics of Marathon’s refined products.

So even though Marathon expects $2 billion in distributions on annual basis, MPLX’s ability to further substantially increase its payout distribution is highly contingent on its own debt load.

On the earnings call, Marathon’s Hennigan said,

As MPLX pursues its growth opportunities, we expect the value of this strategic partnership will continue to be enhanced, and we do not plan to roll up MPLX.

For my part, I’m not entirely convinced of that the actual case here. Put simply, we can’t simply disregard MPLX’s debt. If we are looking at the total available cash shareholders are likely to get over time, we must also consider MPLX’s debt.

Marathon plus MPLX together hold approximately $16 billion of net debt.

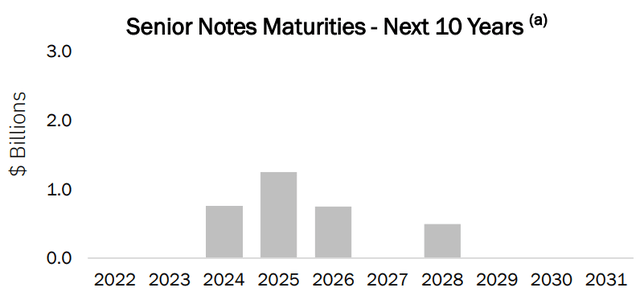

Marathon’s Q3 presentation

Hence, even though Marathon’s debt is spread out over the next decade and beyond. And MPLX’s debt is non-recourse. Not to mention that Marathon holds an investment-grade credit rating.

Q3 2022 10-Q

The fact remains, that MPLX plus Marathon holds a fair amount of debt.

Consequently, even though Marathon’s balance sheet is strong, Marathon’s ability to meaningfully increase its dividend payout will be in some way anchored to the balance sheet of the combined company. Again, despite the debt being non-recourse.

Capital Allocation Policy, 2.4% Dividend Yield

After raising its dividend, Marathon’s annualized dividend now reaches $3 per share or 2.4% annualized. Indeed, as many market commentators have made the point, right now there’s a large dichotomy within the oil and gas sector.

Companies that are paying out a large dividend yield are getting a significant amount of outperformance. While companies that mostly favor buybacks are failing to get investors as excited.

And this makes sense. Investors are still unsure of whether or not the oil market boom is here to stay or not.

And if it’s not, there’s the fear that the buybacks will imminently stop, and investors will be left with an inadequate capital return program, based on razor-thin dividend yields.

And this squarely lines up with Marathon. Even though Marathon contends that it has repurchased $15 billion worth of stock since the capital repurchase program commenced, keep in mind that the start date was roughly 2012.

Yes, the bulk of those buybacks have picked up a lot of speed in the past quarter, and even subsequent to the quarter, but it’s difficult to value a company that fails to lay out an adequate concrete framework.

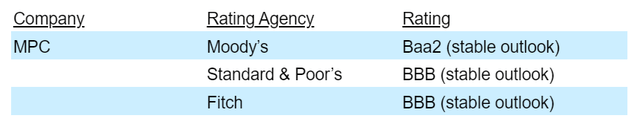

But am I being too harsh? After all, free cash flow in Q3 reached $1.7 billion, and Marathon’s capital return program reached $4.2 billion.

Marathon’s Q3 presentation

Clearly, Marathon is determined to return capital to shareholders. But one part of me nevertheless questions, what’s the sustainability of these capital returns?

And do these questions actually matter when the stock is so cheap already?

MPC Stock Valuation — 4x 2022 Free Cash Flow

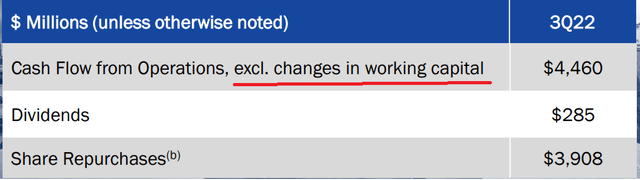

Marathon’s Q3 presentation

Once all is said and done, Marathon’s free cash flow in the quarter was $1.7 billion. But that figure includes a one-off tax payment of $2.3 billion. Without that payment, its free cash flows would have been $4 billion.

And in Q2, when refining margins were seasonally strong, free cash flows were $6.0 billion. Also, recall that Q1 saw free cash flows of $1.5 billion.

Hence, for the trailing 9 months of 2022, Marathon’s adjusted free cash flows, where the one-off tax payment is excluded, are $11.5 billion.

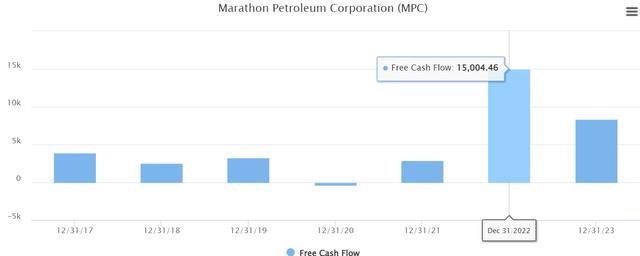

Hence, it’s very possible that in 2022 as a whole, Marathon’s free cash flows could reach $15-$16 billion.

Meanwhile, analysts for their part continue to believe that refining margins will tumble lower in 2023.

TIKR.com

And therein lies the question that investors need to get a firm answer on. How much of an anomaly were 2022 refining margins? Could there be a case where 2022 refining cash flows are roughly flat with 2022?

The Bottom Line

There’s a lot of uncertainty. Bulls believe that refining margins are going to remain wide for the time being. Indeed, commentary from many of the refiners points to this consideration.

While bears know that the refining market is volatile and things can always rapidly turn sour. Particularly, if we enter a global recession.

Nevertheless, I am very hopeful. And at 13% annualized total return, I believe that the odds are very favorable.

Be the first to comment