Funtap/iStock via Getty Images

We can easily forgive a child who is afraid of the dark; the real tragedy of life is when men are afraid of the light.”― Plato

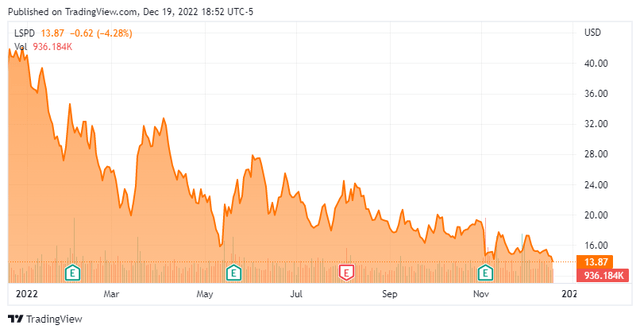

Today, we circle back on Lightspeed Commerce Inc. (NYSE:LSPD) for the first time from our first article on this small-cap SaaS (Software as a Service) concern in March of this year. We advised to avoid the shares due to valuation at the time. The stock has been cut in half since. So, with revenues still rising at an impressive clip, has Lightspeed dropped into the “buy zone” yet? An analysis follows below.

Company Overview:

August Company Presentation

Lightspeed Commerce Inc. is based in Montreal, Canada. The stock trades for around $14.00 a share and sports an approximate market capitalization of $2.1 billion. The company’s primary customers are in the retail, restaurant and hospitality industries. The company’s two flagship products are Lightspeed Retail and Lightspeed Restaurant. Lightspeed’s SaaS omnichannel commerce platform, offerings and capabilities allow its clients to engage with their consumers, manage their operations and accept payments. Revenue is roughly split between the U.S. and the rest of the globe, primarily Europe.

August Company Presentation

Third Quarter Results:

On November 3rd, Lightspeed posted its third quarter numbers. The company lost 53 cents a share on a GAAP basis even as revenues surged 38% on a year-over-year basis to $183.7 million. Results were largely in line with expectations, but net loss increased from 43 cents a share in 3Q2021, it should be noted. Revenues were impacted by the strong dollar, and sales would have been up 41% during the quarter on a constant currency basis.

During the quarter, transaction-based revenue came in at $101.3 million, an increase of 56% from the same period a year. Subscription based revenue grew 25% to $74.5 million during the quarter. Management lowered full year revenue guidance to $730 million to $740 million from previous guidance of $740 million to $760 million.

Analyst Commentary & Balance Sheet:

Since third quarter results came out, eight analyst firms including Barclays and BMO Capital have reissued Buy/Outperform ratings on the equity. A good portion of these had downward price target revisions attached to them. Price targets proffered ranged from $22 to $35 a share. Here was the view from BTIG who reiterated its Buy rating and $35 price target on the stock.

We view the company’s shift in focus to larger customers as promising, especially in the current period of macroeconomic uncertainty, insofar as they are more established businesses with the wherewithal and resources to be more resilient during difficult times. Management noted that 84% of LSPD’s customer location churn during 2Q23 came from SMBs with less than $200k in annual GTV. As such, we believe that as the company’s customer mix shifts to larger SMBs, churn is likely to become less of a concern.”

This week, Morgan Stanley maintained its Hold rating and $19 price target on Lightspeed. Piper Sandler downgraded the stock to a Neutral with a $18 price target right after third quarter numbers were posted. JP Morgan lowered its price target from $27 to $16 after earnings and maintained its Underweight rating on LSPD. Piper citied the following reasons for its downgrade “currency impacts, macro headwinds, & SMB churn that might be too difficult for the business to overcome over the near term.”

Approximately five percent of the outstanding shares are currently held short. At the end of the third quarter, Lightspeed had ~$863 million in unrestricted cash and cash equivalents and no notable long-term debt.

Verdict:

The current analyst firm consensus sees the company losing 27 cents a share in FY2022 as revenues rise nearly 35% to $734 million. Next year, they see Lightspeed roughly breaking even as sales rise 25% in FY2023.

When we last looked at Lightspeed, its stock was trading at approximately 8.3 times FY2022 revenues. 6.5 times if you took the net cash on the balance sheet into consideration. Using that same metric, LSPD now trades under three times 2022 revenues. Less than two times if you equate for the cash hoard on its balance sheet.

The company still has a fortress balance sheet but has burned through approximately $140 million worth of cash since we last visited in March. Buy price targets have also come down significantly from the $40 to $70 a share range at that time. The company’s platform/capabilities help small businesses automate mundane tasks, better connect with their consumers, and act on compelling data insights.

Obviously, small businesses are being negatively impacted by slowing economic activity worldwide and the highest inflation levels since the early 80s. With the economy looking like recession is a likely scenario in 2023 and the Federal Reserve still hiking interest rates, it is hard to see how the market environment improves for Lightspeed’s core customers in the coming year.

While Lightspeed’s revenue growth continues to be impressive, the company is no closer to profitability than when we last looked at it. Therefore, we still are not taking a position even as the stock’s valuation has been more than cut in half since our first piece on it early this year.

It is a mistake to think that moving fast is the same as actually going somewhere.”― Steve Goodier.

Be the first to comment