kali9/E+ via Getty Images

Intro

Lincoln Educational Services Corporation (NASDAQ:LINC) is expected to announce its fiscal third-quarter earnings numbers next week where the bottom-line GAAP estimate comes in at $0.11 per share on estimated sales of just under $89 million. We wrote about LINC back in June when we issued a buy signal on the stock. Our bullish stance was based on a bullish technical formation and growing top-line sales buoyed by an increasing student headcount at the company. This is due to bullish fundamentals where we foresee demand (both from students & corporates alike) continuing for some time to come.

To meet this demand, management has undergone initiatives to free up cash on the balance sheet. Suffice it to say, when we combined the growth curve in LINC with the attractive valuation on offer, it was evident that shares had limited downside risk at the time as sustained investment back into the company could continue to be realized. In saying this, shares are only up approximately 3% since we penned that piece over four months ago so opportunity definitely remains abound in this play. Therefore, let´s delve into the company´s fundamentals and associated trends to see if we can gain some insights on how the company´s pending Q3 numbers will fare out.

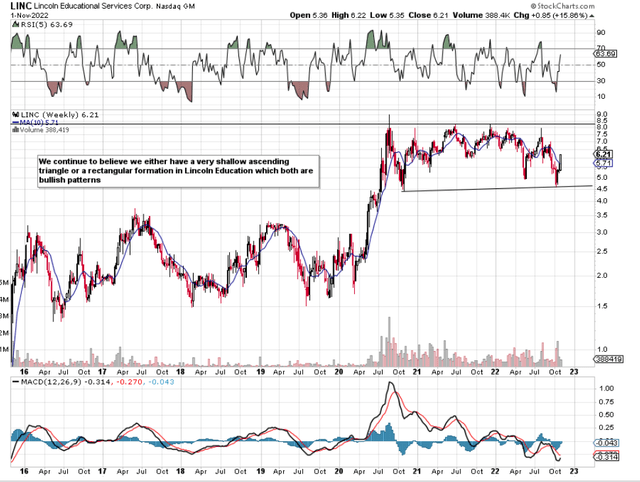

Lincoln Education Technical Chart (Stockcharts.com)

Student Starts

From a core short-term perspective, due to the heavy overhead resistance on the technical chart, shares of Lincoln will most likely remain in the triangle depicted above for the foreseeable future ($8 resistance level) but this should not put investors off. We state this because earnings growth is the predominant trend that drives stocks higher and from Lincoln´s standpoint, that strong bottom-line growth has not arrived for the company yet. Although enrollment levels remain very strong, the growth of “Student Starts” at Lincoln is not buoyant at the moment probably because of a few external trends. For one, the low unemployment rate gives students other options and then you have higher costs overall (Both on the transportation side as well as on the funded side if indeed credit is needed). However, the above trends will not work in unison because if interest rates continue to trend higher, unemployment rates (Which will help Lincoln) will begin to creep up over time. Apart from external conditions, however, management is banking on sustained growth as we see below.

Multiple New Campus To Come On Stream

Management announced an additional campus in Atlanta in July of this year and we expect this trend to continue across more metropolitan areas. The reason being is that demand areas such as air conditioning, automotive & welding to name but a few are crying out for qualified workers of which there is a clear lack at present. These campuses will entail the new blended curriculum which is the future model for the company. Lincoln looks set to benefit significantly from this initiative as the enriched student experience will lead to a higher percentage of students graduating over time while operating costs will also be lower compared to the existing model. Suffice it to say, it is all about getting that new student started. Therefore, with the flexibility that the new model offers from an online/classroom perspective as well as the improved financial aid setup, management is convinced this model can be thoroughly scaled up in time.

Long Term View

Therefore, the present unemployment picture as well as the one-off costs associated with the transition to the new blended model may have depressed earnings to an extent but we believe this will be of a short-term nature. In fact, investors should look at the campuses where the new model is now in full gear as the improvements both with respect to scale potential and customer satisfaction can be clearly seen. Furthermore, management´s recent share buy-back scheme is further proof that sustained growth for the company is on the cards. Sales are still expected to grow this year despite the above-mentioned headwinds. However, Lincoln with the strong investment the company is undergoing will be ready when the environment shifts in its favor in earnest.

Conclusion

Based on current trends and the trajectory of the share price over the past while, we are looking for positive numbers from Lincoln´s upcoming third-quarter report. We expect more partnerships to be announced (Recently with Tesla) which once more should provide a floor for this stock. We look forward to continued coverage.

Be the first to comment