Melpomenem/iStock via Getty Images

By Jack Fischer

The Lipper High Yield Funds classification, by definition, consists of funds that aim at high current yield from domestic fixed income securities. The classification has no maturity restriction and primarily consists of funds that hold greater than 50% of below investment grade debt. With about 527 funds and $292.2 billion in assets at the end of the first quarter, Lipper High Yield Funds is the second-largest classification of all General Domestic Taxable Fixed Income classifications.

Performance-wise, Lipper High Yield Funds have realized strong gains on a trailing five-(+3.66%) and three-(+2.64%) year basis. Fixed income funds across the board have taken a hit so far this year, and high yield funds were no different, posting a negative 5.63% year-to-date as of April 14, 2022. Week-to-date, Lipper High Yield Funds realized a negative 0.61% return, finishing third-highest under General Domestic Taxable Fixed Income Funds-behind Lipper Specialty Fixed-Income Funds and Lipper Loan Participation Funds (-0.06%).

Flow-wise, fixed income classifications both taxable and tax-exempt have observed massive outflows. Taxable fixed-income funds reported $9.5 billion in outflows for the fund-flows week ended April 13, marking their eighth week of outflows in the last 10. Tax-exempt funds have been arguably worse, witnessing $4.1 billion in outflows, which is their ninth straight week of net outflows.

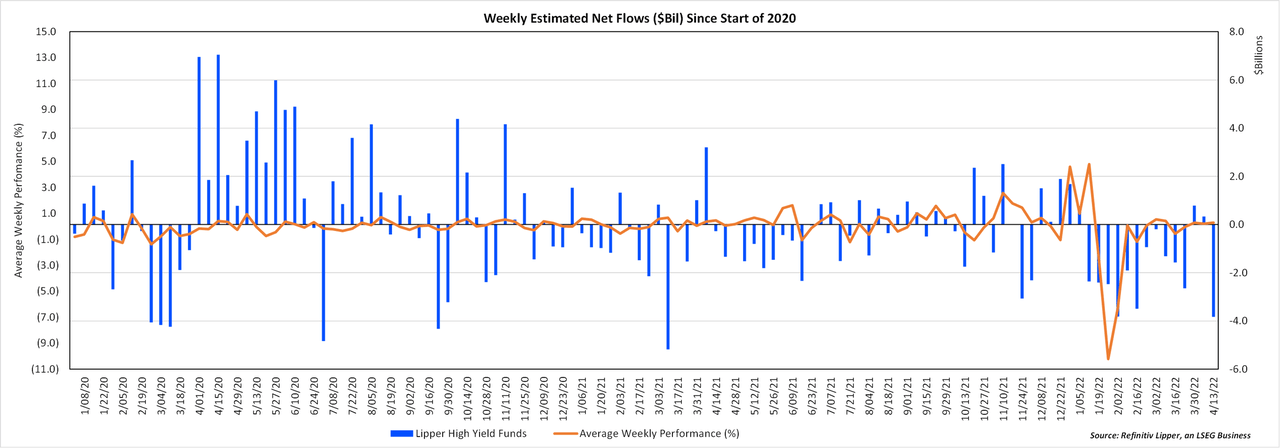

Lipper High Yield Funds suffered $3.8 billion in outflows this past fund-flows week, its sixteenth largest weekly outflow on record-$2.7 billion of the outflows came from ETFs versus the $1.2 billion from conventional mutual funds. This classification has been bleeding since the start of the year, reporting 12 weekly outflows over the past 14 weeks. All but two of those outflows were greater than $1.3 billion. Lipper High Yield Funds set a record quarterly outflow in Q1, seeing $25.3 billion leave the funds within the classification-a significant trend reversal from 2020 when the classification logged record inflows over the 12 months (+$46.5 billion).

Investors have been shifting their focus to commodities and shorter-duration funds to combat inflation and the rising rate cycle since the beginning of the year. While high yield bonds tend to have a shorter duration and are less sensitive to hikes in rates, investors appear to be more concerned with the credit risk component which comes more into the limelight during recessionary periods. Strategists at Bank of America just came out and stated that the Federal Reserve’s actions to combat rising inflation will lead the country toward an economic recession. Their forecast also includes policymakers increasing interest rates in each of the six remaining meetings this year. Bank of America becomes the second big bank to suggest an oncoming recession, following Deutsche Bank this past Tuesday. If economic growth stagnates, we will more than likely see continued outflows from this classification.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment