Apriori1

More often than not, the best investment opportunities involve companies that operate in a space that is heavily out of favor with the broader market. Right now, there are a number of industries that are out of favor because of broader economic concerns. But perhaps few are as unpopular today as the automotive retail space. One company that operates here that most certainly warrants some attention is Lithia Motors (NYSE:LAD), an enterprise that owns and/or operates somewhere around 300 locations representing 40 brands in no fewer than 26 States and three Canadian provinces. Management has been tremendously successful in growing the company’s top and bottom lines. Although its cash flow data has been somewhat mixed this year, the overall trajectory for the company is robust. On top of this, shares are priced so low that it is difficult to imagine a scenario where the company could be overvalued. Because of these factors, I have decided to rate the enterprise a solid ‘buy’ to reflect my opinion that shares should outperform the broader market for the foreseeable future.

A disappointing ride despite great results

Since initially finding out about Lithia Motors back in late 2020, I’ve written a handful of articles about the company. I continue to find the enterprise to be an interesting prospect that offers meaningful upside. In my most recent article on the company, published October 1st of this year, I discussed how the prior few months had been rather difficult for shareholders because of the impact that fears regarding fundamental weakness in the automotive retail space had on the company’s share price. Even though the broader market was concerned about the company’s prospects, the fundamental picture had been really attractive. This led me to keep the ’buy’ rating I had on its stock previously. Unfortunately, since then, the market has continued to underappreciate the enterprise. While the S&P 500 is up 9%, shares of Lithia Motors have generated upside of only 0.8%.

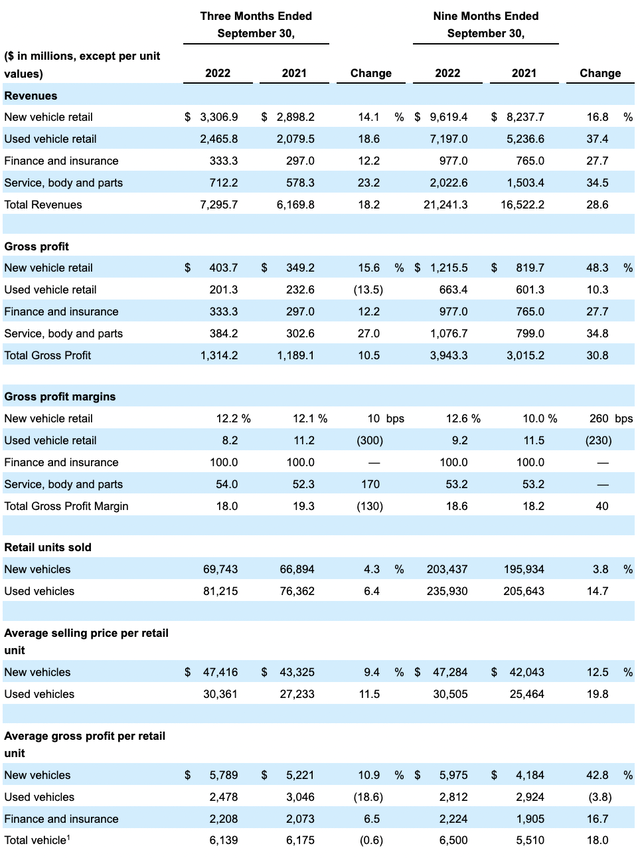

You would think, based on this return disparity, that the fundamental performance of the company was suffering. But that couldn’t be further from the truth. To see what I mean, we need only look at financial data covering the third quarter of the company’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the business. During that time, sales totaled $7.30 billion. That’s 18.2% higher than the $6.17 billion the company generated only one year earlier. Beyond any doubt, some of this growth came as a result of the number of dealerships the company had in operation climbing from 277 to 291 year over year. But in addition to that, the company also benefited from strong pricing and an overall rise in the number of vehicles sold.

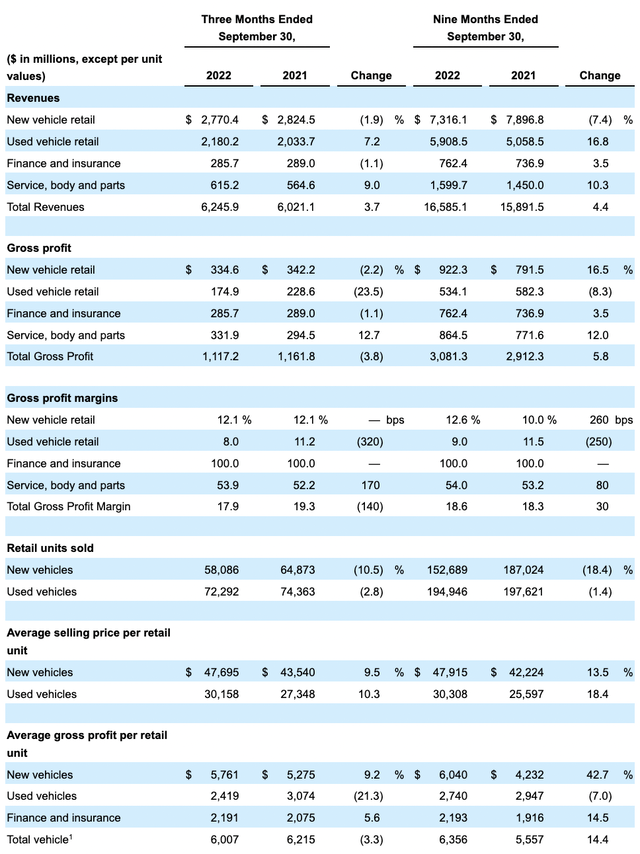

Lithia Motors – Same Location Results

On an aggregate basis, the number of units sold rose from 66,894 to 69,743 for the new vehicles. For used vehicles, it increased from 76,362 to 81,215. It is worth mentioning, however, that on a same-store basis the company experienced some weakness. The number of new vehicles dropped from 64,873 to 58,086, while the number of used ones declined from 74,363 to 72,292. For the company as a whole though, pricing for the units sold improved nicely. The business went from generating $43,325 in revenue per new vehicle in the third quarter of last year to $47,416 this year. For used vehicles, pricing jumped from $27,233 to $30,361. The company also benefited from improvements in its finance and insurance operations, with revenue jumping from $297 million to $333.3 million, while the service, body, and parts, parts of the company jumped from $578.3 million to $712.2 million.

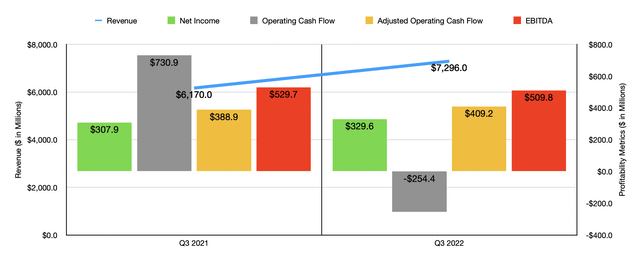

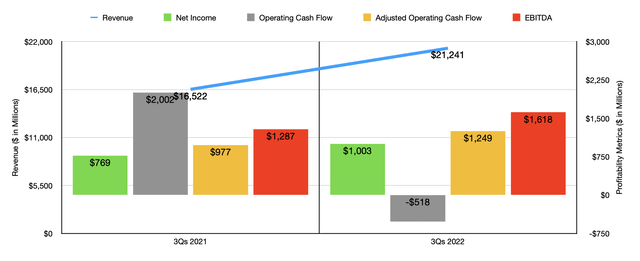

Thanks to these strong results, the company’s bottom line has also improved. Net income went from $307.9 million in the third quarter of 2021 to $329.6 million the same time this year. Operating cash flow, on the other hand, dropped from $730.9 million to negative $254.4 million. But if we adjust for changes in working capital, it would have risen slightly from $388.9 million to $409.2 million. The only other profitability metric for the company that worsened year over year was EBITDA, which dropped from $529.7 million to $509.8 million. As you can see in the chart above, the results experienced during the third quarter of this year look very similar in terms of trend to how the company has performed for the first nine months of the year relative to the same time last year as a whole. Revenue is up, while profits and cash flows have largely followed suit.

Despite broader economic concerns, the management team at Lithia Motors is dedicated to continued growth by means of acquisition. Just as a sample, in late September, management announced that they had acquired 5 stores in Wisconsin. Alone, these locations to generate $625 million in annualized revenue. At the same time, the company’s Driveway Finance Corporation completed its second issuance of securities backed by its originated auto loan portfolio, a move that raised $298 million that can be used to fund further growth. And on top of that, Driveway launched its own customer relationship management and workflow platform to serve customers by helping them to efficiently buy, finance, sell, and service their vehicles from the comfort of their homes.

This was neither the only acquisition nor the most recent acquisition the company made. In late October, the company announced it acquired Airstream Adventures, the largest Airstream dealer group in the country for the iconic ‘silver bullet’ travel trailer. This move marked the company’s entry into the North American luxury recreation vehicle market. In late November, the company announced that it expanded its footprint in Texas with the purchase of some additional assets that should generate $200 million or more in annualized revenue for the company. As of that date, the company’s purchases in 2022 had added over $3.3 billion to the company’s top line. This was followed up on December 6th by the company’s expansion into Colorado with the purchase of Ferrari of Denver, its first Ferrari store, and the move that should generate an additional $75 million in annualized revenue for the business. All while making these purchases, management is also dedicated to rewarding shareholders in other ways. On the first of this year, for instance, the company announced that it was increasing its share buyback program by $450 million, bringing its current share authorization up to $50 million. This comes after the company, through November 1st of this year, bought back 2.4 million shares of stock for $662.4 million in total.

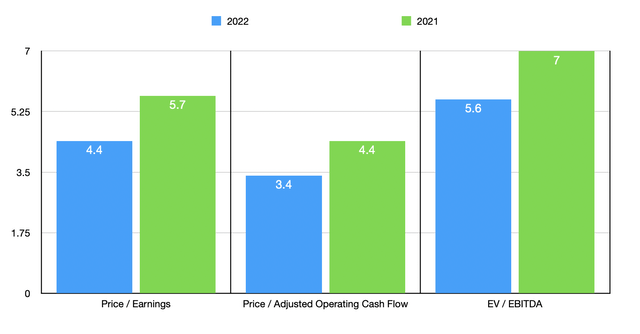

We don’t really know what to expect for the rest of the 2022 fiscal year. But if we simply annualize results experienced so far, we would anticipate net income of $1.38 billion, adjusted operating cash flow of $1.77 billion, and EBITDA of $2.30 billion. Based on these numbers, the company would be trading at a forward price to earnings multiple of 4.4, a forward price to adjusted operating cash flow multiple of 3.4, and a forward EV to EBITDA multiple of 5.6. Using the data from 2021 instead would give us multiples of 5.7, 4.4, and 7, respectively. As part of my analysis, I also compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 4.7 to a high of 6.8. In this case, Lithia Motors was the cheapest of the group. Using the price to operating cash flow approach, the range was from 3.1 to 8.2, with only one of the five companies being cheaper than it. And finally, using the EV to EBITDA approach, the range was from 4.6 to 6.2. In this case, only two of the five companies were cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Lithia Motors | 4.4 | 3.4 | 5.6 |

| Penske Automotive Group (PAG) | 6.8 | 8.2 | 6.2 |

| Sonic Automotive (SAH) | 5.7 | 3.1 | 6.0 |

| Asbury Automotive Group (ABG) | 5.2 | 4.7 | 5.7 |

| Group 1 Automotive (GPI) | 4.7 | 4.6 | 4.7 |

| AutoNation (AN) | 4.8 | 4.7 | 4.6 |

Takeaway

Based on all the data available, I do believe that Lithia Motors remains a solid opportunity for investors to consider. Yes, the company is experiencing some weakness on a same-store basis because higher prices, combined with higher interest rates, have turned customers away from buying additional vehicles. But pricing remains robust and shares are trading at remarkably low levels. It’s not unthinkable that the company could experience a nice bit of upside in the long run, especially if you believe that economic conditions will improve sooner rather than later. Because of these factors, I’ve decided to keep the ‘buy’ rating I had on the stock previously.

Be the first to comment