Michael Vi

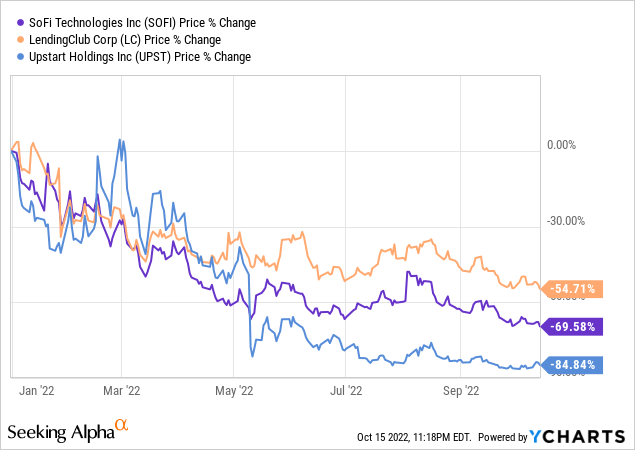

LendingClub (NYSE:LC) is scheduled to release its earnings after the market closes on the 26th of October 2022. The share price performance, not unexpectedly given the macro settings and bear market, has been dismal but still outperformed the likes of SoFi (SOFI) and Upstart (UPST).

LC is profitable on a GAAP basis, growing quickly and trading at a very modest 6 PER. Clearly, the market is factoring in a lot of the bad news to come.

The key risk of course is the upcoming recession, which is pretty much a consensus call amongst the large banks’ executives and even the Fed is not denying it.

For LC, the fears are all about potential loan losses that may need to be absorbed in the coming periods. As you may recap, from my previous articles, the main use case for LC is the refinancing of credit card debt from the likes of Citigroup (C), JPMorgan (JPM), and other credit card issuers.

So for insights on the current and prospective read on credit losses, it is useful to analyze the read across the U.S. banks’ reporting.

The Read Across The U.S. Banks

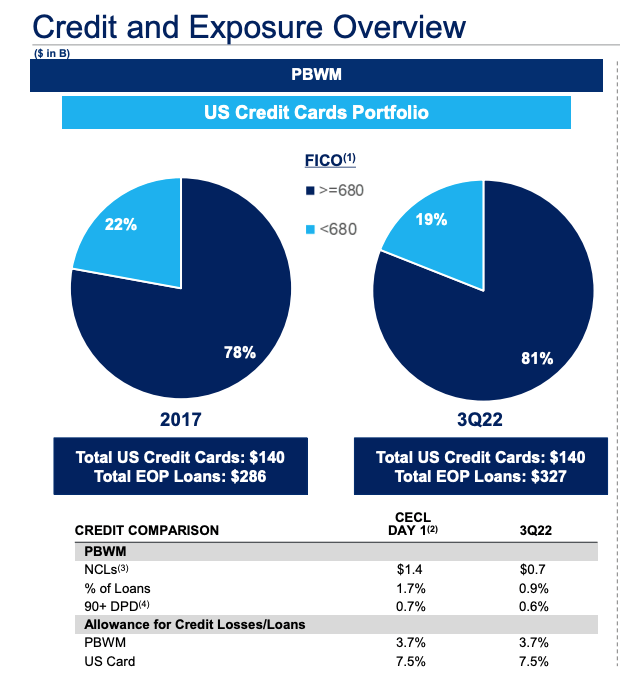

Citigroup reported its 3rd quarter earnings on Friday the 14th of October and the disclosures on credit were quite useful. The below slide details its cards portfolio composition and it is more than 80% with a FICO score of >680. However, 19% of FICO scores are below 680 and one would expect the majority of losses would manifest in a recession.

Citi Investor Relations

In the earnings call, Citi’s CFO Mark Mason noted the followings:

This framework includes credit risk limits that consider concentrations including country, industry, credit rating, and in the case of consumer, FICO scores, and importantly, these limits apply across the firm in aggregate and we continuously analyze our portfolios and concentrations under a range of stress scenarios.

As a result, we feel very good about our asset quality and reserve levels. As I mentioned earlier, our reserve-to-funded loan ratio is approximately 2.5%, and within that PBWM and U.S. Cards is 3.7% and 7.5%, respectively, both right around day one CECL levels.

In PBWM, the majority of our card portfolios skew towards higher FICO customers and while we have started to see signs of normalization in both portfolios, NCL rates continue to be less than half of pre-COVID levels.

LC’s FICO score is an average of 730 based on Q2 numbers and I expect it to be a higher FICO score in Q3 as they target more of the super-prime customer for retention on the balance sheet. It appears that LC’s portfolio is a better credit, overall, compared to Citi’s. Even so, Citi is showing very little stress currently.

Now considering LC’s coverage ratio, it appears to be in line with Citi’s at ~7.5%. Given the better-quality portfolio (i.e. less sub-prime), the coverage ratios seem to be adequately conservative.

Of course, there is an expectation that things will get worse on the unemployment front. It seems to be a deliberate outcome that is desired by the Fed.

JPMorgan’s CEO Jamie Dimon commented on that possibility in the Q3 earnings report:

(consumers) money they have in the checking accounts will deplete probably by sometime midyear next year. And then, of course, you have inflation, higher rates, higher mortgage rates, oil — volatility war. So, those things are out there, and that is not a crack in current numbers. It’s quite predictable. It will strain future numbers.

Jamie also added the following comments on increased provisioning and unemployment:

So, if you look at the pandemic, we put up $15 billion over two quarters, and then we took it down over three or four after that….

I’m trying to give you a number, obviously, this number to be plus or minus several billion. But if unemployment goes to 6%, and that becomes the central kind of case, and then you have possibilities it gets better and possibilities it gets worse, we would probably add something like $5 billion or $6 billion. That probably would happen over two or three quarters. I mean, that’s as simple I can make it. Right now, what we have — right now, we already have a percent in these adverse — in severe adverse case. We can — if we change that next quarter, that will be part of that $6 billion I’m talking about.

What Jamie is alluding to is the operation of CECL that requires banks to recognize loan loss provisions upfront based on macro models (that often get reversed as these are typically conservative). Sure if the unemployment rate goes to 6%+, the severity of losses would certainly increase and banks including LC will like to increase reserves.

Listening to the tone of the LC’s CEO in the earnings call and various other interviews, I am certain that the LC team is exceptionally focused on managing credit risk, especially in an adverse macro scenario. In recent periods, they have targeted clients with higher FICO scores and are conservatively provisioned.

Interestingly, during the pandemic, LC delivered loan loss outcomes that were ~30% better than the industry averages. LC also believes that there is a positive selection bias in their customers. In other words, customers that proactively take action to consolidate their debt and reduce interest rate costs are more likely to repay their debts.

Final Thoughts

My expectation for Q3 earnings is that the marketplace revenue is going to be challenging (I expect a material reduction in revenue quarter on quarter for the marketplace). The rise in interest rates and recession fears effectively mean that some investors (especially ones that use warehouse lines and are interest-sensitive) will move to the sidelines for now.

I expect LC to leverage its balance sheet and retain selective loan assets on its book, especially ones that are of higher quality. I would also not be surprised if they reduced marketing spending and focused on servicing existing LC members.

Clearly, there is very little stress now in terms of loan loss provisions for existing assets but more recent originations are likely to normalize very quickly. I expect LC’s management to exercise caution in the current macro environment.

This upcoming recession is going to be a coming-of-age moment for LC. If they can navigate through these times successfully, they will be coming out of this recession exceptionally strong with their business model and reputation intact. I am confident they will and I remain very bullish.

Be the first to comment