James Andrews/iStock via Getty Images

Manhattan Bridge Capital (NASDAQ:LOAN), is a New York based hard money lender REIT. It has a lightweight operation with a $68 million loan book, concentrated on short term unoccupied residential developments.

Earlier this year, I recommended LOAN on the basis of its trajectory of zero defaults ever, including the Great Recession, its capable management team, and its low leverage. In that article, I expected the company would reduce its loan book and wait for the waves caused by higher interest rates to calm down before expanding again.

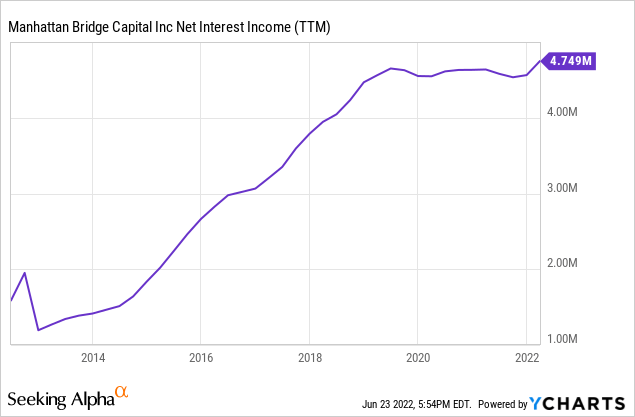

However, LOAN continued expanding its loan book. With increased interest rates, the company is now showing record profits. The main risk facing the company is the tremendous spike in mortgage rates, which will probably affect home purchases and then LOAN’s borrowers.

Will those increased rates cause some of LOAN’s borrowers to default? For the investor willing to take that risk, the company offers a current 7.7% dividend yield, and if things go well, a 9% yield for 2022. Because LOAN is well capitalized, it does not risk catastrophic liquidity failures.

Relationship based lender

LOAN offers hard money loans to real estate developers in New York. Hard money loans are quick, usually simple to get loans that are collateralized and that would not be approved, or not as quickly, by traditional bank lenders.

These are short term, usually 12-month balloon loans. Developers use them either as working capital or as bridge loans until they can get longer term financing. In exchange for the excess risk and expedity of issuance, hard money loans usually carry a higher interest rate.

As of December 2021, LOAN carried $65 million in 131 loans with an average maturity of 6 months, an average balance of $500 thousand and an average interest rate of 9%. 95% of those loans were located in the New York Metropolitan Area, with the remaining 5% located in Florida.

What makes LOAN special is that although it lends in a high risk market, its borrowers have never defaulted on a loan. This includes the Great Recession period. According to the company’s management, LOAN was able to achieve this record because its CEO and CFO source, filter and serve every one of the loans the company generates. The company’s lending standards also include a maximum of the lower of $3 million or 10% of the book per loan, and 75% loan to value ratios.

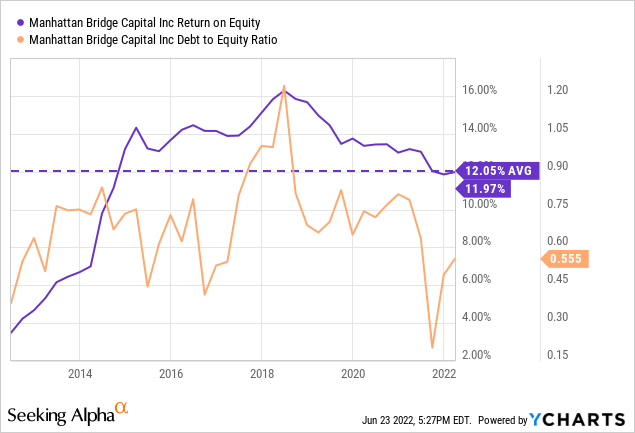

By providing expert judgment on a niche market, LOAN was able to select only quality loans, and earn a huge return in exchange. The company has generated an average 12% return on equity with debt-to-equity ratios rarely above 0.75.

Being a REIT, LOAN is unable to accumulate much cash or self finance its expansion. The company has expanded by issuing shares and debt.

According to the company’s CEO, LOAN has never issued shares if its stock was not trading at all-time highs. In terms of debt, the company has about $6 million in outstanding non amortizing notes paying 6%, maturing in 2026, and a credit facility for up to $32 million paying LIBOR + 4.1%, currently at about 4.5%. Currently the company has drawn $18 million from that credit facility.

LOAN’s interest expenses are semi-fixed. The interest rate is dominated by the fixed term component of 4.1% for the credit facility and 6% for the notes. However, because an increase in the loan book has to be financed through the credit facility, that also moves interest expenses up.

LOAN has no cash in hand most of the time, because as a REIT it has to distribute up to 90% of taxable income. Normally, this would put a company in a difficult liquidity position. However, because the company’s loans have an average maturity of six months, the company can decrease its loan book quickly if it had to, and repay debts when necessary.

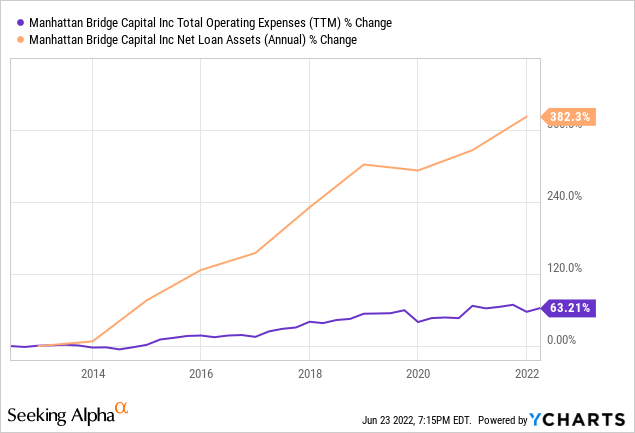

In operational terms, LOAN’s expenses are also relatively fixed, given that it has only six employees. Of course, it has to pay outside services like lawyers, and bonuses to its employees, which will move with the level of profits.

LOAN’s management compensation is quite reasonable. The CEO and CFO, who have a crucial role in the company, add to $470 thousand a year in compensation. Each board member charges $12 thousand a year plus $600 per meeting.

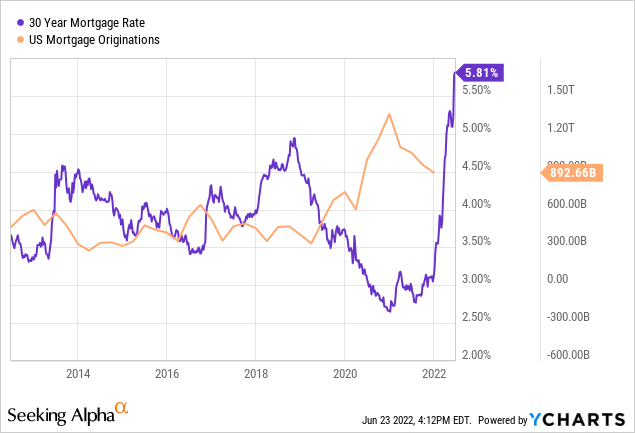

Facing the FED monster

This year is going to be one of LOAN’s most stringent tests. The tremendous increase in mortgage rates, almost doubling since the year began, will definitely put a hard brake on house purchasing. The great question regarding LOAN is whether or not the lower housing demand will affect LOAN’s borrowers, and God forbid, make some of them default.

Even if borrowers did not default, they may still become more risk averse and demand less funds from LOAN, which would drive the loan book and earnings down.

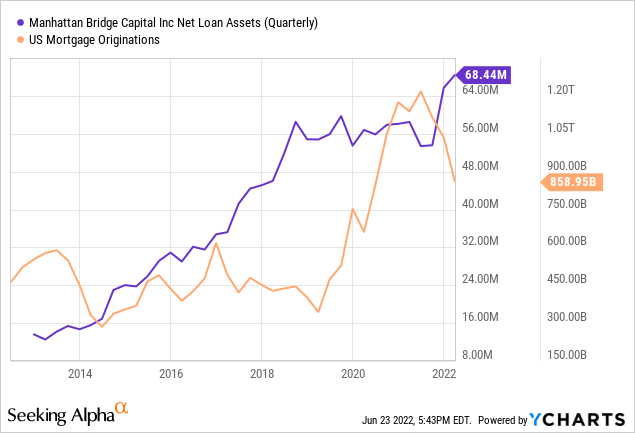

Some data makes me believe that LOAN might not be as exposed as other lenders. Particularly, as the chart below shows, LOAN did not participate in the tremendous increase in lending that started in 2019. The company’s loan book actually has a somewhat counter cyclical behavior with regards to the general market. Second, the fall in mortgage originations started in Q121, almost a year ago, and it has not affected LOAN yet.

As I mentioned, LOAN does not have a high risk of going bankrupt because its loans are not maturing soon and they represent only 35% of the company’s very short term loan book. If its interest coverage became compromised, the company could quickly recover at least a portion of its loans and repay the credit facility.

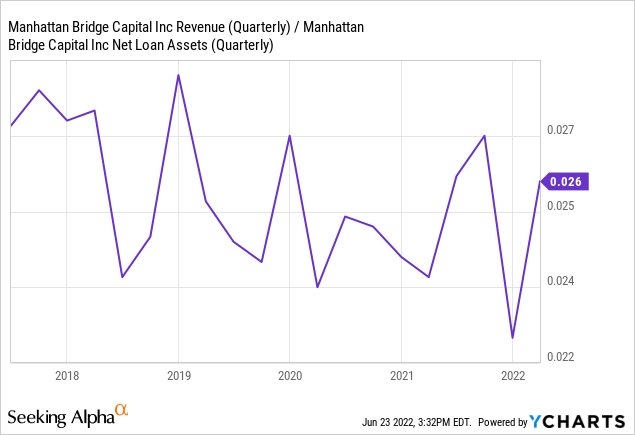

The company also has a substantial margin over interest expenses, as the chart below shows. Even if a substantial portion of LOAN’s borrowers stopped paying interest, the company would still be able to pay its own lenders.

However, even a moderate default rate can hit LOAN’s profitability quite hard. First, the company carries no provision for loan losses, so every loss will go straight to the income statement. Second, with more risk perceived, the company would probably reduce its loan book and reduce its income generating capacity. Even if the company did not do so, a more stringent environment might frighten LOAN’s borrowers.

Up to 1Q22, according to that quarter’s 10-Q report, LOAN was increasing its balance sheet by three million QoQ, obtaining funds from its credit facility, then standing at $18 million.

The bigger loan book and higher interest rates are helping the company generate profits in the order of $0.12 per share per quarter. In the chart below readers can see an approximation to LOAN’s quarterly gross interest margin and its recovery in 2022.

Long term trends and risks

In my previous article about LOAN, readers commented on so-called key-man risk, meaning that LOAN’s operations depend to a large extent on two people, its CEO and CFO. This indeed represents both a risk and a ceiling to growth. It is a risk because if something happened to any of them the company’s operations would be severely affected. It is a ceiling to growth because people have limits, and although LOAN has grown its loan book substantially, at some point processes have to be established rather than only counting on C level employees’ expertise.

Another ceiling to growth is financing. With the stock price significantly below its ATH, and management’s commitment never to issue below ATH levels, issuing does not seem an option. The only other avenue for LOAN to grow its loan book is to keep borrowing from its credit facility. However, LOAN has already asked for $18 million out of the $32 million available. It is not clear that the company could find more financing on the same terms if it used all of its credit facility funds.

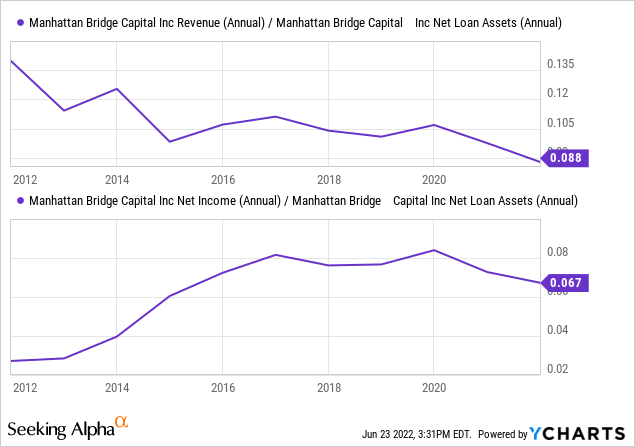

Every time I comment on banks and lenders, I mention the famous long term trend of decreasing interest rates and interest margins. LOAN is no exception with regards to falling rates, with the first chart below showing an approximation to annual gross interest margin. However, in terms of net income to loan assets, the company has not done so badly, at least before the fall in rates in 2020. This was probably caused by an increase in leverage in 2014 and the good administration of operating expenses shown in the business description section.

Finally, LOAN has started increasing its operations in Florida. The latest annual report shows a 2 percentage point increase in Florida’s weight on the loan book, from about 3% to 5%, or $3.4 million. The company does not disclose that data on a quarter level. Recently, the company also made small changes to its credit facility terms, including obtaining permission to loan up to $5 million, representing 7.3% of the company’s loan book, in south Florida.

Expanding to Florida represents several risks. First, it is a different market, probably much different than other northeastern areas. It is probable though that LOAN is landing in Florida carried by either existing clients or references, and not just parachuting on the market. Second, having operations so far away from New York deviates the already precious time of LOAN’s CEO and CFO, putting more pressure on that scarce resource.

Conclusions

LOAN is a little leveraged company with a history of profitability that last year paid $0.41 in dividends, or 7.7% dividend yield at current prices. This year, with a larger loan book and better interest margins, the company generated $0.12 for the quarter, signaling the capacity to reach $0.5 for the year, close to a 9% dividend yield.

In the past, the company has shown the ability to know when to grow and when not to. The company did not join the generalized explosion in mortgages that started in 2019. It also waited for the right timing to issue equity.

However, the company also faces a risky year, when its borrowers are probably going to be under stress. Either defaults or a smaller loan book would cause a fall in profits and consequently on the dividend yield. In my opinion, the return promised pays for the short term risks. On the opposite side of the coin, if LOAN can keep its loan book, it can increase profits even higher riding the rise in interest rates.

In the long term, the company has to transform people based competitive advantages into process based competitive advantages if it wants to keep growing.

Be the first to comment