hapabapa

Electric vehicle start-up Lucid Group (NASDAQ:LCID) reported third-quarter results on Tuesday that sent shares into a tailspin on Wednesday. Shares of Lucid skidded 17% on Wednesday as the company missed profit estimates and reported a lower number of reservations. Sentiment regarding electric vehicle companies has greatly deteriorated this year due to production challenges, a problematic supply chain and high costs. However, Lucid said that it is on track to produce 6-7 thousand Lucid Air sedans in FY 2022. Although Lucid has a strong balance sheet that practically guarantees the ramp of the Lucid Air sedan, I believe it may take Lucid longer to reach critical scale and capital raises may further pressure the company’s stock price!

Lucid production and reservations

Lucid produced 2,282 electric vehicles in the third-quarter which is a significant increase over the 1,405 EVs the company produced in the first six months of FY 2022. The installed annual production capacity remained at 34 thousand electric vehicles in the third-quarter and didn’t change compared to the second-quarter.

As of 11/7/22 Lucid had more than 34 thousand reservations for its Lucid Air sedan or one of its high-spec models on its books… which was less than the 40 thousand reservations I expected. The 34 thousand reservation figure, however, does not include the 100 thousand EV order from the Kingdom of Saudi Arabia which was announced earlier this year. With 34 thousand reservations in Lucid’s system, the combined value of those reservations at the end of Q3’22 was $3.2B.

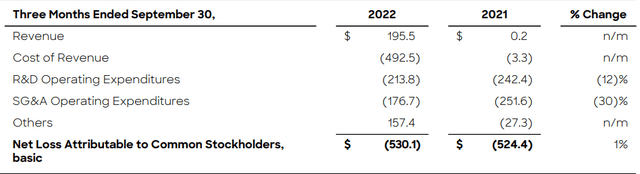

Lucid continues to lose a lot of money

Lucid generated a loss of $530.1M on revenues of $195.5M in the third-quarter. Because Lucid is still ramping up production and had still a relatively low manufacturing output in Q3’22, Lucid will need years to make a profit on its electric vehicle products.

Lucid’s free cash flow was $(859.6)M in Q3’22 compared to $(384.4)M in the year-earlier period. As long as Lucid is ramping up Lucid Air production, the EV company is set to remain free cash flow negative as well.

Balance sheet

Lucid has the second-best balance sheet in the electric vehicle industry after Rivian Automotive (RIVN). Lucid had $3.9B in available liquidity on its balance sheet at quarter-end, but the company is set to raise more cash to ensure that it can ramp up production of the Lucid Air. In a separate release, Lucid said on Tuesday that it could raise up to $1.5B in additional capital from shareholders to finance its operations. Of those $1.5B, up to $915M could come from Saudi Arabia’s sovereign wealth fund which already owns approximately 60% of Lucid. Further capital raises expose investors to dilution.

Valuation

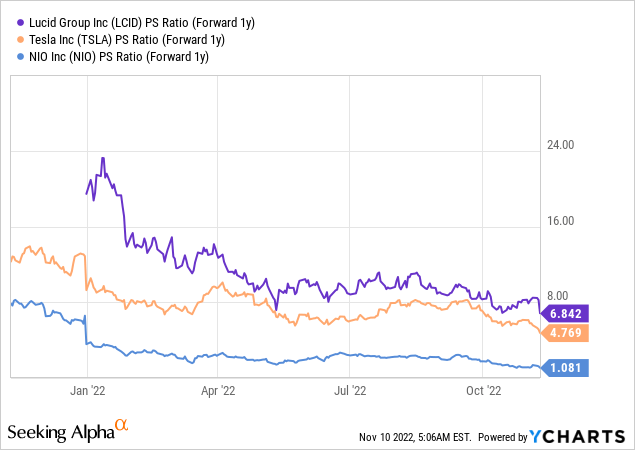

Lucid is valued based off of its potential for EV revenues and the expectation is that the company will see a strong top line increase in FY 2023 and thereafter. In FY 2023, analysts expect Lucid to grow revenues 267% to $2.74B. Based off of revenues, shares of Lucid are valued at a P-S ratio of 6.8 X which makes Lucid one of the most expensive electric vehicle companies in the market. Lucid has an even higher P-S ratio than Tesla (TSLA) which is valued at 4.8 X forward revenues.

The reason for Lucid’s high revenue-based valuation is that the company’s first-ever production car, the Lucid Air, achieves an industry-beating 520 mile travel range which is a compelling proposition for prospective buyers and investors. Additionally, Lucid occupies an attractive and under-served niche — the luxury sedan niche — in the US market which promises strong volume and market share growth going forward.

Risks with Lucid

The single biggest risk for Lucid, as I see it, is the production ramp of the Lucid Air as well as the ramp of higher-spec models that appeal to wealthier buyers. Lucid confirmed its production outlook for FY 2022, but the ramp is not going nearly as quickly as projected earlier this year. If Lucid continues to disappoint with its production ramp in FY 2023, shares of the EV company could extend their down-leg and force investors to wait longer for profits to show up on the firm’s profit and loss statement.

Final thoughts

Lucid’s third-quarter earnings sheet was not as great as I hoped it would be. Lucid’s reservation number was a big disappointment for me although the EV company did make a lot of progress throughout the third-quarter regarding its Lucid Air production ramp. Lucid also kept losing a lot of money in the third-quarter, which was sort of expected, but investors are getting more serious about demanding a clear path to profitability from electric vehicle manufacturers. With a slower than expected production ramp and dilution risks growing, shares of Lucid may remain under pressure for the foreseeable future!

Be the first to comment