Bet_Noire

Introduction

In early August 2022, I wrote a bullish article on SA about motorcycle safety gear maker Leatt (OTCQB:LEAT) in which I said that the company was showing impressive growth but that it seemed impossible to tell how much room there was for sales to increase further or if the pace of the growth could be sustained.

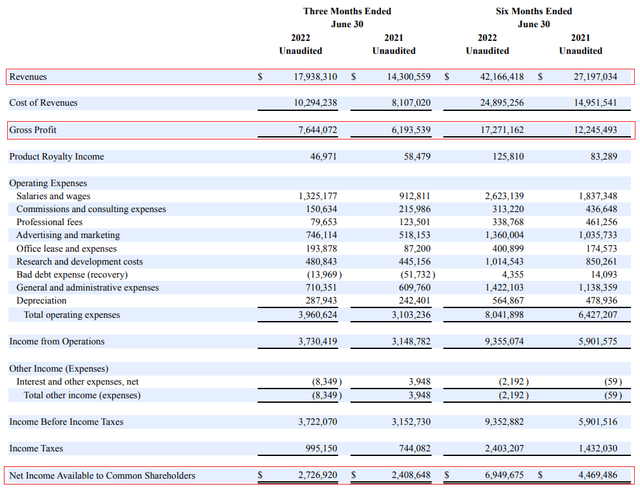

Well, it seems my concerns were justified as revenues declined by over 25% quarter on quarter in Q2 2022 while the net income shrank by almost a third. I’m keeping this company on my shortlist but I’m changing my rating to neutral. Let’s review.

Overview of the Q2 2022 financial results

In case you haven’t read my previous article about Leatt, here’s a brief description of the business. The company focuses on the production of motorcycle safety gear and is perhaps best known for the Leatt-Brace, which is an injection molded neck protection system for off-road moto riders that aims to prevent potentially devastating injuries to the cervical spine and neck. Leatt owns the exclusive global manufacturing, distribution, sale, and use rights while the patent is owned by its chairman, Dr. Christopher Leatt. Over 920,000 neck braces for $156 million have been sold to date.

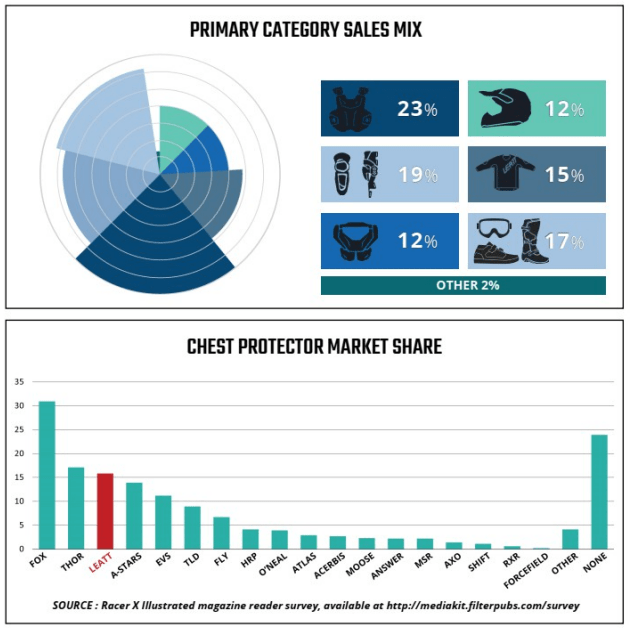

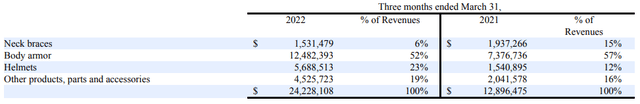

Yet, about half of Leatt’s revenues at the moment are coming from the sale of body armor products. The company also sells helmets, guards, and hydration systems among others and it acts as the original equipment manufacturer for neck braces sold by other international brands. Leatt has a strong position in the global chest protector market

Leatt

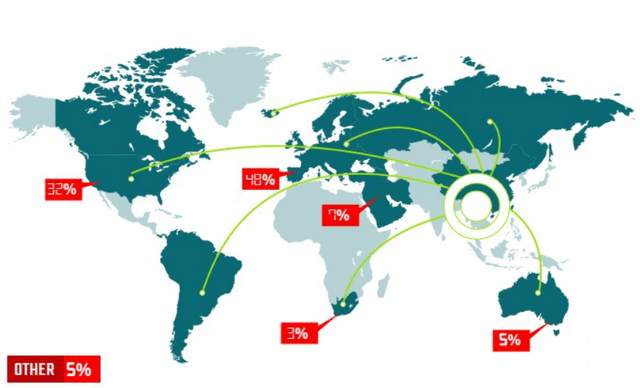

The company has an asset-light business model as it has outsourced manufacturing arrangements with Chinese partners. Leatt mentioned in its Q2 2022 financial report that it’s building manufacturing capacity in Thailand and Bangladesh. However, it’s unclear how large these facilities will be or when they’ll become operational. Considering capital expenses for H1 came in at just $0.44 million and one of the selling points in the latest corporate presentation is no “need for immediate growth capital” (page 27 here), I doubt they will be a game-changer. Leatt currently has a total of 17 manufacturing partners and Europe and North America account for about 80% of sales.

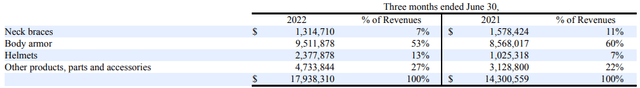

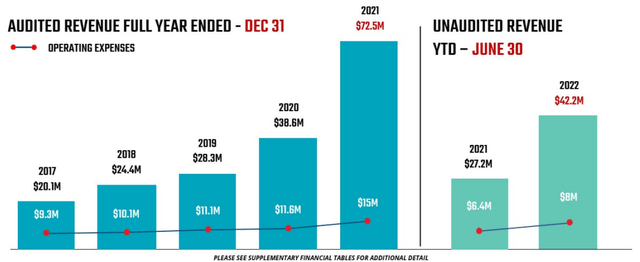

Turning our attention to Q2 2022 financial results, this was Leatt’s 17th consecutive quarter of year-over-year revenue growth as global revenues soared by 25% year on year to $17.9 million thanks to strong sales of apparel, helmet, and off-road motorcycle boot products. Net income, in turn, increased by 13% to $2.73 million.

However, the situation looks bad when you compare the Q2 2022 financial results to the ones for the previous quarter as revenues were 25% lower while net income slumped by 65% as operating expenses barely changed. The decline in revenues is most noticeable in the body armor and helmets segments and there appears to be no obvious reason why this is happening. The seasonality in this market is not significant.

On a positive note, cash flow from operating activities in Q2 turned positive and came in at $1.64 million, mainly due to a $3.94 million decrease in accounts payable. Free cash flow was also positive as capital expenses stood at just $0.17 million in Q2 2022.

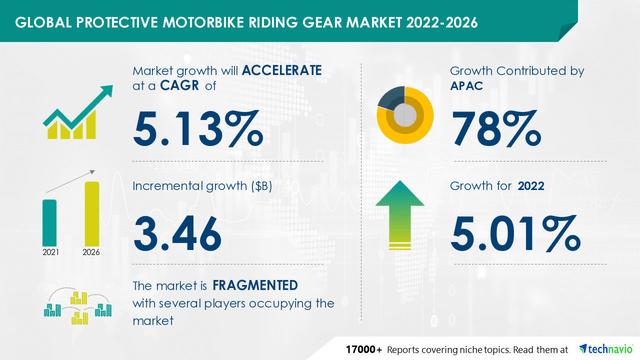

Overall, I was concerned that revenues could plateau or decline sharply at some point as the strong growth over the past few years was hard to explain. You see, the global protective motorbike riding gear market is highly fragmented and almost all of the growth is coming from the Asia-Pacific region, where Leatt barely has any presence. Also, the company doesn’t seem to have a noticeable competitive advantage and its products don’t stand out so chalking up the rapid sales growth to taking market share from competitors doesn’t seem right. Sure, you could argue that the Leatt-Brace is revolutionary, but neck braces account for a small share of the company’s sales.

What’s I find even more unusual is that revenue growth picked up sharply during the COVID-19 pandemic when most countries in Europe and North America were implementing lockdowns. There have been no major product launches over the past few years.

I think that Leatt continues to look cheap as EBITDA for H1 2022 stood at $9.9 million and the EV is $109.9 million as of the time of writing as the company had $4.49 million in net cash at the end of June. However, the sharp quarter on quarter decline in revenues for Q2 2022 raises concerns that whatever the reason was for the strong sales growth over the past two years is now gone. With that in mind, investing in Leatt seems dangerous as the daily trading volume here rarely tops 5,000 shares and another quarter with weak revenues could lead to a run for the exits. This is likely to result in a significant decline in the market valuation due to the low liquidity.

Investor takeaway

Leatt launched its body armor range in 2010, and but its total revenues were stagnant until 2016 before starting to increase at a moderate pace in 2017. The company has no visible competitive advantage and I find it impossible to explain why its sales grew during the COVID-19 pandemic, especially after taking into account that it’s focused on two regions where the protective motorbike riding gear market is stagnant.

It seems that the period of rapid growth could be coming to an end, and I’m concerned that this could lead to a sharp selloff if the company reports lower Q3 revenues around November 10. The date is my estimate based on when the Q3 financials reports were released in previous years.

In my view, it could be best for risk-averse investors to avoid this stock.

Be the first to comment