Pgiam/iStock via Getty Images

Marathon Oil Corp (NYSE:MRO) has had a great 12 months, on the back of the energy industry’s stellar results in that period. Although energy has destroyed shareholder returns over the last decade and even longer, the industry’s capital allocation policies have become more conservative, with profitability returning to the industry and rising significantly. Marathon Oil’s own free cash flow and return on capital policies have allowed it to become profitable despite scaling down in the last decade. The company is priced attractively and in a positive bubble that is unlikely to pop any time soon.

Energy Is Leading the Market

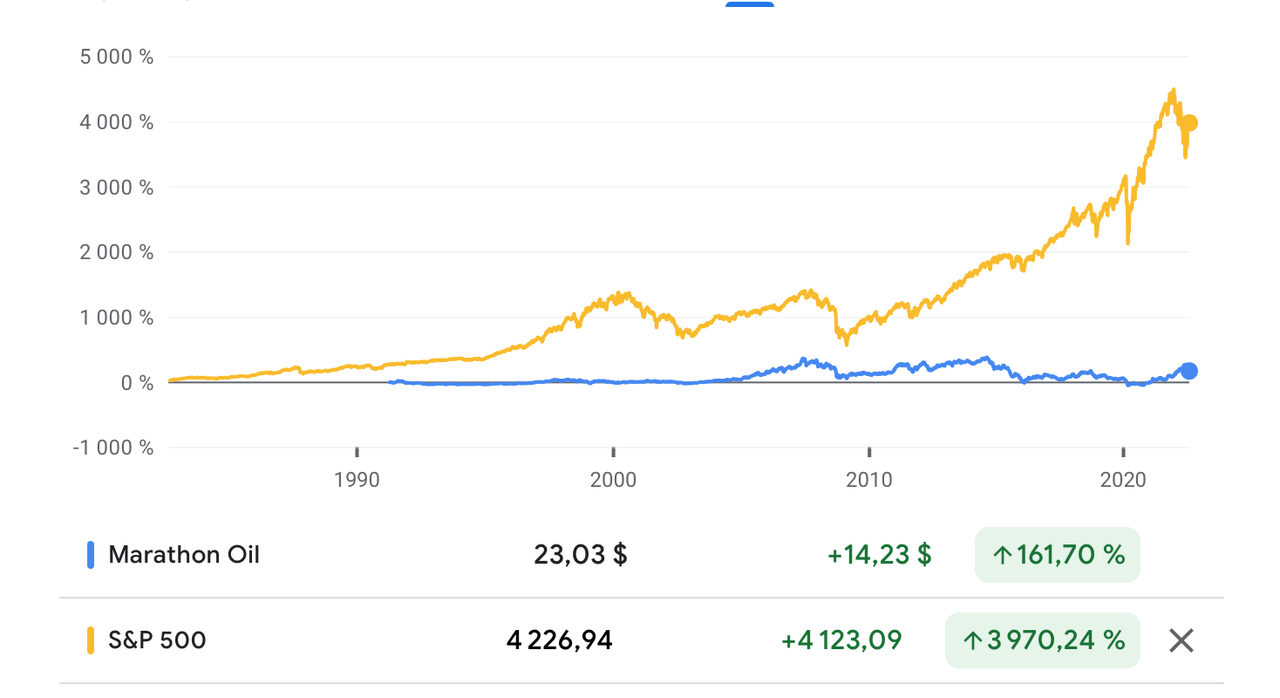

Marathon Oil has been a disaster for investors since it listed in 1991. In that period, the company rose 161.7% in value, compared to 3.970.24% for the S&P 500.

Source: Google Finance

This is reflective of the general performance of energy stocks. This is especially true in the post-Great Recession period. For instance, the MSCI World Energy Index grew by 2.79%, compared to 10.21% for the MSCI World Index. However, in the last five years, that pattern of chronic underperformance has been reversed. The MSCI World Energy Index has grown by 6.02%, compared to 8.81% for the MSCI World Index. Returns are tightening.

Energy stocks are highly dependent on the dynamics of their industry for their success. The energy business follows Kaldor’s cobweb model, and is highly cyclical. The industry tends to expand production when prices go up, with companies raising capital through debt and equity issuance, until a point where there’s an excess of supply and prices collapse, falling until the market clears. As prices fall, returns on invested capital (ROIC) decrease, capital exits the market, until profitability returns. This cyclicality has made it very unprofitable to invest in energy stocks because of the massive risks entailed when the market collapses.

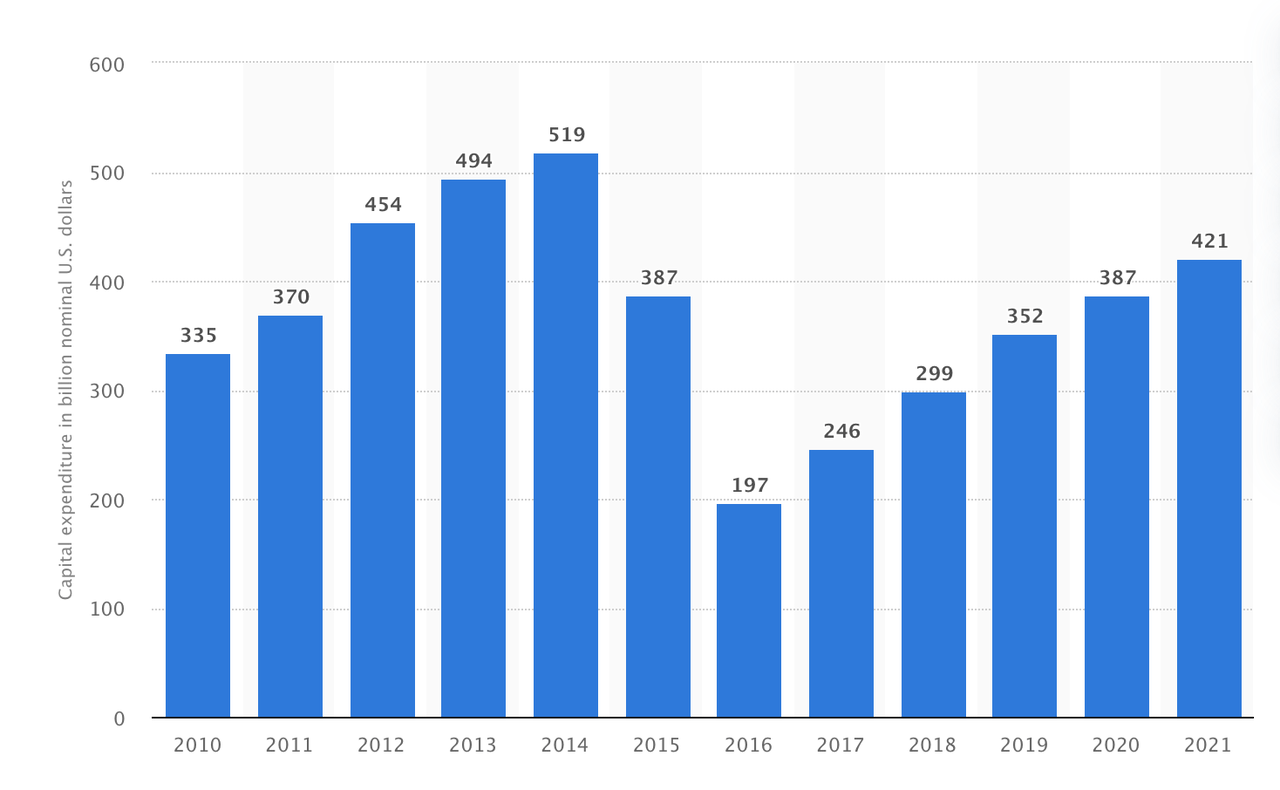

However, in recent years, the industry has become more disciplined. The market has so far resisted any euphoric increases in capital expenditure (capex). Even as prices rise, capex in recent years are still far from the peak of the last decade, of $519 billion in 2014.

Source: Statista

The difficulties that President Joe Biden and the European Union have had in getting OPEC to dramatically increase production, are a sign of the change of the times. What this means is that the downside of the industry is greatly reduced, and the profitability of the industry is more sustainable.

Today, the investability of energy stocks is not a very controversial idea. We all know that energy stocks are up about 30%, whereas the S&P 500 is down around 13%, year to date. Yet, as we have shown, this is not just about inflation in 2022, it’s about secular trends in the industry.

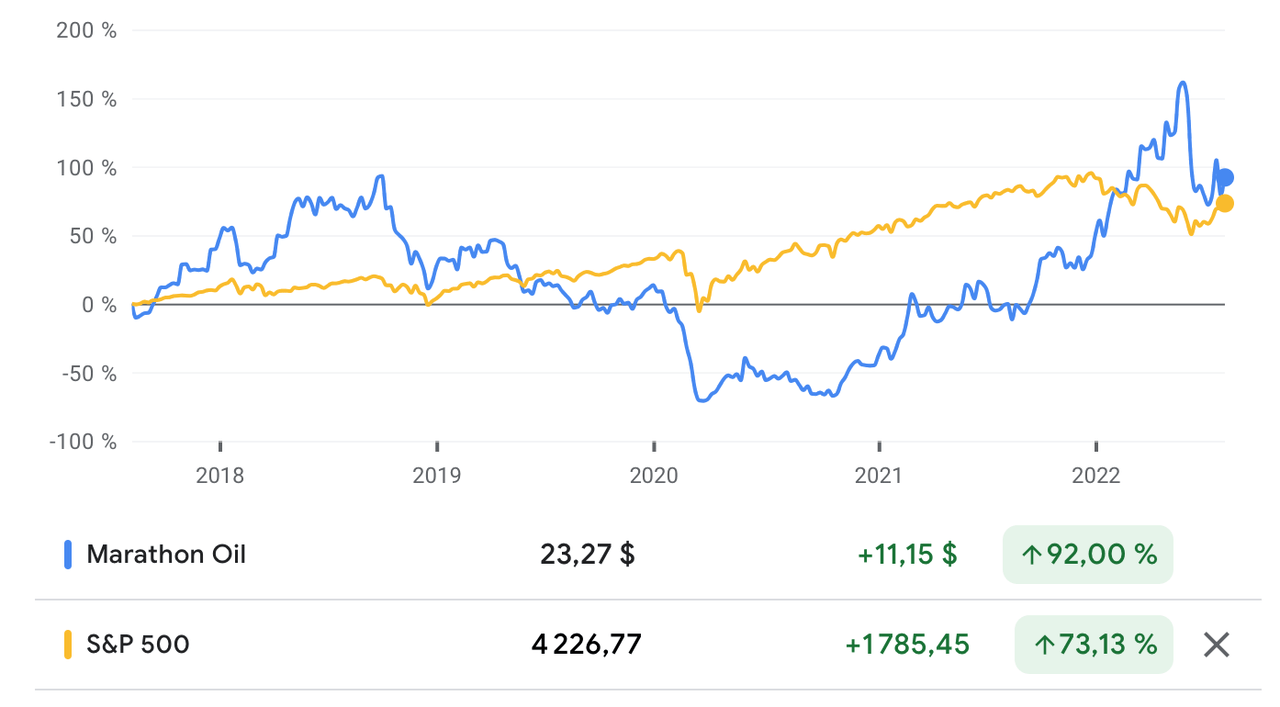

That cyclical pattern is reflected in Marathon Oil’s own results.

Source: Google Finance

As you can see, in the last five years, Marathon Oil has overtaken the S&P 500.

Marathon Oil’s Margin of Safety

According to the FCO Cockpit Global Bubble Status Report from June 2022, Marathon Oil Corp has been in a positive bubble since July 2021. In the year prior, Marathon returned 134% for shareholders. With a bubble score of 17.1%, Marathon’s bubble is unlikely to pop in the near-term. This is important because it provides a unique margin of safety: it tells investors that when they buy stock in the company, that stock is unlikely to go down in value. Instead, investors are likely to experience upward price movement. This is a good thing and something that investors typically do not consider.

The Financial Crisis Observatory (FCO), which compiles bubble status reports, also calculates a value score by comparing ROIC to enterprise value divided by invested capital. Marathon Oil has a value score of 78%, which shows that the company is trading at a very cheap valuation. This reinforces the price-to-earnings (P/E) ratio of the company, which at 5.45, is way lower than the P/E ratio of the S&P 500, which is 21.35.

The FCO also calculates a growth score, which is similar to a price/earnings-to-growth (PEG) ratio. Marathon Oil has a growth score of 9.9%, which shows a low growth and potential growth.

Finally, in 2021, Marathon Oil earned a free cash flow (FCF) of $2.193 billion. With an enterprise value of $18.52 billion, the company had an FCF yield of 11.84%. Based on the company’s Q2 2022 results, FCF yield has risen to over 25%. This is the second highest FCF yield in the S&P 500. This shows that the company has strong prospects of a high stock performance and good underlying company performance. Indeed, the FCF yield is a more powerful indicator of a company’s attractiveness than its PE ratio. The company’s FCF yield is much higher than the average FCF yield of 1.7% of the 2,000 largest companies in the United States, tracked by New Constructs.

Marathon’s margin of safety is a factor not just of a cheap price, but also of the upward trend of the stock price.

Improving Profitability

We can see from the company’s 2021 10-K that revenue has declined dramatically, from nearly $12.5 billion in 2012, to nearly $5.5 billion in 2021. Net income has declined from nearly $1.6 billion in 2012, to $946 million in 2021. For many investors, this is a tale of woe, and points to the Armageddon that the company and the industry as a whole is headed toward.

Although we live in an age that fetishizes growth stocks, in practice, there is an inverse relationship between asset growth and future returns. The asset growth effect is an important thing to consider in the energy sector. It’s a good thing that the company has reduced its asset base from $35.3 billion in 2012, to nearly $17 billion in 2021, and that cash flow for capex declined from nearly $4.4 billion to just over a billion dollars. In that time of contraction, total shareholder returns have risen from 2.78% in 2012, to 11.88% in 2021.

In that 2012 to 2021 period, the company’s ROIC has risen from 12.3% in 2012, to 16.3% in 2021. According to Aswath Damodaran’s data, the integrated oil sector has an average ROIC of 5.12%.

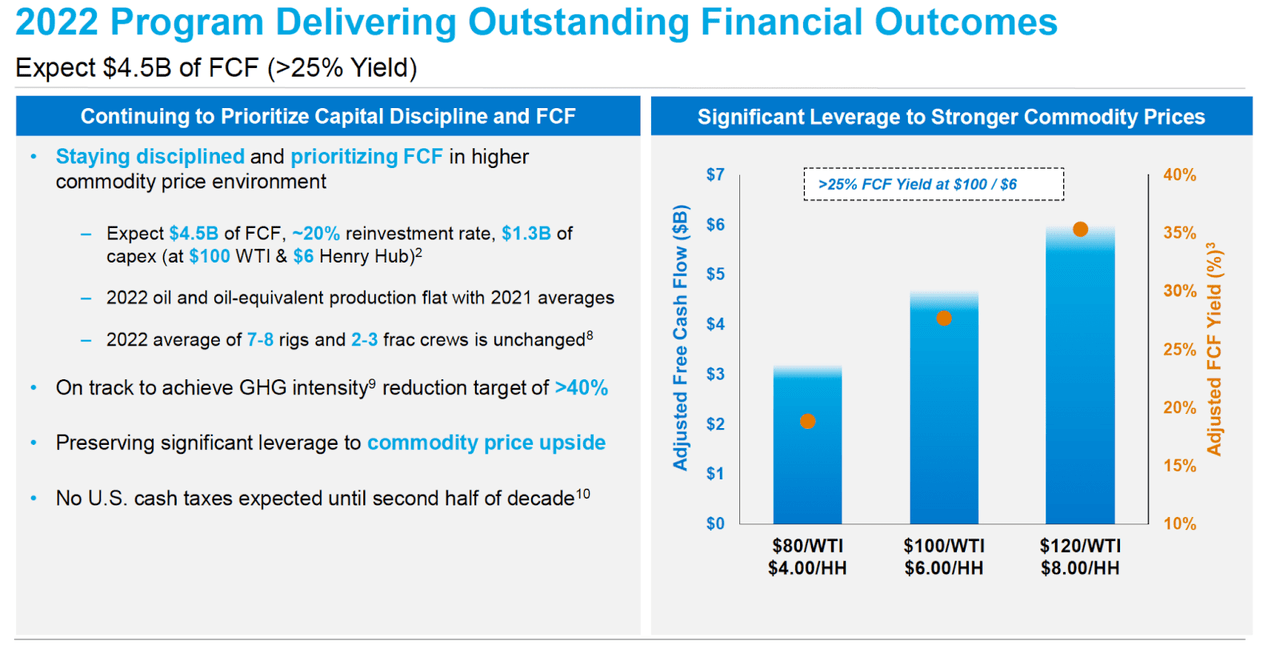

Gross margins have risen markedly, from 58.54% in 2012, to 76.93% in 2021. Marathon Oil’s FCF margin in that time rose from -2.76% to 40.11%. In addition, the company has had a good 2022. In Q2 2022, the company earned $966 million in net income and over $2.3 billion in revenue. Marathon Oil also earned FCF of more than $1.3 billion. The company expects to earn $4.5 billion in FCF this year.

Marathon is a cash generation machine, reinvesting around 20% of its cash flow, which is well below the industry standard of 30% to 40%.

Source: 2021 Earnings Presentation

The company’s profitability is based on the company’s focus on conservative FCF policies and its explicit policy of improving return on capital. This is rare, not just among companies in general, but among energy companies.

Share Repurchases Support Valuation

Buying shares in the company not only has the margin of safety discussed above, it also has additional support in terms of the company’s share repurchase policy.

The company’s capital return policies are geared toward share repurchases over dividends. For example, in Q2 2022, the company bought $760 million worth of shares, and paid out $56 million in dividends. This is attractive from a tax perspective. The company is so capital efficient and generates so much cash that it is able to have very high payout rates. For instance, in Q4 2021, the company returned 70% of its cash in the form of dividends and share repurchases. In Q2 2022, the company reinvested 24% of its $1.2 billion in FCF in the business.

Management believes that its shares are mispriced and that buybacks offer an efficient use of its capital. This provides support for its valuation. In 2021, the company bought back 11% of its shares, and still had $2.5 billion left to spend.

Marathon Oil Is an Attractive Acquisition Target

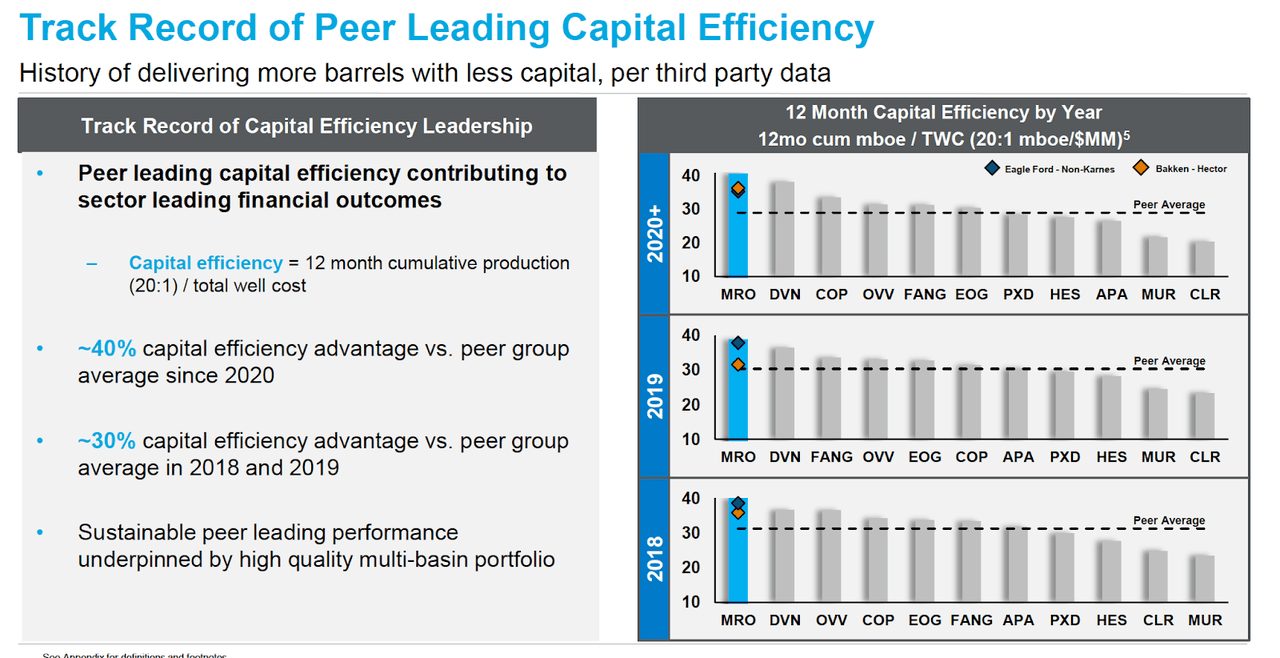

Marathon Oil has valuable shale real estate in the Anadarko Basin, Eagle Ford in Texas, the Permian, and Williston Basin, and a gas interest in Equatorial Guinea. In addition, the company has top tier capital efficiency.

Source: 2022 Earnings Report

The combination of these two things potentially makes Marathon very attractive for a larger producer who wants exposure in those regions or who is already in the region and wants to absorb the company’s operations. The company is very large, so the most obvious buyers are supermajors, although many face pressure from ESG firms to go into renewables, but this may change in the wake of Russia’s invasion of Ukraine and inflation in the next few years.

Risks

The biggest risk to Marathon stems from macro conditions. Energy stocks are enjoying their best year in what seems like forever and Marathon has been a big beneficiary. There is a question as to how high energy prices can go before consumer demand eases and sends prices down and, with it, sector profitability. OPEC believes that supply and demand were very balanced in the second quarter and that demand is likely to ease going forward. If that does happen, the prices will fall, denting the company’s profitability. Indeed, oil prices have eased, and are at six-month lows.

So far, oil and gas avoided the mistakes of the past, and not dramatically scaled assets and assumed more debt, in response to rising prices. In the past, this has led to a bursting of the bubble, plummeting profitability, and bankruptcies. With the European Union and the Biden administration pushing OPEC+ to increase oil production, OPEC+ has so far responded with only a token increase.

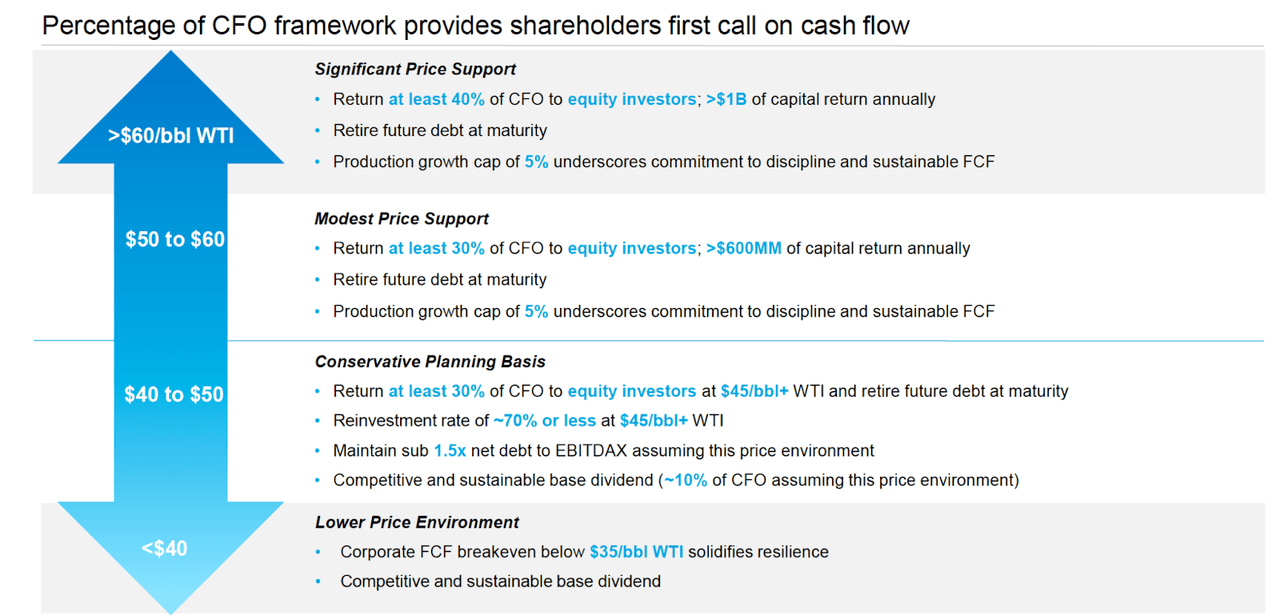

There remains a lot of uncertainty about oil’s future pricing. Nevertheless, Marathon will still be a favorable investment opportunity with softening pricing, as the framework below shows.

Source: Q2 2022 Earnings Report

Conclusion

Although the energy market has destroyed shareholder returns over the last decade, in recent years, the industry has become more conservative in its capital allocation policies. This has resulted in rising profitability for investors, and greater stock price stability. Within that, Marathon Oil has used its conservative FCF and return on capital policies to turn itself into the company with the second highest FCF yield in the S&P 500, while generating top-tier ROIC. The company is highly investible, in a positive bubble, and likely to reward investors.

Be the first to comment