24K-Production

Thesis

Main Street Capital (NYSE:MAIN) stock has met our expectations of a sharp reversal from its capitulation lows in October. We urged investors to tune out from the noise in October as market pessimism over business development companies (BDC) led to significant market volatility.

Given Main Street’s lower middle market (LMM) focus, it raised investors’ concerns about whether the company would be impacted more significantly than its peers. As such, the company’s Q3 earnings release calmed investors’ nerves, as it raised its dividend for Q1’23 while posting a double beat on net investment income (NII) per share and net asset value (NAV) per share.

However, we postulate that the market had already anticipated a robust Q3 release, as it formed its lows in October (pre-earnings). With a 26% price surge from its October bottom toward its November highs, we discuss why MAIN is less appealing now, as its valuation seems more well-balanced.

MAIN’s price action suggests caution, as it faces resistance by its critical 50-week moving average. Therefore, we encourage investors to remain patient for a potential pullback before considering the opportunity to add more positions.

Revising from Buy to Hold for now.

MAIN: Portfolio Companies Outperformed

Investors were justifiably concerned about whether Main Street’s LMM exposure would hurt its portfolio companies more as the macroeconomic environment worsened in Q3.

However, Main Street posted an overall fair value accretion from its LMM and private loan segment, suggesting that its portfolio companies have performed relatively well on average.

We had a number of companies that continued to perform well and also de-lever or improve their capital structure, both of which impacted our valuations [positively.] [We had] net fair value increases of $4.1 million in our lower middle market investment portfolio and $1.8 million in our private loan portfolio. (Main Street FQ3’22 earnings call)

Therefore, it wasn’t too challenging for Main Street to outperform the Street’s revised estimates on its NAV per share in Q3 ($25.94 actual Vs. $25.47 consensus).

Furthermore, the company has continued to leverage the Fed’s rapid rate hikes, given its mainly floating-rate debt portfolio (76% of portfolio) relative to its mostly fixed-rate debt obligations (73% of obligations).

The company’s interest rate sensitivity computations suggest a $0.23 accretion to its annualized NII per share based on a 100 bps hike. Currently, the market’s expectations of the forward Fed fund rates (FFR) indicate a terminal rate of about 5% through H1’23.

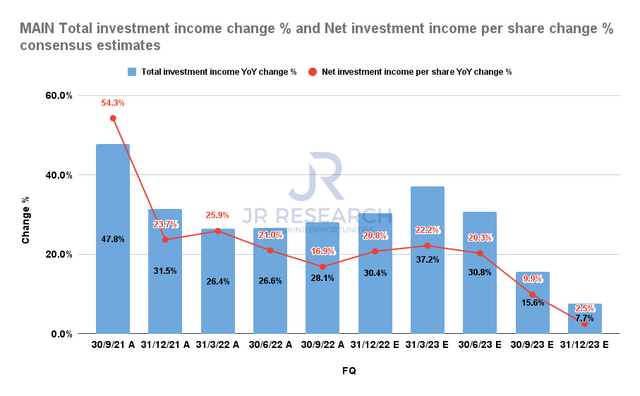

Main Street total investment income change % and NII per share change % consensus estimates (S&P Cap IQ)

Therefore, we postulate that the growth tailwinds in its NII per share could taper off moving forward, even though Main Street’s earnings power should remain elevated.

Hence, we assess that the revised Wall Street estimates indicating normalization in its NII per share growth through FY23 are credible.

Moreover, coupled with a more challenging environment in originations and repayments, the opportunities for above-average capital recycling/investment opportunities should remain challenging as the market adjusts to a higher debt load while keeping the risk-adjusted returns attractive.

Is MAIN Stock A Buy, Sell, Or Hold?

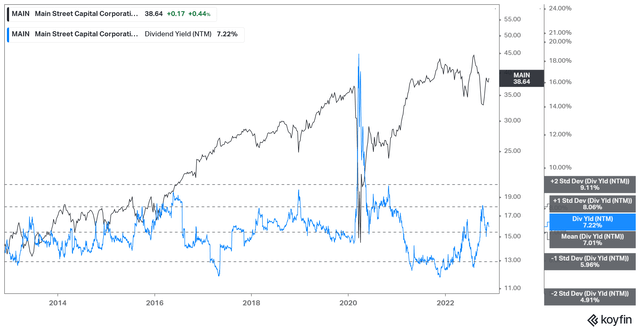

MAIN NTM Dividend yields % valuation trend (koyfin)

MAIN last traded at an NTM dividend yield of 7.22%, broadly in line with its 10Y average of 7%. Notably, it has fallen from its dislocated levels in October, as it surged to 8.1%, or toward the one standard deviation zone above its 10Y average.

Therefore, we believe that the company’s base dividend per share raise to $0.225 per month (from $0.22 previously) from Q1’23 is constructive to sustain its valuation. However, with the marked normalization in its valuation, we don’t find the current levels as attractive for investors to enter.

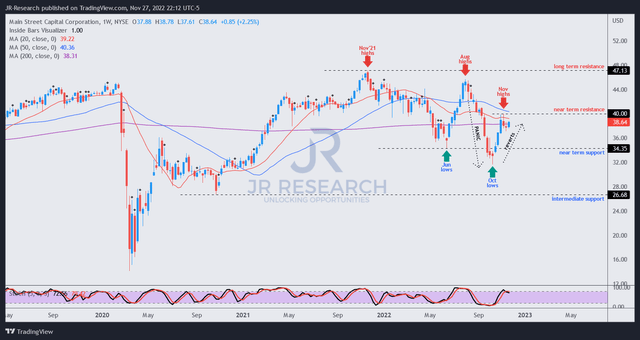

MAIN price chart (weekly) (TradingView)

We assess that the market has reverted MAIN’s price action from the panic selloff from its August highs.

As such, MAIN seems to be facing considerable selling pressure after a sharp recovery, which suggests caution is warranted. Therefore, investors should consider waiting patiently for a potentially deeper pullback leading to consolidation before assessing whether to add more positions.

Revising from Buy to Hold for now.

Be the first to comment