Maskot/DigitalVision via Getty Images

Thesis highlight

Life Time Group Holdings, Inc. (NYSE:LTH) is not cheap enough yet. LTH employs a mixture of strategies to ensure low expansion costs, the creation and maintenance of customer trust and loyalty, expansion into new markets, and the offering of complimentary products or services. All these strategies, combined with the ever-increasing population in need of LTH’s services, point to a brighter future for LTH.

Company overview

LTH is a recognized lifestyle brand that provides health, fitness, and wellness experiences to communities of individual members. LTH boasts of luxurious athletic centers with spacious floors, state-of-the-art equipments, spacious locker rooms, group fitness studios, amongst other fitness facilities. These athletic centers are strategically located in affluent suburban and urban locations.

S-1

More individuals paying attention to fitness

The health, fitness, and wellness industry is a large and ever-growing industry. Post-Covid, the growth is set to increase due to the majority of people gaining unwanted weight during the pandemic. There is also a surge in the prioritization of health, fitness, and wellness among consumers, making the total addressable market extremely huge. LTH’s management estimates that, of the approximate $900 billion market opportunity presented by the U.S. wellness economy, they have only penetrated less than 2% of the market.

According to LTH’s S-1, the obesity prevalence grew from 30.5% to 42.4% from 2000 to 2018, while a full 42% of U.S. adults reported gaining unwanted weight during the COVID-19 pandemic (an average gain of 29 pounds). These factors are an indicator that the number of consumers placing more priority on fitness is on the rise.

Omnichannel strategy to continuously have top-of-mind awareness

LTH operates in a market flooded with competitors. To stay afloat, LTH targets creating a strong brand positioning and making their facilities a go-to venue when one thinks of fitness. The ability to remain the go-to for fitness has made LTH a preferred health and fitness destination for its customers.

LTH’s omni-channel platform has been successful in providing an exceptional breadth of physical and digital experiences that surpass its members’ expectations. When it comes to increasing customer touchpoints and awareness, LTH’s Life Time category offers a wide range of amenities, services, and facilities. All members of a Life Time family can take advantage of Life Time’s comprehensive services and programs, no matter where they are in the wellness continuum. Activities such as using state-of-the-art fitness equipment, sending your child to summer camp, competing in LTH’s sports league, and unwinding in LTH’s award-winning spas are all part of the LTH experience.

When combined with the best digital offerings, these interactions give customers access to some of the best products and services at any time and from anywhere in the United States or Canada.

I believe LTH’s omnichannel strategy would lead it to create a strong brand positioning to constantly be on the top of the consumer’s mind and resemble McDonald’s, which is best known for burgers and fries, or Domino’s, which is well known for pizzas.

S-1

Huge national footprint with strategy in place to optimize pace of expansion

Over the years, LTH has expanded its portfolio to include more than 150 resort-style athletic destinations in a variety of US states and a Canadian province. As I said before about LTH’s top-of-mind awareness, LTH’s massive physical presence is a key advantage over other small players. This greatly improves awareness and helps LTH’s omnichannel strategy.

LTH has reduced its reliance on physical assets through sales and leasebacks, as well as the construction of strategically located, highly adaptable centers. This eliminates and resolves the issue of growth, which would have been capital- and asset-intensive if the traditional buy/build approach had been used. LTH, in my opinion, has developed a business model that significantly improves the return on invested capital and allows it to rapidly expand its number of centers. More importantly, with its premium centers, it has been able to break into high-priced but promising urban and coastal markets. Additionally, LTH has in-house architectural, design, and construction expertise, which they use to build environmentally friendly and resource-conserving buildings. All of LTH’s centers can share a similar look and feel while LTH maintains direct control over capital expenditures.

As a whole, LTH employs a well-defined, methodical, and refined expansion strategy that takes into account demographic, psychographic, and competitive criteria gleaned from the profiles of its most successful centers. They can make constant adjustments based on up-to-the-minute information and the results of their most effective centers, thanks to the data and criteria they collect at those locations. The presence of LTH’s Life Time Centre also increases the value of the surrounding area and is thus beneficial to the landlord. LTH can leverage the goodwill associated with its name and longstanding relationships with landlords to secure more generous lease terms and larger tenant improvement allowances in order to expand with minimal upfront investment.

Opportunity to expand its ecosystem of offerings

LTH’s ability to grow is supported by these factors:

- The over 150 locations that LTH is present in represent less than 2% of the United States’ available market. This gives LTH a lot of room to grow, expand, and go international with their premium athletic centers.

- LTH’s asset-light model and its flexible center formats allow LTH to strategically target premium locations with wealthier demographic profiles, thereby expanding their potential market.

- The current structural shift in consumer preferences, and the increased knowledge of the importance of health, fitness, and Wellness allow LTH to leverage their lifestyle brand to serve these customers.

- LTH can use its well-known brand and customer data and feedback to expand the products and services it offers through its omni-channel platforms and reach more people around the world.

One manifestation of LTH’s development and growth is the introduction of Life Time Work, a brand extension that centers on the provision of co-working spaces. Access to LTH centers across the United States and Canada, private storage, printing stations, coffee, and healthy snack bars are just some of the perks and amenities offered at Life Time Work’s 26,000 square foot locations. As part of the larger LTH ecosystem, it goes from being a coworking space to a comprehensive platform for “trapping” users.

Valuation

Price target

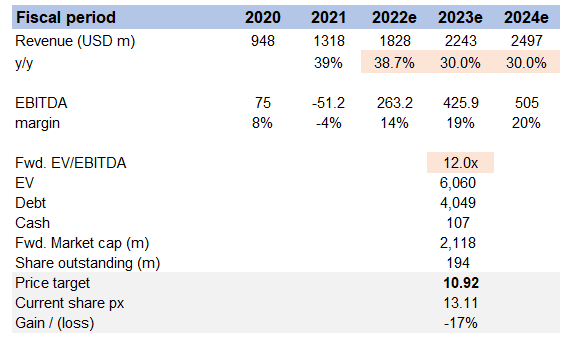

My model suggests a price target of $10.92 in FY23. This assumes that revenue will continue its high growth rate, and the forward EBITDA multiple will be 12x in FY23e.

Own estimates

For FY22e, I used FY22 guidance, and for FY23e and beyond, I believe LTH can continue to grow at historically high rates due to the big TAM. As for how much LTH is worth, it trades at 10x forward EBITDA right now, and I assumed that LTH would trade back to its average as we recovered from this COVID pressure.

Clearly, the market is pricing in a fair bit of growth and margin expansion here, and despite this and a 2x multiple uplift, my model still suggests downside from here.

Risks

Competition

The market for the health, wellness, and fitness industry is flooded with competitors who, with enough capital, can easily replicate LTH’s business and grab the customer base.

Providers who focus on a single vertical may provide better services than LTH, whose resources are divided among varied verticals.

High fixed-cost business

Even though the sale-leaseback strategy reduces capital-intensiveness from the start, it does not come without cost. LTH still faces a high operating leverage that could help or worsen its financials. If a pandemic or economic contraction happens, LTH’s cash flow profile will be decimated.

Conclusion

LTH is not cheap enough yet. LTH has developed a strategy to ensure operational costs are at a minimum while increasing revenue. The switch in customer preference and the increased awareness of fitness and its benefits to the body means more market for LTH to serve. Also, the development of new products like the Life Time Work, also works alongside other strategies to attract new customers and to better serve the existing customers to cement their trust and loyalty.

Be the first to comment