jazz42/iStock via Getty Images

Let us hope that yesterday set the tone for how the market responds to earnings for the first quarter, as stocks rose across the board on what were generally better-than-expected numbers. Delta Airlines (DAL) forecast a return to profitability in the second quarter on what CEO Ed Bastian said were the company’s “highest bookings in our history” over the past five weeks. That put wind in the sails of the consumer discretionary sector, which led all sectors with a gain of 2.5%. The technology sector also got a boost, as long-term interest rates declined. Financials did not fare as well on disappointing earnings from JPMorgan (JPM), but that was largely due to one-time losses related to market volatility caused by the Russia-Ukraine war. More importantly, loans grew, net interest margins expanded, and the company announced a $30 billion stock buyback. The financial sector should rebound as recession fears fade and the yield curve starts to steepen again.

finviz

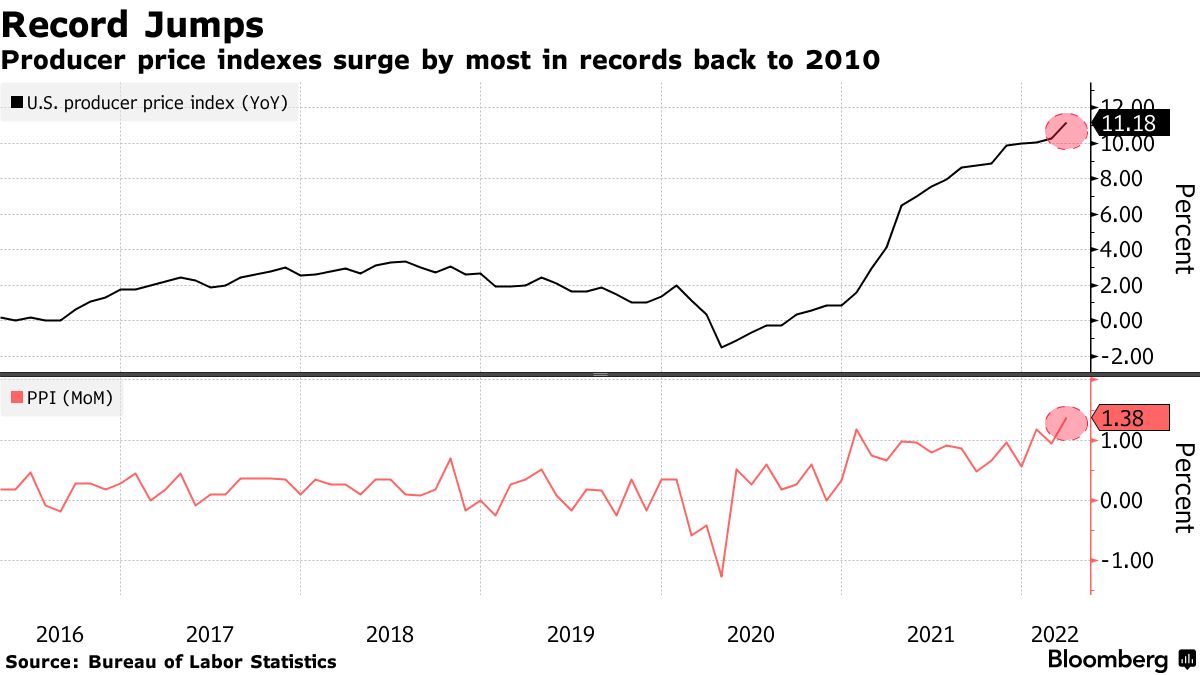

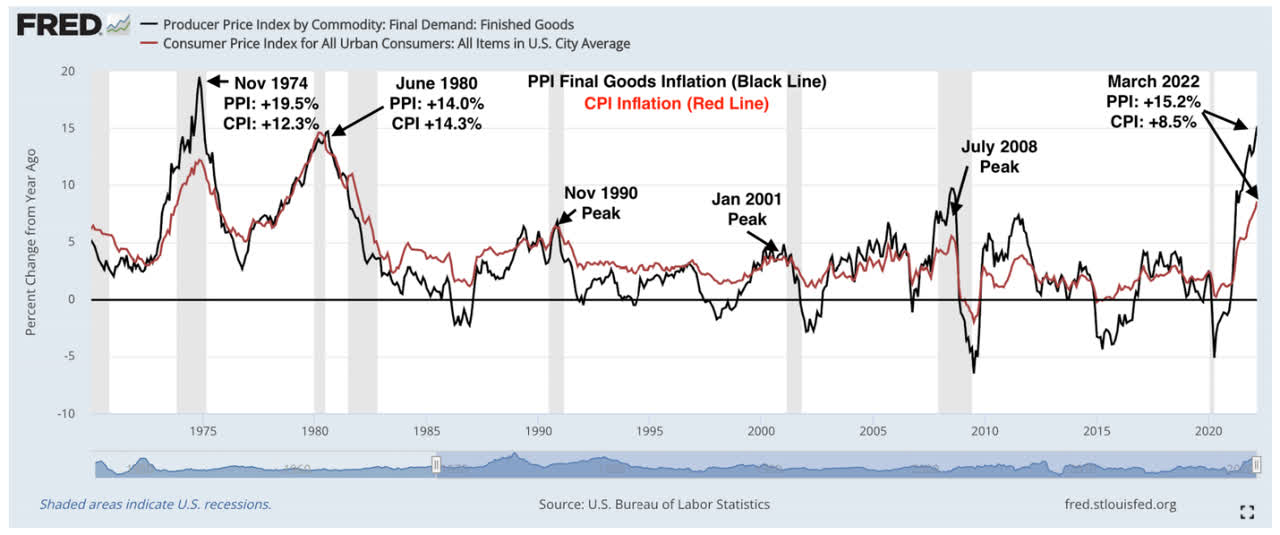

Yesterday’s market performance was all the more impressive given that the Produce Price Index (PPI) report showed an astounding 11.2% increase over the past year. That is the highest rate since the Labor Department reconstituted the index in 2010, otherwise the number would have been 15.2%. It is assumed that higher prices paid by producers are a form of early-stage inflation that will be passed along to consumers down the road, which would mean we have yet to see the peak in the Consumer Price Index, but that is not accurate.

Bloomberg

The research team at DataTrek point out that the Producer Price Index tends to peak at the same time as the Consumer Price Index in data going back to 1970, which is perhaps why stocks rallied yesterday. The market senses, as do I, that this is the peak in both.

DataTrek

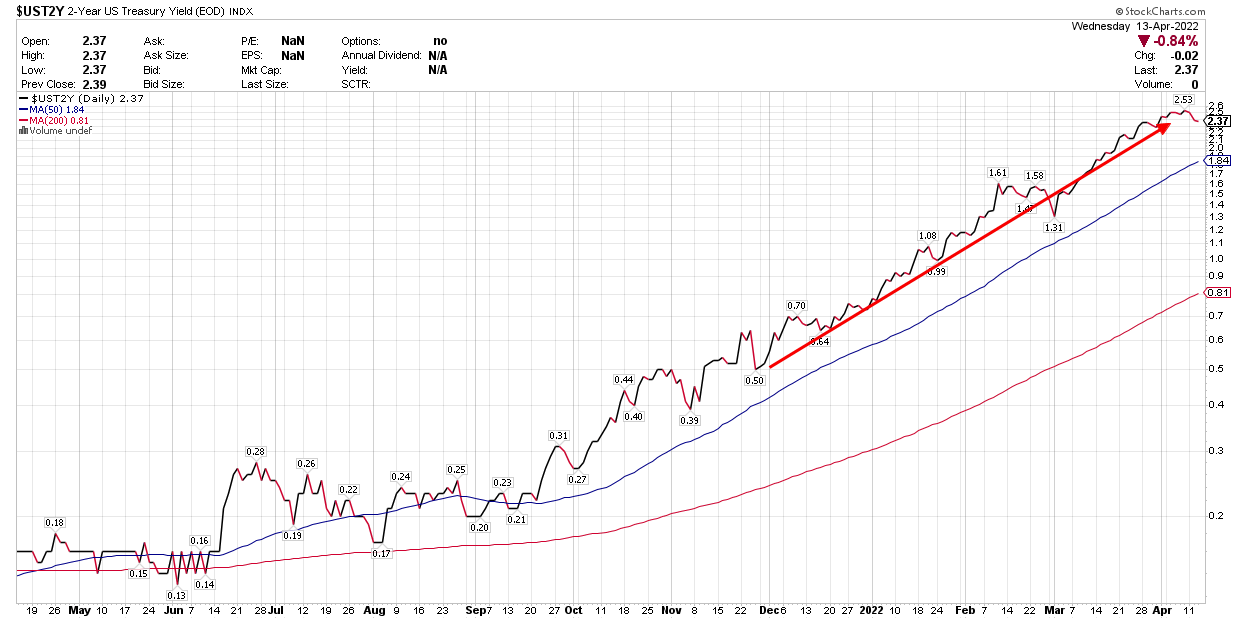

Additionally, short-term rates, as measured by the 2-year Treasury yield, dropped yesterday. The 2-year yield is a proxy for where investors see the Fed’s policy rate headed in the near term. After soaring from 0.50% at the beginning of the year to 2.53%, it has pulled back 20 basis points to 2.37%. This suggests that investors may have been too aggressive in their expectations for monetary policy tightening. A leveling off of this rate or a decline would be bullish for risk assets.

StockCharts

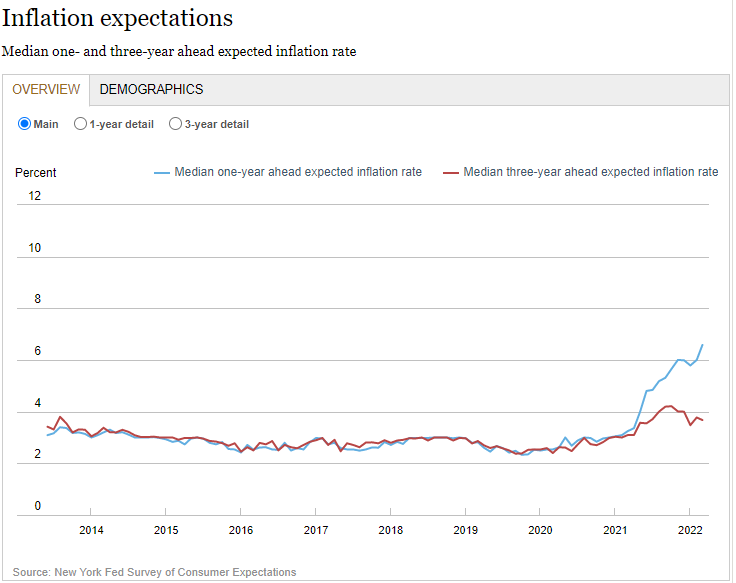

It is also notable that the New York Fed’s most recent survey of consumer expectations showed the median one-year inflation expectation rose again in March to 6.6%, but that the three-year expectation ticked down from the peak of 4.2% last fall to 3.7% today. That is good news for the Fed because it suggests that expectations for a continuation of rising prices has not become anchored, assuaging the Fed’s greatest fear.

New York Fed

In my opinion, this is what separates the bulls from the bears today. Bears are focusing on lagging indicators that tell us more about where we have been than where we are going, while bulls are focusing on leading ones that give us a better idea of where we are headed. Markets are leading indicators, as they tend to discount future events. The bond market has already tightened financial conditions significantly since January, discounting a full year of interest rate increases by the Fed, and lifting mortgage rates some 200 basis points. The stock market has responded with a 13% correction in the S&P 500, as well as bear market declines in the Nasdaq Composite and Russell 2000, which have discounted higher long-term interest rates and slower rates of economic and earnings growth.

If we start to see more meaningful positive rates of change in inflation, inflation expectations, and interest rates, then risk assets should respond positively. A great deal hinges on earnings reports and how corporate managements are navigating what has been an extraordinarily difficult macroeconomic environment. I remain optimistic.

Be the first to comment