Michael Vi

LendingClub (NYSE:LC) continues to trade at pre-COVID levels where the business had a vastly inferior business model. The whole banking fintech sector is down on credit quality fears, yet the large banks just confirmed credit wasn’t even normalizing at 2019 levels despite the 225 basis points of interest rate hikes by the Fed. My investment thesis remains ultra Bullish on the digital bank not correctly valued for the current business model with room for expansion.

Limited Credit Risk

The main issues with an online lending marketplace are two-fold: credit risk and marketplace investors. If credit risk was a real problem, LendingClub wouldn’t still be in business attracting investors to the marketplace. The bigger problem has always been holding onto institutional investors during tough economic times.

Fintech peer Upstart Holdings (UPST) ran into this problem this year with the company now planning a shift to a new business plan of focusing on a concept of committed capital. LendingClub has already solved this problem with their own balance sheet via the acquisition of a digital bank.

The company now has the deposits to continue investing throughout the cycle. The attractive business model of an online lending platform without credit risk just doesn’t work in practicality. If the credit model doesn’t work, the business won’t last whether or not the company avoided the credit losses in the process. If the credit model works, the fintech or digital bank should just invest capital in loans and avoid the downside of outside investment partners not always willing to invest throughout the cycles.

LendingClub is down to the lows around $13 due to credit risk fears and the negative news from Upstart. In the last quarter, LendingClub charged-off only $14.7 million worth of loans while taking a $70.6 million upfront credit provision due to CELC.

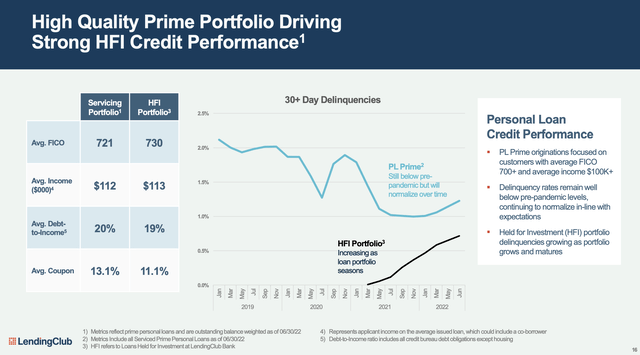

The digital bank lends prime personal loans to borrowers with an average FICO score of 721 and income of $112,000. The company only faces 30+ day delinquencies of ~1.25% while the average coupon on these loans are 13.1%.

Source: LendingClub Q2’22 presentation

As the time of the Q2’22 report, LendingClub wasn’t seeing any meaningful credit hit, yet the company took provision charges of 6.9% on personal loans The good news from the industry the last week is that credit losses, especially on credit cards, aren’t increasing.

Bank of America (BAC) provided the following data points at the Barclays Global Financial Services conference suggesting credit losses aren’t even normalizing for pre-COVID levels yet, much less any recession type issues:

In the month of August 2022, consumers spent 10% more than they spent in August 2021… August grew 10% over last August transactions grew 5.5% to 6%.

So if you look at the core portfolio, it’s gone down and stayed there. And so if you look at the credit card charge-offs, they’ve dropped in half I think and just stayed there. And so does it have to go – so we had 15, 17, 20 basis points do whatever in the last few quarters then we had 40 in 2019-ish, you have 40-ish type thing that was an all-time low. So you’re sitting and saying wait a second you’re not even normalized an all-time low. So that’s the reality.

Our reserve setting methodology that we set the reserve assumes 5% unemployment. This is in three and half months and 5% all the way through next year. That’s the base case. Do we believe that’s going to happen? No, but that’s what – that’s a conservative build in.

In essence, credit card charge-offs aren’t even normalizing for pre-COVID levels while BoA has set credit provisions based on a much worse economic climate. The upside potential here is for the banks to lower provision balances.

Priced For A Recession

For months now, LendingClub has been priced for a major recession. The fintech may not even face a major credit risk scenario even with a recession.

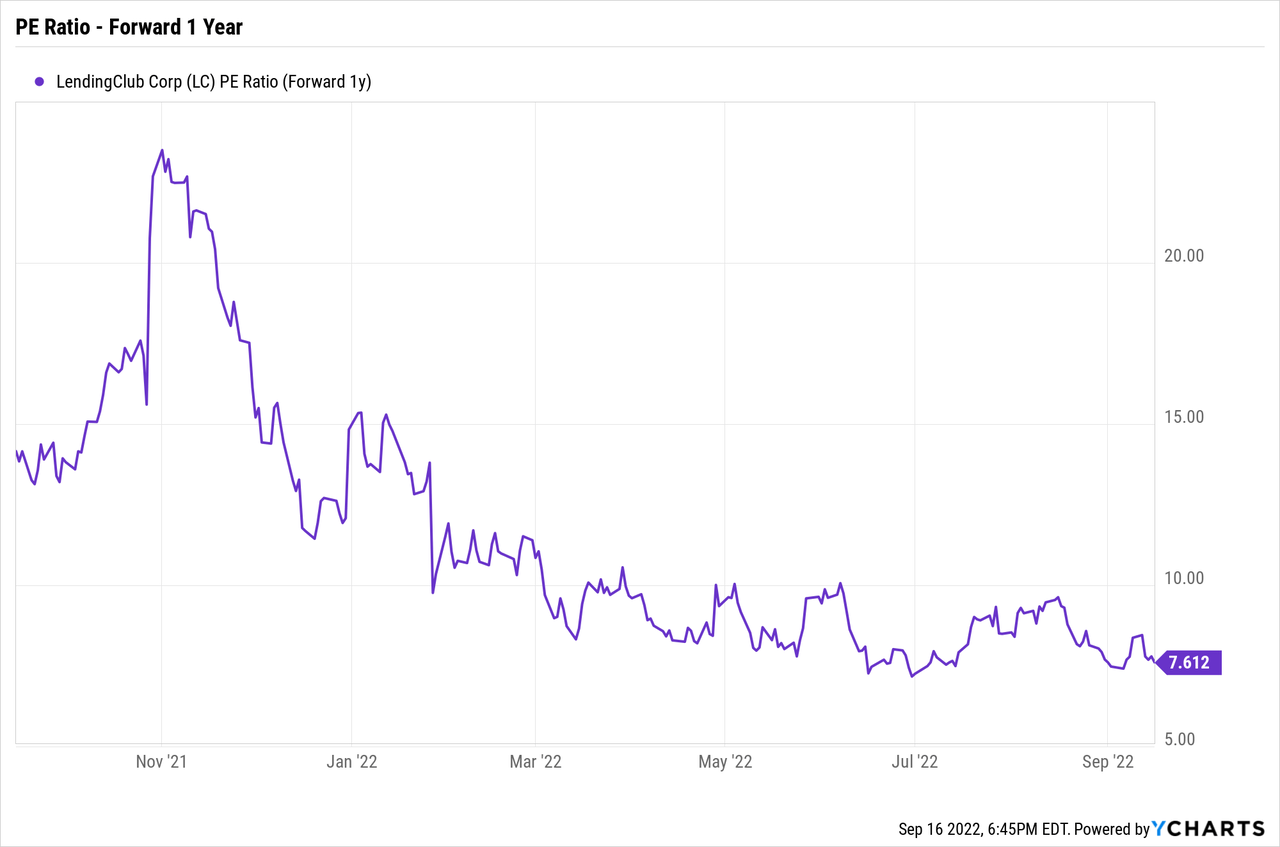

The stock trades at just 7.6x forward EPS targets and these estimates appear conservative. Remember, LendingClub takes massive CECL charges upfront, possibly postponing the company from beating EPS numbers.

Not to mention, the company is still building out a full suite of financial products after acquiring the digital bank last year. The current estimates don’t exactly factor LendingClub moving beyond an online lending marketplace.

Takeaway

The key investor takeaway is that LendingClub remains priced for financial distress, yet the company isn’t likely to see surging loan charge-offs with consumers having strong balance sheets. The stock is too cheap to ignore at $13 and trading like a traditional bank, not a growing online financial marketplace.

Be the first to comment