~UserGI15994093/iStock via Getty Images

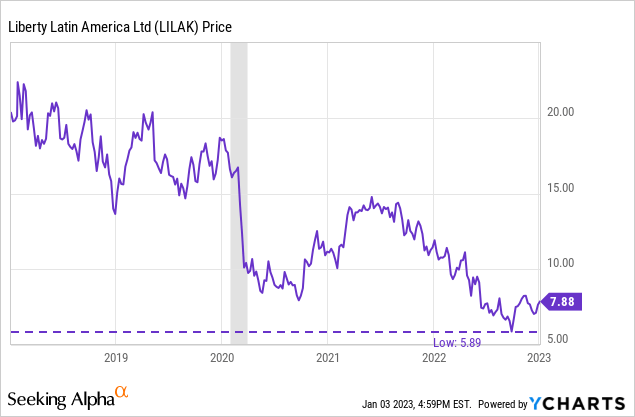

Liberty Latin America (NASDAQ:LILA), a telecommunications company operating in more than 20 countries in Latin America and the Caribbean, has had a difficult time, to say the least, since it was split off from parent company Liberty Global (LBTYA). However, we think investors have been far too pessimistic about the company lately, throwing the baby out with the bathwater.

And those who look more closely see a gem of a company that has been completely mispriced and misunderstood. Its complicated corporate structure, with operations in multiple developing countries and a high level of debt, makes it a hard nut to crack for some analysts. In this article, we argue why Liberty Latin is a hidden gem that sells well below its intrinsic value, and why it could be trading at a multitude of its current value in a few years, courtesy of huge catalysts.

Business Overview

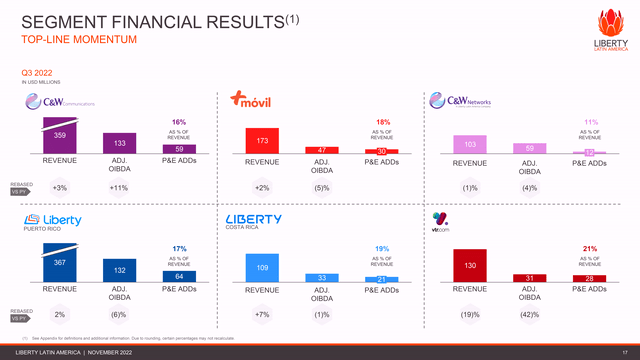

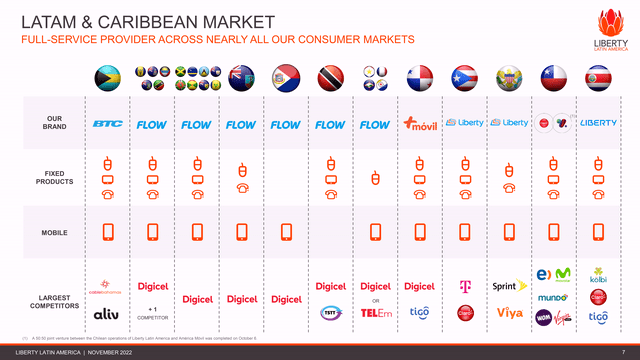

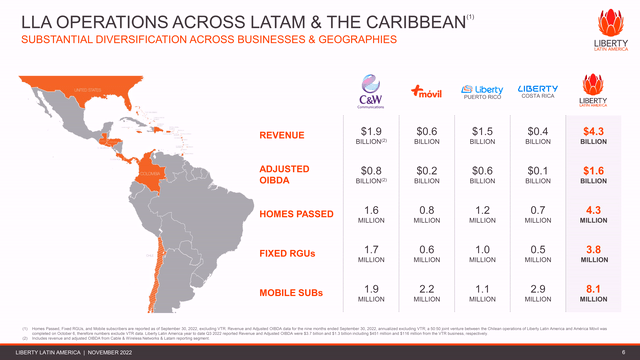

Liberty Latin America is essentially a company that can be divided into a number of entities: Cable & Wireless in the Caribbean and Central America, Liberty Puerto Rico, Liberty Costa Rica, Liberty Panama (MásMóvil) and an operation in Chile that recently entered into a 50:50 joint venture with another operator called Claro. In addition, they also have a subsea (fiber optic) and terrestrial operation connecting these markets.

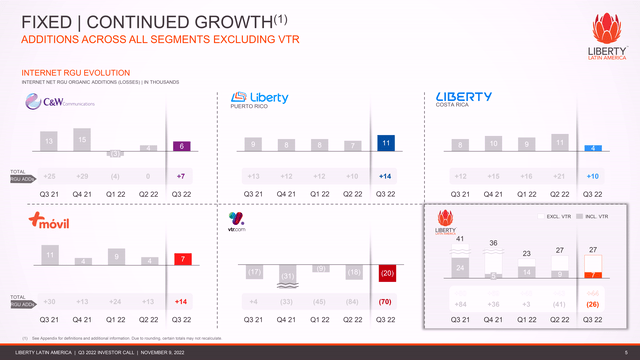

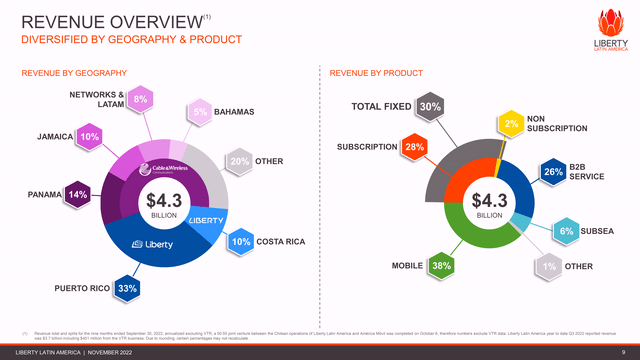

As you can see, some markets are more profitable than others, with Puerto Rico and their subsea operations bringing in a large portion of the cash flow. Currently, all activities bring in about $200 million in annual FCF.

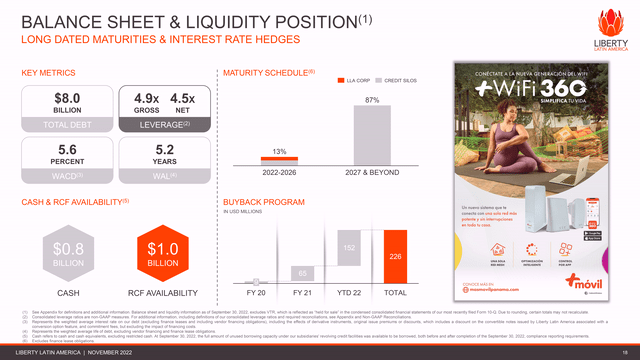

On a first look at Liberty Latin, investors may initially be spooked to see on its balance sheet that it has about $8 billion worth of debt, leveraged at 8x. But upon closer inspection, a good chunk of that debt will disappear into the JV with VTR in Chile, and in fact, all the debt has been carefully siloed, so there is no cross-contamination between major business units.

In addition to the automatic deleveraging due to the inception of the JV in Chile, the company is expected to deleverage even faster because it has incurred a lot of costs in terms of acquisition/integration over the past year, which are also expected to disappear while synergies will become apparent due to larger networks (scale), competitive leverage, access to capital and the like.

However, Liberty Latin has a problematic history dating back to 2015 when Liberty itself overpaid for Cable & Wireless even though it was the market leader and faced a secular decline in terms of fixed/mobile revenues. Then Liberty was hit by a flurry of turmoil as it had to rebuild its operations in Puerto Rico due to Hurricane Maria and the pandemic, so it raised about $350 million in additional capital in a rights offering.

As if things couldn’t get any worse, they recently faced fierce competition in Chile, engaging in a price war with their competitors and losing what was once a very profitable cash flow machine. Yet, there is light at the end of the tunnel.

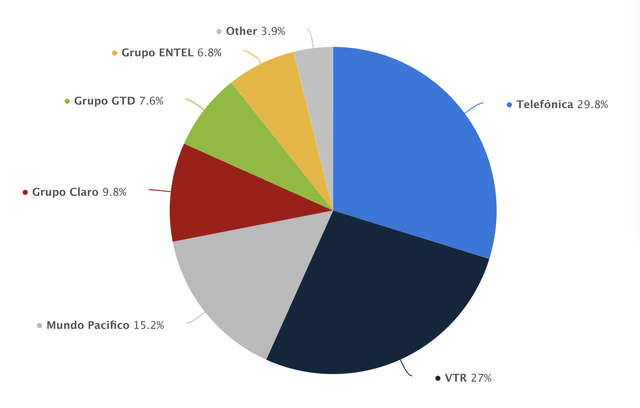

As you can see from the slide above, most markets have a rational amount of competition, with the exception being Chile. In markets like Panama, for example, their position will certainly improve since Digicel has serious problems, effectively giving Liberty almost free rein with their competitor Tigo in the entire market.

In September 2022, credit rating agency Fitch even warned of possible bankruptcy and numerous media outlets suggest that Digicel has little or no equity. But speaking of markets like Chile, Liberty solved this problem by consolidating with another partner, Claro, significantly strengthening its position in that market through synergies and entering into a 50:50 joint venture. This joint venture was recently given the green light by Chile’s national economic prosecutor in October.

In other words, this Chilean entity, which is currently still a drag on the company, burning more than $100 million due to high CapEx and interest expense, is expected to go off the books in the fourth quarter, along with more than $1.33 billion in long-term debt. With that entity off the books, about 75% of Liberty Latin’s revenue is in U.S. dollars and the rest is very responsibly hedged. That is very different from your other LATAM companies, and perhaps should be valued more like a U.S. company.

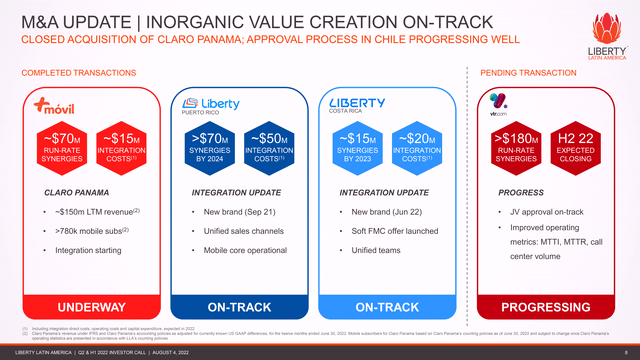

When we hear about mergers and acquisitions and especially “synergies”, we usually see it as a red flag, but in the telecommunications industry there is a lot to be said for real meaningful synergies by sharing infrastructure, equipment, etc. In Panama, for example, Liberty acquired Claro Panama, and is currently still integrating the company. Some synergies take time to materialize, sometimes due to silly regulations, as CEO Balan Nair said at a recent, quite underreported, Goldman Sachs summit:

We didn’t overpay for Claro in Panama, we charge well. In mergers and acquisitions, getting bigger is not our goal. Making money is our goal. We don’t buy bad assets to fix them up, thinking we are geniuses who think we can change them. It usually takes about 24 months to have synergies because there are usually some dis-synergies in the beginning.

And, by way of example:

In this case, the government has imposed a measure that does not allow us to combine stores or commercials until the first quarter of next year (Q1 2023). I have a Claro store and a MásMóvil store next to each other, and I cannot close either of them. I have 2 headquarters, which will eventually become 1. We have thousands of towers, they have thousands of towers, we are going to combine. I don’t need 3500 towers. It will come, just be patient.

Needless to say, where we usually mark the word “synergies” as a red flag, in the telecom sector it is actually one of the few cases where it works out well and matters.

For a company worth $1.72BN, it has a surprising value knowing that it has 3.8M fixed revenue generating units and is passed through 4.3M homes. The company is currently trading at a P/S ratio of 0.38, despite operating in a very stable service market that is primarily denominated in USD.

The main markets in which Cable & Wireless also operates are mainly duopolies, and markets that have a big moat because the barrier to entry is so high for other players, giving Liberty the advantage it has always had. It is no wonder that Berkshire Hathaway (BRK.A) (BRK.B) has been investing alongside John Malone for quite some time, and still owns more than 4M shares of Liberty Latin in Berkshire.

The Chile Situation

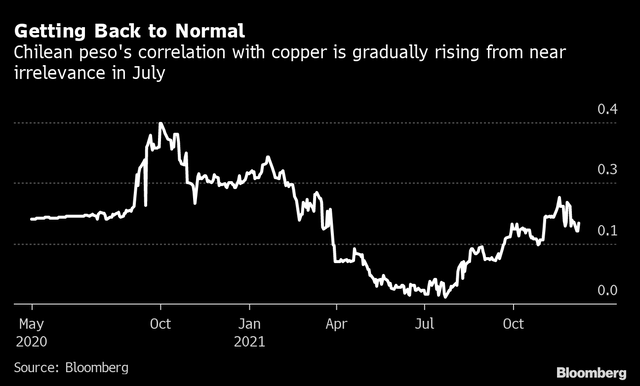

Returning to Chile, it is a scenario that unfolded in a curious situation. It began in 2019 with social unrest in the country, after which the Peso devalued very sharply against the US dollar, with Liberty Latin taking a hit (In US Dollars). The Chilean Peso went from 650 to USD in 2019 to peak at 1050 in July 2021. When the pandemic hit and fierce competition led to a price war, things did indeed go sideways.

The CEO also mentioned this at the last conference. When you have an EBITDA of 300 million, a 30% price change is felt very strongly. However, Liberty Chile is a great company. If you look at the market share that Liberty had in 2020 with VTR, and now teaming up with Claro, you don’t have to be a genius to see that these are the 2 A-teams merging and basically trying to dominate the market. With Claro, they not only have a strong position in the landline market, but also in the mobile market.

Instead of lowering their prices, they could have taken the hit and lost their dominant market share. But Liberty Latin is simply concerned with delivering long-term results to shareholders. And the Peso is starting to fall back to normal levels, things are dissolving, so there is light at the end of the tunnel. As the CEO tells us:

We have proven the business model. If we want to play the price game, we can play the price game. But it will be very destructive to the whole market. And so you have to decide how much of the market you want to take down with you.

On top of that, as we noted earlier, Liberty Latin is very disciplined when it comes to hedging risk, whether it be debt/currency/interest. That’s why they are currently sitting on a ton of profits from derivatives, which, if they decide to exercise them, can buy back a lot of debt traded at a discount: “arbitrage opportunities in our debt and equities.”

Unlike others, we hedge everything. If we look at Chile, we have significant derivative value here. Once the JV is closed, we can decide what to do with it. If we decide to snap our finger, it’s a few $100 million.

As interest rates rise and their position strengthens, many competitors who relied on very cheap capital will be in for a strong surprise. Chilean Entel, for example, put its fiber optic business up for sale in late October for $358 million. We would worry if competition in Chile was rational, but that does not seem to be the case, with Liberty Latin still at the top with its business model.

They are still very keen on Chile, as is Claro, with whom they are entering into a JV. Liberty even tried to buy Claro. If Claro didn’t like Chile, they would have sold their company. And looking at VTR as a single entity, it was very heavily leveraged (+8x).

Now with the 50:50 JV, they no longer have that problem, allowing them to deleverage even faster, since less interest expense means higher OIBDA and faster debt repayment.

The Subsea & Terrestrial Cable Business

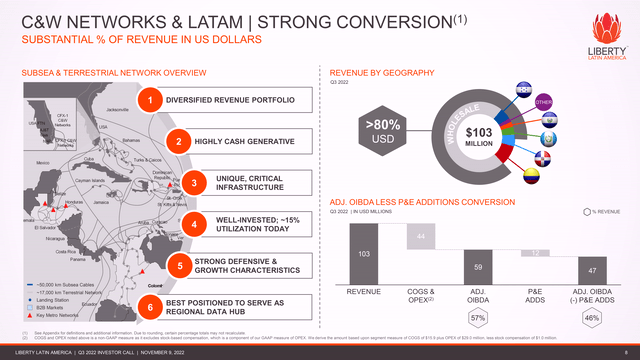

Before proceeding to the valuation of all business units, we would like to put some emphasis on the unique business, namely their Subsea & Terrestrial Cable Business.

Shareholders were so pessimistic about the company lately, and board members asked to “test the market” when it came to their cable business: they set the bar high, and got the math behind it. It is a hugely profitable cash flowing business, with 80% in USD, and 28% of that is even rigid B2B contracts.

In the third quarter, OIBDA was $59 million, and after adding P&E, the company was left with more than $47 million, or about $200 million+ annualized.

It was according to the CEO that:

The board was on essentially on the same page as me, asking “why should we sell this company?”. It is a huge cash generating company, almost all US dollars and long term contracts, it is the only resilient network out there. Every leveraged equity model needs that one cash generating machine, which works whether it’s bright or dark days, the money just keeps flowing in.

And they tested the market, but set the bar very high:

We set the bar high and a few decent bidders stepped up. Come with the money and we can talk. One of them was a SPAC, the second wanted to do it but the debt market closed them in, they wanted to lever it up. They asked for an extra 10 months. In John Malone’s Liberty World, everything is for sale. If they come back with the same number you just gave me, we’ll go ahead with the transaction. But I hope they don’t come back.

Given that the market is predominantly USD denominated, that the company has great power and is a cash flow machine, we think that high bar is somewhere north of what $8 per share would be worth, at 7-8x EBITDA. We also believe that this is absolutely not reflected in the current share price, which is hovering around that same $8 because of the debt load, which as mentioned above will be phased out very soon.

Valuation

And then right into the actual part of why you came to this article: valuation and why the company is grossly mispriced. We will use 2 measures to estimate intrinsic value: EV/OIBDA to account for steady income (similar to EV/EBITDA) and the high debt burden carried by Liberty Latin, and P/FCF adjusted for equity compensation, to also get a good idea of the company’s CapEx intensity and actual cash flow to shareholders.

Something usually overlooked is the fact that Liberty Latin America is extremely disciplined because it is a LATAM-operated company, and has siloed its debt. For this reason, for example, in the JV in Chile, the debt disappears from the balance sheet because it was not with Liberty Latin, but with VTR. This means that we can value each company separately and add up the valuations.

For the OIBDA, we took out the amount of share-based compensation and subtracted it from the OIBDA because it can be quite high ($80 million per year). So, doing our calculations, we can come to the same conclusion as the CEO during their Goldman Sachs earnings call: their Puerto Rico operation alone, valued at 7x EBITDA/OIBDA (minus stock-based compensation) is currently worth almost as much as the entire company. At a 7x multiple, we arrive at $3.65BN of enterprise value, which means that after subtracting the $2.57BN of debt, we have a market cap of $1.08BN.

One could even argue that the company should be valued at higher valuations, more similar to their U.S. competitors, since Puerto Rico is a U.S. dollar denominated market, perhaps closer to 10 times. One could very well argue that you currently pay for Puerto Rico and get all other operations essentially for free, as the CEO noted in an earlier conversation.

| Entity | Q3 OIBDA | – Share Based Comp. | Annualized (OIBDA-Comp) | Total LT Debt | 7x OIBDA |

|---|---|---|---|---|---|

| C&W (Caribbean + Panama + Cable) | 238.3 | 6.3 | 928.0 | 4,477.8 | 6,496 |

| Liberty Puerto Rico | 131.5 | 1.2 | 521.2 | 2,571.4 | 3,648.4 |

| Liberty Costa Rica | 32.8 | 0.5 | 129.2 | 421.0 | 904.4 |

| Corporate/ LLA | — | 12.6 | -50.4 | 371.5 | -352.8 |

If we add up all the OIBDA for these units, and subtract the stock-based compensation, and apply a multiplier of 7x, we arrive at $10.70BN enterprise value, or adjusted for debt, a market cap of $2.85BN, which means that even with current multiples, it trades well below what we believe to be correct intrinsic value.

| 7x OIBDA | -LT Debt | |

| Enterprise Value | 10,696 | 7,841.7 |

| Market Cap (7x EV/OIBDA) | 2,854.3 |

The stock is currently trading at $7.98, and we believe it should be worth at least $13.09 to reflect its intrinsic value, even without taking into account any growth. And that does not include all the synergies, which they will realize in the coming months/years.

| Market Cap (7x EV/OIBDA) | Share Price |

| 2,854.3 | $13.09 |

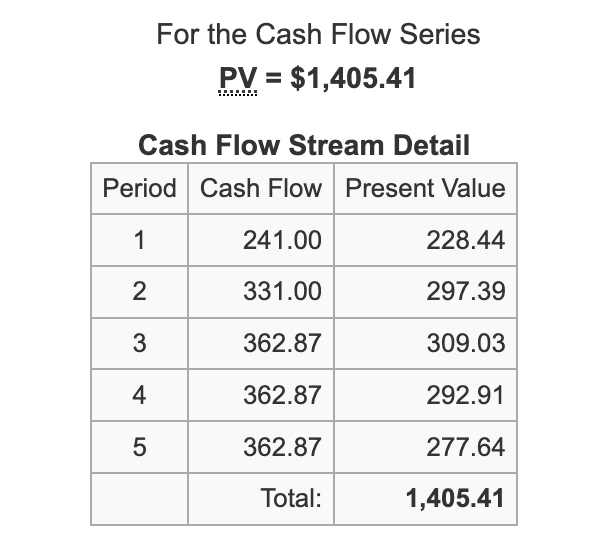

On a P/FCF basis, we look at what the company should look like in the future, since management gave specific guidance on how much cost savings/synergies they expect between now and 2025. This is the slide where the money is at:

For 2022, the company estimated free cash flow at $220 million, but that was adjusted to $200 million to reflect the negative impact of Hurricane Fiona. We also discount share-based compensation, which is $80 million annualized, bringing us to a base of $120 million.

As for the free cash flow estimate for 2023, the CEO has already confirmed that shareholders “will be satisfied” with their estimate for 2023. In Q4 2022, we should take into account 2 things: VTR Chile will be wiped off the balance sheet, which is currently a $100M drag in terms of CapEx and Interest expense. In addition, in 2022 a lot was spent on integration costs, which should also disappear, thus double the cash flow drag.

And especially if we look at Puerto Rico, where they basically robbed AT&T (T) after acquiring them, and rebuilt everything themselves after the hurricane. If we include the Puerto Rico synergies described above, Puerto Rico alone would be worth more by 2024 than the stock is now at 7x EV/EBITDA.

We’re bullish on Chile: we spent billions of capital in there. Our partners spent billions of capital in there. We both want to make this work. We publicly said $180M worth of synergies, we’re going to blow past those expectations. If we NPV that synergies, this is $1BN plus worth of synergies. Debt funds a lot of things. Just the synergies alone, we could build fiber 20 times over in Chile. We’re sitting very good here.

But ridiculous valuations aside, to sum FCF up:

| Cash Flow Base | $120M |

|---|---|

| 2022 Completion Chile JV (Visible Q4) | +~$100M |

| 2023 Costa Rica + Telefonica | +~$28M |

| 2024 Puerto Rico + AT&T | +~$120M |

| 2025 Liberty Panama + MásMóvil | +~$42.5M |

| (Estimated Taxes) | -~$47.63M |

| 2025 Total: | ~$362.87M |

| Long-Term: Chile JV | (+~$90M-$500M) |

Panama is only 50% owned by Liberty Latin, so 50% of $85 million in synergies, or $42.5 million. Same with Costa Rica, where they own 80%, or $28 million. But that means we can expect free cash flow of about $410 million by 2025. However, the additional $190.5 million in synergy cash flow still needs to be adjusted for tax purposes, for which we discount 25%, bringing the total to $362.87 million.

And the best part is that they have virtually no maturities until 2027-2028, except perhaps 1 convertible bond in 2024, valued at $403M. At the current market capitalization, they have a whopping 20.85% Free Cash Flow return in 2-3 years. Not to mention the 50% stake in the Chilean JV.

If these synergies are realized and the stock is still trading at its current price, they could theoretically buy up an unimaginably large portion of the current assets over the next 4-5 years before reaching the maturities they need to repay. If the debt market has cooled at that point, they could refinance/refinance or, otherwise, they will simply deleverage naturally.

Author’s NPV

If we discount all FCF generated between 2023 and 2027 at a discount rate of 5.5%, we would arrive at a NPV of $1.41 billion, which is astonishingly high for the current market capitalization of $1.74 billion. No wonder, management is buying back shares and insiders are buying in droves.

It’s a win-win situation. If prices stay where they are now, they can buy back 50% of shares in the first 3 years and double the earnings power of current shareholders. Currently, they are using 100% of their FCF to buy back shares, although we think that by 2026-2028 the company will also begin to focus on development/rebuilding.

If we take the 2027 present value and apply an 8% free cash flow yield to it, which seems very conservative to us, we arrive at a valuation of $3.47 billion. However, we think the number of shares will also have fallen dramatically by then, to, say, 180M shares instead of 217M today.

That brings us to a share price of $23.14 by 2027. Although, as mentioned above, we think the return will be even more upside, as the JV in Chile could take the share price well above our $23.14 price target.

The Insiders Tell A Story

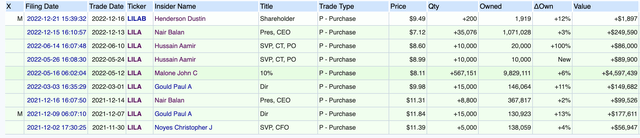

Speaking of insiders, there are some very smart money managers who hold the stock, or have just started a position: Berkshire Hathaway, Michael Burry (Scion Capital) and especially John Malone.

Since 2020, John Malone has been selling shares in most of his companies such as Liberty Media (LSXMA), Qurate Retail (QRTEA), Liberty Broadband (LBRDA), etc. But when he spoke with the CEO of Liberty Latin, they both came to the same conclusion: there is a dislocation in the stock price, which sometimes is not such a bad thing. It’s an opportunity to buy shares aggressively, which they did.

So John Malone put his money where his mouth is and bought 567,151 additional shares worth more than 4.5 million on the open market to make his stamp of approval. Even the CEO himself backed up his claim, buying $250K worth of additional shares on the open market two weeks ago, despite already being heavily incentivized by performance pay. It reminds us of one of our favorite Charlie Munger quotes:

Show the incentive and I will show the outcome.

As we touched on earlier, the company is also using all of its available FCF to aggressively buy back shares, and that will certainly remain a top priority if the stock price remains so distorted. It is as the CEO put it:

It is difficult for us to justify certain investments. It is currently difficult to exceed the IRR of my share repurchases.

Last year alone, Liberty Latin aggressively bought back $152 million worth of shares, taking advantage of lower prices and using almost all of its available FCF.

Risks To Our Thesis

Of course, there are still risks associated with our proposition. One of them was fortunately resolved in the previous 2 months, with the green light for the JV in Chile, leaving even more long-term revenue on the table for us.

As Liberty Latin suffered one bad luck after another, there is nothing to stop us from doing the same things again. Such things could be:

- A US debt crisis, if inflation turns out to be stronger than previously thought, or backfires as usual in history, forcing the Federal Reserve to curb inflation even more strongly by raising interest rates.

- Another strong rise in the US dollar, which may provide some headwinds in the Chilean economy (although VRT can still hedge the company itself).

- Although irrational competition is unlikely to enter one of Liberty Latin’s main markets, such as Puerto Rico (although the barrier to entry is very high and current competition is very rational, unlike Chile).

- Another hurricane or destructive weather-related event.

- Geopolitical risks in countries like Chile.

- Short-term headwinds lead to lower-than-expected cash flow, reducing the opportunity to repurchase shares.

Usually, we never really look at pure LATAM companies, because of their nature of geopolitical risk, currency risk, interest rate risk and a whole host of other issues that make it harder for us to get an accurate handle/valuation on the stock.

But Liberty Latin is quite different, in that they operate in dollar-nominated markets, and if not, they are extremely disciplined when it comes to risk, as with their debt, which they have very cleverly siloed.

The Bottom Line

In summary, we offer a different view: with our expectations and those of management to generate $362.87 million in FCF by 2027 and use a percentage of free cash flow to repurchase shares and get them below 180 million shares outstanding in 2027, each share, excluding Chile, would generate $2.02 in free cash flow. On a FCF basis, at a reasonable 10x FCF, even during a recession, the shares could easily still be worth $20.20 in 4 years.

Everything could go exactly as planned, which we are not counting on because we prefer not to have too many expectations and random variables in our valuations. But if that were the case, and additional synergies were delivered for more than $1BN, their 50% stake could boost the initial FCF of $362.87M to $862.87M FCF. That would be a ridiculous $4.79 FCF per share. So we do not rule out the possibility that Liberty Latin will quote well above $30 per share by 2027. As CEO Balan Nair said, the price is “insanity.”

There are also a couple of other factors that could trigger more upward momentum:

- We did not account for organic growth in markets

- Irrational competition in Chile fading

- The shares remain at a low valuation for longer, allowing them to buy back more shares, significantly increasing earnings per share.

- Easing of debt markets, and Liberty Latin able to repurchase longer and continue buying.

The case seems to be simple. It’s a very misunderstood business in terms of M&A and debt structure, in an industry with monopolistic tendencies and a wide moat. Conclusion: the risk is skewed in a giant way towards the upside, and shares should be bought below intrinsic value.

Be the first to comment