hapabapa/iStock Editorial via Getty Images

Price Action Thesis

We follow up on our previous update on Lucid Group, Inc. (NASDAQ:LCID) as there have been significant developments in its price action over the past month. Notably, LCID has held its May bottom firmly, as the support zone resolutely absorbed further selling pressure in June.

In addition, we also noted that its May bear trap (significant rejection of selling momentum) on its long-term chart is underpinned by well-oversold long-term technicals. In addition, upside momentum appears to be returning on its long-term chart, which augurs well for its sustained bottom.

As a result, we are confident that LCID seems to have bottomed decisively, despite the ongoing macro headwinds. However, investors should remember that price action is forward-looking, and we believe the market has priced in Lucid’s near- and medium-term challenges accordingly.

Consequently, we revise LCID from Hold to Technical Buy, with a near-term price target (PT) of $25. It implies a potential upside of 28% (as of July 13’s close).

LCID’s May Bottom Is Held Decisively

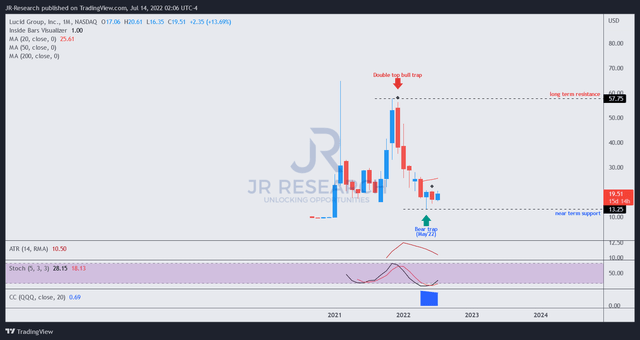

LCID price chart (monthly) (TradingView)

In price action analysis, we have learned that it’s critical to be nimble. So although we were cautious in our two previous articles on LCID, we have been awaiting a sustained bottom in LCID.

Moreover, LCID formed a validated bear trap on its long-term chart in May, as seen above. Long-term charts offer tremendous insights into a market’s expected behavior. Given their potency, we accord higher precedence to long-term charts if we observe significant price structures akin to LCID’s bear trap in May. But, given LCID’s weak fundamentals, we wanted to be cautious and watch for more constructive price action first.

Accordingly, LCID has firmly held its May bear trap over the past two months on its long-term chart. Therefore, we believe the market is sending strong signals that it does not intend to batter LCID any further, likely forming an accumulation phase.

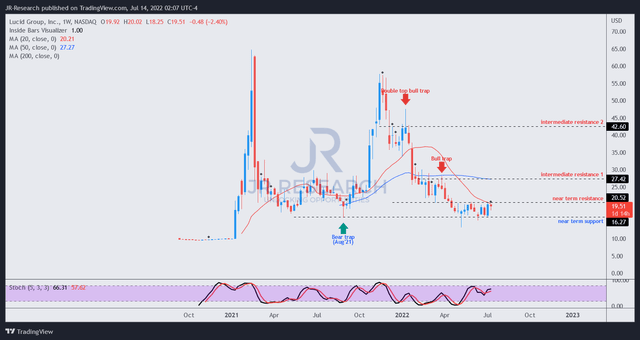

LCID price chart (weekly) (TradingView)

Moving into its medium-term chart, we can glean that LCID has been unable to regain control of its near-term resistance ($20.5). Notwithstanding, in an accumulation phase, such price structures are not surprising, as the market “quietly” accumulates to minimize the rapid run-up of its price levels.

Given its May bear trap (on its long-term chart), we are confident that its near-term support ($16.5) should likely hold firmly. Therefore, investors considering adding exposure can first wait for a short-term retracement to its near-term support. In addition, investors should note that LCID’s technicals suggest that it’s short-term overbought.

Notwithstanding, we are confident that its long-term price structure is increasingly constructive. Therefore, investors can still add exposure at the current levels and add more positions closer to its near-term support.

Is LCID Stock A Buy, Sell, Or Hold?

We revise our rating on LCID from Hold to Technical Buy. Our PT of $25 implies a potential upside of 28% (as of July 13’s close).

Note that we don’t encourage investors to hold the bag on LCID as it does not have a long-term secular uptrend yet. In addition, we believe the market remains tentative over LCID’s valuation, given its weak fundamentals and negative free cash flow (FCF) profitability.

Lucid is also not expected to turn FCF profitable through FY24 and likely needs more financing beyond FY23. It currently has $5.39B of cash and equivalents. But, it’s expected to continue burning cash rapidly as it scales. As a result, based on the revised consensus estimates, Lucid is projected to post an FCF of -$10B from FY22-24. However, we are not unduly concerned, as Lucid has a cornerstone investor in The Kingdom of Saudi Arabia.

Be the first to comment