Robert Way

Why did the stock drop 7% post-earnings?

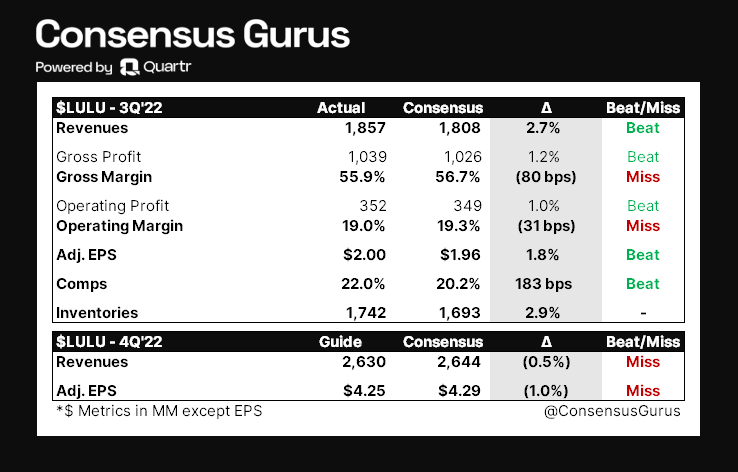

As I’ve said many times on Seeking Alpha, when a business is priced for perfection, results and guidance will have to exceed expectations just to keep the stock from falling. Lululemon Athletica Inc. (NASDAQ:LULU) reported Q3 2022 results that were mostly inline with consensus. However, it was the Q4 outlook – revenue of $2.63 billion and adj. EPS of $4.25 – that disappointed the Street. Prior to the Q3 print, Lululemon’s stock was trading at a demanding multiple of 33x NTM earnings, suggesting very little margin of error should either results or forward outlook surprise analysts’ lofty expectations to the downside.

Consensus Gurus

Granted, Lululemon’s Q3 growth was quite incredible, with total revenue of $1.86 billion (+28% YoY) that beat $1.81 billion consensus while company-store and online sales increased 28% and 31% YoY. Comps were also strong at 22% where same-store sales grew 14% and online grew 31%. China was a bright spot with easing Covid restrictions, where sales increased ~70% YoY. Supply chain issues are almost behind given factory productions are back to pre-pandemic levels, while ocean delivery times have improved from 70 days seen in Q2, leading to lower air freight expenses.

Gross margin was down from 57.2% in 3Q21 to 55.9% in 3Q22, driven by 60bps of impact from FX, 40bps from markdowns and inventory write-downs, and 30bps from fixed cost deleverage due to investments in distribution centers. Markdowns were flat against 2019. While China revenue was strong, margin contribution was below management’s expectations. Despite a YoY decline in gross margin, Q3 EBIT margin of 19% compared favorably to 17.8% in 2021.

Inventory was up 85% in Q3, and Lululemon expects a further step up in Q4 with a 60% growth YoY. This may raise some concerns over heavy discounting going forward, but management noted that 45% of inventory are core styles that carry minimal markdown risks.

In Q3, Lululemon spent $17 million on buyback and had $812 million remaining in the share repurchase program. There was $353 million of cash and no debt on the balance sheet.

Looking to 2023, management didn’t shed much light but noted continuous product innovation across all categories including yoga, run, train, tennis, golf and hike. Though likely a small revenue contributor, the Belt Bag has caught fire as of late. In April 2022, Lululemon held an Analyst Day, with an updated plan to double its revenue from $6.25 billion in 2021 to $12.5 billion in 2026. Both digital and men’s revenue are expected to double and international sales to quadruple, with China being a key source of growth that could account for >50% of international sales, or ~$2 billion by 2026. Should full year 2022 revenue come in at the midpoint of the guided $7.97 billion, this implies a 12% 4-yr revenue CAGR from 2022 to 2026.

How is Lululemon priced for perfection?

As investors ditch unprofitable names and pile into profitable growth stories like Lululemon in 2022, Lululemon’s stock has enjoyed a premium valuation all year long because there simply aren’t that many investable ideas in the retail/consumer sector. Industry stalwart Nike, Inc. (NKE) is a relatively mature player that hasn’t been able to deliver much top-line growth over the last several quarters, yet inventories continue to pile up (analysis here). adidas (OTCQX:ADDYY) has been seeing declining revenues and shrinking margins. Under Armour (UA) failed to catch the athleisure train, and revenue growth has not gone anywhere since 2017.

For analysts covering the consumer discretionary space, Lululemon is unanimously understood as the best growth story in town, and investors have recently been driving up the stock’s multiple potentially on easing inflation and China reopening. Prior to the 3Q22 print, Lululemon traded at 33x NTM earnings despite the fact that growth is expected to moderate to the low teens going forward.

For a brief history, Lululemon was both a pandemic and reopening beneficiary. When Covid took the world by storm in 2020, Lululemon’s store revenue suffered a dramatic 50% decline in 1H20, yet online sales very quickly picked up the slack with triple-digit growth as the need for casual, athleisure, stay-at-home outfits skyrocketed. In 1Q20, total revenue saw a 17% YoY decline, but growth quickly returned to positive territory in 2Q20 and was well above 20% in 2H20. Following 4 straight quarters of YoY decline in store sales, company store revenue growth jumped 70% in 2021 as Covid restrictions eased across the world and consumers demanded more of Lululemon’s clothing for outdoor activities.

Now that the world is almost back to normal, it’s safe to say that both Covid and reopening tailwinds are gone and it’s time for investors to reset their expectations. The question now becomes, what multiple does Lululemon deserve as a 12% grower? The classic “Peter Lynch” answer is 12x P/E for a PEG ratio of 1x. However, the investment landscape is vastly different today vs. the 1980’s, and I cannot remember the last time I saw a stock trading anywhere near that number. Based on the post-earnings price of $348, shares are trading at 30x forward earnings with a PEG of 2.5x. On that, I believe markets are still valuing Lululemon using past growth rates (26% 3-yr CAGR from 2019-22) without giving much scope to normalizing growth in 2023 and beyond.

What to do with LULU stock?

I suspect the majority of investors will again treat Lululemon’s post-earnings decline as a buying opportunity, not because the valuation is attractive but because there aren’t many businesses that can offer the same balance between growth and profitability in this environment. As inflation has likely peaked and the Fed will soon have to consider whether it makes sense to continue tightening, the worst part of the current rate hike cycle may be over. Investors are likely back in a situation where there’s too much money chasing too few deals.

With terminal rates potentially reaching as high as 5%, however, it’s still quite amazing how markets continue to be comfortable paying 30x earnings and 2.5x PEG for Lululemon’s stock. While that seems risky to me, some investors are understandably dealing with very dynamics driven mostly by FOMO. As a result, I’ll not be buying the dip and will need to see a material improvement in valuation (ideally <25x forward earnings) to get more constructive on Lululemon Athletica Inc. stock.

Be the first to comment