guvendemir

Marathon Oil Corporation (NYSE:MRO) recently acquired additional acreage in the Eagle Ford that is materially expanding the company’s production capacity. The oil and gas company expects the transaction to be accretive to FY 2023 free cash flow, and Marathon Oil has hinted at a dividend increase once the transaction closes at the end of FY 2022. However, with WTI prices dropping into a new down-leg and falling below $80 a barrel recently, there is a material risk for Marathon Oil and its investors that the oil and gas exploration company is going to see a continual decline in its free cash flow prospects!

Eagle Ford acquisition

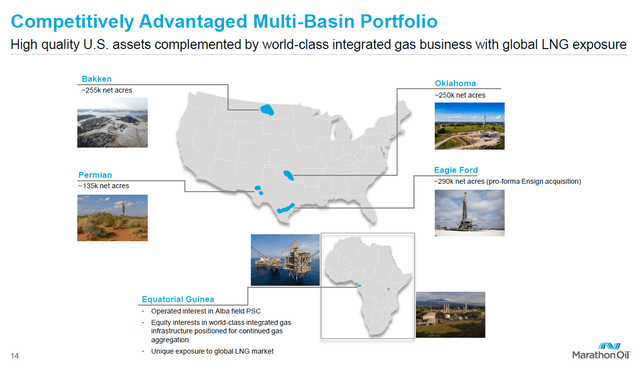

Marathon Oil is a global oil and gas exploration company with key assets in the US. The company is active in Oklahoma, the Permian, the Bakken formation and the Eagle Ford, while its US-centric portfolio of energy assets is complemented by international LNG exposure through its investments in Equatorial Guinea.

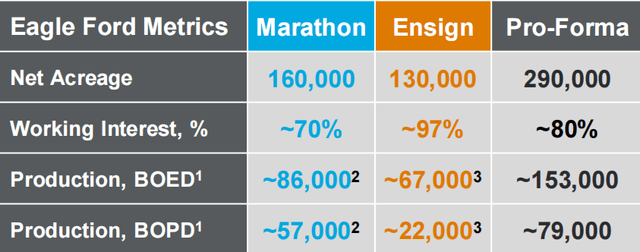

Recently, at the beginning of November, Marathon Oil announced the acquisition of new acreage in the Eagle Ford from Ensign Natural Resources. The acquisition was valued at $3.0B and materially increases Marathon Oil’s footprint in the Eagle Ford. The firm’s net acreage is set to rise by more than 80% from 160 thousand net acreage to 290 thousand. Production, on a pro-forma level, is expected to grow 78% to 153 thousand of BOED once the transaction closes.

The transaction helps Marathon Oil scale its footprint in the Eagle Ford, and the oil and gas company has said that it projects the transaction to be accretive to FY 2023 free cash flow by approximately 15%. Marathon Oil has hinted at raising its quarterly dividend from $0.09 per-share to $0.10 per-share once the transaction closes, which is expected to happen by year-end 2022. The last dividend raise occurred in October, which is when Marathon Oil increased its dividend 13% to $0.09 per-share.

Given that the transaction is expected to be accretive to free cash flow, I believe the transaction makes sense for Marathon Oil. However, the firm’s stock price will move more or less in the same direction as petroleum prices.

Market-driven free cash flow contraction

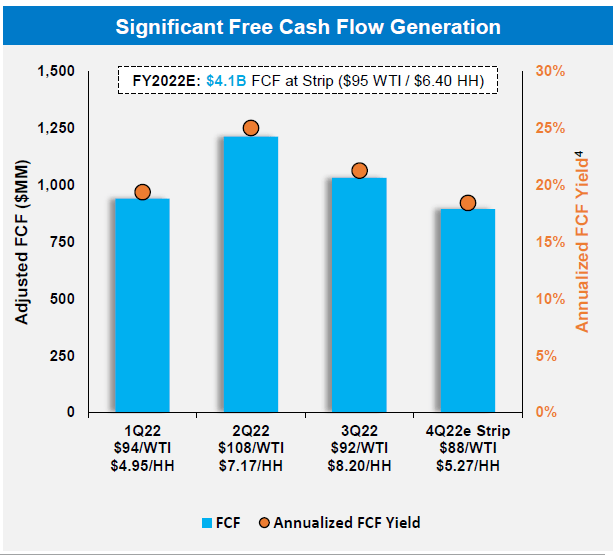

Due to rapidly falling petroleum prices in the second half of FY 2022, Marathon Oil’s free cash flow prospects are deteriorating. According to Marathon Oil’s capital plan, the company expects approximately $4.1B in free cash flow this year, of which approximately 25% are reinvested in the business. However, with WTI prices falling below to their lowest in eleven months (below $74 a barrel), Marathon Oil is potentially looking at dramatically diminished free cash flow prospects in Q4’22 and in FY 2023. In the third-quarter, Marathon Oil’s free cash flow already skidded 15% quarter over quarter to $1.13B in Q3’22, suggesting that the firm’s free cash flow and margins have already peaked in Q2’22.

Source: Marathon Oil

Risks to capital returns

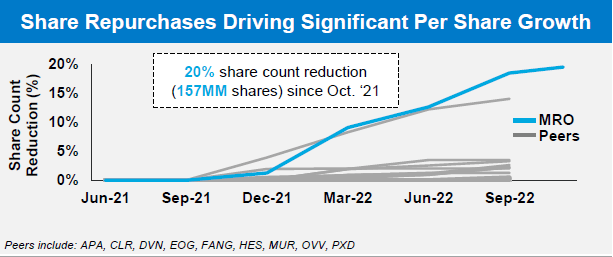

A large part of Marathon Oil’s unexpected free cash flow surge this year has been used to return cash to investors. Since October 2021, Marathon Oil repurchased 20% of its outstanding shares, returning approximately $3.4B in free cash flow to shareholders. A decline in free cash flow, which I continue to expect for FY 2022 due to growing recession risks, may also result in significantly lower capital returns in FY 2023.

Source: Marathon Oil

Marathon Oil: valuation vs. rivals

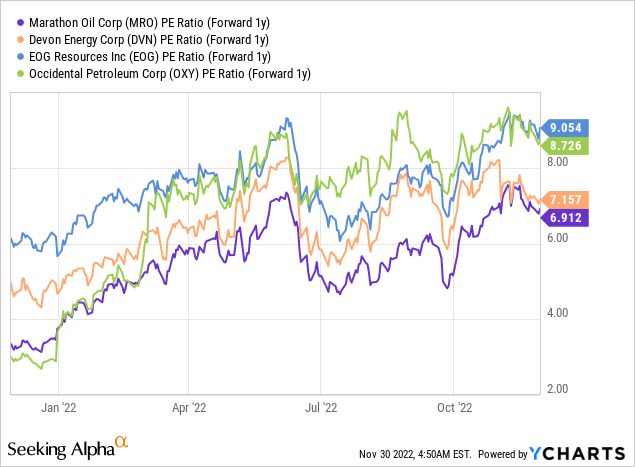

Marathon Oil has a P/E ratio of 6.9 X, but the P/E ratio is set to rise as earnings prospects normalize during a correction cycle. Marathon Oil has a similar valuation as Devon Energy (DVN) and is only slightly cheaper than EOG Resources (EOG) or Occidental Petroleum (OXY). The entire energy sector looks undervalued based off of P/E, but I believe with earnings and free cash flow prospects deteriorating, individual and energy sector P/E ratios are going to see a reset in 2023.

Risks with Marathon Oil

As an exploration and production-focused energy company, Marathon Oil is, and will remain, highly dependent on commodity prices which saw a major and unexpected upward surge this year. However, petroleum prices have fallen back greatly since reaching a high of $130 a barrel in March and with prices for WTI approaching $70 a barrel, the earnings and free cash flow prospects of producers like Marathon Oil are greatly reduced.

Final thoughts

Marathon Oil benefited greatly from the upsurge in petroleum pricing in FY 2022 and the company has returned a lot of free cash flow to investors since October 2021. The oil and gas company also acquired new acreage in the Eagle Ford lately with new assets expected to make a positive contribution to free cash flow in FY 2023.

However, as a producer, Marathon Oil is highly dependent on commodity prices, and the recent decline in WTI prices to below $80 a barrel clouds the firm’s free cash flow and capital return prospects greatly. I believe investors may want to think about closing out their position in Marathon Oil Corporation and consider taking profits!

Be the first to comment