Nilanka Sampath

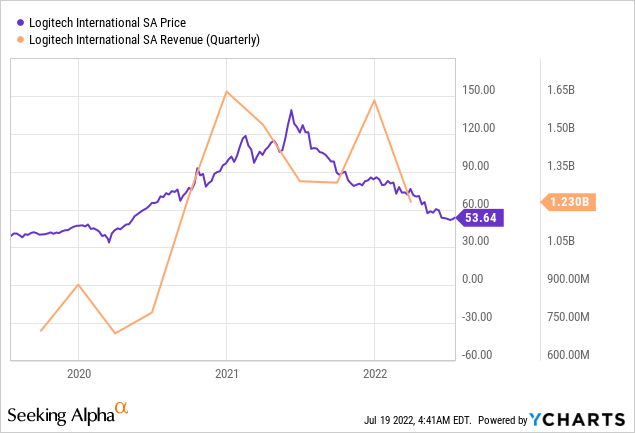

After a one-year fall of more than 50%, Logitech International S.A. (NASDAQ:LOGI), with P/E multiples trading at less than 12x seems particularly cheap for a consumer tech stock, especially given that its revenues (shown in the orange chart below) have suffered only from a 25% shortfall from the December 2020 quarter peak.

Also, this remains a profitable company and one which pays dividends too. For investors, I look for the reasons for such a drop in the share price by looking for the reasons why revenues in the fourth quarter of 2022 (Q4) lag those obtained in the same period last year by nearly 20%.

The top line and bottom line

First, the exceptionally high revenues were due to the Covid pandemic, which started impacting humanity in the first quarter of 2020. It completely altered the way we worked and entertained ourselves as whole cities and even countries went into lockdown mode.

As a result of these restriction measures, employees started working from home using more computers including keyboards, headsets, and webcams for video conferencing purposes. As for gamers and people looking for entertainment, they bought more consoles. These are the type of equipment supplied by Logitech, and, as a result of selling more of these, revenues surged. Furthermore, as shown in the above chart, the fact that sales for Q4 remain above pre-pandemic levels suggests that Logitech’s products have shown a large degree of resilience amid changing market conditions.

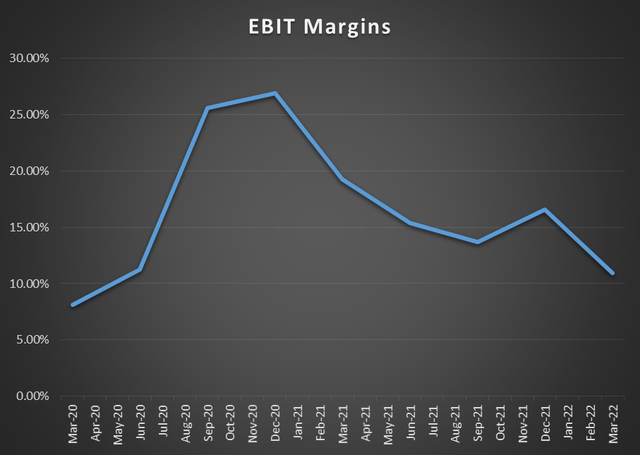

Pursuing further, Covid sales also resulted in a surge in operating profits, resulting in EBIT (earnings before interest and tax) margins peaking in December 2020 as shown in the chart below. Subsequently, these started to fall, but, at 10.9% in Q4, these remain higher than the 8.1% before the pandemic started.

Table built using data from (www.seekingalpha.com)

Looking at the reasons for the reduction of profitability from the second half of 2021 despite no abrupt drop in revenues, I noticed that the issue was related more to a fall in gross margins. Investigating further, these were due to the rising cost of revenues as a result of supply chain disruptions. In this respect, supply tightness signifies higher costs of transport and sourcing raw materials, and for Logitech, they also resulted in a significant rise in inventories as the company stocked more items to mitigate against potential disruptions.

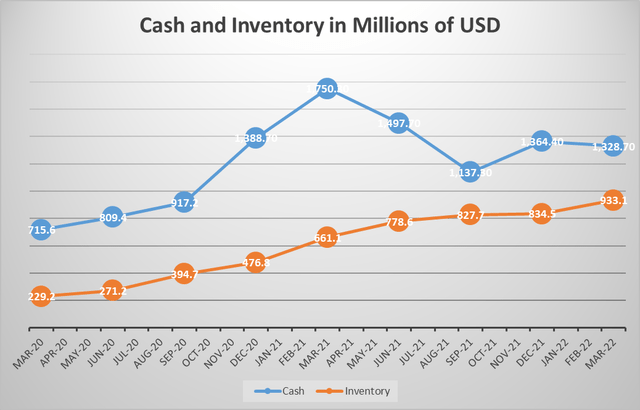

However, part of these higher inventories was also caused by demand forecasts for some of the company’s products not being converted into sales as expected. Now, this can play in favor of Logitech’s operating cash flow if demand picks up, especially in the event that competitors who are also impacted by component shortages may not necessarily be able to produce computer accessories or gaming consoles. In such a case, with its distribution centers and manufacturing sites holding three times the pre-pandemic capacity as shown in the orange chart below, the company could potentially produce more rapidly and increment sales faster than the competition.

The risks

On the other hand, if the above prediction does not materialize, and the company is not able to reduce its inventory in time, its cash position which has decreased both on a sequential and year-to-year basis, as shown in the blue chart below, will continue to deteriorate.

Table built using data from (www.seekingalpha.com)

In a worst-case scenario whereby there is demand destruction due to a significant slowdown in the economy, these inventory levels may prove unsustainable, and the company could have to liquidate these at a discount.

However, the management is not too concerned about the high inventory, which is expected to last till the end of the year. Thus, in the words of the CFO, “I like our position with the inventory. I think it’s a good use of the balance sheet”.

The CFO’s enthusiasm can possibly be explained by the fact that his company carries only $41.9 million of debt against total cash and equivalents of $1.33 billion. Also, with quarterly operating expenses averaging $373 million for the last four quarters and capital expenses of around $25.3 million in Q4-2022, Logitech has sufficient cash to maintain the higher inventories for the rest of this year. Conversely, do expect working capital to come down in the second half of 2022, below the $50.5 million reported in the last quarter.

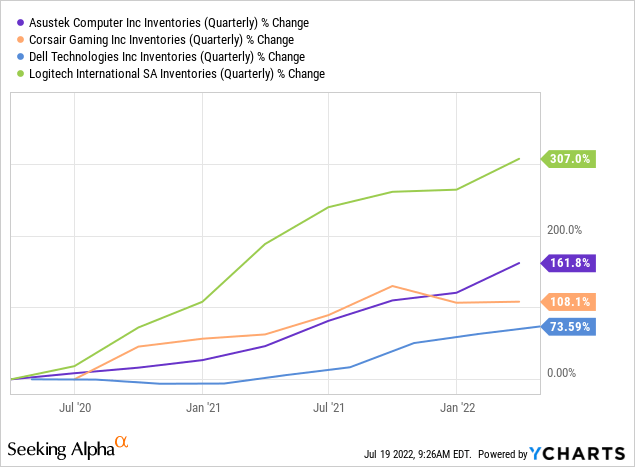

Looking for an industry-level comparison, competitors have also seen their quarterly stock levels rising as shown in the charts below, but Logitech’s inventory as depicted in green in the chart below is much higher than ASUSTeK Computer (OTC:OTCPK:ASUUY) and others.

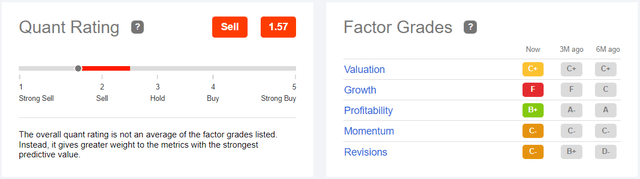

Consequently, with so many items lying idle in the inventory instead of being sold, it is no wonder why the company’s growth has suffered, so much so, that it has been allocated an F grade by SA’s grading system. Additionally, it is flagged with a risk of performing badly as the stock comes with “decelerating momentum”, which is historically associated with poor performance. Hence, Logitech inherits a Sell rating from the Quant rating system, as shown in the table below.

Quant ratings and Factor Grades (www.seekingalpha.com)

However, the table also shows that the company scores a B+ for profitability, a key metric which I further discuss below.

Discussion

Coming back to the inventory, according to the executives, part of the items also consists of components that have been bought ahead of cost increases. Now, going ahead, this signifies that Logitech will incur fewer costs in manufacturing, which will, in turn, lead to higher gross profit margins when the items are sold.

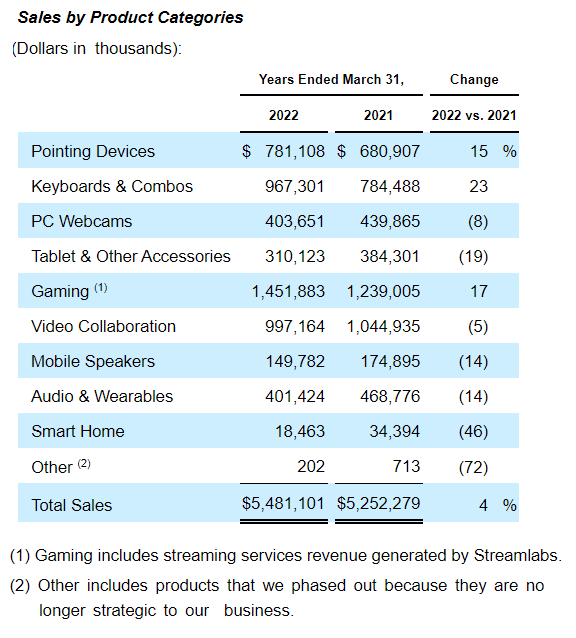

Furthermore, the other part of the inventory consists of finished products which can be readily exchanged for cash once supply conditions ease with wholesalers no longer required to incur higher freight charges. Now, in addition to revenues, the company should also benefit from better profits in case it increases pricing in a supply-constrained environment for competitors. For this purpose, Logitech can rely on a well-diversified revenue base encompassing gaming, video collaboration, etc., as shown in the table below.

SEC filings with Segmental revenues for Q4-2022 (www.seekingalpha.com)

However, do not expect increased profitability in the near term as higher air freight charges due to Covid-induced supply disruptions in China and unfavorable currency rates should keep costs on the high side and pressure cash flow from operations.

Valuations and key takeaways

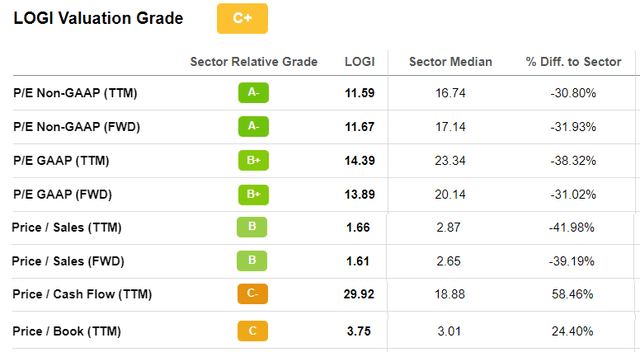

Therefore, unless there is a favorable corporate update, do expect further volatility when the first quarter of 2023 financial results are announced at the beginning of August. Now, thanks to the downside, the stock is now undervalued with respect to the IT sector median by at least 30% when considering the price-to-earnings and price-to-sales metrics.

However, there is another important metric in the form of the trailing price-to-operating cash flow which merits further attention. The fact that it is shaded in orange in the table below indicates overvaluation, by 58%. While some may look at P/E as I mentioned in the introduction, the cash flow metric is key due to the Fed tightening monetary policy to combat high inflation. To this end, in a market where the value strategy prevails, analysts are more likely to focus on cash in the second half of the year, in addition to profitability.

Valuations (www.seekingalpha.com)

Hence, unless you have a long-term investment horizon, it is better to wait for clear signs of improvement in operating cash flow which is down by more than 80% on a year-on-year basis. Given the current high inventory level, an improvement should only happen towards the end of the year.

Hence, summing up, much of Logitech’s cash is currently lying idle, but, from the profitability perspective, stocking up components is not a bad idea when prices keep on going up amid the supply crunch, especially when the cash position permits such a move. Along the same lines, having plenty of finished products ready to be shipped while competitors struggle to meet production targets is another positive. As for demand, with the Americas representing about 42% of total sales and the Consumer Technology Association expecting the U.S. market to progress by 2.8% in 2022 compared to 2021, chances for the company’s products not to find buyers are slim.

Finally, it would be tempting to buy the stock at these levels, but, in these highly uncertain times, better wait for clear signs of operating cash being unlocked from inventories before investing.

Be the first to comment