shaunl

Dear Readers,

As I wrote in my first article on A.P Møller – Mærsk (OTCPK:AMKBY), shipping is a complex sector to invest in or understand. However, it’s a crucial thing to understand if you mean to spend extensive time working in the financial field – because global logistics are really what moves things – people and goods.

Understanding A.P. Møller – Mærsk A/S isn’t easy, but with my first piece with further additions by this piece, I believe we’re moving into more understanding here.

Let’s look and recap regarding this business.

Updating on A.P Møller – Mærsk

So with regards to this company, we have the 2Q22 released in early August. It’s a chaotic time in worldwide shipping, as I am sure you are aware – but this is naturally a net benefit to an operator like AMKBY.

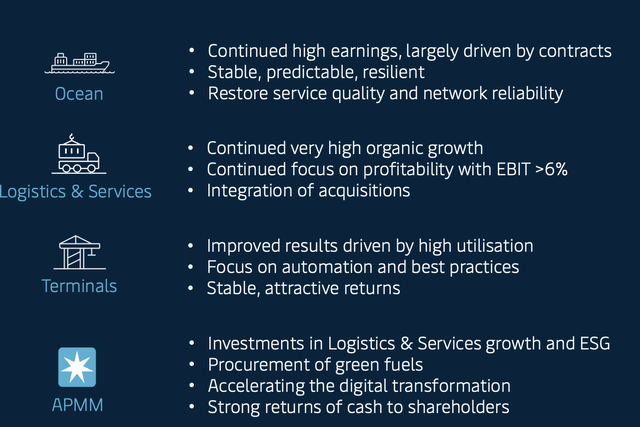

Mærsk has been delivering record results after record results – and last quarter was no different in any way. The company delivered record results across all segments – again.

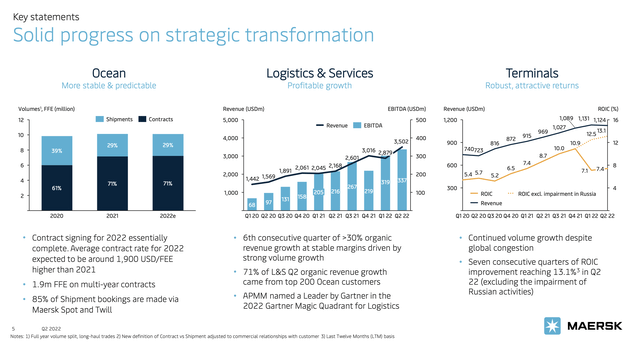

Maersk IR (Maersk IR)

This notes the 6th consecutive quarter of more than 30% organic revenue growth. The company’s margins, despite increased inputs in the forms of fuel, staffing, and the like, have remained good and have even expanded. All on the back of strong, continued volume growth. Contract signings for the Ocean segments are even more predictable than before because – once again – volumes and demand are so solid here.

You’ve probably heard all about congestion in the harbors and terminals – well, the company’s terminal segment is still delivering strong growth in both earnings and revenues, which marks the 7th consecutive quarter of terminal segment growth.

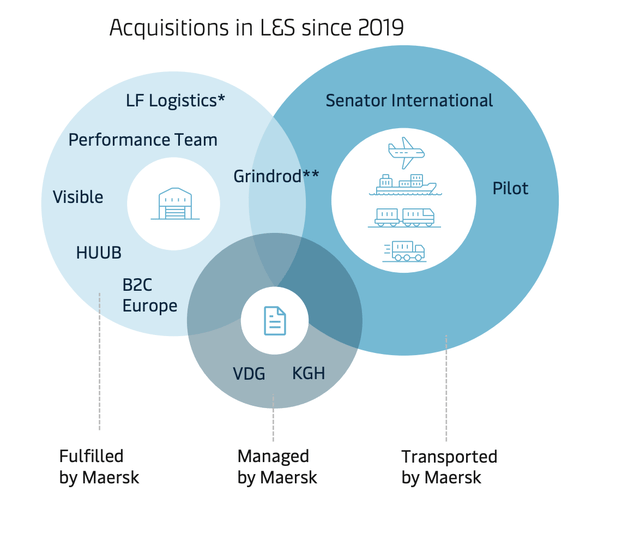

The company is therefore delivering on every part of its 2021-2025 transformation plan. It’s continuing to build both through organic growth and means, as well as through accretive and inorganic means, including acquisitions. The company has had an impressive M&A record since late 2019.

Maersk IR (Maersk IR)

These M&As have powered the company’s impressive revenue growth. Even if legacy operations have been a core part of it as well, the company’s M&As have delivered some very impressive results, in particular when considering the M&As of visible and PT. In the last 10 quarters, the company’s L&S business has grown 143%, of which 55% was contributed by the company’s M&As.

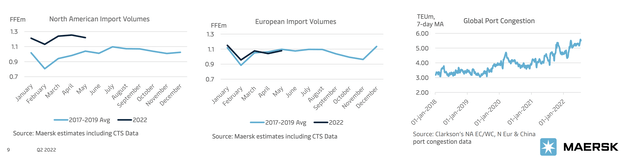

There is really no end in sight for congestion. This seems bound to continue for the foreseeable future here – even intensifying, in fact, but for a mix of different reasons depending on the geography you’re looking at.

Maersk IR (Maersk IR)

For North America, the congestion is driven by sustained, high import levels. In Europe on the other hand, it’s not import at all, but a result of labor and the Russian war against Ukraine. The problem also isn’t seaside congestion, at least not as a root cause. The reason why ships are “standing” in line in the ports is that the bottlenecks in the system are found in on the land side of things.

This has caused the company to revise down its expectations for global container volume down to nearly flat or even slightly negative levels. However, with prices up, it won’t really impact the company’s earnings as much. Congestion for the time being is one of the number one challenges faced by the company.

The current expectations for Maersk from the FY22 period is that strong results from 2Q22 and the continuing quarters have resulted in an EBITDA guidance of around $37B. This is an improvement of $7B, and that’s despite the worsening situation here.

The company expects a gradual normalization as opposed to a quicker one, with a beginning n 4Q22, and the CapEx guidance remains unchanged.

This also means that on the back of improved results, the company is now increasing its buybacks of shares by half a billion annually to a target of $3B per year for the years 2022-2025.

All of these things speak for the company significantly improving in the next few quarters, and years.

Maersk IR (Maersk IR)

Maersk has over 83,000 employees active in over 900+ subsidiaries around the globe. Maersk has representation and offices in over 130 nations across the world.

Fundamentally speaking, Maersk remains at a high BBB+ credit rating with a stable outlook. The dividend for the company is typically low, but because of the surge in results, the company has significantly elevated its payout. It pays a dividend this year of 2500DKK for this year, coming to a yield of well over 8% based on the current share price. This dividend is an outlier, and the typical yield for Maersk is closer to 2-3%. This dividend is the result of a massively attractive set of 2021 results, with a strong 2022 expected due to the very strong current trends in shipping – so it’s possible we’ll see increased, positive dividends for this fiscal payable in 2023 as well.

Remember also that Maersk is a business with a high percentage of family ownership, and that its operations are tiered around 75% to container shipping.

In this industry, company operating costs come from container handling and bunker costs, oil prices/fuel costs, and similar factors. Maersk obviously competes with some very impressive economies of scale here.

Still, despite scale, the increased use of low-sulfur/carbon fuels has driven up fuel costs, and corresponding freight costs to significant levels.

Compared to historical levels, current freight rates are well above $4,000 on average, compared to $2,900 in 2011. It’s the highest price we’ve seen in well over a decade – and it shows no sign of slowing down.

The volatility in this business is highly dependent on the world macroeconomic environment and geopolitical considerations. You can imagine what the crisis in Russia could do to freight prices, for instance. The latest biggest impact here was the US/Chinese trade war/trade restrictions, which impacted trade by an estimated $630 billion back in 2018-2019, and reduced the demand by a full 100 bps.

In short – plenty of things can happen, but at the same time the current trends seem continually positive for the company, and similar companies like Maersk.

Maersk wants to achieve a ROCE not below 7.5%. This is still a high target, in my estimate, given the weighting and volatility of Ocean Freight/segment revenues.

During up-times, this target is achievable, but this is not the case during downturns. The company recently set a 12% ROCE target in 2021-2025 on the back of increased demand. It’s important to point out that this is significantly above the <4% ROCE in 2016-2020, when things weren’t as rosy.

However, as previously mentioned, the company’s ROCE during 2021 was 45.3% – so there’s definitely room for further outperformance. However, it’s important to point out that over 90% of this outperformance is driven by freight rates, and nothing else. Once these turn back down, so will Maersk.

Let’s look at company valuation at this time.

A.P Møller – Mærsk – Valuation

Valuing Maersk remains a very complex task.

In DCF valuation, the thesis is based on modest revenue growth and EBITDA growth at a GDP level of 1.5-2.5%, with CapEx growth at the same levels. I retain these growth estimates for the future period.

Do realize however that there are sensitivities here that are hard to account for, such as the portion of greener fuel and the pricing developments for these commodities.

Maersk has a WACC of around 8%, with a relatively low cost of debt below 4%, though it wouldn’t be wrong to bump this up to around 4.5-5% given the current rate increases.

Taking current data and trends into account, our estimates are for normalization of company sales as freight costs normalize somewhat. This now brings us to an implied EV of between 18,600 DKK and 19,400 DKK, or thereabouts, for the DCF valuation.

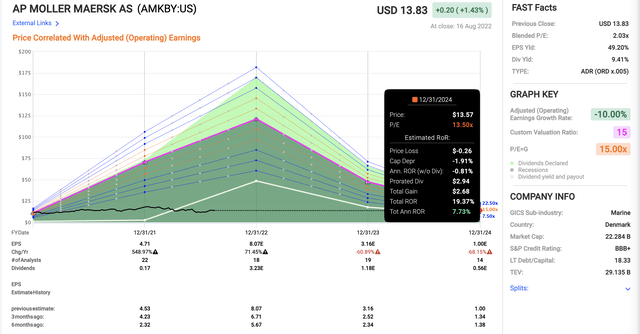

We can forecast AMKBY at a 15x forward P/E and still get 7-9% annual RoR, even if the company drops its profits by 61% in 2023E another 68% in 2024E. This would imply a full normalization of freight rates, with a slight bump up for inflation. Even in this scenario, the RoR for the investment at this valuation would be around 20% – not the highest, but enough to safeguard your returns in this BBB+ rated investment.

Maersk Valuation (F.A.S.T graphs)

The only thing I would be careful about would be the expectation for the dividend. I have no doubt that the company will continue to pay a dividend along the lines in terms of percentages that it currently does, however this would be a much lower yield if you buy at today’s price – just know this going in.

In terms of peers, Kuehne + Nagel (OTCPK:KHNGY) is the closest peer with a decent market cap, but the problem with many of Maersk’s European peers is that they are in logistics more than in container shipping. I also include Hamburger Hafen (OTCPK:HHULY) and consensus numbers out of COSCO in the comparison to get some balance here, and logistics business have significantly higher multiples than container shipping. Especially with the latest troubles in Europe, it makes it difficult to compare many of these peers to international shipping like AMKBY.

The current analyst average by S&P Global, with 17 analysts following the company, is $3,465/share, which is down somewhat from peak target valuations which were in effect at my last article. The company is considered undervalued 25.8% to average PT, with 11 out of 17 analysts now considering Maersk a “BUY” Here.

Maersk has an ADR called AMKBY which we are discussing here, and which offers the opportunity to invest at a cheap share price due to the 0.005X nature of the ADR.

I personally invest in the native share, as this is one of the most liquid stocks traded in Copenhagen. I have been investing in a few of the company’s native shares, and intend to continue to buy slowly at what I believe is a long-term appealing investment valuation.

Remember, there are some complications for Danish dividend stocks – Danish dividends are taxed at 27%, but even the national IRS here only recoups 15% “automatically”, with the remainder needing to be applied for manually, by myself, with the Danish IRS. For investment funds, recent news in 2021 confirms that Denmark will deny dividend withholding tax refunds to foreign investment funds (Source). This may affect the appeal of the company for you.

It does not, for me.

Thesis

My thesis for Maersk is as follows:

- This is one of the world’s most important shipping companies. At a good valuation, this company is, to me, a no-nonsense “BUY” with no looking back. The flow of goods dictates the state of our national economies, which makes the company a major player in macro.

- I view the company currently as fairly or even slightly undervalued in the face of what is an unprecedented logistic crisis.

- It’s a “BUY” here to me – and I view it with a target of around 21,500 DKK/share.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them:

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment