Adrian Vidal/iStock via Getty Images

Introduction

As a dividend growth investor, I keep adding to my undervalued dividend growth stocks. Yet, in addition to that, I also make sure that I constantly scan for new opportunities in shares I do not own yet. I analyze new stocks on a monthly basis in order to have more investment options available.

Right now in my dividend growth portfolio, I lack exposure to the consumer staples and the consumer discretionary sectors. In this article, I will analyze a consumer discretionary company I do not own yet. Leggett & Platt (NYSE:LEG) is a dividend aristocrat that I have wanted to analyze for the last several weeks.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same methodology to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, Leggett & Platt designs manufactures, and markets engineered components and products worldwide. It operates through three segments: Bedding Products, Specialized Products and Furniture, Flooring, and Textile Products. The company was founded in 1883 and is based in Carthage, Missouri.

Wikipedia

Fundamentals

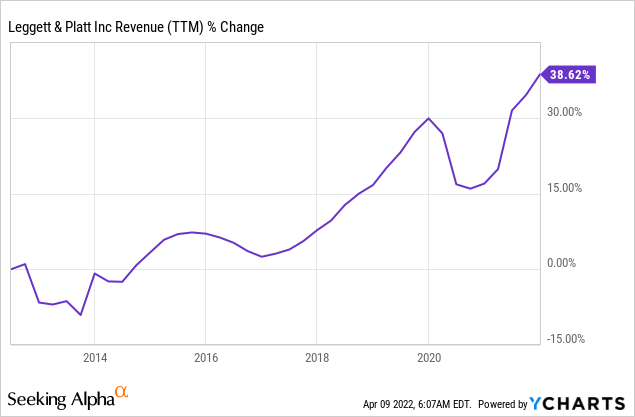

Revenues have grown by almost 40% over the last decade, which means that sales have grown by low single digits annually. Sales are growing mainly organically, and due to small investments to build a more integrated operation. The cyclicality of the business can be seen by the significant drop in revenues during the pandemic. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Leggett & Platt to keep growing sales at an annual rate of ~5% in the medium term.

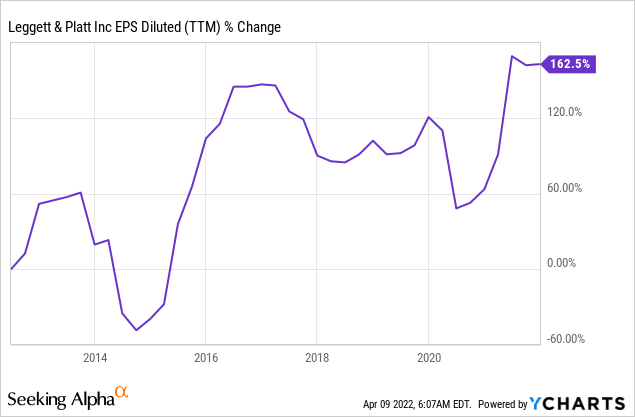

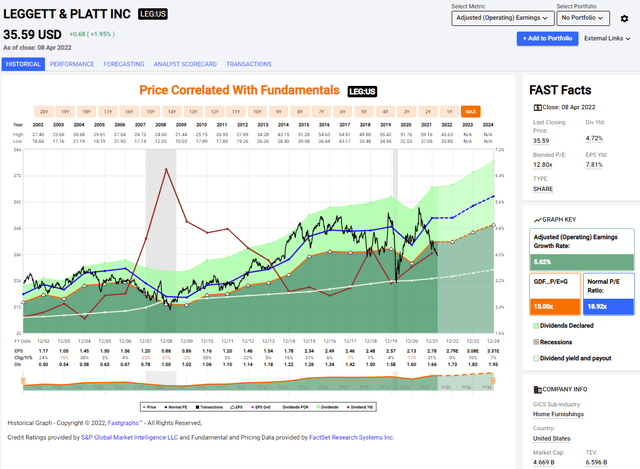

The EPS (earnings per share) has increased significantly over the last decade. A 160% increase means double digits annual growth. The company managed to offer a much higher growth in EPS compared to sales due to the buybacks, but most importantly due to improvement in margins as the company has become more integrated thus owning a bigger part of the value chain allowing for the margins to increase by 30%. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Leggett & Platt to keep growing EPS at an annual rate of ~6% in the medium term.

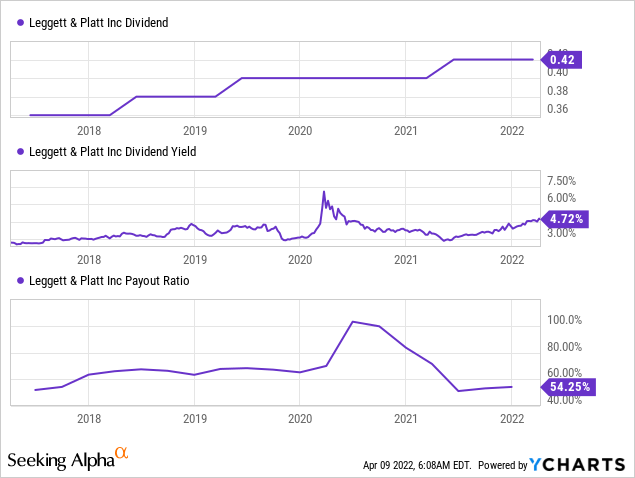

The company is not just a dividend aristocrat with over 25 years of dividend increases, but it is a dividend king, which means it has raised the dividend for 50 years or more. The dividend yield is attractive at 4.7%, and it is very safe as the payout ratio stands at 54%. The company is expected to increase the dividend again in the coming months, yet investors should not expect a massive increase as the company aims to maintain its payout at 50%.

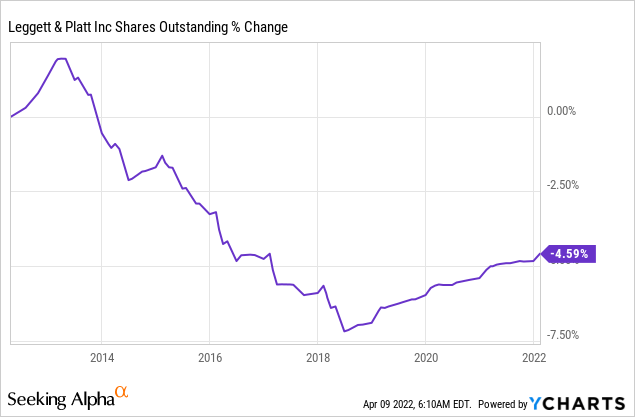

The company is also using excess cash for buybacks. Buybacks are not a priority for the company, but just a bonus in case there is some extra cash on hand. Over the last decade, the number of shares outstanding has decreased by 4.5%. However, since mid-2018, the company is experiencing an increasing number of shares. I don’t find it worrisome as the company is devoted to returning capital to shareholders in form of dividends and buybacks.

Valuation

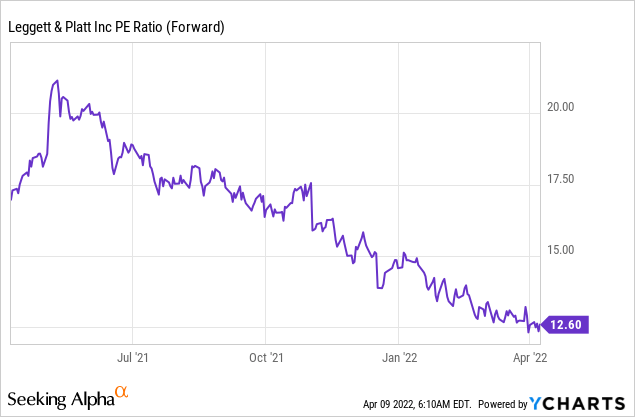

The company’s P/E (price to earnings) ratio has become extremely attractive over the last twelve months. Less than a year ago, shares of the company were trading for more than 20 times earnings. Today the current valuation is roughly 40% lower, as the P/E ratio reaches 12.6 when using the earnings estimates for 2022.

The graph below emphasizes how the valuation decline made the company very attractively valued. The company’s average valuation over the past two decades was much higher with an average P/E of 19 and a growth rate of 5.6%. The current P/E is 12.6 and it comes with a medium-term forecast for an annual growth rate of around 6%. Investors get a similar growth rate with a much lower valuation.

To conclude, Leggett & Platt is enjoying strong fundamentals which have led historically to 50 years of increasing sales, earnings, and dividends. This package is coming at a P/E ratio of only 12.6, thus making the company attractively valued for long-term investors.

Opportunities

The first growth opportunity is the company’s leading position across its segments. The company’s vast majority of sales come from products where it is a market leader. Being a market leader allows the company to compete with fewer players- only other well-established brands. The leading position will also give the company higher flexibility when it comes to raising prices in the future.

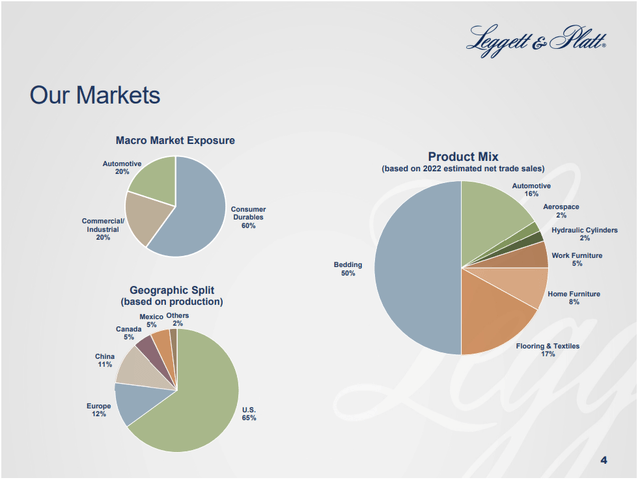

Moreover, the company is extremely diversified. The company doesn’t rely on a single product family or on a single market. Selling a large variety of prices in a variety of markets allows the company to be a better capital allocator, as it can always choose to increase in segments and markets where the demand is higher.

Leggett & Platt March 22 Presentation

Vertical integration is another competitive advantage which in turn serves as a growth opportunity. Vertical integration means that the company is controlling a larger portion of the value chain, and with fewer middlemen, its profitability is higher. It also allows the company to offer a better cost structure compared to its peers, and thus increase its market share.

Risks

Competition is an important risk for a company like Leggett & Platt. The company is mainly a B2B business, which makes it harder to build a brand and awareness. Therefore, the company constantly has to invest and develop better products to remain the preferred supplier to its clients. The company’s cost structure and its leadership position are helpful, but it still poses a risk.

Inflation is another prominent risk for Leggett & Platt. Inflation will force the company to raise prices, and it may either hurt the company’s market share or its profitability. The consumer discretionary sector is more challenging than the consumer staples sector. The reason for that is the clients may delay purchases of discretionary items if the prices are too high. The company will have to become leaner to deal with increasing materials prices.

A recession is a significant short-term risk. The company is cheaper today, but there are analysts who forecast that a recession may be coming in 2023. The company is selling discretionary spending items. A weaker economy will have an impact on the company’s future expectations, and we may see the multiples expand due to lower expectations, which may lead to further weakness in the medium term.

Conclusions

The company is a very solid investment for long-term dividend growth investors. Leggett & Platt enjoys growth in sales and EPS, and in turn, it leads to capital being returned to shareholders in the form of dividends and buybacks. The company is attractively valued with a P/E below 13, and it is also enjoying a good market positioning that will support future growth.

There are several risks, and a possible recession is the most significant one. However, as the company’s valuation is much lower than the average valuation, I believe that the company has enough margin of safety even if a recession looms and the EPS will decline temporarily. Just like with the Covid recession and other recessions before, the company will recover and investors can take advantage of the current valuation.

Be the first to comment