Matt_Brown/E+ via Getty Images

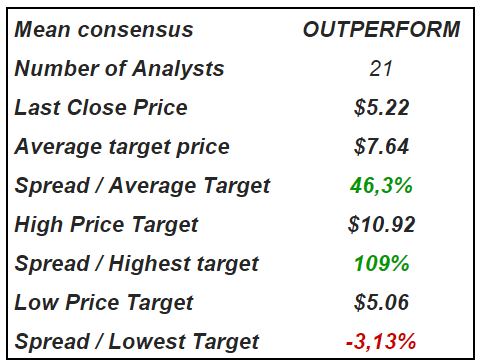

Lundin Mining Corporation (OTCPK:LUNMF) recently modified its guidance to include inflationary risks and some delayed production. That’s not beneficial, but I don’t believe that it should affect the share price the way it did. I assessed the valuation of Lundin’s flagship project Candelaria and the production from the rest of the mines. I believe that there is significant upside potential in the stock price. If the production expected for Candelaria is correct, and the other mines continue to produce without relevant delays, the stock price should reach more than $7 per share. Other analysts out there have even talked about the stock price hitting $10 per share.

Lundin Mining: Recent Guidance May Not Be Helping

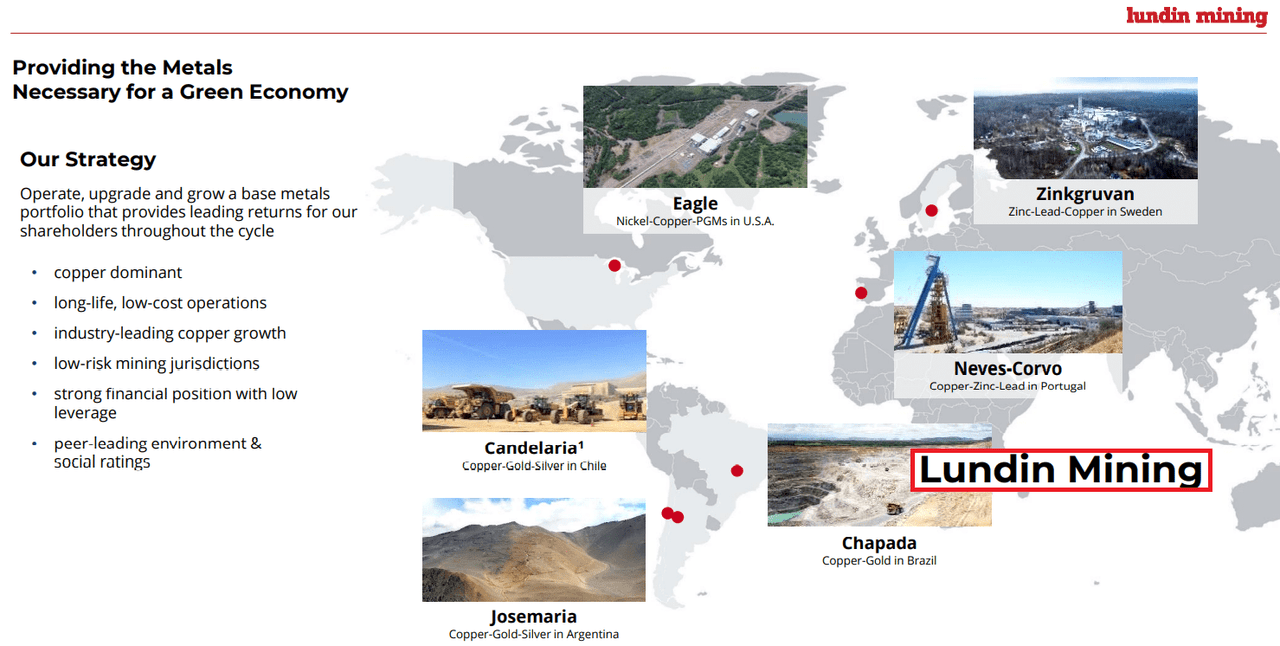

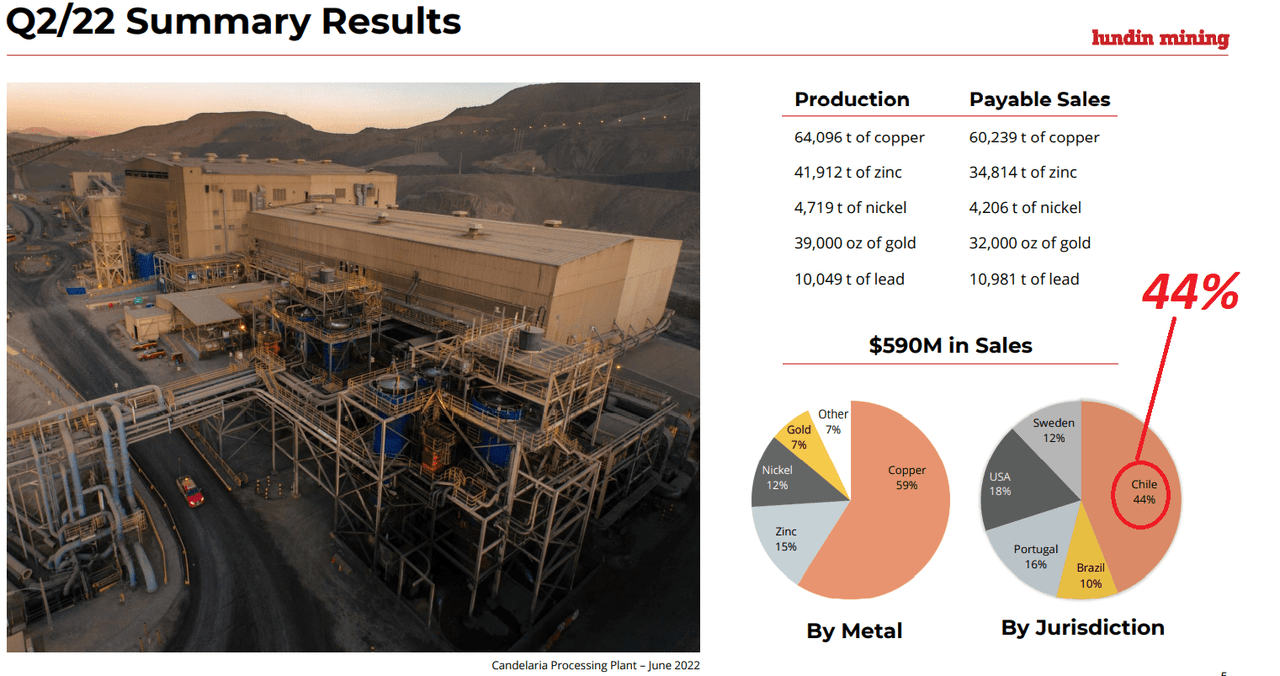

Incorporated in Canada, Lundin is a mining company with mining interests in the USA, Sweden, Portugal, Chile, Brazil, and Argentina. The company produces copper, zinc, gold, and nickel.

In my view, the company runs so many mines that traders can’t really figure out Lundin’s total valuation. In my view, the current market valuation is too small.

Presentation

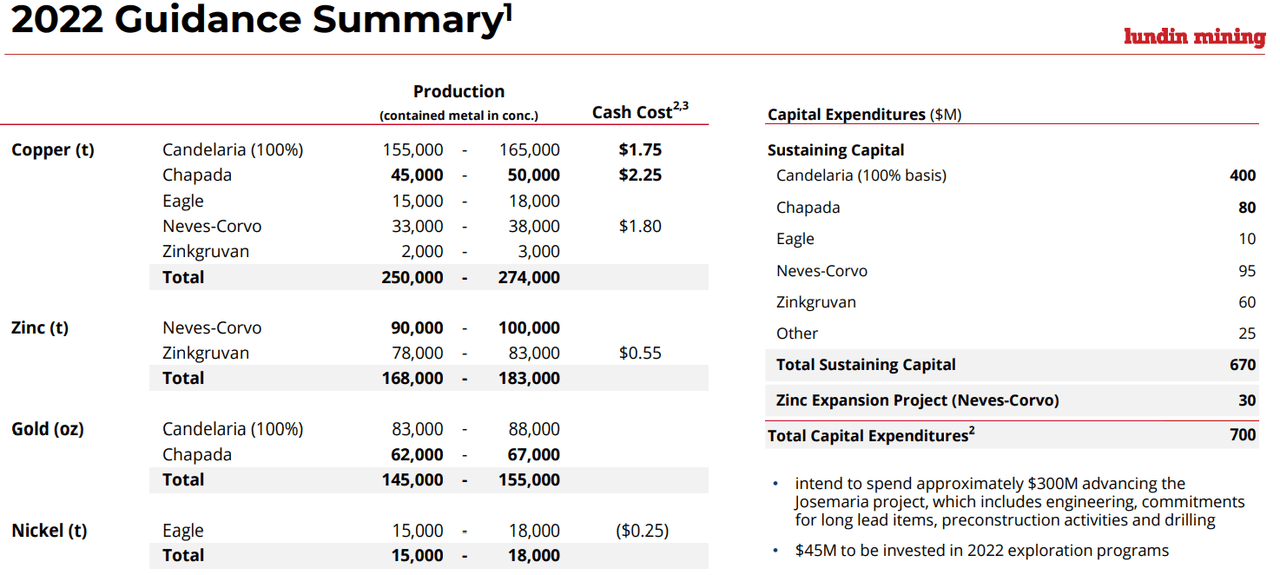

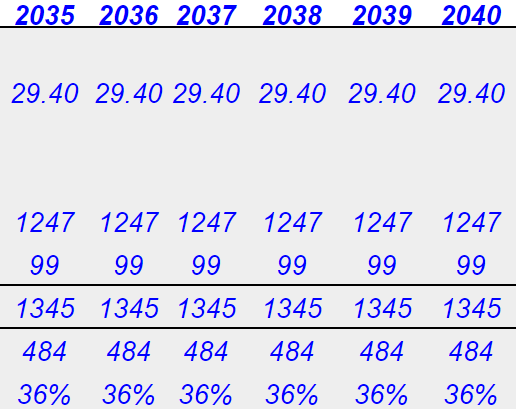

In my view, the most recent guidance given by Lundin will most likely not enhance the stock price. According to management, inflation risk and its impact on electricity and contractor costs along with supply chain problems will likely increase operating costs. For instance, Chapada production guidance was modified to reflect delayed access to planned ore types. Besides, cash cost guidance for Candelaria and Chapada was also modified to include inflationary impacts.

Cash cost may be impacted by higher costs for energy, consumables, and lower by-product credits, partially offset by favorable foreign exchange. Source: presentation – about Candelaria

Full-year capex guidance was revised to $80M, from $65M, primarily reflecting increased capitalized waste mining input costs. Source: presentation, about Chapada

Zinc production guidance reflects progress to-date and re-forecast of when full mining rates from newly developed ZEP areas are expected to be achieved. Source: presentation, about Chapada Neves-Corvo

Presentation

With that about the guidance, let’s say that investors seem to be forgetting several catalysts that may enhance production in the years to come. First, the company continues to report an increase in production in Chapada thanks to increases in the mineralized area discovered. Besides, drilling in Alcaparrosa could soon enhance mineralization in Candelaria.

Saúva mineralized area has increased to approximately 1,200 m by 950 m, from 1,000 m by 750 m, and remains open in all directions. Presentation – Words About Chapada

Alcaparrosa drilling extended mineralization to the south. Source: presentation, about Candelaria

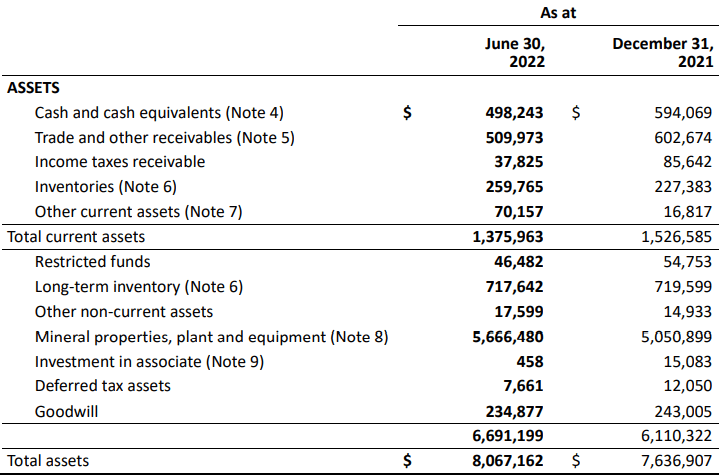

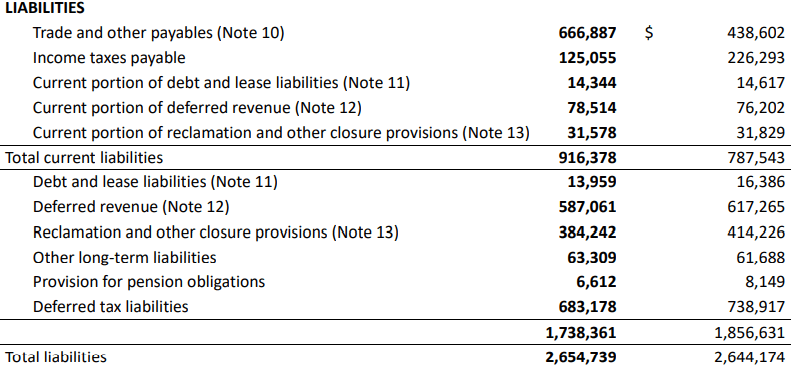

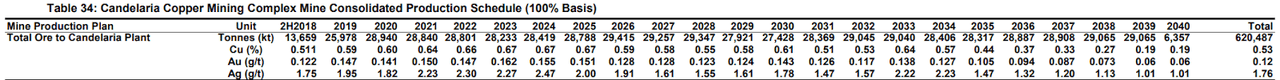

Traders Seem To Forget That With $498 Million In Cash, Lundin Is Cash Rich

As of June 30, 2022, with $498 million in cash and $8 billion in total assets, in my view, the company’s financial situation appears quite stable. If we assume a share count of 777 million, the cash per share would stand at $0.63 per share.

Quarterly Report

The company reports little debt. In my view, management would not likely obtain debt financing if directors talk to bankers. With that, the company already reports a lot of free cash flow, so debt financing may not be necessary.

Quarterly Report

In My View, Candelaria’s Net Present Value Could Stand At $5.6 Billion

The assessment of Lundin’s mines appears easy because close to 44% of the total amount of revenue comes from only one mine. The Candelaria mine, in Chile, is the largest asset owned by Lundin. If we figure out the valuation of Candelaria, we may not be far from the valuation of Lundin.

Presentation

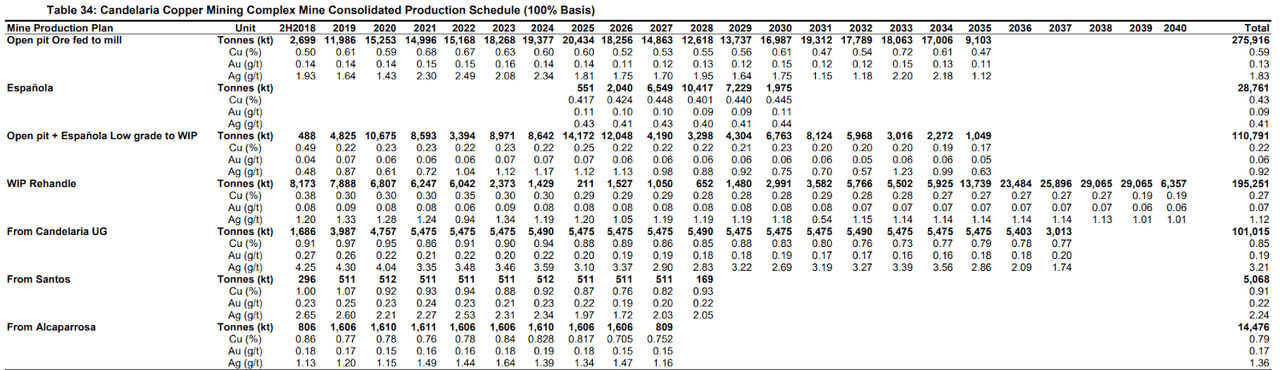

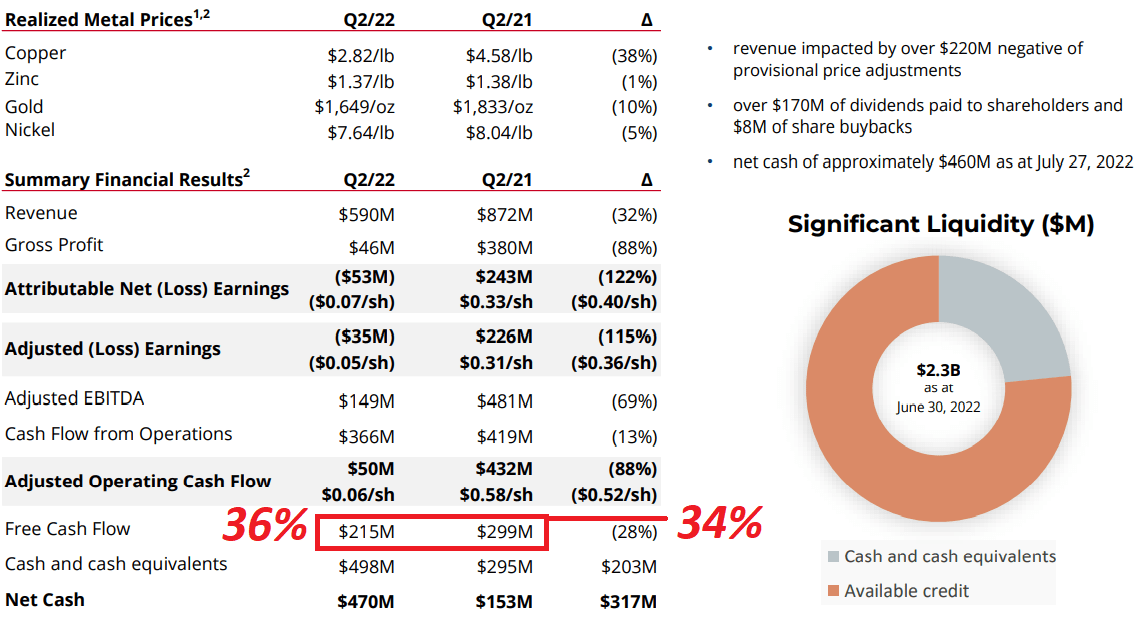

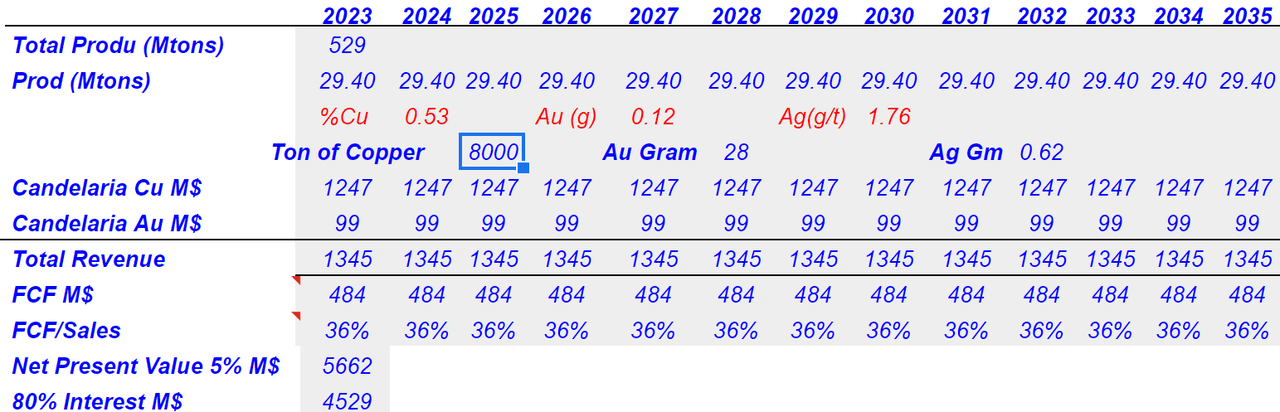

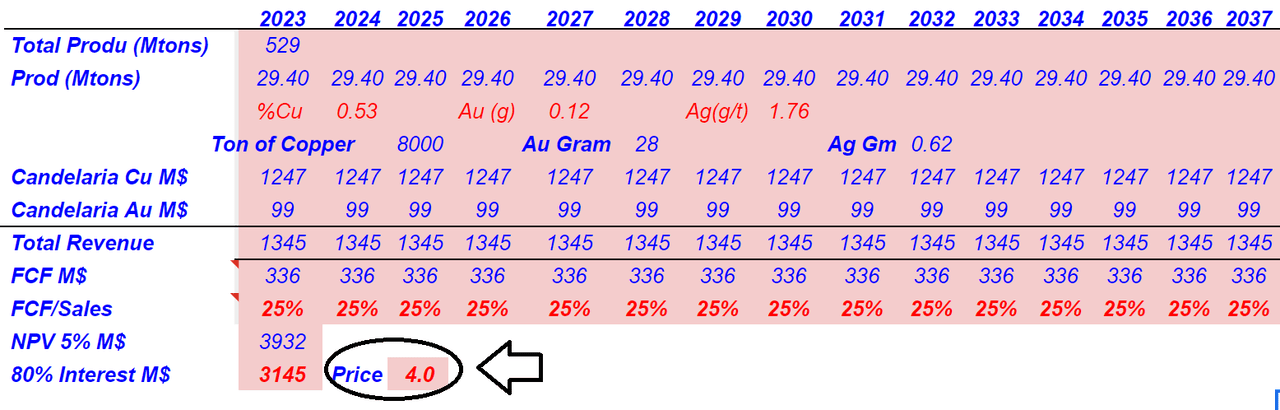

The Candelaria project produces silver, gold, and copper. However, in my view, the most relevant is the production of copper and gold. Summing all the units, in the technical report, the Candelaria plant is expected to produce close to 29 million tons of ore mineral per year until 2040. The concentration of copper would stand at 0.53%, with 0.12 grams per ton. I used these figures in my discounted cash flow model.

Technical Report Technical Report

I looked at the company’s financials to obtain financial ratios, which I could later use in my model. In the past, the company’s free cash flow/sales margin was equal to 36% and 34%. I assumed a similar ratio for the Candelaria project.

Presentation

I included production of 29.4 million tons from now until 2040, $8k per ton of copper, $28 per gram of gold, and $0.62 per gram of silver. Total revenue would stay close to $1.3 billion, and free cash flow would reach $484 million per year. The net present value of the project would stand at $5.6 billion. However, since Lundin owns 80%, I assumed that Lundin’s investment would be worth $4.52 billion. If we assume 777 million shares outstanding, the implied valuation would be $5.8 per share.

Author’s Work Author’s Work

Total Valuation Could Stand At Close To $8-$10. Other Investment Analysts Reported As Much As $10.9 Per Share

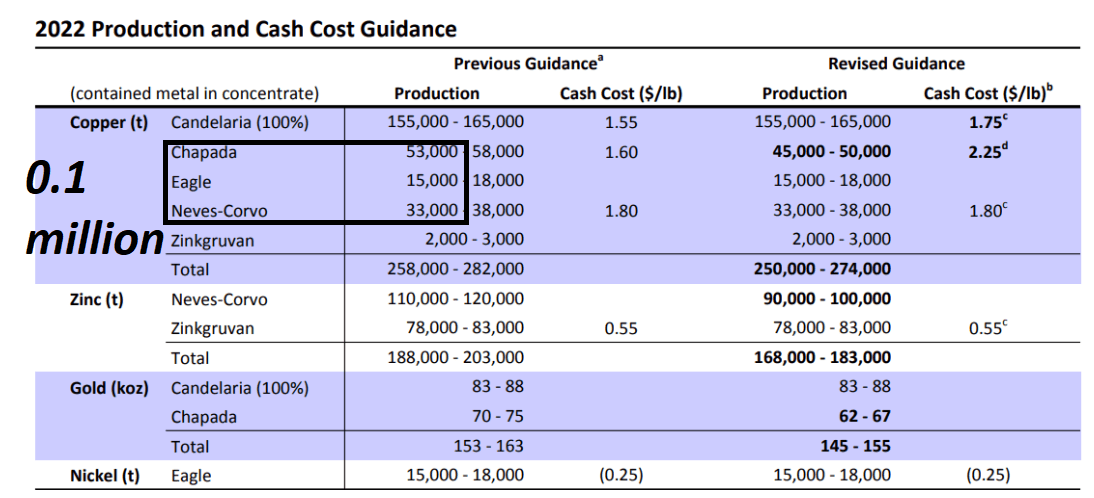

The other mines are expected to produce 0.103 million tons of copper concentrate in 2022. With my assumption of 8k per ton, remaining revenue would stand at $824 million, which is, in my view, a conservative figure.

Quarterly Report

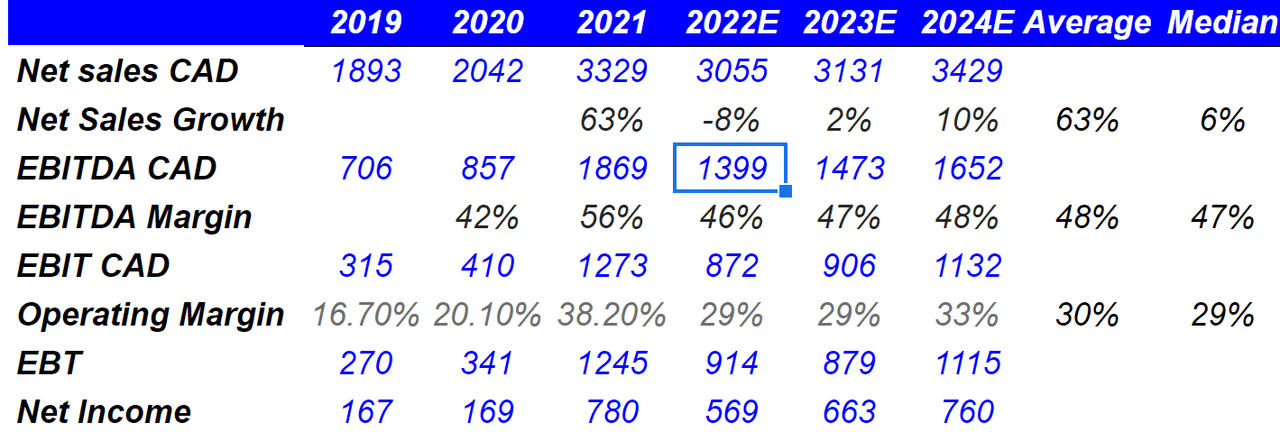

The company’s EBITDA margin stands at close to 56%. So, with revenue of $824 million, the EBITDA attributable to the production of copper from other mines would stand at close to $461 million.

marketscreener.com

The company trades at approximately 2.9x EBITDA, so I would say that $461 million would imply a valuation of $1.33 billion, or with 777 million shares, a valuation of $1.7 per share. Now, if we sum the valuation of $5.8 per share for Candelaria, my total implied valuation would be $7.5 per share.

Let’s note that I am not counting the production of zinc, nickel, or gold from the Chapada project. With all this in mind, the current market valuation appears to be a gift. The number of analysts out there noting that Lundin is quite undervalued is substantial. The average target price is $7.64 per share, and the maximum price target is $10.9 per share.

MarketScreener.com

Risk Factors From Inflation, Supply Chain, And Failed Geological Models

Consideration of the current risks from inflation is quite necessary here. Inflation could increase capital expenditures or opex, which may lead to deteriorating free cash flow margins and declining net income. In the worst case scenario, traders may notice the decline in profitability, and will likely sell their stakes. The results could create a decrease in the stock price along with an eventual increase in the cost of equity. The company’s fair price would definitely decline.

Management also warned about risks coming from supply chain disruptions. Let’s note that Lundin requires a significant number of machinery and tools to explore and develop its mining assets. If providers can’t offer these tools, or they increase their prices, the company’s free cash flow margins would decline. If equity researchers write notes about these risks and their consequences, the total valuation would also decline.

Geologists and mining engineers could also make failed projections and assumptions about the future production of copper or gold. If the geological models are not as accurate as expected, future free cash flow could be lower than expected. In the worst case scenario, the decline in profitability could be meaningful, which could lead to declines in the stock price.

Finally, I believe that Lundin could suffer from detrimental actions from governments in certain countries. Changes in regulatory frameworks and new environmental laws could damage the company’s free cash flow line. Government changes could also affect the stability of some of the company’s projects. For instance, in Brazil, perhaps there will be soon a new government in place, which may affect Chapada’s business.

I made a quick simulation about what it would mean if a decline in the FCF/Sales in Candelaria occurs. If the free cash flow margin declines from 36% to 25%, I obtained a valuation of the company’s interest in Candelaria of around $3.11 billion or $4 per share. With a FCF/Sales ratio of 36%, the implied valuation was $5.8 per share. Keeping in mind these figures, I believe that the downside risk is not that significant.

Author’s Work Author’s Work

Takeaway

With Lundin’s management modifying its guidance for some of its mines, I believe that many traders are forgetting the total valuation of the company’s assets. In my view, a quick assessment of the company’s flagship mine, Candelaria, reveals that the current market price is too low. I believe that Lundin’s 80% interest in Candelaria is worth $5.8 per share. In my view, if Lundin continues to produce copper, gold, zinc, and silver as it currently does, the total valuation would stay at more than $7 per share. There are other analysts claiming that the stock could even reach $10, but I want to remain cautious and conservative.

Be the first to comment